In forex trading, the deciding factor between winning and losing isn't just finding the right entry point, it's managing risk. Many traders overlook the most critical question: "Is this trade actually worth the risk?".

To answer that question visually, the risk reward indicator for MT4 is the tool that many traders rely on. It’s not a holy grail, but it transforms complicated risk calculations into a clear, actionable plan right on your screen.

Key takeaways:

- Risk managment is crucial: The risk-reward ratio (RRR) is a vital tool for assessing trade viability, helping traders prioritize disciplined decision-making over emotional impulses.

- MT4 risk reward indicator: Automates RRR calculations, visually displaying potential profit versus loss on MetaTrader 4 charts, enhancing speed and precision.

- Supports disciplined trading: Encourages sticking to predefined risk parameters, reducing impulsive decisions during market volatility.

- Real-time feedback: Allows traders to adjust stop loss (SL) and take profit (TP) levels with instant RRR updates, ensuring alignment with trading strategies.

- Customizable and versatile: Offers features like drag-and-drop SL/TP zones, pip value displays, and multi-timeframe compatibility, suitable for scalpers and swing traders.

- Platform comparison: MT4 excels for custom indicators, MT5 offers advanced data, and TradingView suits manual visual planning, but MT4 remains the most flexible for RRR tools.

- Practical application: Combine RRR with market structure analysis, avoid forcing ratios, and use break-even or trailing stops to optimize trade outcomes.

1. What is risk reward in Forex trading?

Managing risk is one of the most critical aspects of successful forex trading. Among the various tools and concepts traders rely on, the risk reward indicator for MT4 stands out for its ability to help users evaluate trade setups with more clarity and discipline.

This tool allows traders to visualize potential gains versus potential losses before entering a trade, which is essential for maintaining long-term profitability.

At the core of this concept lies the risk-reward ratio (RRR), a simple yet powerful formula used to assess whether a trade is worth taking. The basic formula is:

Risk/Reward Ratio = Potential Loss / Potential Gain

For example, if you risk $100 to potentially earn $300, your risk-reward ratio is 1:3. A higher ratio typically means a more favorable trade setup, assuming market conditions align.

Going beyond just dry numbers, applying the risk-reward ratio genuinely helps you build discipline. One of the biggest mistakes in trading is acting on emotion entering a trade out of fear of missing out or holding a losing position out of hope.

This tool forces you to pause and intentionally plan your entry, stop loss, and take profit. Gradually, you'll develop the habit of only taking trades that have an edge, building a more sustainable trading approach.

In the sections below, we’ll explore how MT4 risk reward indicators simplify this process, what makes them valuable, and how to use them effectively to enhance your forex trading strategy.

2. What is a risk reward indicator for MT4?

A risk reward indicator for MT4 is a visual tool that helps traders calculate and display the ratio between potential profit and loss directly on their MetaTrader 4 charts. Rather than manually measuring distances between entry, stop loss (SL), and take profit (TP) levels, the indicator automates the process and presents the information in real-time.

In essence, it shows how much you're risking compared to how much you aim to gain in a trade. This simple calculation often overlooked by beginners can make the difference between consistent profits and unsustainable losses. For those new to the market, understanding how forex trading works is crucial to applying these calculations effectively.

Traditionally, traders would calculate the risk-to-reward ratio manually by:

- Measuring the number of pips between the entry price and the SL

- Measuring the distance to the TP

- Dividing those two values to get the RRR

While this works, it can be slow, error-prone, and difficult to repeat consistently especially in fast-moving markets.

This is where the mt4 risk reward indicator comes in. It simplifies everything by letting traders:

- Click and drag SL/TP levels visually on the chart

- Automatically view the pip distance and RRR values

- See clearly whether the current setup meets their strategy requirements

Some versions of the mt4 risk to reward indicator even allow customization of colors, fonts, and calculation methods, making them flexible enough for both scalpers and swing traders.

Using such an indicator is not just about speed it’s about precision, discipline, and making well-informed decisions in real-time.

3. Why you should use a MT4 risk reward indicator?

Based on my experience and information from EarnForex Forum, understanding the risk-reward ratio is one thing, but using it effectively in real trades is another. This is where an MT4 risk-reward indicator proves invaluable. By providing clear visual cues and eliminating guesswork, it helps traders make smarter decisions and reduce emotional trading mistakes.

3.1. Supporting disciplined trading

Emotion is a trader's enemy. We've all felt the urge to move a stop loss just a little further, hoping the price will turn around, or greedily chased an unrealistic profit target. The Risk Reward Indicator acts like a cold but necessary reminder right on your chart.

It clearly displays your original plan, helping you stick to your predefined risk parameters instead of making impulsive decisions in the middle of market volatility.

3.2. Real-time visual feedback

One of the most powerful features of any mt4 risk to reward indicator is the ability to show RR values live on the chart. As you adjust SL and TP levels by dragging them, the ratio updates instantly. This lets you see whether a trade still meets your minimum acceptable risk-reward ratio, such as 1:2 or 1:3.

This immediate feedback makes the indicator a perfect companion for traders who want to:

- Validate trades before execution

- Quickly adapt to market conditions

- Reduce errors in fast-paced scalping or intraday environments

3.3. Alignment with your trading plan

Whether you follow a trend-following strategy or trade reversals, your system likely includes rules around minimum risk-reward ratios. Using a mt4 risk reward indicator ensures you can easily measure setups against these benchmarks. If a setup doesn’t meet your criteria, you can skip it with confidence no second-guessing needed.

In short, this type of indicator helps you trade with intention, not instinct. It’s a small tool with a major impact on consistency and risk control.

4. Key features of the best MT4 risk to reward indicators

Not all mt4 risk reward indicators are created equal. Some are basic and static, while others offer a wide range of dynamic features that can make a real difference in your trading workflow. If you're considering adding this type of tool to your MT4 setup, it's worth understanding the features that define a high-quality solution.

Below are the key functionalities to look for in an effective risk reward indicator for MT4, based on popular tools discussed in trusted trading communities and forums.

Before jumping into a download, make sure your chosen indicator includes the following:

- Drag-and-drop SL/TP zones: Quickly set stop loss and take profit levels by dragging lines on the chart instead of inputting values manually.

- Auto-calculation of RR ratios: Displays real-time risk-to-reward ratio as you adjust levels, helping you stay within your strategy rules.

- Pip value & distance display: Shows the pip distance between entry, SL, and TP, often with monetary values based on lot size for better risk tracking.

- Multi-timeframe compatibility: Works seamlessly whether you’re trading on M15, H1, or Daily charts ideal for scalpers and swing traders alike.

- Color-coded visualization: Makes it easier to identify risk (usually in red) and reward (green or blue), providing clarity in split-second decisions.

5. How to install a risk reward indicator on MT4

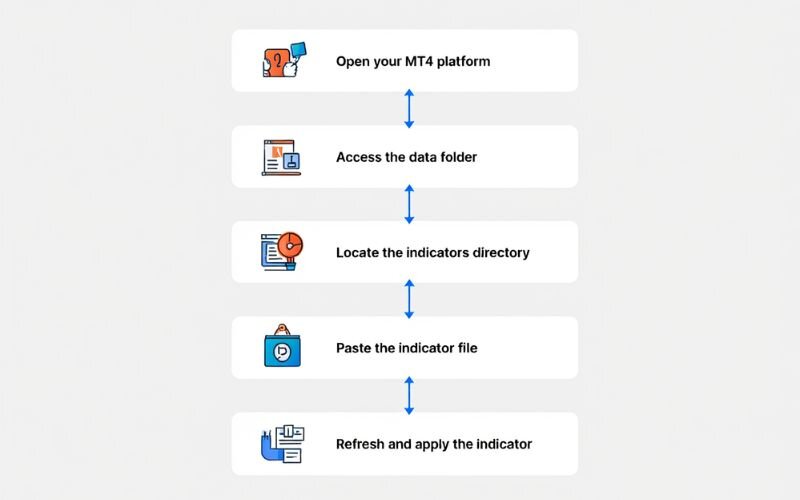

Installing a risk reward indicator for MT4 is a quick process, even for those new to MetaTrader 4. Whether you're downloading a free version from a trading forum or using a custom tool, the steps remain the same. Here’s a step-by-step guide to get your mt4 risk to reward indicator up and running.

5.1. Installing the indicator in 5 easy steps

Before you begin, make sure you’ve downloaded the indicator file. These typically come in .ex4 or .mq4 format.

- Open your MT4 platform

Launch MetaTrader 4 on your desktop. - Access the data folder

From the top menu, go to:

File → Open Data Folder - Locate the indicators directory

In the new window, navigate to:

MQL4 → Indicators - Paste the indicator file

Copy your downloaded .ex4 or .mq4 file into the Indicators folder. - Refresh and apply the indicator

Return to MT4, open the Navigation pane (Ctrl+N), right-click on Indicators, and select Refresh.

Then drag your indicator onto a chart or double-click it to activate.

5.2. Tips after installation

- You may be prompted to enable DLL imports or external inputs. Always check the settings before clicking “OK.”

- Save your custom indicator layout as a template, so you can reuse it on other currency pairs or timeframes.

Once installed, your mt4 risk reward indicator should begin displaying visual SL/TP levels, pip values, and RR ratios directly on the chart.

6. How to use the risk reward tool in MT4 (step-by-step guide)

Once you’ve installed a risk reward indicator for MT4, the next step is learning how to use it effectively in your trading routine. The main benefit of these tools is that they simplify the process of planning a trade, visually helping you define stop loss (SL) and take profit (TP) levels based on your desired risk-to-reward ratio.

Most mt4 risk reward indicators work in a similar way: they allow you to interact directly with the chart, making it easier to visualize potential outcomes before placing a trade.

6.1. Step-by-step: Using the risk reward indicator

Here’s how to get the most out of your mt4 risk to reward indicator:

- Add the indicator to a chart

Choose the currency pair and timeframe you plan to trade. Drag the indicator onto the chart from the Navigator panel. - Set your entry point

Use the tool to define your expected entry price. Some indicators may automatically place this level at the current market price. - Drag the SL and TP levels

Click and drag the stop loss and take profit lines to their appropriate levels. The indicator will automatically calculate:- Distance in pips

- Potential reward/loss

- Live risk-to-reward ratio

- Adjust for a suitable ratio

Shift the SL or TP lines until your trade setup meets your predefined risk-reward threshold (e.g. 1:2 or 1:3). - Use the visual data to confirm or skip the trade

If the ratio doesn’t align with your strategy or the market structure, consider skipping the trade entirely.

6.2. Pro tips for better results

- Combine with trendlines or key support/resistance zones to improve trade precision.

- Testing different SL/TP distances before committing small changes can greatly affect your RRR.

- Use templates to save setups and maintain consistency across different pairs.

By making your trade planning visual and measurable, the risk reward indicator for MT4 helps you stay disciplined and objective critical traits in any trading strategy.

7. Comparing MT4 vs MT5 vs TradingView for risk management

Choosing the right trading platform goes beyond order execution; it directly impacts how efficiently you can plan and manage risk. While MT4 remains one of the most popular choices thanks to its simplicity and massive indicator library, newer platforms like MT5 and TradingView offer advanced features that may better suit certain strategies.

Let’s compare how each handles risk management, particularly when using tools like a risk reward indicator.

7.1. Key differences in risk management tools

Each platform has its strengths and limitations. Here’s a closer look at how MT4, MT5, and TradingView stack up when it comes to visualizing and applying the risk-reward concept.

| Platform | Visual RR Tools Available | Custom Indicators | Ease of Use | Ideal User Type |

|---|---|---|---|---|

| MT4 | Yes (via plugins) | Very high | Easy | Beginners to experienced traders |

| MT5 | Yes (native + plugins) | Moderate | Slightly complex | Experienced traders |

| TradingView | Built-in (manual setup) | Limited (unless Pro) | Very intuitive | Chart-focused, web-based traders |

7.2. MT4: simplicity and broad indicator support

MetaTrader 4 supports a wide range of custom tools, including advanced mt4 risk reward indicators like the ones from TFLab or forums such as ForexFactory. The drag-and-drop interface and low resource demands make it beginner-friendly, while the vast online community provides access to hundreds of free and paid RR calculators.

7.3. MT5: more data, fewer custom indicators

MT5 offers improvements in charting and order management, including built-in risk controls for more complex trades. However, it doesn’t yet support as many third-party risk management indicators as MT4, and older .mq4 indicators need to be rewritten for MT5 compatibility. For traders prioritizing depth over ease, it’s a strong option.

7.4. TradingView: Modern interface, great for manual planning

TradingView is ideal for traders who prefer a web-based platform with built-in drawing tools. While it doesn’t offer plugin-style risk reward indicators like MT4, you can still draw SL and TP zones manually and use built-in measurement tools to estimate risk-to-reward ratios. However, automation and customization are limited unless you subscribe to a paid plan.

7.5. Which platform is best for managing risk?

If your trading strategy depends on custom visual indicators like a mt4 risk to reward indicator, MT4 is still the most flexible and cost-effective choice. MT5 is better for traders needing broader market access and integrated data, while TradingView shines in technical analysis and quick visual planning.

8. Tips for using risk reward ratios in real trading

While having a mt4 risk reward indicator on your chart adds clarity and speed, how you apply the risk-to-reward concept in actual trades determines long-term success. It’s not just about hitting a specific ratio, it's about making sure that ratio aligns with the market structure, strategy, and psychological discipline.

Let’s explore how to get the most out of this essential trading metric.

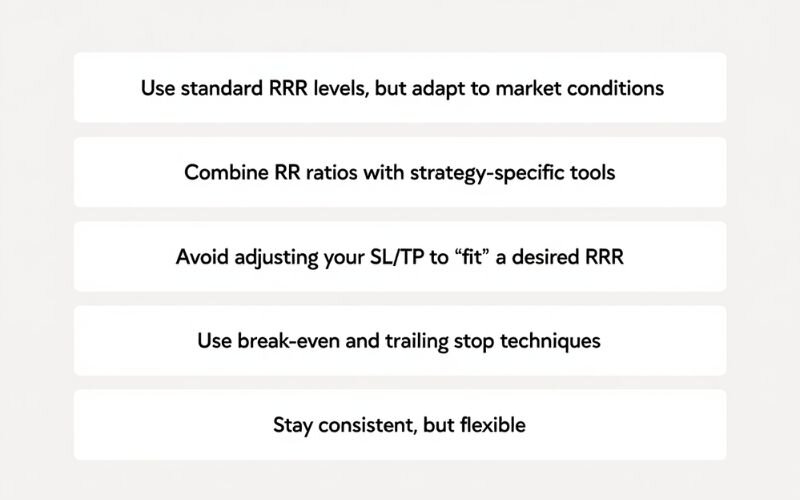

8.1. Use standard RRR levels, but adapt to market conditions

Many traders aim for common risk-reward targets like 1:1.5, 1:2, or 1:3. These are good baselines, but they shouldn't be applied blindly. A 1:3 trade might look great numerically but may be unrealistic in choppy or range-bound markets. In such cases, forcing a high reward ratio could lead to frequent stop-outs.

Instead, let price action and structure guide your RR goals:

- In trending markets: Aim for extended targets like 1:3 or higher.

- In consolidating markets: Use more conservative ratios like 1:1.5 or 1:2.

- Near major support/resistance zones: Avoid stretching your TP too far beyond these technical barriers.

8.2. Combine RR ratios with strategy-specific tools

A mt4 risk to reward indicator becomes even more effective when paired with tools you already use. Whether it’s supply and demand zones, trendlines, or moving averages, aligning your SL/TP levels with these reference points increases your trade’s structural logic.

For example:

- Place your stop loss beyond a key zone of rejection, not just a round number.

- Target profit areas near the next logical resistance level, not arbitrary pip distances.

8.3. Avoid adjusting your SL/TP to “fit” a desired RRR

This is one of the most common traps: you see a potential signal, but the initial RRR is only 1:1. Instead of passing on it, you try to 'force' the ratio to 1:2 by setting your stop loss too tight or your take profit too far from the actual market structure. This practice is like fooling yourself; it detaches your plan from realistic analysis and often leads to unnecessary losses.

Stick to your technical reasoning:

- If your setup naturally gives you a 1:1.8 RRR that respects market structure, take it.

- If you need to move your TP beyond major resistance just to get a 1:3 ratio, consider passing on the trade.

8.4. Use break-even and trailing stop techniques

Once your trade has moved in your favor, protect your capital. Many mt4 risk reward indicators do not automate trailing stops, but combining your tool with a manual or EA-based trail can help:

- Move SL to break-even after reaching a 1:1 risk-reward milestone.

- Use dynamic trailing stops to lock in profit while giving the trade room to breathe.

8.5. Stay consistent, but flexible

Lastly, consistency in applying your risk-to-reward standards is key but flexibility ensures you adapt to ever-changing markets. Don’t sacrifice quality setups just because the RR isn’t perfect on paper.

The best mt4 risk reward indicator can guide your decision, but it’s your judgment that completes the trade.

9. Pros and cons of using MT4 risk reward indicators

Like any trading tool, an mt4 risk reward indicator comes with both benefits and limitations. Understanding these can help you decide how to best incorporate it into your trading workflow and what to watch out for as you rely on visual aids for decision-making.

Let’s break down the main advantages and potential drawbacks.

9.1. Pros

- Enhances decision clarity: By visually displaying potential profit and loss, these tools help you evaluate setups faster and more objectively. You no longer have to calculate pip distances or ratios manually.

- Supports consistent trade planning: Risk-reward indicators enforce structured thinking. They make it easier to follow your trading plan, apply predefined ratios, and stay disciplined even in volatile markets.

- Saves time on every trade: Once installed, the indicator eliminates repetitive math and guesswork. Just drag the SL/TP lines and see the results instantly. This is particularly useful for intraday traders or scalpers.

- Suitable for traders at all levels: Whether you’re a beginner learning to respect stop losses or an advanced trader fine-tuning entries, the mt4 risk to reward indicator is a practical and scalable solution.

9.2. Cons

- Requires manual interaction: Most indicators require you to manually drag SL/TP lines for each trade. This can be a drawback if you’re looking for a fully automated risk management solution or trading high frequency.

- Accuracy varies by coding quality: Not all free indicators are built equally. Poorly coded tools may miscalculate ratios, especially when used with exotic pairs, custom brokers, or during spread spikes.

- Doesn’t replace strategy or market context: While useful, risk reward indicators are not magic bullets. They don’t analyze trend direction, price structure, or momentum. They simply show math and it’s up to you to apply it correctly.

Overall, the mt4 risk reward indicator offers tremendous value but only when paired with a solid trading strategy and thoughtful risk management. It should support your decisions, not make them for you.

Check out more similar blog posts here:

10. Related questions (FAQs)

To further clarify how mt4 risk reward indicators fit into a trader’s toolkit, here are answers to some frequently asked questions. These help address both technical concerns and practical usage for traders of all levels.

10.1. What is a good risk to reward ratio in forex?

There’s no universal “best” ratio, but many traders aim for at least 1:2 risking 1 unit to potentially gain 2. Scalpers might accept lower ratios like 1:1.2, while swing traders often look for 1:3 or higher. The key is consistency and ensuring that the potential reward always justifies the risk.

10.2. Can I use a risk reward indicator on MT5?

Yes, but with limitations. Some mt4 risk reward indicators have been rewritten for MT5, but not all are compatible. MT5 uses a different codebase (.mq5 instead of .mq4), so you’ll need to search for MT5-specific versions or check if the developer offers a cross-platform tool.

10.3. Is MT4 better than TradingView for risk planning?

MT4 is better for traders who want plugin-based, automated risk tools like the mt4 risk to reward indicator. TradingView, while visually modern, lacks native support for drag-and-drop RR calculators unless you're using custom Pine Scripts or manual drawing tools. It’s great for visual planning but not as streamlined for execution-based risk setup.

10.4. Are there any mobile versions of risk reward indicators?

MetaTrader mobile apps (MT4/MT5) currently do not support custom indicators like risk-reward tools. However, you can still manually calculate RR by measuring pip distances and comparing SL/TP levels. For full functionality, desktop versions remain the best option.

11. Conclusion: Elevate your trading with the risk reward indicator for MT4

In conclusion, to trade methodically, you need more than a good strategy; you need tools to execute that strategy with discipline. This is precisely where the risk reward indicator for MT4 shows its core value.

The points above highlight why this is a must-have tool in your arsenal. If you want to strengthen your foundational knowledge, don't forget to explore our Forex Basics category of H2T Finance, which is packed with useful resources to help you trade with more confidence and control.