If you’ve ever switched from trading forex to futures, you've probably asked yourself: how many pips is a point in YM? It’s a great and common question. For anyone trading currency pairs and then looking at the E-mini Dow Jones (YM), getting the price units straight is the first step to making confident trades.

Pips, points, and ticks might sound like confusing jargon, but they are the foundation of all market movements. Whether you're scalping EUR/USD or betting on the Dow's next move, mastering these terms ensures you're in control of the game.

H2T Finance going to break down pips, points, and ticks in a way that makes sense, helping you connect the dots between the forex and futures worlds.

1. Understanding the basics – pips, points, and ticks explained

To confidently trade across both forex and futures markets, it’s essential to understand the standard units used to measure price changes: pips, points, and ticks. These terms may seem interchangeable at first glance, but each serves a specific role depending on the instrument being traded.

1.1. What is a pip in forex trading?

A pip, short for percentage in point, is the most common unit used to express price movement in the forex market. It represents the smallest price change in most currency pairs, typically occurring at the fourth decimal place.

For example, if EUR/USD moves from 1.1050 to 1.1051, it has moved up by 1 pip, which equals 0.0001.

Some currency pairs, such as those involving the Japanese yen, are quoted to two decimal places, where 1 pip equals 0.01 instead.

Pips are crucial in calculating profit and loss, determining stop-loss distances, and setting risk parameters. Understanding pip value per trade size is a foundational skill for all forex traders.

1.2. How is a point defined in YM futures trading?

In futures markets like the YM (E-mini Dow Jones), price movement is not measured in pips. Instead, traders refer to points and ticks.

- Each point in the YM futures contract reflects a $1 change in the index’s value.

- If the YM contract price increases from 34,000 to 34,001, that's a 1-point movement.

Points are often used to express larger market moves, especially in index futures, and serve as a more intuitive unit for traders accustomed to dollar-based fluctuations.

1.3. Understanding ticks: How they differ from points and pips

A tick represents the minimum price fluctuation allowed in a futures market, based on the specific contract terms.

- For YM, 1 tick is the minimum price fluctuation and it is equal to exactly 1 point. Each tick (or each point) is valued at $5.

- This means that when YM moves 1 point, the contract value changes by $5.

While pips are standard in forex and points/ticks are used in futures, all three serve the same purpose: measuring market movement with precision. However, they do so on different scales and within different asset classes.

2. What is YM?

To fully understand the comparison between pips and points, it’s important to get familiar with the financial instrument in question YM futures. YM is the ticker symbol for the E-mini Dow Jones Industrial Average futures, a popular equity index futures contract in the U.S. market.

Unlike forex pairs, YM represents a stock index derivative, which means its price is derived from the value of the Dow Jones Industrial Average (DJIA).

2.1. Introduction to YM: The E-mini dow jones futures contract

The YM contract is offered on the CME Group exchange and provides exposure to the DJIA, allowing traders to speculate on or hedge against moves in the broader U.S. equity market.

Here are the key specifications:

- Symbol: YM

- Contract Size: $5 per index point

- Minimum Tick Size: 1 tick = 1 point = $5

- Trading Hours: Nearly 24/5 via CME Globex

- Underlying Asset: Dow Jones Industrial Average (DJIA)

The “E-mini” prefix simply indicates that this contract is smaller in size than the full-sized DJIA future, making it more accessible to retail traders.

2.2. Pricing and volatility characteristics of YM

YM futures are priced in whole-number index points, with price movements happening in increments of 1 point (i.e., one tick). Since each point of movement is equivalent to $5, even small price changes can quickly accumulate, making YM a volatile and high-leverage instrument.

Unlike forex, which quotes prices in decimals like 1.1234, YM uses whole numbers such as 34000 or 34105.75, making the point-based pricing more intuitive for equity traders.

2.3. Why points and ticks are used in ym instead of pips

Pips are not applicable in futures trading, particularly with index contracts such as YM. Instead, traders rely on points to represent price levels and ticks to measure the smallest movement possible.

This is not just a naming preference it reflects how these instruments are designed and how profit/loss is calculated:

- In forex, P&L depends on how many pips the market moves and your lot size.

- Each tick in YM represents a $5 value, with gains or losses determined by the number of ticks or points moved multiplied by the contract size.

Take it from me: when you move from forex to futures, the biggest mental shift is learning that points and ticks are your new language. Getting this right is crucial, it affects your order placement, how you size your trades, and whether your strategy even works.

3. How many pips is a point in YM?

Alright, let's get to the main question you're here for: How many pips is a point in YM? The honest answer is that you can't compare them directly—they're completely different. But I know that's not what you want to hear. The best way to bridge this gap, especially if you're used to thinking in forex terms, is to create a rough comparison to help you get a feel for it.

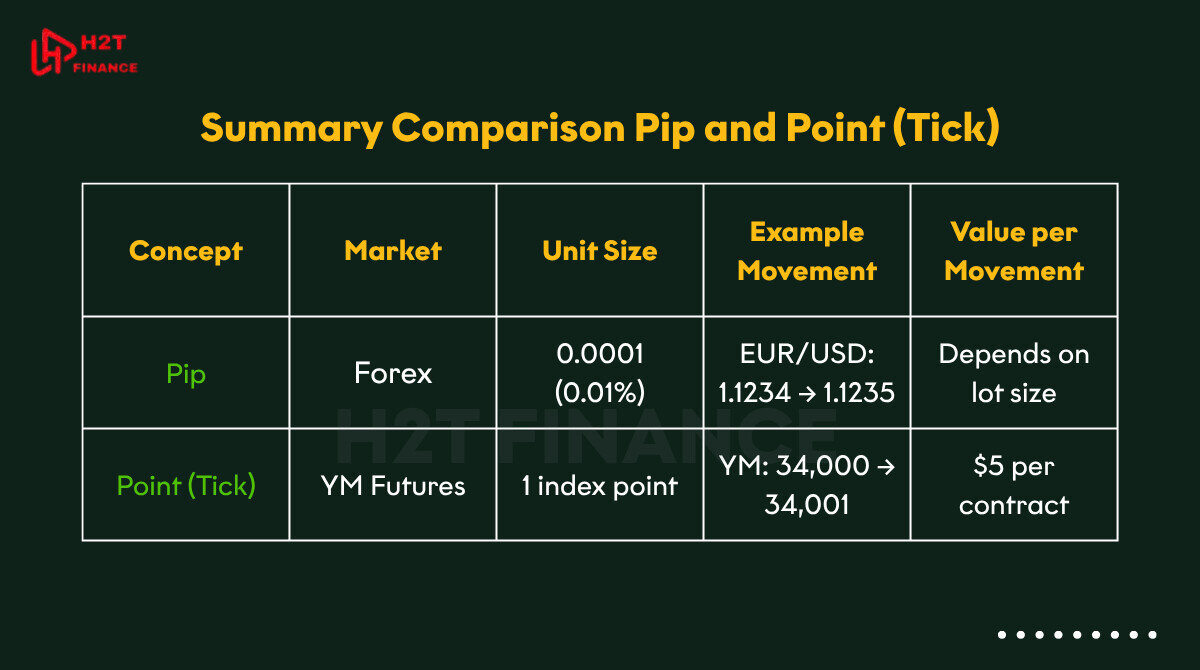

3.1. Clarifying the comparison: point in YM vs pip in forex

Let’s break it down:

- In forex trading, a pip is usually 0.0001 of the quoted price for most currency pairs.

- Example: EUR/USD moves from 1.1234 → 1.1235 = 1 pip

- In YM (E-mini Dow Jones Futures), a point represents a $1 change in the index.

- Example: YM moves from 34,000 → 34,001 = 1 point

Here’s where it gets interesting:

3.2. Understanding the conversion: Linking pips to points

According to the contract specifications, the value of each point in YM is determined as follows:

1 point in YM = $5 worth of movement per contract

Now, to answer the main question "how many pips is a point in YM?", we cannot make a direct conversion. However, we can draw a rough analogy based on monetary value:

If you trade 1 standard lot in forex, 1 pip is typically worth around $10.

Meanwhile, 1 YM contract = $5 per point.

→ Therefore, in monetary terms, 1 point in YM is roughly equivalent to half (0.5) a forex pip when trading 1 standard lot.

But remember: this analogy only works in dollar value, not in how price is structured.

Important clarification: Pips do not exist in YM. The correct terminology is points and ticks. But many forex traders ask this question to align their strategies or calculators across markets.

Understanding this difference is essential to avoid confusion in trade planning, particularly when using automated systems or manual strategies that were originally built for forex.

Table: YM vs Forex unit breakdown

| Feature | Forex | YM Futures |

| Smallest Unit | Pip (0.0001) | Tick (1 point) |

| Larger Unit | – | Point |

| Typical Contract Value per Move | ~$10/pip (standard lot) | $5 per tick / $5 per point |

| Measurement Term Used | Pip | Tick / Point |

| Price Display Format | 1.1234 | 34001 |

4. Why it matters – measuring market movement accurately

Understanding the difference between pips, points, and ticks isn’t just a matter of terminology; it directly affects how you manage risk, size positions, and set targets. Whether you’re trading forex or YM futures, precision in interpreting price movement is essential for executing a sound trading strategy.

4.1. Importance of tick, point, and pip accuracy in managing risk

Every successful trader, regardless of market, builds strategies around two pillars: risk and reward.

Misinterpreting how much a market moves per unit can cause severe errors in:

- Stop-loss placement

- Take-profit calculations

- Position sizing

- Risk-reward ratios

For example, if you assume a 1-point move in YM is equivalent to 1 pip in forex, you may unintentionally take on unintended risk because their dollar values and volatility are completely different. One point in YM has a fixed value of $5 per contract.

That small misunderstanding could result in a trade with too much exposure, or worse, a margin call if your account isn't prepared for that volatility.

4.2. How it affects the placement of stop-loss and take-profit orders

Here’s a side-by-side example:

| Market | Typical Stop-Loss | Unit | Dollar Risk |

| Forex (EUR/USD, 1 std lot) | 20 pips | ~$10/pip | $200 |

| YM Futures | 40 points | $5/point | $200 |

Note: On paper, both traders are risking $200, but the unit and behavior of each market are completely different.

A forex pair may take hours to move 20 pips, while YM futures could move 40 points in seconds or minutes during volatile market conditions.

4.3. How misunderstanding units can lead to wrong position sizing

Many traders use position sizing formulas tied to pip values (e.g., 2% risk per trade). But if you apply a pip-based system to YM without converting units to points or ticks, your calculations may be off. This leads to:

- Overtrading

- Misaligned lot sizes

- Skewed reward/risk ratios

To avoid this, always:

- Convert pip-based expectations to tick/point values

- Use tick value calculators for futures (similar to pip calculators in forex)

- Factor in volatility differences between markets

5. From forex to YM – how traders should adjust their mindset

Transitioning from forex to futures trading, especially YM futures requires more than just understanding new terminology. It involves a fundamental shift in mindset, particularly when it comes to how markets move, how trades are calculated, and how you define risk and reward.

5.1. Common mistakes made by forex traders in futures markets

Forex traders often bring useful experience with technical analysis and strategy design, but many struggle initially with futures contracts due to:

- Misunderstanding tick value vs pip value

- Applying lot sizing from forex (e.g. 1 lot = $10/pip) directly to futures

- Underestimating how fast futures contracts move, especially during economic releases

- Confusing leverage differences between brokers and clearing houses

These missteps can lead to over-leveraging, misjudged risk levels, and emotional decision-making.

5.2. Tips for adjusting your trading system to account for points and ticks

Here are a few tactical ways to bridge the gap between forex and YM futures:

- Recalculate your position sizes using tick value, not pips

- Backtest your strategies on tick-based historical data rather than pip-based

- Adjust your indicators' sensitivity (e.g. ATR, moving averages) to match point volatility

- Use stop-loss in points, not price difference in decimals

In essence, you must map your pip-based intuition into a point-and-tick framework. This includes redefining what a "tight stop" or "wide target" looks like in YM.

5.3. Practical example: EUR/USD vs YM risk/reward logic

| Criteria | EUR/USD (Forex) | YM (Futures) |

| Entry | 1.1050 | 34,000 |

| Stop-Loss | 20 pips | 40 points |

| Lot Size | 1 standard lot | 1 YM contract |

| Risk per Unit | ~$10/pip | $5/point |

| Total Risk | $200 | $200 |

Note: Although the risk amount is identical, YM will likely hit a 40-point stop much faster than EUR/USD might hit a 20-pip stop.

This highlights the importance of understanding market behavior and volatility, not just the dollar value at risk.

Explore more trading insights:

- CME What Does It Stand For? Quick Guide for Traders

- Elegant oscillator indicator formula: How it works & how to use

- How to trade the Forex market: Strategies & tools explained

6. FAQs about pips, points, and ticks

When navigating between forex and futures markets, it's common to encounter confusion around units like pips, points, ticks and even basis points. Let’s clear up some of the most frequently asked questions traders have when making these comparisons.

6.1. How many pips is 1 basis point?

For most currency pairs quoted to four decimal places, one pip usually corresponds to one basis point (bps) in forex trading. That means:

- 1 pip = 0.0001

- 1 basis point = 0.01%

Therefore, for the majority of forex transactions, one pip is equal to one basis point.

However, this can vary depending on how a currency pair is quoted (e.g. Currency pairs involving JPY are quoted with two decimal places, meaning one pip equals 0.01).

6.2. Are points and pips equivalent?

No, they are not the same:

- In forex trading, a pip generally represents the value at the fourth decimal place in a currency quotation.

- A point is used in stock indices and futures markets like YM, representing a whole number movement in price.

For example:

- EUR/USD moving from 1.1234 → 1.1235 = 1 pip

- YM moving from 34,000 → 34,001 = 1 point ($5 per contract)

So while they both represent unit movements, they operate in different market contexts and different price scales.

6.3. How many points is 1 pip in XAUUSD?

XAU/USD (gold vs USD) is usually quoted with two decimal places, such as 1945.30. In this case:

- 1 pip = 0.01

- 1 point = 1.00

So:

1 point = 100 pips in XAUUSD

1 pip = 0.01 point

This distinction is essential for risk calculations in precious metals trading.

6.4. How many points is 50 pips?

This depends on the instrument:

- In forex (EUR/USD):

1 point = 1 pip = 0.0001

→ 50 pips = 50 points - In gold (XAU/USD):

1 point = 1.00

1 pip = 0.01

→ 50 pips = 0.50 point - In YM Futures:

“Pip” terminology doesn't apply. You’d use points and ticks. If you want to compare the dollar risk:

→ 50 pips (with 1 std lot) = ~$500 risk

→ In YM: $500 / $5 (per point) = 100 points

So the answer is market-specific.

6.5. How many pips is 1 point?

- Forex (e.g., EUR/USD): 1 point = 1 pip = 0.0001 (for most pairs; USD/JPY: 1 pip = 0.01).

- YM Futures: 1 point = $5 per contract, roughly ~0.5 pips in forex (based on $10/pip for 1 standard lot).

- XAU/USD (Gold): 1 point = 1.00 = 100 pips (1 pip = 0.01).

Note: Conversion depends on the market; YM uses points/ticks, not pips. Adjust for contract size and volatility.

7. Final thoughts – Know your units, trade with confidence

So, what's the bottom line? Knowing the difference between pips, points, and ticks isn't just trivia; it's what keeps you from making costly mistakes. The question 'how many pips is a point in YM' isn't about finding a magic conversion number. It's about respecting that each market has its own rhythm. Get the units right, and you're one step closer to trading with real confidence.

If you want to expand further, H2T Finance other guides in the Pips & Lots section are a great next step to explore.