What is leverage in Forex and how to use it is one of the most common questions among new traders stepping into the currency market. Leverage enables traders to manage larger trades with a smaller capital outlay. Although it can enhance potential gains, it simultaneously increases the risk of significant losses.

Grasping the mechanics of leverage and applying it wisely is essential for sustaining long-term success in Forex trading. In this article, H2T Finance will break down the concept of leverage, explore its benefits and risks, and provide practical tips on how to apply it effectively in your trading strategy.

Key takeaways:

- Forex leverage works like a loan from your broker, allowing you to control larger positions with minimal capital.

- The leverage ratio (e.g., 100:1) shows how much bigger your trade can be compared to your deposit.

- While leverage magnifies potential profits, it equally increases the risk of significant losses.

- Different leverage levels (low, moderate, high, very high) suit different strategies and risk tolerances.

- Effective use of leverage requires strong risk management: proper position sizing, stop-loss orders, and awareness of margin requirements.

- Leverage is a tool, not a shortcut — success depends on discipline and strategic application.

1. What is leverage in Forex?

At its core, Forex leverage functions like a loan provided by your broker to increase your trading power. It allows you to open trading positions that are substantially larger than the amount of money you have deposited in your account.

You can think of it as putting up a small portion of your own funds (called the margin) to gain control over a much larger amount in the market. The broker effectively lends you the difference, enabling you to gain greater market exposure when trading popular pairs like GBP/USD or other traded currencies.

The ratio between the total value of the position you control and the amount of your own capital required is known as the leverage ratio in Forex trading. In practice, traders often ask how to calculate leverage in Forex, which is done by dividing the total position size by the margin used.

For example, a 100:1 leverage ratio allows you to control a $100 trade using just $1 of your own funds as margin. If you have $1,000 in your account balance and use 100:1 leverage in Forex, you could potentially open a trade worth $100,000, significantly multiplying your initial investment.

The capacity to manage substantial positions with minimal capital is what makes Forex leverage appealing and accessible to more traders. However, it's vital to remember that this amplification works both ways.

While leverage in Forex can significantly boost potential returns from favorable exchange rate movements, it equally increases the potential for substantial losses if the market moves against your position. This is why leverage in Forex is often referred to as a double-edged sword in currency trading.

Main points:

- Forex leverage works like a loan provided by the broker.

- It allows traders to control positions much larger than their margin deposit.

- The leverage ratio (e.g., 100:1) determines how a small amount of capital can manage a large trade.

- Leverage increases potential profits but also magnifies the risk of losses.

- It is often described as a “double-edged sword” in currency trading.

2. The mechanics: How does Forex leverage work in practice?

To understand how leverage in Forex trading works, we need to introduce the concept of margin. Margin isn’t a charge or a fee; it’s a portion of your account that your broker sets aside as a good-faith deposit to help cover possible losses from an open position. It serves as the collateral needed to initiate and sustain a leveraged position in currency trading.

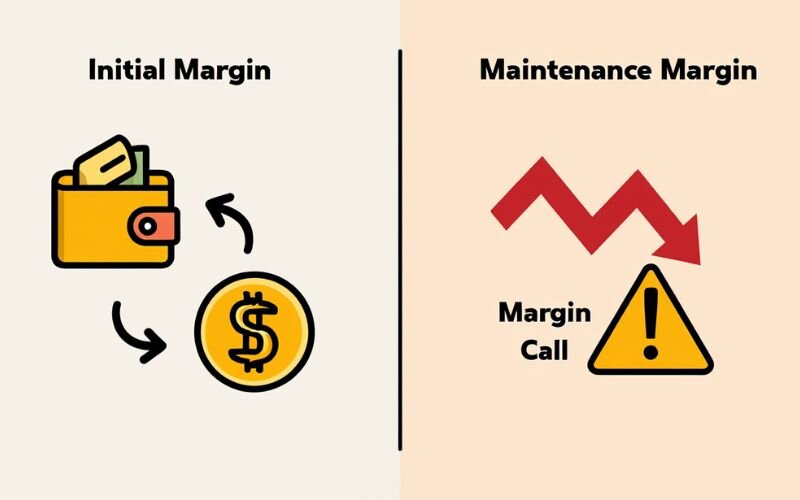

In Forex trading, leverage involves two main types of margin:

- Initial Margin, sometimes referred to as Required Margin, is the minimum amount of funds you must deposit to initiate a new position. It’s determined by the trade size and the applied leverage ratio. For instance, with 100:1 leverage in Forex, the initial margin requirement is typically 1% of the position's value (1 / 100 = 0.01 or 1%). So, for a $100,000 position, the initial margin would be $1,000, which is a small fraction of your initial investment.

- Maintenance Margin is the minimum amount of equity that must be maintained in your account to prevent your leveraged trades from being closed. Should your account equity drop below this threshold as a result of losses, a margin call will be triggered.

Here is a simple leverage in Forex example using the GBP/USD pair to show how small margin deposits can control much larger positions. Let's illustrate with an example using the popular GBP/USD currency pair. Imagine you're looking to purchase one standard lot (100,000 units) of GBP/USD, and your broker provides leverage at a ratio of 50:1.

The initial margin requirement would be 2% (1 / 50 = 0.02). If the current GBP/USD exchange rate is 1.3000, the total value of the position is $130,000 (100,000 * 1.3000). Your required initial margin would be $2,600 (2% of $130,000). You only need $2,600 in your account balance to control a $130,000 position through leverage in Forex trading.

If the GBP/USD exchange rate moves favorably by 50 pips (to 1.3050), the position value increases to $130,500. Your profit is $500. Because you only used $2,600 of margin, this $500 profit represents a significant return on your committed capital.

Conversely, if the price moves against you by 50 pips (to 1.2950), the position value drops to $129,500, resulting in a $500 loss. This loss is deducted from your account balance, highlighting how leverage in Forex magnifies losses just as effectively as profits.

3. Understanding various leverage ratios in Forex trading

Forex brokers offer a wide range of leverage ratios, often varying based on regulatory requirements in different regions, the specific currencies being traded, and the trader's account type or experience level.

Broadly speaking, there are different types of leverage in Forex, ranging from conservative low leverage to very high leverage offered by offshore brokers. Common ratios in leverage in Forex include:

- Low Leverage (e.g., 1:1 to 20:1): This is a more conservative approach to leverage in Forex trading, requiring a larger margin relative to the position size. It reduces the potential for both magnified profits and magnified losses. Often preferred by risk-averse traders or those holding long-term positions in traded currencies like GBP/USD.

- Moderate Leverage (e.g., 30:1, 50:1): Commonly offered in regulated markets like the US and Europe. Offers a compromise between maximizing capital use and managing risk. Suitable for many retail traders with solid risk management plans and reasonable initial investment amounts.

- High Leverage (e.g., 100:1, 200:1): Allows for significant market exposure with relatively small margin. Increases potential returns from exchange rate movements but also drastically elevates risk. Requires strict discipline and experience with leverage in Forex.

- Very High Leverage (e.g., 400:1, 500:1): Often available through offshore brokers. While offering maximum capital efficiency, this level of leverage in Forex is extremely risky and can lead to rapid depletion of account balances even with small adverse price movements. For example, comparing 1:100 leverage vs 1:500 highlights the significant difference in both market exposure and risk management required. Generally not recommended for beginners.

The choice of leverage ratio is critical in Forex trading. Higher leverage in Forex is not inherently better; it simply means taking on more risk. The appropriate level depends on your risk tolerance, trading strategy, account balance, and the volatility of the traded currencies you are trading, such as GBP/USD or other major pairs.

See more related articles:

- How does forex trading work? Learn the basics today

- What is price action? Understanding core Forex concepts

- How do financial advisors get paid: Key models and pay structures

4. Leverage in Forex: Weighing the benefits and risks

Leverage in Forex trading presents a compelling set of advantages, but these are intrinsically linked to significant disadvantages.

4.1. Advantages of Forex leverage

- Magnified Profits: The primary allure of leverage in Forex is its ability to amplify returns. A slight increase in the exchange rate can result in a significantly higher return relative to your invested margin and initial capital.

- Capital Efficiency: Forex leverage enables traders to manage sizable positions while using only a small portion of their own trading capital and account balance. This frees up funds that can potentially be used for diversification or other opportunities, enhancing capital efficiency.

- Accessibility: Leverage reduces the amount of capital needed, making it easier for more people to participate in the Forex market. Traders don't need vast sums of capital to participate meaningfully in trading traded currencies, making it accessible to retail investors with modest initial investment amounts.

- Trading Opportunities: Increased market exposure through leverage in Forex allows traders to potentially capitalize on smaller exchange rate fluctuations (pips) in pairs like GBP/USD that might not be worthwhile without leverage.

4.2. Disadvantages and risks of Forex leverage

- Magnified Losses: This is the flip side of magnified profits and the most significant risk of leverage in Forex. While leverage can increase profits, it also magnifies losses. Even a minor unfavorable change in the exchange rate may cause significant losses, sometimes going beyond your original investment if risks aren’t carefully controlled.

- Margin Call Risk: When your account equity falls below the required maintenance margin due to market fluctuations, your broker may issue a margin call. You will need to either add more funds to your account or close some positions to restore your equity above the necessary threshold. If you don’t respond to a margin call, your positions may be liquidated.

- Liquidation Risk: If you don’t fulfill a margin call, the broker may automatically close part or all of your open trades at the prevailing market price to limit losses and safeguard their interests. This forced closure often locks in losses.

- Increased Pressure: Trading with high leverage in Forex can be psychologically demanding. The risk of quick and significant losses may trigger emotional reactions like fear and greed, causing traders to stray from their well-designed trading strategies.

- Overtrading: The ability to open large positions with small margin can tempt traders to overtrade or take excessive risks with their account balances.

5. How to use leverage in Forex safely: Effective risk management strategies

Using leverage in Forex trading doesn't have to be a gamble. By implementing disciplined risk management techniques, traders can mitigate the inherent dangers.

- Use appropriate leverage levels: Avoid the temptation of using the maximum leverage in Forex offered by your broker. Choose a level that aligns with your risk tolerance and strategy. Beginners should start with very low leverage in Forex (e.g., 10:1 or lower) until they gain experience and consistency, especially when trading volatile pairs like GBP/USD.

- Determine proper position size: This is arguably the most critical aspect of risk management with leverage in Forex. Instead of focusing on the leverage ratio itself, calculate your position size based on a predetermined percentage of your account balance you are willing to risk per trade (e.g., 1-2%). This ensures that even if a trade hits your stop-loss, the loss is a manageable fraction of your total capital.

- Always use stop-loss orders: A stop-loss order is an instruction to your broker to automatically close your position if the exchange rate reaches a specific predetermined level. This limits potential losses on any single trade, protecting your initial investment from significant adverse movements.

- Understand margin requirements: Be constantly aware of your initial margin and maintenance margin requirements. Monitor your account balance and margin level (% of equity relative to required margin) to avoid unexpected margin calls when trading traded currencies.

- Don't risk capital you can't afford to lose: This is a fundamental rule of trading, especially crucial when using leverage in Forex. Only trade with funds that you can afford to lose without impacting your financial stability.

- Continuous learning: The Forex market is dynamic. Continuously educate yourself about leverage in Forex trading, risk management, market analysis, and trading psychology to better navigate the complexities of trading traded currencies like GBP/USD.

By combining a cautious approach to leverage in Forex selection with strict risk management rules like proper position sizing and the use of stop-loss orders, traders can navigate the amplified risk environment more safely and protect their account balances and initial investment.

6. Frequently asked questions (FAQ) about leverage in Forex

Leverage is a highly effective yet often misinterpreted tool in Forex trading. Although it can greatly boost profits, it likewise raises the risk of losses. To help traders navigate this double-edged sword, H2T Finance has compiled answers to some of the most frequently asked questions about leverage in forex. From understanding the risks to knowing where to find your broker's leverage terms, this section provides clarity on the most common concerns faced by both new and experienced traders.

6.1. Is higher leverage always better in Forex trading?

Absolutely not. Higher leverage in Forex simply means higher risk. While it increases the potential for magnified profits from favorable exchange rate movements, it equally increases the potential for magnified losses and the likelihood of a margin call.

The best leverage in Forex trading depends entirely on your individual risk management strategy, experience, and the size of your account balance and initial investment.

6.2. Can I lose more money than I deposit when using leverage in Forex?

Yes, it is possible, especially with very high leverage in Forex or during extreme volatility in traded currencies (like unexpected news events causing large price gaps). Although negative balance protection is provided by many regulated brokers, it is not guaranteed across the board.

Understanding your broker's policies and employing strict risk management, particularly stop-loss orders and appropriate position sizing, is crucial to prevent losses exceeding your initial investment.

6.3. How do leverage and margin differ in Forex trading?

In Forex, leverage enables you to manage a bigger position than the amount of your own capital. Margin is the actual capital required from your account balance as collateral to open and maintain that leveraged position.

They are inversely related: higher leverage in Forex trading means a lower margin requirement (as a percentage of the total position value), and lower leverage in Forex means a higher margin requirement.

6.4. How does leverage affect my trading costs when trading currency pairs like GBP/USD?

Leverage in Forex itself doesn't directly change the spread or commission costs per trade. However, because you are controlling larger positions, the *total* cost of the spread or commission for that larger position will be higher than for a smaller, unleveraged trade.

Moreover, keeping leveraged positions open overnight usually leads to financing costs—often called swap or rollover fees—which are interest charges calculated from the difference in interest rates between the currencies in pairs such as GBP/USD.

6.5. Where can I find the leverage ratio offered by my broker for different traded currencies?

Your broker will typically display the available leverage in Forex ratios on their website, often in the account types or trading conditions sections. Some brokers even provide tools like the forex.com leverage calculator to help traders estimate margin requirements before placing a trade.

You can usually select or adjust your desired leverage in Forex trading level within your trading platform or account settings, subject to the broker's maximum limits and regulatory constraints.

Different leverage levels may apply to different traded currencies and exchange rate pairs like GBP/USD. Always confirm the specific leverage in Forex applied to your account and trades before committing your initial investment.

6.6. What does 1 to 500 leverage mean in Forex?

A 1:500 leverage means that for every $1 of your own capital, you can control a $500 position in the market. While this offers very high market exposure, it also carries extremely high risk, as even small price movements can cause significant losses.

6.7. What is a good leverage for Forex?

A “good” leverage depends on your trading style and risk tolerance. For most retail traders, leverage between 1:10 and 1:50 is considered reasonable, as it balances capital efficiency with manageable risk.

6.8. What leverage is good for $100?

If you are starting with just $100, using very high leverage like 1:500 or 1:1000 can quickly wipe out your account. A safer approach is to use leverage no higher than 1:20 and focus on small position sizes to protect your capital.

6.9. What does a 1:1000 leverage mean?

A 1:1000 leverage ratio allows you to control a position size 1,000 times larger than your margin deposit. This is often offered by offshore brokers and is extremely risky, as even a tiny market move can liquidate your account.

6.10. What is leverage in Forex for beginners?

For beginners, leverage is the ability to control larger trades with a small deposit, thanks to funds borrowed from the broker. It is best to start with very low leverage (e.g., 1:10) while learning, to minimize the risk of large losses.

6.11. What is the best leverage in Forex for beginners?

The best leverage for beginners is usually between 1:10 and 1:30. This range provides enough market exposure to trade effectively without taking on excessive risk. Beginners should focus on building discipline, risk management, and consistency before considering higher leverage.

7. Conclusion

Leverage is a powerful yet risky tool in the world of Forex trading. By now, you should have a clear understanding of what is leverage in Forex, how it works, its benefits, and the risks it carries. Remember, leverage is not a shortcut to success but a tool that requires discipline, knowledge, and proper risk management.

At H2T Finance, we believe every trader should approach it with caution and strategy to achieve long-term results. Continue exploring our Forex Basics category to build a strong foundation and trade with confidence.