If you're new to forex trading, understanding what is contract size in forex is a crucial first step. Contract size represents the amount of currency you buy or sell in a trade, and it directly affects your potential gains and losses.

Grasping this concept helps you manage your risk and make informed decisions. This guide will walk you through the basics of contract size in forex, why it matters, and how to calculate it effectively - all designed to give you a solid foundation as you start your trading journey.

Key takeaways:

- Definition: Contract size in forex refers to the number of currency units traded in a single transaction, determining the scale of your trade.

- Types of contract sizes: Includes standard (100,000 units), mini (10,000 units), micro (1,000 units), and nano (100 units) lots, catering to different trader profiles.

- Impact on risk and profit: Larger contract sizes increase both potential gains and losses per pip movement, directly affecting trade value and risk exposure.

- Leverage and margin: Contract size influences the margin required for a trade, with higher sizes demanding more capital, amplified by leverage.

- Risk management: Choosing the appropriate contract size based on account size and risk tolerance is crucial for beginners to minimize losses.

- Practical application: Understanding contract size aids in calculating trade value, pip value, and margin, enabling informed trading decisions.

- Position vs. contract size: Position size refers to the number of lots traded, while contract size defines the value of each lot, critical for accurate risk assessment.

1. Understanding the basics: What is a contract size in forex?

In simple terms, contract size refers to the number of currency units involved in a single trade. It defines how big or small your position is on the forex market. What is the size of a forex contract?

The standard contract size in forex trading is typically 100,000 units of the base currency, but there are also smaller denominations like mini, micro, and nano lots to accommodate different trader profiles.

For example, if you trade 1 standard lot on the EUR/USD pair, your contract size is 100,000 units of EUR. If you trade 0.1 lot, the contract size becomes 10,000 units (a mini lot), and 0.01 lot equals 1,000 units (a micro lot).

What is contract size 100 in forex?

This typically refers to a very small position size, likely a nano lot where 1 lot = 100 units of the base currency. Such a size is often used by beginner traders or for testing strategies in a low-risk environment.

In the next section, we’ll look deeper into why contract size matters, especially in the context of leverage, risk, and real-world trading outcomes.

2. Why contract size matters in forex trading

Understanding contract size is more than just a technical detail; it's the foundation of managing your risk and profits. So why is this concept so important that you can't afford to ignore it? Let's dive into each reason, because they directly impact your wallet.

2.1. Impact on trade value and risk

Your contract size directly influences the total value of your trade and how much you're risking per pip.

For example:

- A standard contract size (100,000 units) means that each pip movement equals $10 in a major currency pair like EUR/USD.

- A mini contract (10,000 units) moves $1 per pip.

- A micro contract (1,000 units) moves $0.10 per pip.

The larger your contract size, the more each pip movement affects your bottom line both positively and negatively. This is why traders with small accounts often choose smaller lot sizes to limit risk.

Advice from experience: This is the golden rule. Always adjust your contract size based on your risk tolerance and trading capital. A contract that's too large, trust me, can wipe out your account quickly, especially in volatile markets.

2.2. Relationship with leverage and margin

Leverage and contract size go hand in hand. When you increase your contract size, you also increase the required margin to open and maintain the trade.

Here’s how it works:

- If your broker offers 1:100 leverage, opening a 100,000-unit contract would require only $1,000 in margin.

- But if you use a 500,000-unit contract, the required margin would jump to $5,000, assuming the same leverage.

So, while leverage can magnify your potential returns, a large contract size can also magnify your losses just as quickly if you’re not careful.

2.3. Real-world example: EUR/USD trade using different contract sizes

Let’s say you want to trade EUR/USD at 1.1000. Here’s how different contract sizes impact your trade:

| Contract Size | Lot Size | Value Per Pip | Margin Required (1:100) |

|---|---|---|---|

| 100,000 units | 1 lot | $10 | $1,000 |

| 10,000 units | 0.1 lot | $1 | $100 |

| 1,000 units | 0.01 lot | $0.10 | $10 |

As you can see, the contract size directly determines your exposure. This is why every trader, especially beginners needs to understand this concept before opening trades.

In the next section, we’ll walk through the different types of forex contract sizes, including standard, mini, micro, and nano lots, so you can choose the one that fits your strategy and risk profile.

3. Common forex contract sizes explained

In forex trading, the contract size refers to the number of currency units you’re trading. Understanding the different contract sizes standard, mini, micro, and nano is essential for managing your trading strategy effectively.

3.1. Standard contract size

The standard contract size in forex is 100,000 units of the base currency. For example, if you're trading EUR/USD, one standard lot represents 100,000 euros.

- Value per pip: In most major pairs, the pip value for a standard lot is $10.

- Example: A movement of 1 pip in EUR/USD from 1.1000 to 1.1001 would equal a gain or loss of $10.

Standard lots are ideal for experienced traders with large capital and higher risk tolerance. While they offer higher returns, they can also lead to significant losses if not managed properly.

3.2. Mini contract size

A mini lot is 10,000 units of the base currency. It’s a more manageable size for many traders, especially those who are still learning or trading with a smaller account.

- Value per pip: A mini lot moves $1 per pip in most major pairs.

- Example: A movement of 1 pip in EUR/USD with a mini lot equals a $1 change.

Mini lots are a great choice for traders who want to get the feel of larger trades without risking as much capital. If you're just starting, mini lots are a good stepping stone between micro and standard lots.

3.3. Micro contract size

A micro lot is 1,000 units of the base currency. Micro lots allow traders with smaller accounts to participate in the forex market without exposing themselves to significant risk.

- Value per pip: The pip value for a micro lot is $0.10.

- Example: A movement of 1 pip in EUR/USD with a micro lot results in a $0.10 change.

Micro lots are especially useful for beginners who want to practice and gain experience with smaller risk while still learning the ropes of forex trading.

3.4. Nano contract size

The nano lot is the smallest contract size in forex, representing 100 units of the base currency.

- Value per pip: The pip value for a nano lot is $0.01.

- Example: A movement of 1 pip in EUR/USD with a nano lot results in a $0.01 change.

Nano lots are useful for those who are looking to make tiny trades with minimal risk. They’re not commonly available with all brokers but can be ideal for testing strategies or paper trading.

Summary of forex contract sizes:

| Contract Size | Units of Base Currency | Pip Value (EUR/USD) | Ideal For |

|---|---|---|---|

| Standard Lot | 100,000 | $10 | Experienced traders with large accounts |

| Mini Lot | 10,000 | $1 | Intermediate traders or those with smaller accounts |

| Micro Lot | 1,000 | $0.10 | Beginner traders or small-cap traders |

| Nano Lot | 100 | $0.01 | Experimenting or paper trading |

Each contract size has its own pros and cons, and choosing the right one depends on your risk tolerance, account size, and trading goals. In the next section, we will dive into how to calculate forex contract size, so you can determine exactly what fits your trading style.

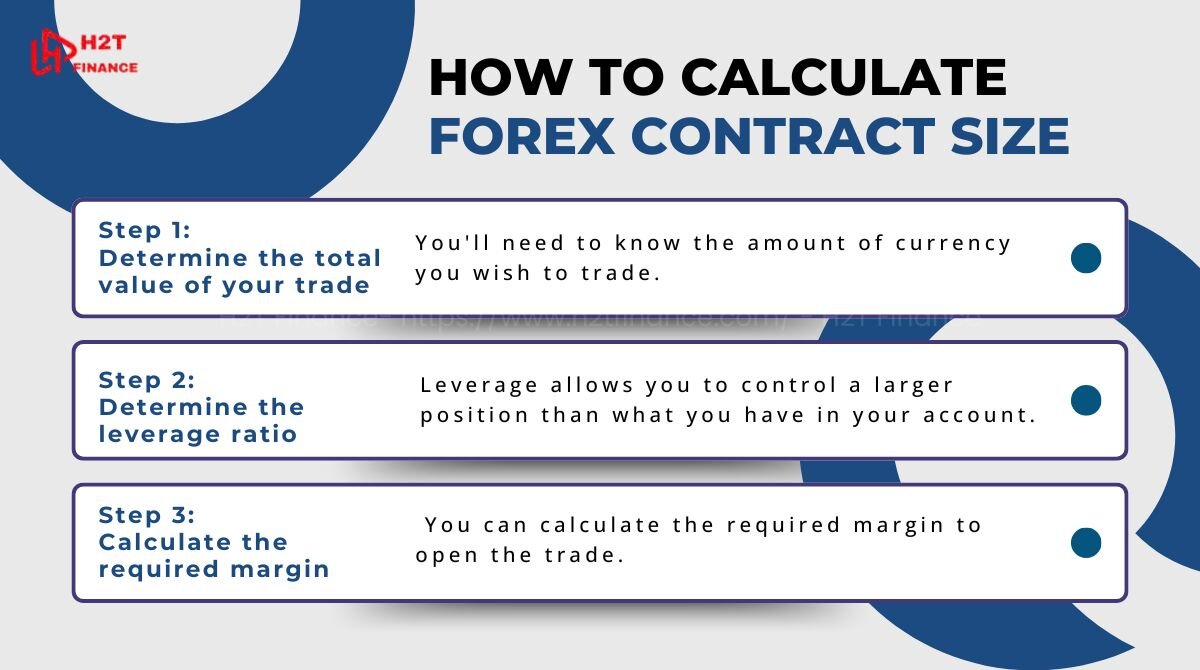

4. How to calculate forex contract size: A step-by-step guide

Calculating the contract size in forex is crucial for managing your trades and ensuring you’re not taking on more risk than you’re comfortable with.

Here's how you can calculate the correct contract size for your forex trades:

4.1. Step 1: Determine the total value of your trade

First, you'll need to know the amount of currency you wish to trade. This is usually in USD, but depending on the pair you're trading, it could be in another currency.

For example, if you're trading EUR/USD and you want to trade 10,000 euros (which equals 1 mini lot), the total value would be the EUR/USD exchange rate multiplied by the amount of euros.

If the EUR/USD exchange rate is 1.1200, the total value of the trade would be:

10,000 EUR x 1.1200 = 11,200 USD

4.2. Step 2: Determine the leverage ratio

Leverage allows you to control a larger position than what you have in your account. For example, if you're using a 50:1 leverage, you only need to put up 1/50th of the total trade value as margin.

If you're trading 10,000 EUR/USD with 50:1 leverage, you would need:

11,200 USD ÷ 50 = 224 USD in margin.

This margin is the amount you need to have in your account to open the trade.

4.3. Step 3: Calculate the required margin

Once you have chosen your contract size (e.g., 1 mini lot = 10,000 units) and you know your leverage ratio, you can calculate the required margin to open the trade. Margin is the amount of money you need in your account as collateral.

The formula is as follows:

Required Margin = (Contract Size × Current Price) / Leverage Ratio

For example, if you want to trade 1 mini lot (10,000 units) of EUR/USD at an exchange rate of 1.1200 with 50:1 leverage:

Required Margin = (10,000 EUR × 1.1200) / 50 = 224 USD

This means you need to have at least $224 in your account to open this trading position.

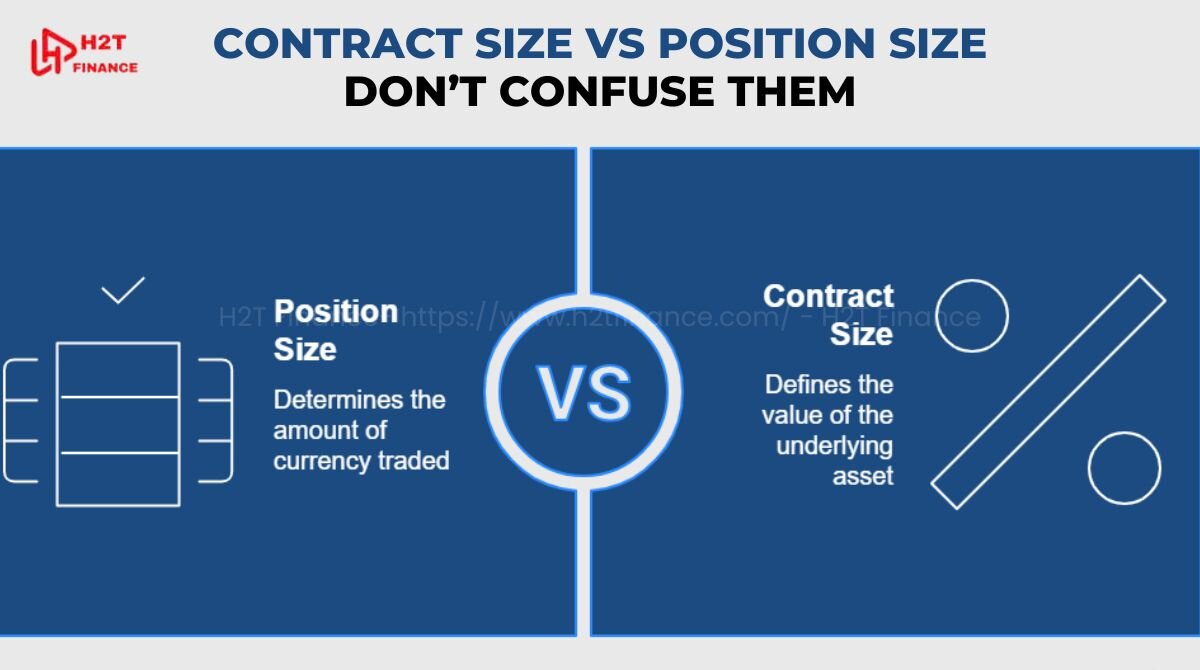

5. Contract size vs position size: Don’t confuse them

In forex trading, it is crucial to clearly distinguish between "contract size" and "position size."

Although they are related, they refer to two different aspects of a trade. Understanding each concept clearly is key to accurate risk management and avoiding flawed trading decisions.

5.1. What is position size?

Position size refers to the amount of a particular asset you choose to trade, often expressed in terms of the number of lots you're trading. It dictates the amount of currency you're buying or selling in a trade, but it is not directly linked to the value of that trade in terms of the contract size.

For example, if you decide to trade 2 mini lots of EUR/USD, your position size is 2 mini lots (or 20,000 units of EUR/USD), but the contract size still refers to the actual value of the lot size being traded.

5.2. Contract size is about value

In contrast, the what is contract size in forex calculator is tied to the value of the underlying asset being traded. It is often standardized by brokers, with one standard lot typically being worth 100,000 units of the base currency (e.g., EUR in EUR/USD), 1 mini lot equaling 10,000 units, and 1 micro lot equaling 1,000 units.

5.3. How the two work together

- Position size: Determines the number of lots you're trading. For instance, you may decide to trade 2 mini lots (20,000 units of EUR/USD).

- Contract size: Defines the size of each lot. For example, each mini lot represents 10,000 units.

To put it simply, position size tells you how many lots you're trading, while contract size tells you how much is actually in each lot.

5.4. Why the distinction matters

Understanding the difference between contract size and position size is important for controlling your risk. By correctly calculating your position size, you can ensure that you're not over-leveraging your trades or taking on too much risk for your capital.

Similarly, knowing the contract size helps you determine the total value of your trade and its potential for profit or loss.

5.5. Example to illustrate the difference:

Let’s say you want to trade EUR/USD using 2 mini lots. If the EUR/USD exchange rate is 1.1200, the contract size is 10,000 units per lot, and your total position size will be:

- Position size = 2 mini lots = 20,000 units of EUR/USD.

- Contract size = 10,000 units per mini lot = 10,000 EUR per lot.

Even though you’re trading 2 mini lots, the contract size refers to the size of each lot, which is 10,000 EUR per lot.

6. Contract size in action: Examples from real forex trades

Understanding contract size is crucial when making actual trades, as it directly affects the value of each pip movement and how much you stand to gain or lose. Let's walk through some real forex trade examples to demonstrate how contract size impacts your trading decisions and overall risk.

Example 1: Trading a standard lot (100,000 units)

Let’s say you decide to trade a standard lot (100,000 units) of EUR/USD. If the exchange rate is 1.1200, here's how your contract size plays out:

- Contract size: 100,000 EUR (1 standard lot).

- Trade value: 100,000 EUR * 1.1200 USD = 112,000 USD (the amount of USD you're effectively trading).

With a standard lot of 100,000 units, each pip move in the EUR/USD pair is worth $10 (this is based on the common formula of pip value for standard lots).

- If the EUR/USD pair moves 10 pips in your favor (up to 1.1210), you would gain:

10 pips * $10 per pip = $100. - If the EUR/USD pair moves 10 pips against you (down to 1.1190), you would lose:

10 pips * $10 per pip = $100.

Example 2: Trading a mini lot (10,000 units)

Now, let’s say you decide to trade a mini lot (10,000 units) of EUR/USD at the same exchange rate of 1.1200.

- Contract size: 10,000 EUR (1 mini lot).

- Trade value: 10,000 EUR * 1.1200 USD = 11,200 USD (the amount of USD you're trading).

With a mini lot of 10,000 units, each pip movement in EUR/USD is worth $1.

- If the EUR/USD pair moves 10 pips in your favor (up to 1.1210), you would gain:

10 pips * $1 per pip = $10. - If the EUR/USD pair moves 10 pips against you (down to 1.1190), you would lose:

10 pips * $1 per pip = $10.

Example 3: Trading a micro lot (1,000 units)

Let’s take it a step further and trade a micro lot (1,000 units) of EUR/USD, with the exchange rate still at 1.1200.

- Contract size: 1,000 EUR (1 micro lot).

- Trade value: 1,000 EUR * 1.1200 USD = 1,120 USD (the amount of USD you’re trading).

With a micro lot of 1,000 units, each pip movement is worth $0.10.

- If the EUR/USD pair moves 10 pips in your favor (up to 1.1210), you would gain:

10 pips * $0.10 per pip = $1. - If the EUR/USD pair moves 10 pips against you (down to 1.1190), you would lose:

10 pips * $0.10 per pip = $1.

How contract size impacts your risk

In all these examples, we can see that contract size plays a direct role in the potential gains or losses per pip movement. The larger the contract size, the more capital you are risking with each trade, and the larger your profit or loss potential becomes.

Conversely, smaller contract sizes like mini and micro lots allow you to trade with less capital at risk, making them more suitable for beginners or those looking to minimize exposure.

It’s also important to note that risk management is key. Using a stop-loss or take-profit strategy will help you manage your risk based on your contract size.

7. Best practices: Choosing the right contract size as a beginner

As a beginner trader, understanding how to choose the right contract size is crucial for your success in forex trading. Your decision should be based on your capital, risk tolerance, and trading strategy. Let's go over some practical tips that will help you make better decisions when it comes to choosing your contract size.

7.1. Consider your capital, leverage, and risk appetite

Before diving into trading, it's essential to assess your capital (how much money you have for trading) and the amount of leverage you’re using. Leverage allows you to control a larger position than what you can afford with your initial capital. However, it also increases your exposure to risk.

- Smaller contract sizes (like micro lots or mini lots) are often recommended for beginners, as they allow you to trade with lower risk while gaining experience.

- Larger contract sizes, such as standard lots, can result in higher profits but also lead to higher losses. As a beginner, you should approach them with caution.

A general rule of thumb is not to risk more than 1–2% of your trading capital on any single trade. This way, even if a trade goes against you, it won’t wipe out a significant portion of your capital.

7.2. Use demo accounts to experiment with different lot sizes

When you're just starting out, it's highly recommended to practice with a demo account. Demo accounts allow you to trade with virtual money, which helps you understand how contract sizes impact your trades without any financial risk.

- On your demo account, try out different contract sizes (standard, mini, micro) to see how they affect your trading results.

- Test your ability to manage risk with different lot sizes and observe how much profit or loss you incur with each movement.

This hands-on practice will give you a better feel for contract size in forex trading and help you make more informed decisions when you switch to live trading.

7.3. Combine with stop-loss and risk percentage rules

While choosing the right contract size is important, it should always be part of a comprehensive risk management strategy. The use of stop-loss orders and risk percentage rules can help you control the amount you’re willing to lose per trade, further minimizing the potential impact of a large contract size.

- A stop-loss order automatically closes your trade when the price reaches a certain level, protecting you from large losses.

- Combining a stop-loss with a sensible contract size ensures that your losses are manageable, even in volatile market conditions.

For example, if you’re trading a mini lot (10,000 units), you might decide to risk only 1% of your account balance on a single trade. By calculating your stop-loss distance based on the pip value, you can ensure that even a losing trade won’t wipe out too much of your capital.

Discover related blog posts in this section:

8. Related questions about forex contract size (FAQ section)

You probably still have a few questions. Don't worry, that's completely normal! Here are the questions that most new traders ask, along with straightforward answers to help you feel more confident on your journey.

8.1. What is the standard contract size in forex?

The standard contract size in forex is typically 100,000 units of the base currency in a currency pair. For example, when you trade the EUR/USD pair, one standard contract represents 100,000 euros. This is also referred to as a standard lot.

- Standard lot = 100,000 units

- Mini lot = 10,000 units

- Micro lot = 1,000 units

The larger the contract size, the more capital you need to trade. For beginners, it's often better to start with micro or mini lots to reduce your exposure to risk.

8.2. Is contract size the same as lot size?

Not exactly the same, but they are intrinsically linked. To be precise:

- Lot Size: This is a standardized unit of measurement. You choose to trade in "lots," for example: 1 lot, 0.1 lots, or 0.01 lots.

- Contract Size: This is the actual number of currency units that the "lot size" represents.

For example: When you choose a lot size of 1 standard lot, your contract size is 100,000 units of the base currency. In other words, "lot size" is the label, while "contract size" is the actual value behind that label.

8.3. How does contract size affect pip value?

The contract size directly affects the pip value in forex. A pip is the smallest price movement in a currency pair, and it represents a change in the exchange rate.

- Standard lot (100,000 units): 1 pip equals $10 in profit or loss

- Mini lot (10,000 units): 1 pip equals $1 in profit or loss

- Micro lot (1,000 units): 1 pip equals $0.10 in profit or loss

The larger your contract size, the more money you stand to gain or lose with each pip movement. Therefore, contract size plays a critical role in managing risk and potential reward in forex trading.

8.4. Can I trade forex with a small contract size?

Yes, you can. In fact, trading with smaller contract sizes (like micro lots) is a great way for beginners to practice and learn how the forex market works without taking on too much risk.

- Micro lots allow you to trade with less capital while gaining hands-on experience.

- Mini lots are a good option if you want to increase your position size slightly, but still manage your exposure.

By trading smaller contract sizes, you can learn risk management techniques and refine your strategy before moving to larger contracts.

8.5. What’s the best contract size for beginners?

For beginners, micro lots or mini lots are often the best choice. They allow you to trade with a smaller amount of capital, which limits your exposure to risk while providing the opportunity to practice.

- Micro lots (1,000 units) are ideal for very small trades and allow beginners to take small steps in the market.

- Mini lots (10,000 units) offer a balance between risk and reward and can help you transition to standard lots later on.

Start small, learn the ropes, and increase your contract size as you gain more experience and confidence in your trading.

8.6. What is contract size in XAUUSD?

XAUUSD represents the trading pair for gold priced in US dollars, where XAU is the symbol for gold and USD is the US dollar. In forex trading, the contract size for XAUUSD refers to the amount of gold (in troy ounces) you are trading per lot.

- Standard contract size: Typically, one standard lot in XAUUSD equals 100 troy ounces of gold.

- Mini contract size: A mini lot is usually 10 troy ounces of gold.

- Micro contract size: A micro lot is 1 troy ounce of gold.

- Pip value: The pip value for XAUUSD depends on the contract size and the price of gold. For a standard lot (100 troy ounces), a $1 movement in the price of gold (e.g., from $2,000 to $2,001) equals $100 in profit or loss. For a mini lot (10 troy ounces), it’s $10, and for a micro lot (1 troy ounce), it’s $1.

- Example: If you trade 1 standard lot of XAUUSD at $2,000 and the price moves to $2,010, you gain 10 pips * $100 per pip = $1,000.

Trading XAUUSD with smaller contract sizes (mini or micro lots) is recommended for beginners due to gold’s high volatility and price per ounce, which can lead to significant gains or losses.

9. Conclusion: Final thoughts: why every forex trader should understand contract size

Understanding what is contract size in forex is fundamental for every trader, regardless of experience level. Here are the key reasons why mastering contract size is essential:

- Risk management: Contract size determines how much money you are exposing per trade, helping you control potential losses.

- Trade value clarity: Knowing your contract size ensures you understand the real value of your positions in the forex market.

- Leverage and margin calculation: Contract size directly affects how much margin you need and how leverage amplifies your trades.

- Position sizing: It helps you choose the right lot size based on your capital and risk tolerance.

- Strategic decision-making: Accurate knowledge of contract size supports better planning of entries, exits, and stop-loss levels.

Mastering contract size is like laying the very first foundation stone for your trading career. At H2T Finance, we believe knowledge is power, and that's why our Forex Basics category exists to give you the strongest possible foundation.

Now that you've grasped this concept, don't stop here. Explore the other articles in this series to continue building your own successful trading strategy.