If you’re new to trading or looking to improve your risk management strategies, you might be wondering what is a trailing stop order and how it can help you manage your trades more effectively.

A trailing stop order is a dynamic type of stop order designed to protect your profits by automatically adjusting your exit point as the market price moves in your favor. Unlike a fixed stop loss, it allows you to lock in gains while still giving your trade room to grow.

In this article, we’ll explore what a trailing stop order is, how it works, its types, and how you can use it smartly in your trading strategy.

Key takeaways:

- A trailing stop is a dynamic stop-loss order that moves automatically with favorable price movements.

- It helps traders lock in profits while limiting potential losses without constant manual adjustments.

- Trailing stops work best in trending markets, both uptrends and downtrends.

- There are different types of trailing stops: trailing stop loss, buy trailing stop, and sell trailing stop.

- Common strategies include trend-following, volatility-based, trailing stop with Take Profit, and news trading.

- Benefits of trailing stops include: locking in profits, staying in winning trades longer, limiting downside risk, and reducing emotional trading decisions.

- Limitations include premature exits, slippage, and reduced effectiveness in sideways or choppy markets.

- Trailing stops can be set on most popular platforms like MT4/MT5, TradingView, and broker-specific tools, but platform behavior may vary.

1. What is a trailing stop order?

A trailing stop is a type of stop-loss order that automatically moves with the market price when it moves in your favor. It helps you lock in profits while limiting potential losses.

Unlike a fixed stop-loss, a trailing stop follows the market at a set distance, measured in points or percentages, and only moves in one direction, securing gains as long as the trend continues. This dynamic mechanism makes it a smart tool for managing trades in volatile markets like Forex, where prices can change rapidly.

As the price moves in your favor, the trailing stop adjusts automatically. If the price reverses and reaches the stop level, the order is triggered, converting into a market order that attempts to close the position at the next available price.

Trailing stops are a powerful yet often underutilized tool in a trader’s risk management arsenal. This dynamic feature allows traders to stay in winning trades longer without manually updating stop-loss levels.

Trailing stops are particularly suitable for trend-following strategies and are popular among Forex traders. They are ideal for those who prefer to “let profits run” while still protecting capital against sudden market reversals.

What is trailing stop-loss with an example?

For example, suppose you buy a stock at $100 and set a trailing stop of 5%. If the stock price rises to $110, your stop-loss will trail upward to $104.50 (which is 5% below $110). However, if the stock price starts falling from $110, your trailing stop remains at $104.50. If the price drops to or below $104.50, your order will be triggered and the stock will be sold, locking in gains.

Key points to remember about trailing stops:

- Automatically moves with the market price in a favorable direction.

- Follows the market at a fixed distance (points or percentage).

- Moves only in one direction; it does not decrease when the price reverses.

- Converts to a market order when triggered.

- Useful for trend-following strategies and “letting profits run.”

- Helps protect capital from sudden volatility and reduces emotional risk.

2. How does a trailing stop order work?

Understanding how trailing stop orders function is essential for using them effectively. These orders rely on price movement to automatically adjust your stop level and ultimately convert to a market order when certain conditions are met. Let’s break down the mechanics and see how they work in practice.

2.1. Mechanics of a trailing stop

A trailing stop works by setting a stop price that "trails" the current market price by a predefined distance. This distance can be set in:

- Points (e.g., 50 pips in Forex)

- Percentages (e.g., 2% below the market price)

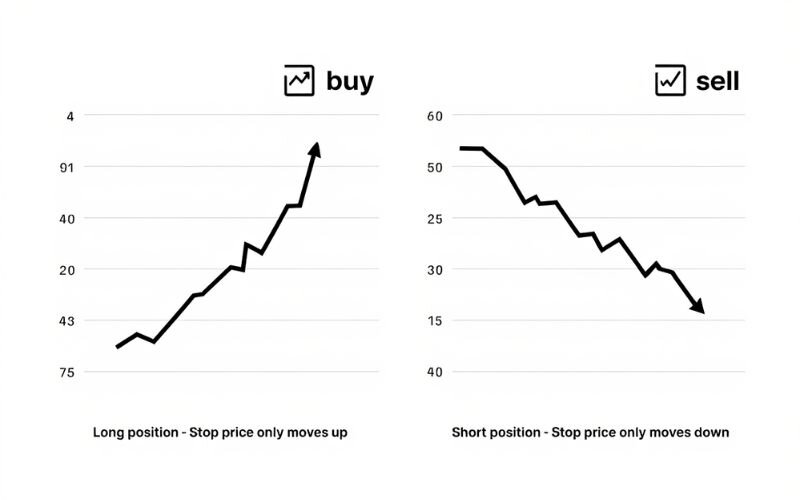

The stop price only moves in one direction:

- For long (buy) positions, the stop price rises with the asset price but never decreases.

- For short (sell) positions, the stop price falls with the asset price but never increases.

When the asset price moves in your favor, the trailing stop price automatically adjusts. If the price moves against you by the trailing amount, the stop is triggered and becomes a market order executed at the next available price.

This mechanism allows traders to follow trends without actively monitoring and adjusting their stop-loss levels.

2.2. Illustration: How a trailing stop works in practice

Let’s say you bought EUR/USD at 1.1000 and set a trailing stop of 50 pips.

- If the price rises to 1.1050, your trailing stop moves up to 1.1000.

- If the price climbs further to 1.1100, the stop now trails at 1.1050.

- But if the price then drops to 1.1050, the stop is triggered and your order becomes a market order to sell.

This flexibility allows you to lock in profits as the trend continues while automatically protecting against sharp reversals.

3. Types of trailing stop orders in forex

Trailing stop orders can be customized to fit different trading positions and goals. Understanding the key types helps traders apply the right strategy based on market direction, trading style, and risk tolerance. Below, we break down the three main types: trailing stop loss, buy trailing stop, and sell trailing stop.

3.1. What is a trailing stop loss order?

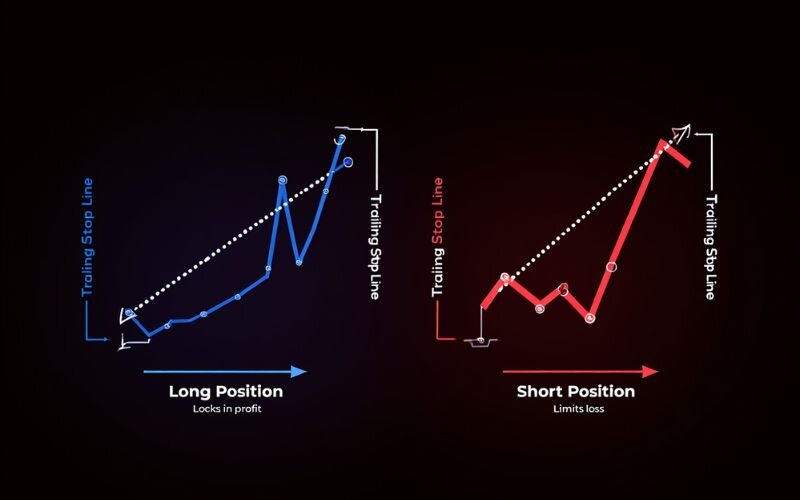

A trailing stop loss order is the most common form of trailing stop. It’s designed to protect profits or limit losses on an open position by setting a stop that adjusts as the market price moves in your favor.

- For long positions: The trailing stop loss moves upward as the asset’s price increases.

- For short positions: It trails downward as the price decreases.

This type of order becomes a market order once the price retraces by the predefined trailing amount (e.g., 2% or 50 pips). It’s widely used for risk management and for locking in gains during trending markets.

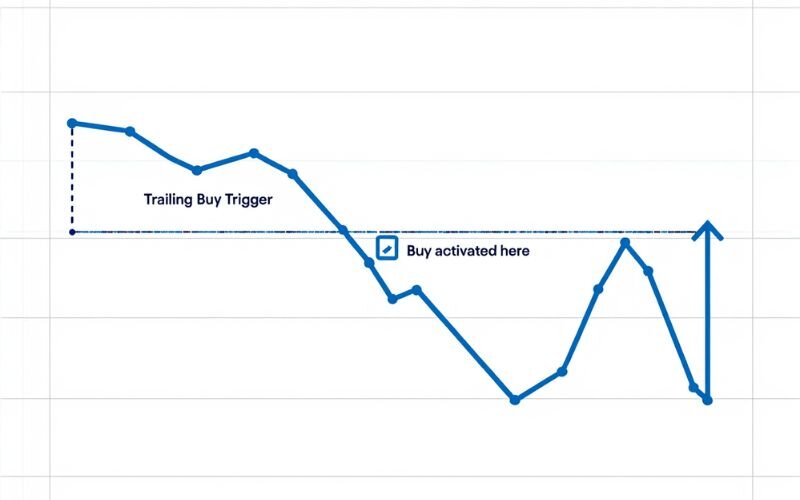

3.2. What is a buy trailing stop order?

A buy trailing stop order is typically used by traders looking to enter a long position once an asset starts recovering from a downtrend.

- It sets a trigger price that follows the lowest price by a trailing distance.

- When the price reverses upward by that amount, a market buy order is placed.

This strategy allows traders to avoid catching a falling knife and only enter once signs of a trend reversal are evident. It’s commonly used in momentum-based or reversal strategies.

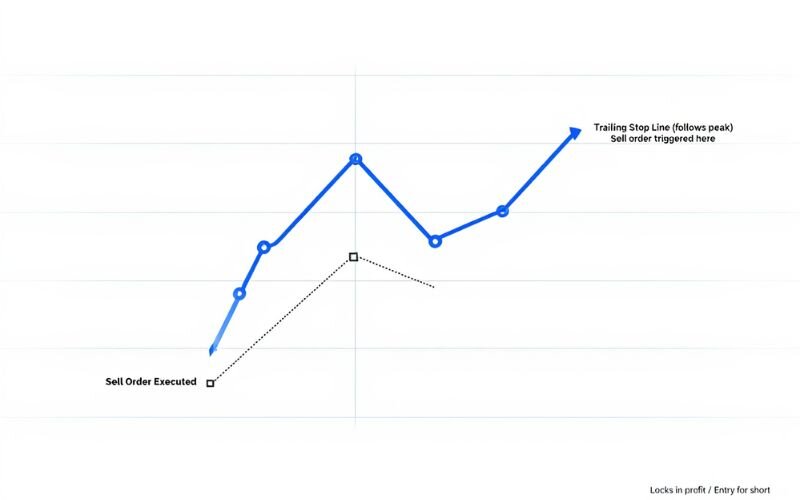

3.3. What is a sell trailing stop order?

A sell trailing stop order is used either to exit a long position or to initiate a short position when prices start falling.

- It sets a trigger price that follows the highest price by a set distance.

- Once the price drops by that amount, it converts into a market sell order.

This type of trailing stop is ideal for locking in profits from long positions or riding bearish trends with new short entries.

Each type of trailing stop order offers unique advantages depending on your trade direction and strategy making it a versatile risk control tool in any trader’s arsenal.

See more related articles:

- What is price action? Understanding core Forex concepts

- How do financial advisors get paid: Key models and pay structures

- What is forex exchange trading? Explained for total beginners

4. When and why to use trailing stop orders

Knowing when and why to use a trailing stop order can help traders make more informed decisions and manage trades with confidence. Trailing stops are not just for protecting downside they can also help ride strong trends and automate exits without emotional interference. This section explains the ideal market conditions, common use cases in forex, and the key benefits for traders.

4.1. Best market conditions

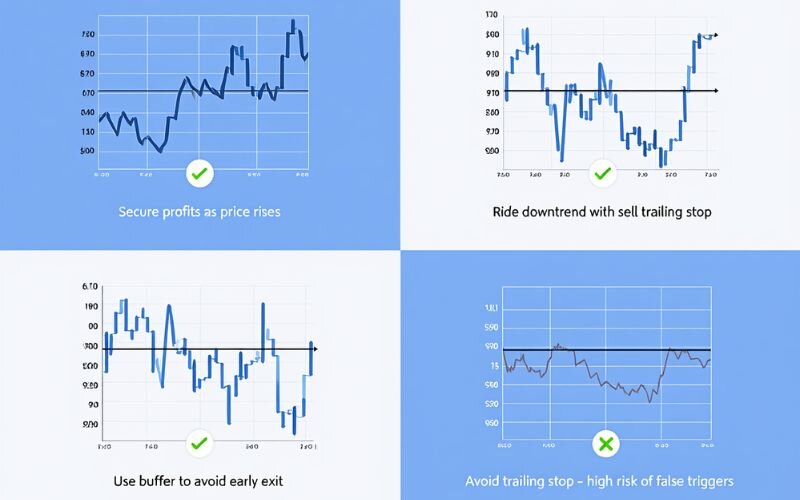

Trailing stops are most effective in trending markets whether bullish or bearish. These orders allow traders to stay in the trend as long as it lasts, without manually adjusting their exit points.

- Uptrends: Trailing stop loss can secure profits as the price continues higher.

- Downtrends: Sell trailing stops can help short sellers capture moves without micromanaging the trade.

- Volatile markets: When used with a volatility buffer, trailing stops can provide flexible exits without getting triggered prematurely.

Avoid using trailing stops in sideways or choppy markets, where price fluctuations may trigger stops too early.

4.2. Use cases in forex trading

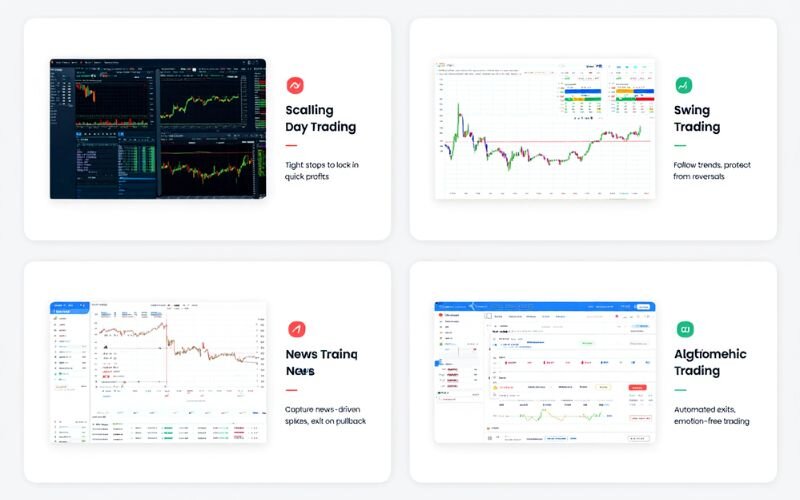

In the forex market, trailing stop orders are widely used due to the high volatility and 24/5 market availability. Some common use cases include:

- Scalping and day trading: Traders use tight trailing stops to lock in small gains quickly.

- Swing trading: Trailing stops follow longer price movements, allowing positions to run while protecting from reversals.

- News trading: Trailing stops capture sharp moves post-announcement, exiting automatically on retracement.

Forex traders also use trailing stops with EA/algorithms on MT4/MT5 to automate exits and reduce the emotional impact of decision-making.

4.3. Benefits for traders

Here are the core advantages of using trailing stop orders:

| Benefit | Description |

|---|---|

| Lock in profits | Secure gains as the market moves in your favor |

| Let winners run | Stay in profitable trades longer without manual adjustments |

| Limit downside risk | Automatically exit when price reverses beyond your risk tolerance |

| Emotion-free exit | Avoid panic selling or hesitation by automating the decision |

| Dynamic adaptability | Adjusts with the market, unlike static stop-loss orders |

Trailing stop orders combine flexibility and discipline making them a valuable component of every serious trader’s toolbox.

5. Common strategies using trailing stops

Trailing stop orders are versatile tools that can be adapted to various trading strategies. Understanding how to apply them effectively can improve trade management and outcomes. Below are some of the most popular strategies that use trailing stops, providing practical guidance for traders in Forex and other markets.

5.1. Trend-following strategy

The trend-following strategy is one of the most common ways to use trailing stops. Traders identify ongoing price trends and enter positions aligned with that trend, using trailing stops to lock in profits as the trend progresses.

- Uptrend: A trailing stop loss follows the price at a set distance below, allowing the position to stay open while the price rises.

- Downtrend: Sell trailing stop orders are used to protect short positions, moving down as the price decreases.

Example: You buy EUR/USD at 1.1000 with a trailing stop of 50 pips. As the price rises to 1.1050, your stop moves up to 1.1000. If the trend continues to 1.1100, the stop adjusts to 1.1050. A reversal to 1.1050 triggers the stop, securing profits automatically.

This strategy maximizes gains by letting profits run while minimizing losses when the trend reverses.

5.2. Volatility-based strategy

This approach adjusts the trailing stop distance based on market volatility. Instead of using a fixed number of pips or percentage, the trailing stop adapts dynamically according to price fluctuations.

- High volatility: Trailing stop distance widens to avoid being stopped out by normal swings.

- Low volatility: Trailing stop tightens to protect profits more aggressively.

Indicators like the Average True Range (ATR) can help set appropriate trailing distances, making this method effective for fast-moving or choppy markets.

Example: A trader sets a trailing stop on GBP/USD using ATR. During a high-volatility session, the stop is set at 70 pips, preventing premature exits. In calmer periods, it narrows to 30 pips to lock in gains efficiently.

5.3. Trailing stop with take profit strategy

Combining a trailing stop with a Take Profit level helps optimize profits while managing risk.

- Mechanics: Set a trailing stop at a certain distance and a Take Profit target for the trade. The trailing stop moves with the price, but the position closes automatically once the Take Profit is reached.

- Benefit: Balances “letting winners run” with achieving a predetermined profit goal.

Example: You buy USD/JPY at 145.00 with a 50-pip trailing stop and a Take Profit at 100 pips. If the price moves to 146.00, the trailing stop rises to 145.50. If the price reaches 146.00, your Take Profit is triggered, closing the trade with full gains.

5.4. News trading trailing stop strategy

Trailing stops can be particularly useful during high-impact news events, where price volatility is significant.

- Mechanics: Set a trailing stop close to the current price before the news release. The stop moves favorably as the market reacts, securing profits without manual intervention.

- Benefit: Reduces emotional decision-making and prevents large losses during rapid price swings.

Example: A trader anticipates a U.S. Non-Farm Payroll (NFP) report and enters a trade on EUR/USD. A trailing stop of 40 pips is placed. As the news pushes the price upward, the trailing stop follows, locking in profits automatically when the market reverses after the initial surge.

By applying these four strategies trend-following, volatility-based, trailing stop with Take Profit, and news trading traders can use trailing stops more effectively, protecting profits while letting favorable trades run. Each method can be tailored to market conditions, trading style, and risk tolerance, making trailing stops a versatile tool in any trader’s risk management toolkit.

6. Risks and limitations of trailing stops

While trailing stop orders offer many advantages, they also come with inherent risks and limitations that every trader should understand before relying on them exclusively. This section explains the common pitfalls and scenarios where trailing stops may not perform as expected.

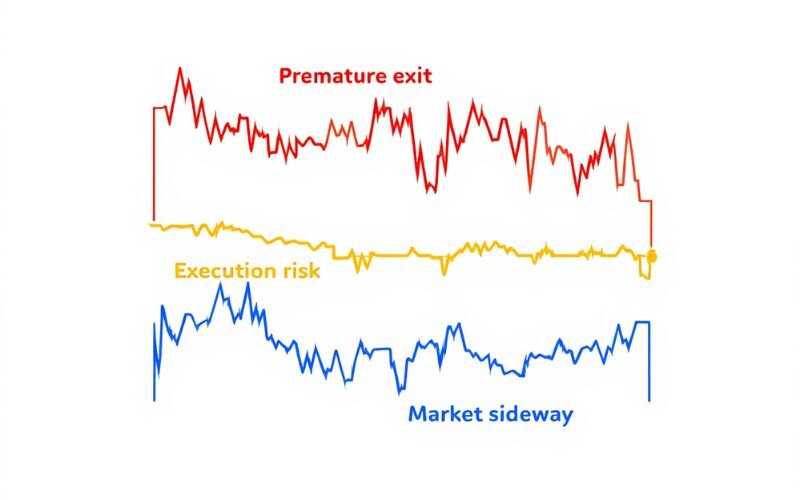

6.1. Premature exits

One of the biggest risks of trailing stops is getting stopped out too early due to normal market fluctuations or short-term volatility. Price retracements or “noise” can trigger the trailing stop, closing a position before the trend actually reverses.

- This can happen especially in highly volatile markets or during news releases.

- Traders may miss out on larger profits if the stop distance is set too tight.

6.2. No control over execution price

Trailing stops convert to market orders once triggered, meaning the actual exit price can vary. In fast-moving markets, the execution price may be worse than the trailing stop trigger price, causing slippage.

- Slippage risk increases during low liquidity or high volatility.

- Traders should be aware that the exit price is not guaranteed.

6.3. Not suitable for all market types

Trailing stops work best in trending markets where price moves steadily in one direction. In sideways or range-bound markets, trailing stops can trigger repeatedly on minor price swings, causing unnecessary losses or “churn.”

- Markets with frequent gaps or sharp reversals may also reduce trailing stop effectiveness.

- Alternative exit strategies may be preferable in such conditions.

7. How to set trailing stops on popular trading platforms

Setting trailing stop orders correctly can vary depending on the trading platform you use. This section guides you through the steps to set up trailing stops on some of the most popular platforms used by forex and stock traders today.

7.1. MetaTrader 4 / MT5

MetaTrader 4 and MetaTrader 5 are widely used forex trading platforms known for their robust charting and order management features.

- To set a trailing stop on MT4 or MT5, first, open the Terminal window and navigate to the Trade tab.

- Right-click on an open position or pending order and select Trailing Stop from the context menu.

- Choose a predefined trailing stop distance or enter a custom value in points.

- The trailing stop will automatically adjust as the market price moves in your favor.

- Note: Trailing stops on MT4/MT5 work only when the platform is running and connected to the broker.

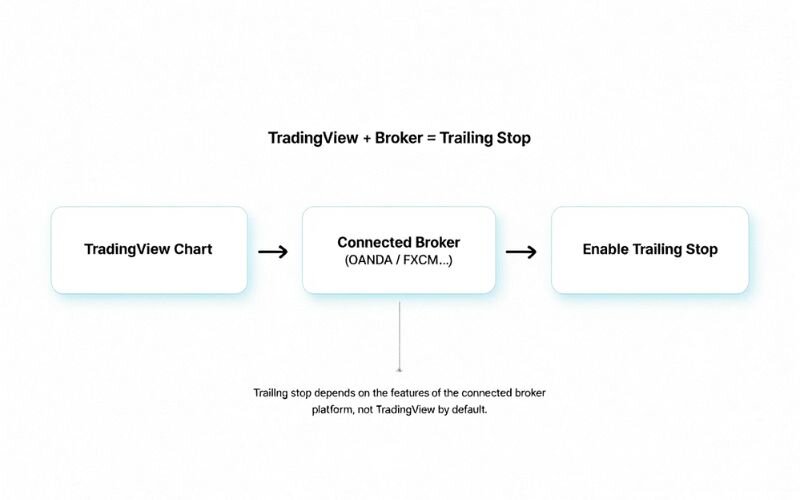

7.2. TradingView

TradingView is a popular web-based charting platform that integrates with several brokers.

- While TradingView supports setting stop-loss orders, trailing stops depend on broker integration.

- To set a trailing stop, you may need to place an initial stop order and manually adjust it as price moves, or use a broker platform linked to TradingView that supports trailing stops.

- Automated trailing stops may be limited on TradingView alone but are accessible through supported brokers’ native apps.

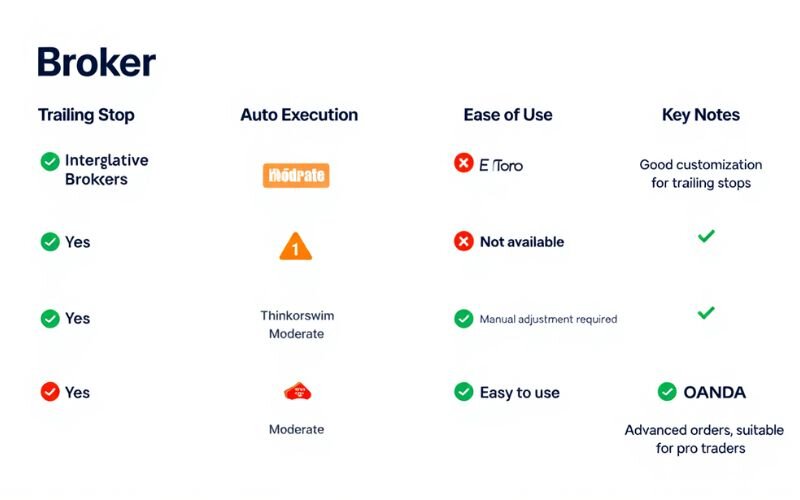

7.3. Broker tools comparison

Different brokers provide varying levels of trailing stop functionality.

| Broker Platform | Trailing Stop Support | Auto Execution | User Interface Ease | Notes |

|---|---|---|---|---|

| Interactive Brokers | Yes | Yes | Moderate | Advanced order types available |

| Thinkorswim (TD Ameritrade) | Yes | Yes | User-friendly | Good trailing stop customization |

| eToro | Limited | No | Simple | Manual stop adjustment required |

| OANDA | Yes | Yes | Easy | Supports trailing stops on MT4 |

When choosing a broker or platform, consider how well trailing stop orders fit into your trading workflow and risk management strategy.

8. Tips for using trailing stops effectively

Using trailing stop orders effectively can help traders protect profits while allowing trades to run with favorable momentum. Here are some practical tips to maximize the benefits of trailing stops:

- Choose the right trailing distance: Set your trailing stop at a distance that matches the market volatility and your trading timeframe. Too tight can trigger premature exits; too wide may risk bigger losses.

- Consider percentage vs. fixed points: Decide whether a percentage-based trailing stop or a fixed point amount suits your strategy and the asset’s price behavior.

- Combine with other risk management tools: Use trailing stops alongside stop-loss orders, take profit targets, and position sizing to build a comprehensive risk control plan.

- Monitor market conditions: Trailing stops work best in trending markets. Be cautious in sideways or highly volatile markets where price swings can trigger stops unnecessarily.

- Use platform alerts: Set alerts to notify you when trailing stops are close to triggering, so you can review the trade and adjust if necessary.

- Test in a demo account: Practice using trailing stops in a risk-free demo environment before applying them in live trading.

- Be aware of platform limitations: Understand how your trading platform executes trailing stops, including any delays or conditions for activation.

By applying these tips, traders can better manage risk and enhance trade management efficiency with trailing stops.

9. FAQ

9.1. Are trailing stops a good idea?

Yes, trailing stops can help lock in profits while still giving your trade room to grow. They offer a dynamic risk management strategy, especially in volatile markets.

9.2. Can a trailing stop-loss fail?

Yes. In fast-moving or illiquid markets, your stop may not be triggered at the expected price, resulting in slippage. Also, gaps in price can cause the execution price to differ from your stop price.

9.3. What is a limit offset in trail stop limit order?

A limit offset is the amount above or below the stop price that sets your limit order. It defines the worst acceptable price for the trade after the stop is triggered.

9.4. Can market makers see trailing stops?

No, market makers cannot directly see your trailing stop. However, certain trading platforms or brokers may handle stop orders differently, so it's best to confirm with your brokerage.

9.5. Should long-term investors use stop losses?

Generally, long-term investors may avoid stop losses to prevent being forced out during short-term volatility. Instead, they often rely on fundamental analysis and broader portfolio strategies.

9.6. Do scalpers use trailing stop-loss?

Yes, scalpers often use tight trailing stops to lock in small, quick profits while limiting downside risk. It's a key component of high-frequency trading strategies.

Read more:

- What is a pennant pattern in Forex? Guide to this key chart pattern

- How does forex trading work? Learn the basics today

10. Final thoughts: Should you use a trailing stop order?

Understanding what is a trailing stop order is essential for traders who want to manage risk without limiting potential profits prematurely. This flexible tool allows you to follow market trends, protect your capital, and secure gains with minimal manual intervention.

While trailing stop orders offer many advantages, it’s important to know their limitations and how to use them effectively on different trading platforms. By mastering this order type, you can enhance your trading discipline and better navigate volatile markets.

Continue exploring essential trading tools and strategies in our Forex Basics category at H2T Finance to strengthen your foundation and trade smarter every day.