Curious about how a stop limit order works and how it can enhance your trading strategy? This type of order gives you more precision by allowing you to control the exact price at which your trade is executed.

That said, the dual-price setup can be a bit tricky to grasp for those new to trading. This article will break down the stop limit order most simply and understandably, covering its definition, how it works, and specific examples. Let's explore the details with H2T Finance to help you trade with more confidence!

Key takeaways:

- Definition and purpose: A stop limit order combines a stop price (trigger) and a limit price (execution price) to provide precise control over trade execution, ideal for managing risks in volatile markets.

- How it works: The stop price activates the order, turning it into a limit order that executes only at the limit price or better, ensuring no trade occurs at an unfavorable price.

- Advantages: Offers better control over execution prices, reduces negative slippage, provides flexibility for breakout or stop-loss strategies, and allows automated trading with predefined conditions.

- Risks: Main drawback is the risk of non-execution if the market moves past the limit price after the stop is triggered, potentially missing trade opportunities or exits.

- Use cases: Best for volatile assets, breakout trading, controlled stop-loss, or when unable to monitor markets actively, though caution is needed in low-liquidity scenarios.

- Comparison: Unlike stop-market orders (prioritize execution) or limit orders (prioritize price), stop limit orders balance both but may not execute if conditions aren't met.

1. What is a stop limit order? Definition and basics

A stop limit order is an instruction you give to your broker to buy or sell an asset, but with specific conditions attached regarding price. It's considered a more advanced order type because it involves two distinct price levels – a stop price and a limit price – unlike simpler market orders or limit orders that operate with a single price point or immediate execution.

This type of order cleverly merges elements of both stop and limit orders into a single strategy. The "stop" part acts as a trigger: your order remains dormant until the market price of the asset reaches or passes through your specified stop price. Once this trigger occurs, the "limit" part comes into play: your stop order then converts into a limit order to buy or sell at your specified limit price, or better.

The primary purpose of a stop limit order is to provide traders with enhanced control over the execution price of their trades. This is particularly useful when you want to ensure you don't pay more than a certain price when buying, or sell for less than a certain price when selling, especially in volatile market conditions where prices can change rapidly.

It helps to mitigate the risk of unfavorable execution prices that can sometimes occur with a standard stop-market order (which executes at the next available market price once triggered, regardless of how far it might have slipped). In essence, you're telling your broker: "If the price reaches X (stop price), then I want to try and buy/sell at Y (limit price) or better, but no worse than Y."

2. How does a stop limit order work?

To fully comprehend a stop limit order, it’s important to know the unique purpose of its two key price levels: the stop price and the limit price. These prices work in tandem to provide more control over your trade entries and exits.

2.1. The stop price: The trigger

The stop price serves as the trigger that activates your order. When the market price of an asset reaches or passes through this pre-set level, it triggers the placement of a limit order. It's important to remember that the stop price itself is not the price at which your trade will execute.

Instead, think of it as the condition that must be met for your limit order to become active and enter the market.

2.2. The limit price: The specific price at which you aim to execute the trade or better

When the stop price is reached, a limit order is placed on the market using your chosen limit price. This price sets the highest amount you're prepared to pay when buying, or the lowest you're willing to accept when selling.

The trade will only go through if it can be matched at your limit price or better. If the market moves beyond your limit price once the stop is triggered, your order might not get executed.

2.3. Stop price vs. limit price: The key interaction

The key to a stop limit order lies in the relationship between the stop price and the limit price. To summarize their distinct roles: the stop price acts as the trigger that activates the order, while the limit price defines the acceptable execution price range for that order once it's active.

Think of it this way: the stop price is like an "on switch" for your order. Once that switch is flipped, the limit price determines the specific price (or better) at which you're willing to trade. Here's a simple breakdown of their roles:

| Feature | Stop Price | Limit Price |

| Primary Role | Triggers the order | Specifies the execution price (or better) |

| Order State | Activates a pending limit order | Is the price for the active limit order |

| Execution? | Does not guarantee execution by itself | Dictates the price constraint for execution |

| Analogy | The "if" condition (e.g., if price reaches X) | The "then" condition (e.g., then trade at Y or better) |

Traders have the option to align the stop and limit prices or create a gap between them. Setting the limit price slightly higher or lower than the stop price can be a strategic decision based on current market conditions.

For example, when dealing with a volatile asset, some traders might set a sell stop limit order with a stop price of $48 and a limit price of $47.80. This provides a small buffer or "breathing room" for the order to get filled if the price is moving rapidly downwards. However, it's crucial to understand that if the price gaps down past $47.80, the order may still not execute.

3. Stop limit order example

To truly understand how stop limit orders function, let's look at some practical scenarios. These examples will illustrate how the stop price and limit price work together in different trading situations.

3.1. Example of a buy stop limit order

Imagine you’re watching Stock A, which is trading at $50 per share. You believe that if the stock price breaks above a key resistance level of $52, it has a strong potential to continue rising.

However, you're cautious about overpaying in a potentially fast-moving breakout. You decide you don't want to buy the stock for more than $52.50.

- Stop Price: $52

- Limit Price: $52.50

Interpretation of the order:

When Stock A’s market price reaches or exceeds $52 (the stop price), your buy limit order is activated and submitted to the market. The order aims to buy Stock A, but only if it can be acquired at $52.50 or below (the limit price). If the price rapidly surges above $52.50 after being triggered, your order might not be filled.

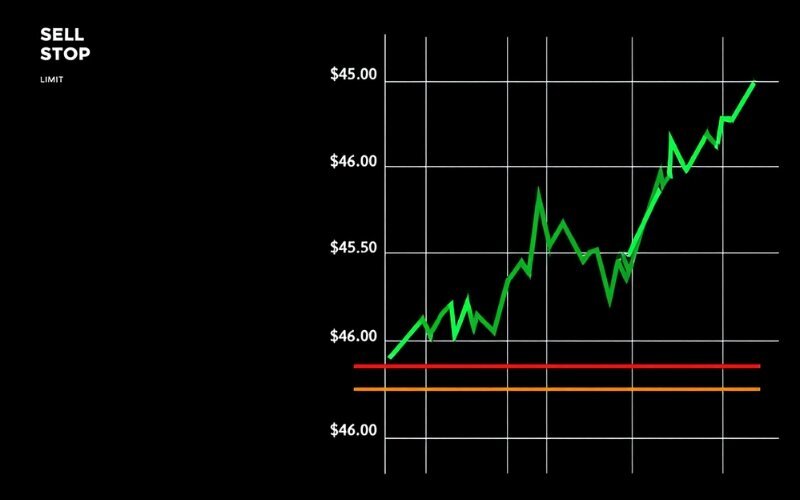

3.2. Illustration of a Sell Stop Limit Order (commonly utilized as a stop-loss limit order)

Now, let's consider a different scenario. Suppose you already own shares of Stock B, which you bought at an earlier price, and it's currently trading at $100 per share. You want to protect your existing profits or limit potential losses if the stock price starts to fall.

You decide that if the price drops below $95, you want to sell, but you are unwilling to sell for less than $94.50 per share. This is a common way to use a sell stop limit order as a more controlled form of stop-loss.

- Stop Price: $95

- Limit Price: $94.50

Interpretation of the order:

See more related articles:

- How big is the foreign exchange market? Inside a global financial giant

- What is currency converter historical rates? Historical exchange rates of 7 major currency pairs

- What time does the forex market open? Track the 24-hour cycle across the 4 major trading sessions

4. Advantages of using a stop limit order

Stop limit orders offer several distinct advantages for traders who understand how to use them effectively. These benefits primarily revolve around price control and strategic trade execution.

4.1. Better control over execution price

This is arguably the most significant advantage. A stop limit order lets you set the highest price you’re prepared to pay when buying, or the lowest price you’re willing to accept when selling. This prevents your order from being filled at a price that is unexpectedly worse than what you deemed acceptable.

4.2. Avoids excessive negative slippage:

Slippage occurs when an order is filled at a different price than requested, often due to rapid price movements. While a standard stop-market order guarantees execution (if there's a market), it can lead to significant negative slippage in volatile markets, meaning your order gets filled at a much worse price than your stop price.

A stop limit order helps mitigate the risk of extreme negative slippage because it will not execute if the price moves beyond your specified limit.

4.3. Flexibility in trade execution:

Stop limit orders provide versatility for various trading strategies. They can be used to:

- Enter the market on breakouts: You can place a buy stop limit order above a resistance level to initiate a trade after the price surpasses it, provided the entry is at or below your specified limit price.

- Protect profits or limit losses with price control: As seen in the sell stop limit example, you can aim to exit a position if the price moves against you, but without being forced to sell at any available price if the market gaps down violently.

4.4. Increased peace of mind when not actively monitoring:

For traders who cannot constantly watch the markets, setting a stop limit order can offer a degree of reassurance. Knowing that you have pre-defined your entry or exit parameters with a specific price limit can reduce anxiety about sudden, adverse market swings affecting your execution price beyond what you're comfortable with. This focus is on the control aspect rather than a guarantee of execution or profit.

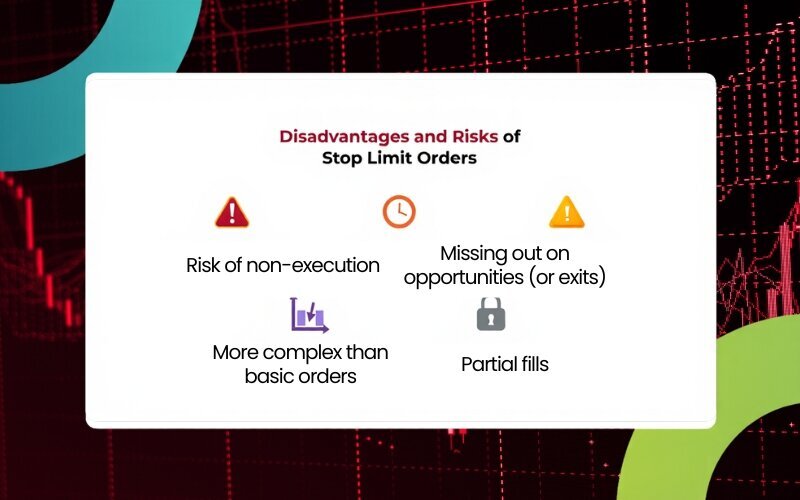

5. Disadvantages and risks of a stop limit order

While stop limit orders offer valuable control, it's crucial to be aware of their potential drawbacks and the risks involved. Understanding these can help you make more informed decisions about when and how to use them.

5.1. Risk of non-execution

The main limitation of a stop limit order is that, even though the stop price is met, there’s no guarantee that your order will be fulfilled. If the market rapidly passes your stop price and goes past your limit price without any available shares or contracts at your limit price or more favorable, your order might not be filled.

For example, in a sell stop limit order, if the price drops sharply, gapping below both your stop price and your limit price, your order might not find any buyers at or above your limit price, leaving you in the trade at a potentially worse position than anticipated.

5.2. Missing out on opportunities (or exits)

A direct consequence of non-execution is that you might miss a trading opportunity if a buy stop limit order isn't filled. Conversely, if a sell stop limit order (intended as a stop-loss) isn't filled during a sharp decline, you could fail to exit your position at your desired level, potentially leading to larger losses than if you had used a stop-market order (though the latter would have price uncertainty).

5.3. More complex than basic orders

Compared to simple market orders or limit orders, stop limit orders require a better understanding of their two-price mechanism and how the stop and limit prices interact. For beginners, this added layer of complexity can sometimes lead to errors in order placement if not fully understood.

5.4. Partial fills

In some less common scenarios, especially with larger orders or in less liquid markets, a stop limit order might only be partially filled. This means only a portion of your order executes at the limit price or better, while the rest remains unfilled if the price moves away.

It's important to internalize these risks. A personal experience that highlighted this was when attempting to use a sell stop limit order to protect against a significant loss. The market experienced a sharp gap down overnight due to unexpected news.

While the stop price was technically breached, the opening price was already far below the limit price, and the order did not execute at the desired level, leading to a more substantial loss than initially planned for with that specific order.

This served as a stark reminder that no order type is a perfect shield, and one must always be prepared for scenarios where orders don't behave exactly as hoped, especially in fast-moving or gapping markets.

| Advantages | Disadvantages |

| Better control over execution price | Risk of non-execution (order may not fill) |

| Helps avoid excessive negative slippage | May miss trading opportunities or exits |

| Flexible for various trading strategies | More complex to understand than basic orders |

| Can provide peace of mind (with limits) | Potential for partial fills |

6. Stop limit order vs. stop order vs. limit order: Key differences

Navigating the world of trading orders can seem daunting at first, with various types serving different strategic purposes. Comprehending the core distinctions between a stop order (commonly known as a stop-market order when it triggers a market order), a limit order, and a stop limit order is vital for successful trade execution and efficient risk management. Each has unique characteristics regarding how and when it's triggered and executed.

To make these distinctions clearer, here’s a comparative table:

| Feature | Stop Order (typically Stop-Market) | Limit Order | Stop Limit Order |

| Trigger Price | Yes (Stop Price) | No (Order is live immediately) | Yes (Stop Price) |

| Execution Price | Best available market price once triggered | Specified limit price or better | Specified limit price or better |

| Execution Guarantee | High (usually executes, unless liquidity is extremely low) | No (only executes if limit price is reached) | No (only executes if limit price is reached AFTER stop is triggered) |

| Price Control | Low (susceptible to slippage) | High | High (AFTER stop price is triggered) |

| Number of Prices to Set | 1 (Stop Price) | 1 (Limit Price) | 2 (Stop Price and Limit Price) |

| Primary Purpose | Enter/exit when price hits a certain level, accepting market price | Enter/exit at a specific price or better | Enter/exit when price hits stop level, WITH condition of execution at limit price or better |

| Main Risk | Slippage (execution at an unexpected price) | Non-execution (order may not be filled) | Non-execution (even after stop is triggered) |

Further Clarifications:

- A stop order (stop-market) is primarily used to initiate a trade once a certain price level is breached (e.g., buying on a breakout or selling as a stop-loss). Its priority is execution; once the stop price is hit, it becomes a market order, meaning it will almost certainly execute, but the price can vary.

- A limit order lets you buy or sell at your chosen price or a more favorable one, providing price control, but it doesn’t guarantee execution if the market doesn’t reach that price.

- A stop limit order blends characteristics of both orders: it triggers once the stop price is hit, like a stop order, but rather than becoming a market order, it switches to a limit order. This gives you more price control than a stop-market order but introduces the risk that the order might not fill if the market moves too quickly past your limit price after being triggered.

The choice between these orders depends on your trading approach, risk appetite, and the particular market environment you’re dealing with.

7. When and how to use stop limit order

The first step is to grasp what a stop limit order is and how it functions. The next is knowing when to deploy it effectively. Here are some practical scenarios where using a stop limit order can be advantageous:

7.1. Trading highly volatile assets

In markets known for sharp and rapid price swings (like some cryptocurrencies or stocks during earnings announcements), a stop limit order can help prevent your order from being filled at a significantly unfavorable price due to sudden volatility. It provides a safety net against extreme slippage that might occur with a stop-market order.

7.2. Entering positions at key breakout points

When you spot an important resistance level for buying or a support level for selling, a stop limit order lets you try to enter the market as the price moves beyond that point. The crucial benefit here is the control over your entry price, ensuring you don't chase the price too high (on a buy) or sell too low (on a short sell entry) immediately after the breakout.

7.3. Setting stop-loss orders with price control

While a traditional stop-loss (often a stop-market order) prioritizes exiting a losing trade, a sell stop limit order can be used to attempt to limit losses while also controlling the minimum exit price.

This helps avoid a scenario where a flash crash or sudden dip triggers your stop and sells your asset at an unnecessarily low price, provided there's liquidity at or above your limit price.

7.4. Trading during after-hours or with less liquid assets (use with caution)

For assets that trade outside regular market hours or for those with lower trading volumes (thin liquidity), stop limit orders can be considered. They can help protect against potentially wider bid-ask spreads or erratic price movements.

However, it's crucial to remember that the risk of non-execution is also higher in such scenarios due to the potential lack of counter-parties at your limit price.

7.5. When you cannot actively monitor the market

If you're unable to watch market movements continuously, a stop limit order allows you to pre-set your entry or exit conditions with specific price parameters. This automates part of your trading plan, ensuring that your order is only considered for execution if both your stop and limit price conditions are met.

Many traders, especially those new to the markets, might initially overlook stop limit orders due to their perceived complexity. However, once you grasp their mechanics, they can become an invaluable tool.

They offer a way to balance the desire for order execution with the need for a favorable price. Don't hesitate to practice using stop limit orders with small position sizes or on a demo account to become comfortable with how they behave in live market conditions.

8. FAQ about stop limit order

Here are answers to some frequently asked questions about stop limit orders:

8.1. Will my stop limit order always execute once the stop price is hit?

A: No, not always. Reaching the stop price merely triggers your limit order. For the order to be executed, the market price must then meet your designated limit price (or a more favorable one). If the market price quickly surpasses your limit price after the stop is activated, your order may remain unfilled.

8.2. What's the difference between a stop price and a limit price in a stop limit order?

A: The stop price is the trigger that activates your order into a live limit order. The limit price is the maximum price you'll pay (for a buy) or the minimum price you'll accept (for a sell) once that order is active.

8.3. What happens if my stop limit order doesn't get filled?

A: If your stop limit order doesn't get filled (because the market price never reaches your limit price after the stop is triggered), it will typically remain pending in the market. It stays active until it's either filled, you cancel it, or it expires based on the "time-in-force" setting you chose (e.g., at the end of the trading day for a 'Day' order).

8.4. Is a sell stop limit order the same as a stop loss order?

A: A sell stop limit order can function as a form of stop-loss, but it differs from a conventional stop-loss, which is typically a stop-market order. Both aim to limit losses.

A stop-market order focuses on exiting the trade swiftly at the next available market price, whereas a sell stop limit order offers greater control over the exit price, with the potential downside of the order not being executed if the price falls too rapidly.

8.5. When should I use a stop limit order instead of a stop-market order?

A: Use a stop limit order when controlling the execution price is more important to you than guaranteeing the execution itself. This is often preferred in volatile markets or for less liquid assets, where a stop-market order could result in significant slippage (getting a much worse price than expected).

9. Conclusion: Key takeaways on stop limit orders

To wrap up, the stop limit order is a versatile tool in a trader's arsenal, but it requires a clear understanding of its mechanics to be used effectively. The primary disadvantage is the risk of non-execution. Even if the stop price is triggered, your order might not fill if the market price doesn't subsequently reach your limit price.

Now that you have a solid understanding of what is a stop limit order, are you ready to deepen your trading knowledge? To reinforce what you've learned and explore other essential trading tools and concepts, don't miss the insightful articles in the Beginner Basics section at H2T Finance!