Are you wondering what is a pip in

Forex trading, and why it is so essential? Pip is not just the

smallest unit for measuring price movements; it is also the foundation for

calculating your profits, losses, and

managing risk effectively.

This article by H2T Finance will explain in the simplest, most understandable way what a pip is, how to read it, how to calculate it, and its overall importance, helping you become a strategic, knowledgeable, and analytical trader.

1. What is a pip in Forex trading?

The term "pip" stands for either "Percentage In Point" or sometimes "Price Interest Point". A pip is the smallest standardized unit of measurement for the change in value between two currencies.

When trading forex, an important note for traders to remember is that the bid-ask spread (spread) of a quoted price is usually measured in pips. It represents the smallest price move in forex that a currency pair can make, according to standard convention. One pip is equal to one-hundredth of 1% (1/100 × 0.01) and appears to the fourth decimal place (0.0001).

[caption id="attachment_7349" align="aligncenter" width="800"]

pip in Forex trading[/caption]

A basic example of pips in forex trading:

If the EUR/USD currency pair moves from an exchange rate of 1.0850 to 1.0851, this represents

an increase of one pip. Conversely, if it moves from 1.0850 down to 1.0849, this is a decrease of one pip.

The primary role of the pip is to serve as

a uniform unit that allows traders, brokers, and the entire market to communicate about price fluctuations consistently. Instead of saying "the Euro against the US dollar increased by 0.0001," traders simply say it "went up by one pip."

This standardization makes discussing price movements much simpler and less prone to confusion. However, new traders often confuse pips with bps (basis points). BPS is a different unit, often used to measure percentage changes, especially in major accounts of the market. Understanding pips in trading is, therefore, one of the very first steps to deciphering market activity.

Understanding what is a pips in Forex trading is one thing, but knowing its actual monetary worth – the

pip value – is crucial for practical trading.

The process of calculating pips in forex in terms of their value is essential for every trader. This calculation allows you to translate those small price movements into tangible financial gains or losses.

[caption id="attachment_7346" align="aligncenter" width="800"]

Calculate pip value in Forex[/caption]

The general formula for calculating pip value is:

Pip Value = Value Traded × Quote Currency Pip

2.1. Why pip value matter?

The pip value forex calculation is critically important for several reasons:

- Calculating potential profit and loss: Knowing the value of each pip allows you to determine how much money you stand to make or lose on a trade. If a currency pair moves a certain number of pips in your favor (or against you), the pip value is what converts that movement into a real monetary amount. This is central to measuring profit in pips and understanding how pips make money (or lose money).

- Effective risk management: Pip value is fundamental to setting appropriate risk parameters. For example, when you set a stop-loss order X pips away from your entry price, the pip value tells you exactly how much money you are risking on that trade. It also helps in determining the appropriate position size relative to your account balance and risk tolerance.

- Informed decision making: Understanding how pip value affects profit and loss helps you make more informed decisions about which trades to take, how long to hold them, and when to exit.

In short, without knowing the pip value, you are essentially trading blind to the actual financial implications of price movements.

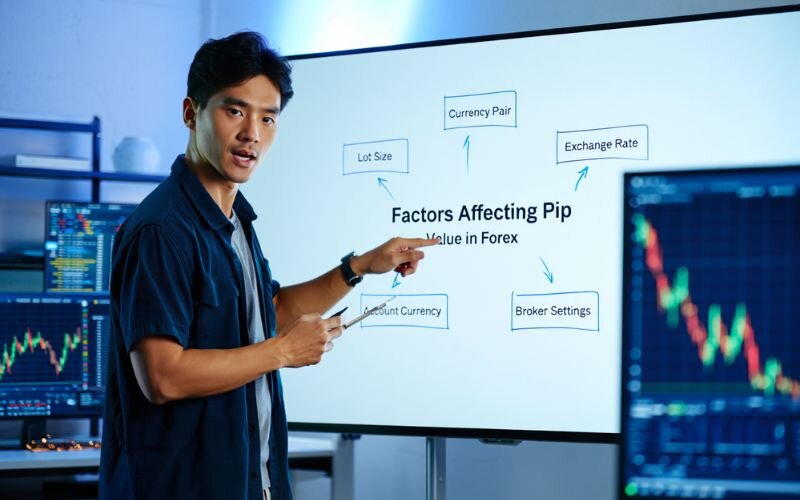

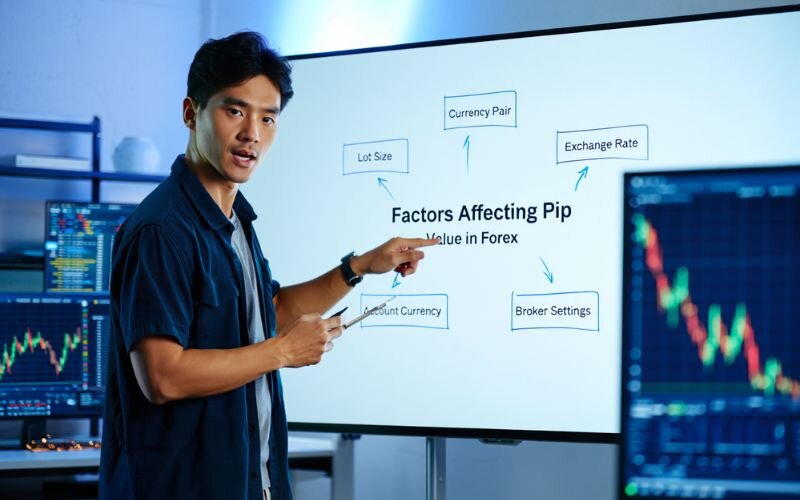

2.2. Factors affecting the pip value

The value of a single pip is not constant across all trades. Several factors influence it:

- The currency pair being traded: Different currency pairs will have different pip values due to varying exchange rates.

- The Lot Size (Trade Size): This is one of the most significant factors. A pip’s value increases proportionally with the size of your trade. We will touch upon pips and lots in forex here, but a more detailed discussion on lot sizes is available in our dedicated article. (This is a good place to internally link to the "Lots" article when it's ready).

- The account currency: The currency in which your trading account is denominated (e.g., USD, EUR, GBP) will affect the final pip value expressed in that account currency. For simplicity in our examples, we will assume a USD-denominated trading account.

[caption id="attachment_7347" align="aligncenter" width="800"]

Factors affecting the pip value[/caption]

3. How pips are displayed in currency pairs

Understanding what is a pip in trading Forex also involves knowing how these incremental price changes are shown in currency pair quotations. The way pips are displayed primarily depends on the specific currency pair, particularly whether the Japanese Yen (JPY) is involved.

3.1. Standard pip quotation (Most currency pairs)

For the vast majority of currency pairs,

a pip is represented by the fourth decimal place in the exchange rate quote. This answers the common question, how many decimal places is a pip for most pairs?

Let's look at some examples of pips in forex trading for standard quotations:

- EUR/USD: If the quote is 1.1234, the digit '4' is the pip location. A move from 1.1234 to 1.1235 is a one-pip increase.

- GBP/USD: In a quote like 1.2567, the digit '7' represents the pip. If the price changes from 1.2567 to 1.2560, it has decreased by 7 pips.

- AUD/USD: For a quote such as 0.6789, the digit '9' is the pip. A change from 0.6789 to 0.6799 signifies a 10-pip increase.

[caption id="attachment_7353" align="aligncenter" width="800"]

Standard pip quotation (Most currency pairs)[/caption]

When observing price movements for these pairs, you focus on the fourth decimal digit to count the pips. For instance, if the EUR/USD rate moves from 1.1234 to 1.1238, the price has

increased by 4 pips (38 - 34 = 4). If it moves from 1.1234 down to 1.1204, the price has

decreased by 30 pips (34 - 04 = 30).

3.2. The JPY exception: A different way to count

There's a notable exception to the four-decimal-place rule: currency pairs involving the

Japanese Yen (JPY). The question of why JPY pairs are quoted differently for pips arises due to the relatively lower value of a single Yen compared to other major currencies. Because of this, quoting JPY pairs to four decimal places would result in extremely small and impractical pip values.

[caption id="attachment_7345" align="aligncenter" width="800"]

A different way to count[/caption]

Therefore, for all pips in currency pairs that include JPY (such as USD/JPY, EUR/JPY, GBP/JPY, AUD/JPY, etc.),

a pip is represented by the second decimal place in the exchange rate quote. Here are some JYP pips examples:

- USD/JPY: If the quote is 145.56, the digit '6' is the pip location.

- EUR/JPY: In a quote like 158.72, the digit '2' represents the pip.

- GBP/JPY: For a quote such as 183.49, the digit '9' is the pip.

To interpret changes for these JPY pairs: if the USD/JPY rate moves from 145.56 down to 145.50, the price has

decreased by 6 pips (56 - 50 = 6). If it moves from 145.56 up to 146.06, the price has

increased by 50 pips (146.06 - 145.56 = 0.50, which is 50 pips in JPY terms).

[caption id="attachment_7348" align="aligncenter" width="800"]

How pips are displayed in currency pairs[/caption]

For me, I recognize this distinction between standard pairs and JPY pairs is crucial for accurately reading Forex quotes and understanding price movements.

See more useful additional articles:

4. How to calculate the pip value in each currency pair?

When trading forex, it is important to understand how pip values are calculated in each currency pair. Each currency pair has its own way of calculating pip values, depending on the base currency and the current exchange rate.

4.1. Calculating pip value for pairs where USD is the quote currency

When the US dollar (USD) is the

quote currency (the second currency listed in the pair, e.g., EUR/USD, GBP/USD) and your trading account is denominated in USD, the pip value calculation is quite straightforward.

For these pairs, one pip is 0.0001 of the quote currency. The formula for a

standard lot (100,000 units of the base currency) is:

Pip Value = (0.0001) * Lot Size

Pip Value = 0.0001 * 100,000 units =

$10.00 per pip

This means for pairs like EUR/USD, GBP/USD, AUD/USD, NZD/USD, when trading one standard lot from a USD account,

each pip movement is worth $10. The value scales with different lot sizes:

- Mini Lot (10,000 units): 0.0001 * 10,000 = $1.00 per pip

- Micro Lot (1,000 units): 0.0001 * 1,000 = $0.10 per pip

- Nano Lot (100 units): 0.0001 * 100 = $0.01 per pip

4.2. Calculating pip value for pairs where USD is the base currency

When USD is the

base currency (the first currency listed, e.g., USD/CHF, USD/CAD) and your account is in USD, the calculation requires an extra step because the pip value is initially in the quote currency and needs to be converted back to USD.

The formula for a standard lot (100,000 units) is:

Pip Value (in quote currency)

= (0.0001) * Lot Size

Pip Value (in USD)

= Pip Value (in quote currency)

/ Current Exchange Rate of the Pair

Let's take an example with

USD/CHF quoted at

0.9100:

- Pip movement in CHF for 1 standard lot = 0.0001 * 100,000 = 10 CHF.

- To convert this to USD: Pip Value (USD) = 10 CHF / 0.9100 (USD/CHF rate) = $10.989 per pip (approximately).

So, for 1 standard lot of USD/CHF at an exchange rate of 0.9100, each pip movement is worth about $10.99. This value will fluctuate slightly as the pair's exchange rate changes.

4.3. Calculating pip value for JPY pairs

For pairs involving the Japanese Yen (JPY), remember that a pip is

0.01 instead of 0.0001.

When JPY is the quote currency and the account is in USD (e.g., USD/JPY)

The formula for a standard lot (100,000 units of base currency):

Pip Value (in JPY) = (0.01) * Lot Size

Pip Value (in USD) = Pip Value (in JPY) / Current Exchange Rate of the Pair (USD/JPY)

Let's take an example with

USD/JPY quoted at

145.50:

- Pip movement in JPY for 1 standard lot = 0.01 * 100,000 = 1,000 JPY.

- To convert this to USD: Pip Value (USD) = 1,000 JPY / 145.50 (USD/JPY rate) = $6.87 per pip (approximately).

When JPY is part of a cross-currency pair and the account is in USD (e.g., EUR/JPY)

The calculation involves finding the pip value in JPY first, and then converting it to USD using the current USD/JPY exchange rate.

Formula for a standard lot of EUR/JPY (100,000 units of EUR):

Pip Value (in JPY) = (0.01) * Lot Size (This gives pip value in JPY for 100,000 EUR)

Pip Value (in USD) = Pip Value (in JPY) / Current USD/JPY Exchange Rate

Let's assume

EUR/JPY is quoted at

158.75 and

USD/JPY is

145.50:

- Pip movement in JPY for 1 standard lot of EUR = 0.01 * 100,000 = 1,000 JPY.

- To convert this to USD: Pip Value (USD) = 1,000 JPY / 145.50 (USD/JPY rate) = $6.87 per pip (approximately) for each pip movement in EUR/JPY.

It's important to note that many trading platforms automatically calculate and display the pip value for your chosen trade size and account currency, simplifying this process for traders. However, understanding the underlying calculations is beneficial for a deeper comprehension of your trading.

5. Why are pips important in Forex trading?

Understanding what a pip is and how to calculate its value is crucial for every trader. Here’s why I believe pips are essential in forex:

- Standardized measurement of price movement:

Pips provide a universal way to measure changes in currency exchange rates. This common language allows traders, brokers, and analysts worldwide to communicate price changes precisely, eliminating ambiguity.

- Calculation of profit and loss:

Profits and losses are determined by the number of pips gained or lost, multiplied by the pip value for that trade size. For example, if I make 20 pips on a trade worth 10perpip,myprofitis10 per pip, my profit is 10 per pip, my profit is 200 before fees. This direct link makes tracking performance straightforward.

- Essential for Risk Management:

Pips help me implement sound risk management strategies:

-

- Setting stop-loss orders: I often define my maximum acceptable loss in pips. For instance, placing a stop-loss 30 pips below my entry price limits my loss to the monetary value of those pips.

- Setting take-profit orders: I also set profit targets in pips, aiming for a specific number, like 60 pips.

- Determining position size: Knowing the pip value helps me decide on an appropriate lot size based on my risk tolerance. If I want to risk 100onatradewitha20−pipstop−loss,thepipvalueshouldbe100 on a trade with a 20-pip stop-loss, the pip value should be 100onatradewitha20−pipstop−loss,thepipvalueshouldbe5.

- Comparing broker spreads:

The bid-ask spread, a primary trading cost, is quoted in pips. Comparing spreads across brokers helps me choose the most cost-effective option for my trading style.

- Foundation for technical analysis and strategies:

Many technical indicators and trading strategies incorporate pip movements. For example, volatility indicators like Average True Range (ATR) are expressed in pips, and breakout strategies look for price movements beyond certain pip levels.

[caption id="attachment_7352" align="aligncenter" width="800"]

Pips important in Forex trading[/caption]

In essence, pips are the building blocks for quantifying market movements, assessing performance, managing risk, and applying trading strategies. Without a solid understanding of pips, navigating the forex market effectively would be incredibly challenging.

6. Pips and lots in Forex: Understanding the connection

While pips measure the change in price of a currency pair,

lot sizes determine the value of each pip movement. Understanding the interplay between pips and lots in forex is absolutely crucial for managing your trades and understanding the potential financial outcome of each pip your trade gains or loses.

[caption id="attachment_7351" align="aligncenter" width="800"]

Pips and lots in Forex[/caption]

First, let's briefly define lot sizes in Forex. A

lot refers to the size of your trade, or the number of currency units you are buying or selling. The common lot sizes are:

- Standard Lot: 100,000 units of the base currency.

- Mini Lot: 10,000 units of the base currency.

- Micro Lot: 1,000 units of the base currency.

- Nano Lot: 100 units of the base currency (less common with some brokers).

The connection is direct:

the larger your lot size, the more money each pip movement will be worth. Conversely, a smaller lot size means each pip will have a smaller monetary value.

Let's illustrate this with an example. Suppose you make a profit of

20 pips on a EUR/USD trade, and your account is denominated in USD. Here’s how the lot size impacts your actual profit:

- Trading 1 Standard Lot (100,000 units):

- As we calculated earlier, for EUR/USD, 1 pip with a standard lot is worth approximately $10.

- Your profit: 20 pips * 10/pip = 200

- Trading 1 Mini Lot (10,000 units):

- For EUR/USD, 1 pip with a mini lot is worth approximately $1.

- Your profit: 20 pips * 10/pip = 20

- Trading 1 Micro Lot (1,000 units):

- For EUR/USD, 1 pip with a micro lot is worth approximately $0.10.

- Your profit: 20 pips * 0.10/pip = 2

This example clearly shows that while the number of pips gained (20 pips) was the same in all three scenarios, the actual dollar profit varied significantly based on the lot size traded. The same principle applies to losses – a 20-pip loss with a standard lot would mean a $200 loss, while with a micro lot, it would be a $2 loss.

Therefore,

choosing an appropriate lot size is a critical component of risk management. It must align with your account capital, your risk tolerance per trade, and your overall trading strategy. Understanding pips tells you how much the market has moved, but understanding lots tells you how much that movement is worth to you.

7. What about pipettes (Fractional pips)?

As Forex trading technology has advanced, brokers have sought ways to offer more precise pricing and potentially tighter spreads. This has led to the introduction of

pipettes (known as

fractional pipettes), one of the terms that you also need to understand and know clearly to trade currencies. So, what is a pipette in forex?

A

pipette represents one-tenth of a standard pip. It allows for price movements to be quoted with an additional decimal place, providing a more granular view of price changes. Here’s how pipettes are displayed in relation to standard pips:

- For standard currency pairs (where the pip is the fourth decimal place): The pipette is the fifth decimal place.

- Example: If EUR/USD is quoted as 1.08505, the '0' is the pip location, and the final '5' represents 5 pipettes (or 0.5 pips). A move from 1.08500 to 1.08505 is a change of 5 pipettes.

- For JPY pairs (where the pip is the second decimal place): The pipette is the third decimal place.

- Example: If USD/JPY is quoted as 145.562, the '6' is the pip location, and the final '2' represents 2 pipettes (or 0.2 pips). A move from 145.560 to 145.562 is a change of 2 pipettes.

The key difference in the standard pip vs fractional pip discussion is the level of precision. Pipettes allow for the measurement of even smaller price fluctuations than a standard pipette. This can be particularly relevant for high-frequency traders or scalpers who aim to profit from very small price movements. It also enables brokers to quote spreads with more precision (e.g., a spread of 0.5 pips, which is 5 pipettes).

[caption id="attachment_7350" align="aligncenter" width="800"]

Pipette represents one-tenth of a standard pip[/caption]

It's important to note that

when traders and analysts generally refer to "pips," they are usually talking about the standard pip (the fourth or second decimal place, depending on the pair).

Unless fractional pips or pipettes are specifically mentioned, assume the standard definition. Many trading platforms will display the pipette digit slightly smaller or differentiate it in some way to avoid confusion, but it's always good to be aware of your broker's specific quoting convention.

While pipettes offer greater pricing detail, the fundamental unit for most strategic trading decisions, risk management calculations, and general market analysis remains the standard pip.

8. FAQ about pips in Forex trading

Here are answers to some of the most common questions traders have in forex trading what is a pip:

Q1. What does pip stand for in Forex?

A: "Pip" most commonly stands for

"Percentage In Point" or sometimes

"Price Interest Point." It refers to the smallest standard unit of change in a currency pair's exchange rate.

Q2. How is a pip calculated for different currency pairs?

A: A pip's location is based on decimal places:

- For most currency pairs (e.g., EUR/USD, GBP/USD), 1 pip is the change in the fourth decimal place (0.0001).

- For currency pairs involving the Japanese Yen (JPY) (e.g., USD/JPY, EUR/JPY), 1 pip is the change in the second decimal place (0.01).

The monetary value of that pip then depends on the specific pair, the lot size traded, and your account currency.

Q3. What is the difference between a pip and a pipette?

A:

A pipette is one-tenth of a pip. For example, if a pip is 0.0001, a pipette is 0.00001. Pipettes allow for more precise pricing from brokers, but the "pip" remains the standard unit for most trading discussions and calculations.

Q4. How many decimal places is a pip?

A: A pip is typically located at the

fourth decimal place for most currency pairs (e.g., EUR/USD 1.123

4) or the

second decimal place for JPY pairs (e.g., USD/JPY 145.5

6).

Q5. Why are JPY pairs quoted differently for pips?

A: JPY pairs are quoted to two decimal places for pips because the

individual value of a Japanese Yen is much smaller compared to other major currencies. Using the second decimal place provides a more practical and meaningful measure of price movement.

Q6. How does pip value affect profit and loss?

A: The

pip value (the monetary worth of one pip for your trade size) multiplied by the number of pips the price moves determines your total profit or loss. A larger lot size increases the pip value, thereby amplifying both potential profits and potential losses.

Q7. Can you lose more than your pips?

A: "Pips" measure price movement. The actual amount of money you lose depends on the

pip value (determined by your lot size) and the use of leverage. Poor risk management, especially with high leverage, can lead to losses exceeding the simple monetary value of adverse pip movement against your initial capital dedicated to that trade, potentially even your entire account balance if not managed with tools like stop-losses.

Q8. What is a good number of pips to aim for daily?

A:

There is no universally "good" number of pips to aim for daily. This is highly subjective and depends on an individual's trading strategy (e.g., scalping vs. swing trading), risk tolerance, market conditions, and overall trading plan. Focusing on a consistent trading process and effective risk management is more important than chasing a specific daily pip target.

Q9. How much is 1 pip in Forex?

A: The monetary value of 1 pip in Forex varies based on:

- The currency pair: For EUR/USD, 1 pip is a price change of 0.0001. For USD/JPY, 1 pip is 0.01.

- The lot size: For a USD account trading EUR/USD, 1 pip can be worth $10 (standard lot), $1 (mini lot), or $0.10 (micro lot).

- Your account currency and the current exchange rate (especially for pairs where USD isn't the quote currency or for cross-currency pairs).

Q10. What is a pip in Forex example?

A: For instance, if the EUR/USD exchange rate moves from 1.0850 to 1.0851, that is an increase of

1 pip. If the USD/JPY rate moves from 145.52 down to 145.50, that is a decrease of

2 pips.

Q11. How much is 50 pips worth?

A: The value of 50 pips depends entirely on the value of 1 pip for your specific trade.

- If 1 pip is worth $10 (e.g., a standard lot of EUR/USD), then 50 pips are worth 50 * 10 = 500

- If 1 pip is worth $1 (e.g., a mini lot of EUR/USD), then 50 pips are worth 50 * 1 = 50

Q12. How much is a 0.01 lot pip worth?

A: A 0.01 lot is commonly known as a

micro lot. For a USD-denominated account, the pip value for a 0.01 lot is typically:

- Around $0.10 per pip for pairs like EUR/USD or GBP/USD.

- The value will vary for other pairs (like JPY pairs or when USD is the base currency) and needs to be calculated based on the current exchange rate, as explained earlier in the article.

Q13. What is a pip worth in forex trading?

A pip in forex trading is typically worth $10 for a

standard lot (100,000 units), $1 for a

mini lot (10,000 units), and $0.10 for a

micro lot (1,000 units). The exact value can vary based on the currency pair and the exchange rate.

9. Conclusion

Understanding

what is a pip in forex trading is far more than just learning a new piece of jargon; it's about equipping yourself with an essential tool to navigate the foreign exchange market. From accurately reading price quotes and calculating pip values to linking them with lot sizes for effective risk management, pips play a central role in every trading decision you make.

H2T Finance hopes that with the detailed explanations and illustrative examples provided in this guide, you have built a solid foundation of knowledge about pips. This understanding will empower you to analyze market movements better, quantify potential outcomes, and manage your trades with greater confidence. Explore more

Forex Basics in our beginner's section. Read our guide on

Pips and Lots to understand how they work together. Have questions about pips? Ask in the comments below!

pip in Forex trading[/caption]

A basic example of pips in forex trading:

If the EUR/USD currency pair moves from an exchange rate of 1.0850 to 1.0851, this represents an increase of one pip. Conversely, if it moves from 1.0850 down to 1.0849, this is a decrease of one pip.

The primary role of the pip is to serve as a uniform unit that allows traders, brokers, and the entire market to communicate about price fluctuations consistently. Instead of saying "the Euro against the US dollar increased by 0.0001," traders simply say it "went up by one pip."

This standardization makes discussing price movements much simpler and less prone to confusion. However, new traders often confuse pips with bps (basis points). BPS is a different unit, often used to measure percentage changes, especially in major accounts of the market. Understanding pips in trading is, therefore, one of the very first steps to deciphering market activity.

pip in Forex trading[/caption]

A basic example of pips in forex trading:

If the EUR/USD currency pair moves from an exchange rate of 1.0850 to 1.0851, this represents an increase of one pip. Conversely, if it moves from 1.0850 down to 1.0849, this is a decrease of one pip.

The primary role of the pip is to serve as a uniform unit that allows traders, brokers, and the entire market to communicate about price fluctuations consistently. Instead of saying "the Euro against the US dollar increased by 0.0001," traders simply say it "went up by one pip."

This standardization makes discussing price movements much simpler and less prone to confusion. However, new traders often confuse pips with bps (basis points). BPS is a different unit, often used to measure percentage changes, especially in major accounts of the market. Understanding pips in trading is, therefore, one of the very first steps to deciphering market activity.

Calculate pip value in Forex[/caption]

The general formula for calculating pip value is:

Pip Value = Value Traded × Quote Currency Pip

Calculate pip value in Forex[/caption]

The general formula for calculating pip value is:

Pip Value = Value Traded × Quote Currency Pip

Factors affecting the pip value[/caption]

Factors affecting the pip value[/caption]

Standard pip quotation (Most currency pairs)[/caption]

When observing price movements for these pairs, you focus on the fourth decimal digit to count the pips. For instance, if the EUR/USD rate moves from 1.1234 to 1.1238, the price has increased by 4 pips (38 - 34 = 4). If it moves from 1.1234 down to 1.1204, the price has decreased by 30 pips (34 - 04 = 30).

Standard pip quotation (Most currency pairs)[/caption]

When observing price movements for these pairs, you focus on the fourth decimal digit to count the pips. For instance, if the EUR/USD rate moves from 1.1234 to 1.1238, the price has increased by 4 pips (38 - 34 = 4). If it moves from 1.1234 down to 1.1204, the price has decreased by 30 pips (34 - 04 = 30).

A different way to count[/caption]

Therefore, for all pips in currency pairs that include JPY (such as USD/JPY, EUR/JPY, GBP/JPY, AUD/JPY, etc.), a pip is represented by the second decimal place in the exchange rate quote. Here are some JYP pips examples:

A different way to count[/caption]

Therefore, for all pips in currency pairs that include JPY (such as USD/JPY, EUR/JPY, GBP/JPY, AUD/JPY, etc.), a pip is represented by the second decimal place in the exchange rate quote. Here are some JYP pips examples:

How pips are displayed in currency pairs[/caption]

For me, I recognize this distinction between standard pairs and JPY pairs is crucial for accurately reading Forex quotes and understanding price movements.

See more useful additional articles:

How pips are displayed in currency pairs[/caption]

For me, I recognize this distinction between standard pairs and JPY pairs is crucial for accurately reading Forex quotes and understanding price movements.

See more useful additional articles:

Pips important in Forex trading[/caption]

In essence, pips are the building blocks for quantifying market movements, assessing performance, managing risk, and applying trading strategies. Without a solid understanding of pips, navigating the forex market effectively would be incredibly challenging.

Pips important in Forex trading[/caption]

In essence, pips are the building blocks for quantifying market movements, assessing performance, managing risk, and applying trading strategies. Without a solid understanding of pips, navigating the forex market effectively would be incredibly challenging.

Pips and lots in Forex[/caption]

First, let's briefly define lot sizes in Forex. A lot refers to the size of your trade, or the number of currency units you are buying or selling. The common lot sizes are:

Pips and lots in Forex[/caption]

First, let's briefly define lot sizes in Forex. A lot refers to the size of your trade, or the number of currency units you are buying or selling. The common lot sizes are:

Pipette represents one-tenth of a standard pip[/caption]

It's important to note that when traders and analysts generally refer to "pips," they are usually talking about the standard pip (the fourth or second decimal place, depending on the pair).

Unless fractional pips or pipettes are specifically mentioned, assume the standard definition. Many trading platforms will display the pipette digit slightly smaller or differentiate it in some way to avoid confusion, but it's always good to be aware of your broker's specific quoting convention.

While pipettes offer greater pricing detail, the fundamental unit for most strategic trading decisions, risk management calculations, and general market analysis remains the standard pip.

Pipette represents one-tenth of a standard pip[/caption]

It's important to note that when traders and analysts generally refer to "pips," they are usually talking about the standard pip (the fourth or second decimal place, depending on the pair).

Unless fractional pips or pipettes are specifically mentioned, assume the standard definition. Many trading platforms will display the pipette digit slightly smaller or differentiate it in some way to avoid confusion, but it's always good to be aware of your broker's specific quoting convention.

While pipettes offer greater pricing detail, the fundamental unit for most strategic trading decisions, risk management calculations, and general market analysis remains the standard pip.