NFP stands for Non-Farm Payrolls, a key U.S. economic indicator. As a forex trader or someone curious about market-moving news, you've likely stumbled upon the term NFP. But what does NFP stand for, and why does it command so much attention every month?

In this expert guide, you'll discover not just the definition of NFP, but how it impacts the economy, moves the forex market, and how smart traders prepare to leverage its release.

Key takeaways:

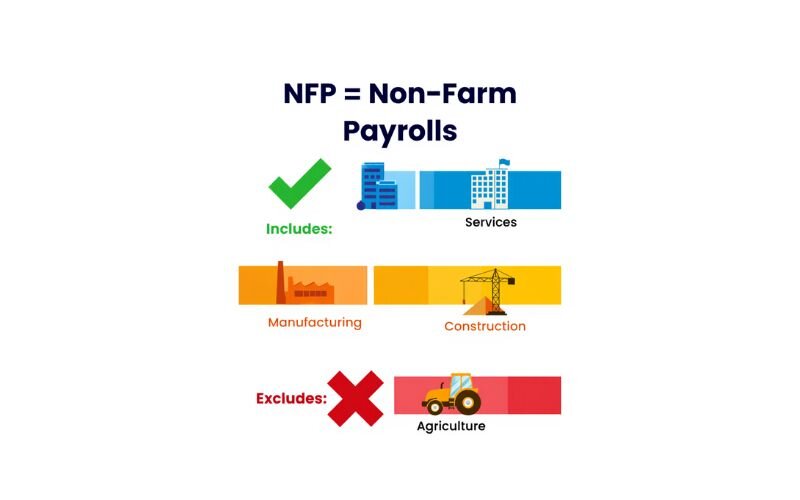

- NFP stands for Non-Farm Payrolls, a monthly U.S. employment report excluding farm work and a few other sectors.

- The report shows job growth, unemployment rate, earnings, and labor force participation.

- Strong NFP numbers often strengthen the USD, while weak numbers may weaken it.

- NFP strongly influences interest rate expectations and overall market sentiment.

- Forex traders must prepare for extreme volatility during and after the release.

- Common misconceptions include thinking NFP is a leading indicator or the same as the ADP report.

- Traders can use strategies like waiting for pullbacks instead of chasing the initial spike.

- The report is released on the first Friday of every month at 8:30 AM ET by the U.S. Bureau of Labor Statistics.

1. What does NFP stand for? Quick and complete answer from expert

NFP stands for Non-Farm Payrolls, a monthly figure reported by the U.S. Bureau of Labor Statistics (BLS) that estimates how many jobs were added or lost in the U.S. economy during the previous month, excluding the farming industry, private households, nonprofit organizations, and self-employed individuals.

This data is a core part of the Employment Situation Summary, released on the first Friday of every month at 8:30 AM ET.

The report includes:

- Total non-farm employment change.

- Unemployment rate.

- Average hourly earnings.

- Labor force participation rate.

Why do traders care? Because NFP releases often cause major forex volatility. For example, if the NFP number beats expectations significantly, it could push the USD stronger, whereas a weak reading may trigger selloffs.

In short, what does NFP stand for in forex? It stands for opportunity, or risk, depending on your strategy and preparation.

2. What does the NFP report tell us about the economy? How does it affect the forex market?

The NFP report serves as a pulse check on the U.S. labor market, derived from two core surveys:

- Household survey

This portion measures:

- Unemployment rate (overall and by demographics).

- Labor force participation rate.

- Reasons for unemployment.

- Establishment survey

This is where the headline NFP number comes from:

- Number of jobs added or lost.

- Industry-specific data (e.g., manufacturing, services).

- Average hours worked.

- Hourly earnings.

When you read “NFP beats expectations,” it often refers to this portion of the release.

How NFP affects the forex market?

Through my own trades and community feedback, these are patterns I’ve noticed:

- A strong NFP (e.g., +250K jobs added) often leads to USD appreciation, as it suggests a healthy economy and potential rate hikes.

- A weak NFP (<100K or negative numbers) often leads to USD depreciation, due to recession fears or looser monetary policy.

Market reactions aren’t always rational, though. Sometimes, positive jobs data may still cause the USD to fall if traders believe it's already priced in or overshadowed by weaker wage growth.

Tip: If you're wondering what does NFP stand for in trading terms, think of it as a market-moving event that often defies logic. Use economic calendars like Forex Factory or Trading Economics to watch NFP consensus forecasts and plan trades accordingly.

See more useful additional articles:

- The Difference: What is Ask Price vs Bid Price?

- What is leverage in Forex trading? A simple explanation for beginners

- What is a direct quotation? Clarifies its role in Forex

3. Why is the NFP report important for forex traders?

The Non-Farm Payrolls (NFP) report is far more than just a headline number. It offers a crucial window into the state of the U.S. economy and, by extension, the direction of monetary policy, particularly interest rates set by the Federal Reserve.

Here's why it matters:

- Interest rate expectations

One of the primary reasons the NFP matters so much is its influence on interest rate expectations. A strong jobs report often signals a robust economy, which can lead the Fed to consider tightening monetary policy.

We saw this dynamic play out clearly between 2022 and 2023, when a resilient labor market supported an aggressive cycle of interest rate increases, leading to a significant rally in the U.S. dollar.

- Inflation and GDP insight

The NFP also offers insights into GDP growth and inflation trends. Higher employment typically leads to greater consumer spending, a key driver of economic expansion.

At the same time, rising average hourly earnings, another component of the NFP report, can signal wage inflation. If wage growth begins to outpace productivity, it can spark broader price inflation, prompting the Fed to take action.

- Market volatility triggers

Perhaps most importantly for forex traders, the NFP report is a catalyst for extreme market volatility.

It’s not unusual to see currency pairs like USD/JPY, EUR/USD, GBP/USD, and even gold (XAU/USD) experience sharp, sudden price swings in the minutes following the release.

From my experience, even traders who avoid news trading still keep a distance from open trades during Non-Farm Payroll (NFP) releases, especially once they understand what does NFP stand for in terms of market impact, simply due to the unpredictable volatility.

Common misunderstandings about NFP:

Despite being widely followed, there’s still confusion around what NFP is and what it’s not.

| Misconception | Explanation |

|---|---|

| NFP is just about jobs | Although focused on employment, the NFP report includes multiple data points. Traders who only watch the headline job numbers may overlook key factors like average earnings and revisions to past reports, which can strongly influence market sentiment. |

| NFP is a leading indicator | The NFP is actually a lagging indicator, reflecting the previous month’s employment data rather than predicting future trends. Still, it can provide insights into the broader economic momentum when analyzed over several months. |

| NFP equals ADP Report | ADP reports on private sector employment but is calculated differently from the Bureau of Labor Statistics’ official NFP data. These figures often diverge significantly, so they are not interchangeable. |

Pro tip: Treat ADP as a “sneak peek,” but don’t base trades solely on it.

4. Expert guide: What forex traders can do with the NFP report

The NFP report gives a monthly update on U.S. job growth or loss, which is a strong sign of how healthy the economy is. By understanding this report, you can better predict market trends and improve your trading timing.

Let’s explore how to read the NFP report properly and how forex traders like you can act on its data.

4.1. How to read the NFP report correctly?

What does NFP stand for in finance? The NFP number shows the total jobs added or lost in the U.S. economy in the past month, excluding farm jobs. For example, if the report says -100,000, it means 100,000 jobs were lost.

But don’t just look at the latest number. It’s important to review past NFP reports to spot trends. Is the job market generally growing or shrinking over time? A steady increase usually means a strong economy, which can boost the U.S. dollar.

Also, check whether recent numbers are near historic highs or lows. This helps you understand if the job market is unusually strong or weak. For instance, an NFP number near a record high may make traders confident in the U.S. economy, pushing the dollar up.

In my experience, good traders analyze NFP data within its broader context instead of reacting to just one report. This gives a clearer picture of where the market might be heading.

4.2. How can FX traders act on NFP data?

NFP releases often cause sudden price swings in forex markets. If you’re holding open trades, be ready for more volatility, wider spreads, and possible margin calls.

Many traders close their positions before the report and wait to reopen after the initial market reaction. Others prefer to avoid trading during the release to reduce risk.

Right after the report drops, scalpers jump in, causing fast, unpredictable moves. If you’ve ever wondered what does NFP stand for in moments like these, it’s the chaos and opportunity of Non-Farm Payrolls in action. It can take a little while for the market to settle into normal patterns. That’s when more traders jump back in to make their moves.

There are two main ways to trade NFP:

- Before the release:

Some traders try to predict the outcome based on economic clues and place trades ahead of time. This requires strong risk management because unexpected numbers can cause big price jumps that skip stop losses. If you go this route, give your trades plenty of room to move. - After the release:

Others wait for the initial reaction to calm down. The market often shows a quick spike followed by a reversal. Waiting for this pullback can give you a safer entry point.

Personally, I find it safer to wait and watch how the market reacts before jumping in.

5. Expert insights: Are there any reliable strategies for reacting to NFP data?

No trading strategy can guarantee success with NFP, but one popular method is the pullback strategy.

Let me share an example from March 2019. The NFP report showed only 20,000 new jobs, far below the expected 180,000. This weak data usually hurts the U.S. dollar, causing pairs like EUR/USD to rise.

Right after the release, the price shot up sharply. But then it quickly pulled back below where it started. Traders using the pullback strategy would wait for this dip before buying, expecting the price to rebound. And indeed, the price bounced back strongly soon after.

From my own trades, I’ve seen this strategy work well because it avoids chasing the initial, often misleading, market reaction. For traders still figuring out what does NFP stand for in terms of timing and execution, this approach can offer a more measured entry into the chaos.

6. So, where and when can you find the NFP report?

The NFP report is released by the U.S. Bureau of Labor Statistics on the first Friday of each month at 8:30 AM Eastern Time (ET). For example, if you’re in the Netherlands, it comes out at 1:30 PM CET.

You can find the report on trusted sites like Investing.com, Babypips, or the Bureau of Labor Statistics website. I always recommend checking a couple of reliable sources to confirm the numbers.

Mark your calendar for the first Friday of each month so you don’t miss this important event.

7. FAQs: Common questions when searching for what does NFP stand for

7.1. Is Non-Farm Payrolls a leading or lagging indicator?

It’s a lagging indicator, reflecting past employment changes, but its release often causes immediate market reactions.

7.2. How should traders prepare for NFP releases?

Use economic calendars to check forecasts, avoid entering trades just before release, and plan for higher volatility to manage risk effectively.

7.3. Can NFP data be misleading sometimes?

Yes, markets can overreact or price in expectations early, so it’s crucial to combine NFP data with other analysis and not chase initial moves blindly.

7.4. What’s the difference between NFP and unemployment rate reports?

NFP counts actual jobs added or lost, while the unemployment rate shows the percentage of people out of work. Both are important, but tell different parts of the economic story.

7.5. Should beginners trade during NFP releases?

Due to extreme volatility, beginners should approach with caution or avoid trading right at release time until they understand market behavior better.

7.6. How can I use NFP data to improve my trading strategy?

Use NFP as a timing tool: avoid entering trades just before release, watch for confirmed trends afterward, and combine with technical analysis for smarter decisions.

7.7. What does the NFP stand for?

NFP stands for Non-Farm Payrolls, a U.S. labor market report that tracks the number of jobs added or lost each month outside farming and a few other excluded sectors.

7.8. What does NFP stand for in forex?

In forex, NFP refers to the Non-Farm Payrolls report, which is a high-impact event that often triggers sharp USD movements and creates trading opportunities.

7.9. What is NFP in investing?

In investing, NFP is a key economic indicator that helps investors gauge the strength of the U.S. economy, influencing stocks, bonds, and commodities as well as currencies.

7.10. What does the NFP insurance stand for?

In insurance, NFP stands for Not-for-Profit, referring to organizations that provide insurance or related services without seeking to make profits for shareholders.

Read more:

- What is forex exchange trading? Explained for total beginners

- How do financial advisors get paid: Key models and pay structures

8. Conclusion: Why you should understand what does NFP stand for

Now you know what NFP means and why this report matters so much in finance and forex trading. NFP stands for Non-Farm Payrolls. Understanding NFP explained helps you interpret key economic signals and prepare for market moves with confidence.

By learning how to read the report and applying strategies like waiting for pullbacks, you can better manage risk and spot trading opportunities.

If you're serious about growing as a trader and still asking what does NFP stand for beyond just a headline number, it’s time to go deeper. Explore the “Forex Basics” section on the H2T Finance website, because continuous learning and smart strategies are the real keys to long-term success in your forex journey.