In the dynamic world of forex trading, success isn’t just about predicting market direction, it’s also about managing trade size effectively. A crucial component of this is understanding lot sizes.

Whether you're a beginner exploring micro lots or a seasoned trader scaling positions with standard lots, knowing what a "lot" is and how it impacts risk, margin, and profit potential is essential for long-term performance.

This guide breaks down the concept of lot sizes, explains how to calculate them accurately, and provides practical tips to choose the right lot size for your trading strategy. Let’s start with the basics and build a strong foundation for smarter, more confident trading decisions.

Key takeaways:

-

Lot size is the unit of measurement for trade volume in forex, directly impacting your profit, risk, and margin requirements.

-

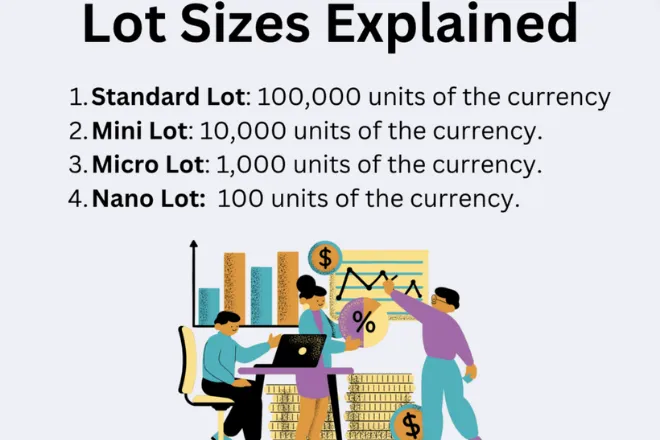

There are 3 common types of lot sizes:

-

Standard lot – 100,000 units: high profit potential, high risk

-

Mini lot – 10,000 units: balanced profit and risk

-

Micro lot – 1,000 units: suitable for beginners

-

-

Calculating lot size depends on your account balance, acceptable risk percentage, and stop-loss distance.

-

Choosing the right lot size is a key factor in effective risk and money management strategies.

-

Beginners should start with micro lots and gradually increase as they gain experience.

-

Avoid common mistakes such as overleveraging, ignoring market conditions, and failing to align lot size with a specific strategy.

-

Understanding and adjusting your lot size based on market volatility will lead to safer and more effective trading.

1. What is a "lot" in the forex market?

In forex trading, a "lot" is the standard unit of measurement for trade volume. It represents the amount of the base currency you are buying or selling in a trade.

For example: If you trade 1 lot of EUR/USD, it means you are buying or selling a fixed amount of Euros (the base currency), while the U.S. dollar is the quote currency.

Depending on the lot size, even small price movements in the market can have varying impacts on your profit or loss.

Having a clear understanding of lot size is the foundation of any effective trading strategy. Choosing the wrong lot size can lead to:

- Over-leveraging your capital, increasing the risk of a margin call or account wipeout

- Failing to fully capitalize on profit opportunities

- Struggling with proper risk management

Lot size also directly affects:

- The level of leverage applied

- Margin requirements

- Account volatility with every market movement

Therefore, mastering the concept of lot size enables you to manage risk more effectively and make more confident trading decisions.

2. What is lot size? Understanding lot sizes in trading

Lot size is the standard unit used to measure the volume of a financial asset that a trader buys or sells in a transaction. In the forex market, understanding lot size is essential for risk management, estimating potential profit, and building an effective trading strategy.

Common lot sizes in forex trading

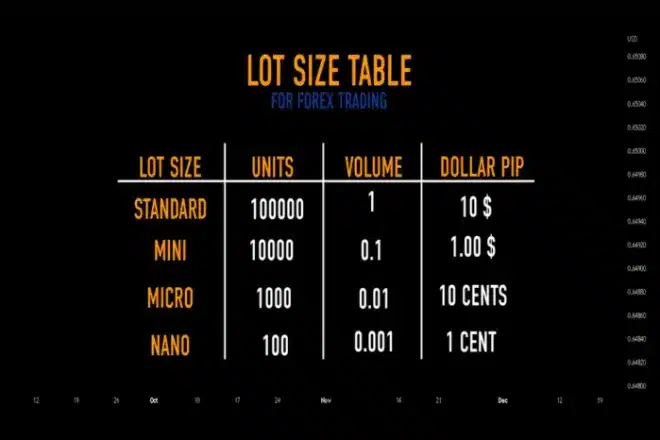

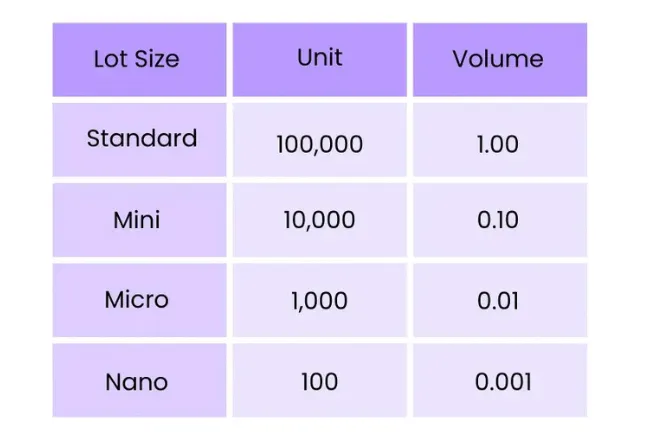

| Lot type | Volume of base currency | Suitable for | Average profit/risk |

|---|---|---|---|

| Standard Lot | 100,000 units | Professional traders, large institutions | Highest |

| Mini Lot | 10,000 units | Individual traders with moderate capital | Medium |

| Micro Lot | 1,000 units | Beginners or those with small capital | Lowest |

Summary of strengths & purpose for each lot type:

- Standard lot: Maximizes profit but requires strict risk management.

- Mini lot: Balances risk and return; suitable for most individual traders.

- Micro lot: Ideal for learning and testing strategies with minimal risk.

Tips for choosing the right lot size

Choosing the right lot size should be based on:

- Available capital

- Risk tolerance

- Personal experience and trading strategy

If you're a beginner: Start with micro lots to get familiar with the market.

If you're experienced: Consider moving to mini lots to optimize profits while maintaining risk control.

See more related articles:

3. Calculating lot sizes

Calculating lot sizes is a critical aspect of trading, as it directly affects risk management and overall trading performance. Properly determining the appropriate lot size enables traders to manage their capital effectively, minimize risk, and enhance profitability. The calculation of lot sizes involves understanding both the size of the trade and the trader's risk tolerance, making it essential for successful trading strategies.

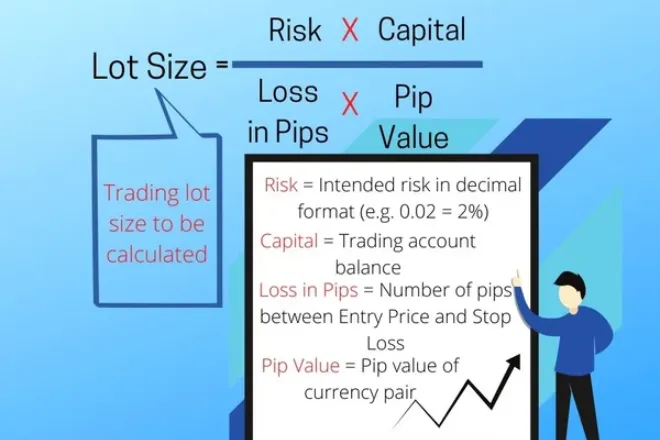

To calculate lot sizes, traders often use a specific formula that considers their account size, the percentage of risk they are willing to take on a trade, and the stop-loss distance in pips. The formula typically looks like this:

[text{Lot Size} = frac{text{Account Balance} times text{Risk Percentage}}{text{Stop Loss (in pips)} times text{Pip Value}}]

For instance, if a trader has an account balance of $10,000 and is willing to risk 1% on a trade with a stop loss of 50 pips and a pip value of $1, the calculation would be:

[text{Lot Size} = frac{10,000 times 0.01}{50 times 1} = 2 text{ lots}]

This formula helps traders ensure they are not over-leveraging their positions, which can lead to significant losses.

Several factors influence lot size decisions, including market volatility, trading strategy, and individual risk tolerance. High volatility markets may require smaller lot sizes to manage risk effectively, while stable markets might allow for larger positions. Additionally, traders using scalping strategies may opt for smaller lot sizes to take advantage of small price movements, whereas swing traders may choose larger sizes to capitalize on longer-term trends.

It is essential for traders to regularly reassess their lot size calculations, especially when market conditions change or their account balance fluctuates. Adapting lot sizes to current market scenarios can significantly enhance a trader's ability to respond to unexpected price movements, thereby safeguarding their capital and ensuring sustainable trading practices.

4. Choosing the right lot size for your strategy

Selecting the appropriate lot size is crucial for establishing a successful trading strategy. Understanding how to choose the right lot size can significantly affect your overall trading performance and risk management. A well-calibrated lot size allows traders to optimize their positions in the market while managing potential losses effectively.

One of the primary considerations when choosing a lot size is risk management. Traders must determine the appropriate percentage of their trading capital to risk on a single trade. For instance, many traders follow the rule of risking no more than 1-2% of their account balance on any given trade. If a trader has a $10,000 account and decides to risk 1%, they would only risk $100. This decision directly influences the lot size they can utilize, ensuring that losses remain within acceptable limits.

Another aspect to consider is the impact of lot sizes on trading performance. A larger lot size increases potential profits but also amplifies risks. Conversely, a smaller lot size mitigates risk but may limit profit potential. For example, trading a standard lot in a currency pair can yield substantial profits if the market moves favorably, but it can also lead to significant losses in a volatile market. Traders must align their lot size with their risk tolerance, market conditions, and trading strategy to maintain a balanced approach.

Additionally, market conditions play a pivotal role in choosing the right lot size. In highly volatile markets, traders might opt for smaller lot sizes to reduce exposure, while in stable market conditions, they may feel more comfortable increasing their lot sizes. Adapting to the current market environment is essential for effective trading.

Lastly, traders should continually evaluate their trading strategies to ensure that their lot sizes remain appropriate as their experience and capital evolve. Regularly reviewing and adjusting lot sizes based on performance can lead to improved outcomes and a more sophisticated trading approach. By integrating these considerations, traders can enhance their overall trading strategy and increase their likelihood of success in the market.

5. Common mistakes with lot sizes

Understanding the common mistakes with lot sizes is crucial for traders looking to enhance their trading performance. Many newcomers in the trading world often overlook the significance of selecting the appropriate lot size, which can lead to substantial financial risks and missed opportunities. By recognizing these pitfalls, traders can make informed decisions that align with their trading strategies and risk tolerance.

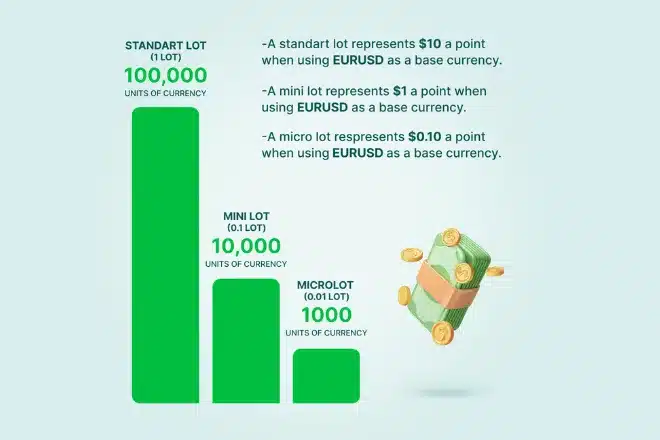

One of the most prevalent mistakes is overleveraging with large lot sizes. Traders may be tempted to increase their potential profits by trading larger lot sizes without fully considering the associated risks. For example, trading a standard lot in forex can expose a trader to a loss of $10 per pip movement. If a trader does not have adequate capital to withstand such fluctuations, they may face margin calls or even account liquidation. It's essential for traders to align their lot sizes with their overall risk management plan to avoid such scenarios.

Another critical error is ignoring market conditions when deciding on lot sizes. Market volatility can significantly impact trading outcomes, and failing to adjust lot sizes in response to changing conditions can be detrimental. For instance, during high volatility periods, such as major economic announcements, traders should consider reducing their lot sizes to mitigate risk. This approach allows for better management of potential drawdowns and helps maintain a more stable trading account over time.

Furthermore, many traders neglect to account for their overall trading strategy when determining lot sizes. The lack of a cohesive strategy can result in inconsistent lot sizing, which may lead to erratic trading results. Establishing clear guidelines that incorporate lot size calculations in relation to account size, risk per trade, and overall trading goals is vital. By doing so, traders can create a more disciplined approach to trading that fosters long-term success.

In summary, avoiding these common mistakes with lot sizes—such as overleveraging, ignoring market conditions, and lacking a cohesive strategy—is essential for traders aiming to optimize their trading results. Adopting a mindful approach to lot sizing can significantly enhance trading performance and contribute to overall financial success in the markets.

6. Frequently asked questions (FAQs)

6.1. How do you understand lot sizes?

Lot size represents the volume of a trade in forex. It determines how much of a currency pair you’re buying or selling.

6.2. What does a 0.01 lot size mean?

A 0.01 lot size equals 1,000 units of the base currency. It's known as a micro lot, ideal for beginners.

6.3. Which lot size is the best?

There’s no one-size-fits-all. The best lot size depends on your account balance, risk tolerance, and trading strategy.

6.4. How much is 1 lot size in forex?

1 standard lot = 100,000 units of the base currency. For EUR/USD, that means trading €100,000.

7. Conclusion: Mastering lot sizes for successful trading

Mastering the concept of understanding lot sizes is a foundational step for any trader entering the forex market. It's not merely about knowing what a micro, mini, or standard lot is — it's about recognizing how each decision on trade size can impact your capital, leverage, and long-term strategy.

At H2T Finance, we’re committed to providing beginner-friendly, actionable insights in our Forex Basics series. If you're just getting started, choosing the right lot size can help you avoid costly mistakes and build a sustainable trading journey from day one.