To trade effectively, you first need to clearly understand the different types of currency pairs in forex because they determine your strategy, influence market trends, and present various opportunities or risks.

From major pairs and minor pairs to exotic pairs, each type has its own characteristics that traders need to grasp. This article will help you distinguish, evaluate, and choose the right currency pairs to optimize your profits in this highly volatile market.

Key takeaways:

- Types of currency pairs in forex: Major pairs (e.g., EUR/USD) offer high liquidity and tight spreads, minor pairs (e.g., EUR/GBP) provide regional opportunities, and exotic pairs (e.g., USD/THB) involve higher volatility and risk.

- Trading strategies: Tailor approaches based on pair type—technical analysis for major pairs, regional focus for minors, and cautious risk management for exotics.

- Influencing factors: Economic indicators, central bank policies, political events, market sentiment, commodity correlations, and technical factors drive currency pair movements.

- Risk management: Use stop-loss orders, position sizing (1-2% risk per trade), diversification, and correlation awareness to protect capital in the 24/5 FX markets.

- Common mistakes: Avoid impulsive trading, poor risk management, ignoring market hours, and overlooking correlations to enhance trading success.

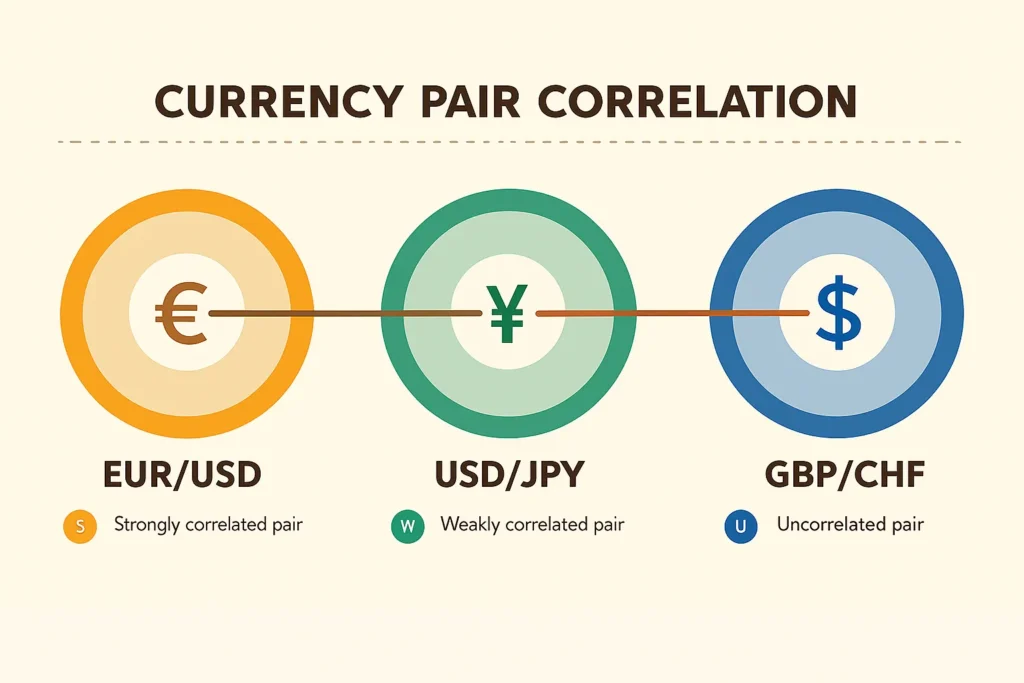

- Correlation insights: Understanding positive (e.g., EUR/USD and GBP/USD) and negative (e.g., EUR/USD and USD/CHF) correlations aids diversification and risk management.

- Tools for analysis: Leverage charting software, economic calendars, correlation matrices, and news services to make informed trading decisions.

1. Understanding currency pairs in forex

Before trading, you need to clearly understand the structure and classification of currency pairs. This is the foundation for determining strategies, managing risk, and taking advantage of price fluctuations in the Forex market.

1.1. What are base currency and quote currency?

In Forex trading, currencies are always traded in pairs, consisting of a base currency and a quote currency.

- Base currency: The first currency listed in the pair, representing the value of 1 unit of currency.

- Quote currency: The second currency in the pair, showing how many units of this currency are needed to buy 1 unit of the base currency.

Example: If the EUR/USD exchange rate is 1.20, it means 1 EUR = 1.20 USD.

- When you buy the EUR/USD pair, you are buying EUR and selling USD.

- Conversely, when you sell it, you are selling EUR and buying USD.

The value between the two currencies constantly changes due to factors such as economic reports, political events, and market sentiment. Understanding this relationship is the first step in predicting exchange rate movements.

1.2. What are currency pairs in forex?

A currency pair is a comparison of the value of two currencies, allowing traders to speculate on the rise or fall of one currency against the other. In the Forex market, currency pairs are divided into three main groups:

- Major pairs

- Cross pairs

- Exotic pairs

Popular pairs usually have high liquidity and low volatility, while less common pairs tend to have low liquidity and high volatility. Traders should choose pairs that match their strategy and risk tolerance.

2. Types of currency pairs: Major, minor, and exotic

In the Forex market, not all currency pairs are created equal. Categorizing them into major, minor, and exotic pairs helps traders understand their liquidity characteristics, volatility levels, and potential risks.

Knowing the differences between these three groups not only supports selecting pairs that align with personal trading strategies but also helps optimize capital management and trade timing.

2.1. Major pairs

Major pairs are those that include the U.S. dollar combined with another strong global currency, such as EUR/USD, USD/JPY, GBP/USD, and USD/CAD.

- High liquidity: Account for the majority of global Forex trading volume.

- Tight spreads: Lower trading costs, often under 1 pip for EUR/USD under normal market conditions.

- Stable volatility: Less prone to sudden price swings, making them suitable for both beginner and professional traders.

These pairs are especially active during overlapping trading sessions, such as the Europe–U.S. overlap.

2.2. Minor pairs (Cross currency pairs)

Minor pairs are those that do not include the U.S. dollar, such as EUR/GBP, AUD/NZD, and CHF/JPY.

- Lower liquidity: Leads to wider spreads compared to major pairs.

- Regional trading opportunities: Often experience stronger movements when there is news or economic events in the related regions.

- Volatility risk: Prices can be harder to predict but are useful for portfolio diversification and for capturing short-term opportunities outside the influence of the U.S. dollar.

2.3. Exotic pairs

Exotic pairs combine a strong currency (usually USD or EUR) with a currency from an emerging or less-traded market, such as USD/SEK, EUR/TRY, and USD/THB.

- Low liquidity: Fewer participants, resulting in wider spreads.

- High volatility: Easily affected by political or economic events in the currency’s home country.

- High profit potential: Correctly predicting trends in these volatile markets can yield significant profits but also carries substantial risk.

Clearly distinguishing between major, minor, and exotic pairs will help you take a more proactive approach to trading, enabling you to choose instruments that align with your risk appetite and strategy. Each group has its own characteristics in terms of liquidity, volatility, and profit potential. Mastering them is the foundation for effective and sustainable Forex trading.

See more related articles:

3. How to trade different types of currency pairs

Trading different types of currency pairs in the Forex market requires a clear understanding of their unique characteristics and the strategies best suited for each type. Currency pairs are categorized into major, minor, and exotic pairs, each offering distinct opportunities and challenges in the FX markets. By tailoring strategies to these characteristics, traders can optimize their performance and navigate the complexities of the Forex market, which operates 24 hours a day, five days a week.

3.1. Major currency pairs

Major currency pairs, such as EUR/USD and USD/CAD (US Dollar/Canadian Dollar), are the most popular among traders due to their high liquidity and tighter spreads. These pairs are ideal for both novice and experienced traders, as they allow for quick reactions to market-moving events across different time zones. To trade major pairs effectively, traders often rely on technical analysis, utilizing tools like chart patterns, support and resistance levels, and indicators such as the Relative Strength Index (RSI) or Moving Averages. For instance, when trading the EUR/USD pair, identifying key price levels where the exchange rate has previously reversed can help pinpoint potential support or resistance areas for entry and exit points.

3.2. Minor currency pairs

Minor pairs, also known as cross-currency pairs, such as GBP/EUR or AUD/NZD (involving the Australian Dollar), do not include the US dollar and typically have slightly lower liquidity than major pairs. This can lead to wider spreads, especially during major economic or political announcements affecting the involved currencies. Traders must consider factors like economic reports and regional events that can introduce volatility. Understanding these dynamics allows traders to capitalize on short-term opportunities while being mindful of the increased volatility risk in these pairs.

3.3. Exotic currency pairs

Exotic currency pairs, which pair a major currency (like USD or EUR) with a currency from an emerging market, such as TRY (Turkish Lira) or ZAR (South African Rand), come with higher spreads and lower liquidity. Trading these pairs demands a thorough understanding of the economic conditions in the respective countries and the potential impact of global events. Due to their unpredictable and sometimes dramatic price movements, risk management is critical when trading exotic pairs. Traders must approach these pairs cautiously, as their volatility can lead to significant profits but also substantial losses.

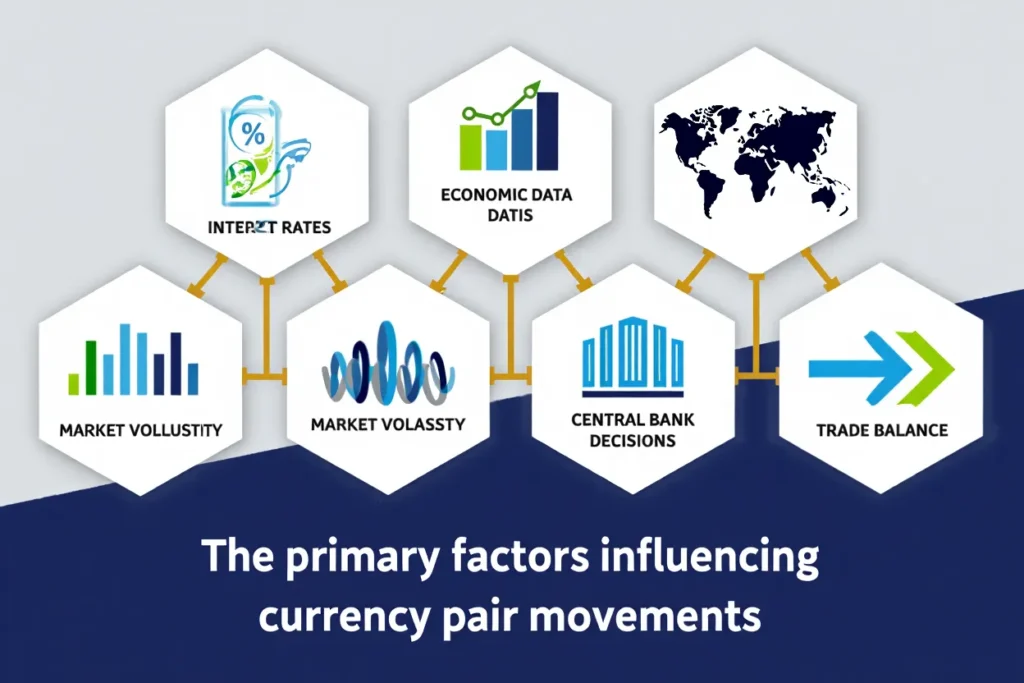

4. Factors influencing currency pair movements

Currency pair movements in the Forex market, which operates 24 hours a day, five days a week, are driven by multiple factors that traders must understand to make informed decisions. Key elements such as economic indicators, central bank policies, political events, market sentiment, commodity correlations, and technical factors collectively shape exchange rate fluctuations and trading opportunities in the FX markets.

4.1. Economic indicators

Economic indicators provide critical insights into a country’s economic health, significantly impacting currency pair movements, especially major pairs like EUR/USD and USD/CAD. These include:

- GDP growth rates: Reflect economic performance.

- Employment statistics: Indicate labor market strength.

- Inflation rates: Influence purchasing power.

- Interest rates: Affect currency value, e.g., a U.S. Federal Reserve rate hike may strengthen the USD, impacting pairs like EUR/USD or USD/CAD. Traders monitor these indicators closely to anticipate price changes and react swiftly to economic news.

4.2. Central bank policies

Central banks shape currency movements through monetary policies, including:

- Interest rate decisions: Higher rates often strengthen a currency.

- Quantitative easing/tightening: Impacts money supply and currency value. For example, a hawkish Bank of Canada stance may boost the Canadian Dollar, affecting USD/CAD, while Reserve Bank of Australia policies influence AUD/USD and AUD/JPY pairs.

4.3. Political events

Political developments create volatility in the Forex market. Key events include:

- Elections and trade agreements: Cause rapid currency value shifts.

- International conflicts: Impact exchange rates of involved countries. For instance, Brexit introduced sustained volatility in GBP-related pairs, affecting their relationships with EUR, USD, and other currencies.

4.4. Market sentiment

Market sentiment drives price trends, often independent of fundamental data. During economic uncertainty:

- Safe-haven currencies like CHF and JPY appreciate.

- Riskier assets may weaken, reflecting traders’ emotions and perceptions.

4.5. Commodity correlations

Certain currencies correlate with commodity prices, creating predictable patterns:

- Canadian Dollar (CAD): Moves inversely with oil prices due to Canada’s oil exports.

- Australian Dollar (AUD): Tracks gold and mineral prices, impacting pairs like AUD/USD. Traders can leverage these relationships for strategic trading decisions.

4.6. Technical factors

Short-term price movements are influenced by technical analysis tools, such as:

- Support and resistance levels: Identify key price zones.

- Trend lines and chart patterns: Guide entry and exit points. Traders combine technical and fundamental analysis, particularly for major pairs like EUR/USD, to enhance decision-making.

Currency pair movements are shaped by economic indicators, central bank policies, political events, market sentiment, commodity correlations, and technical factors. By understanding these elements, traders can improve their decision-making and navigate the FX markets effectively. Our economic research team provides daily briefings, helping clients stay ahead in predicting market movements.

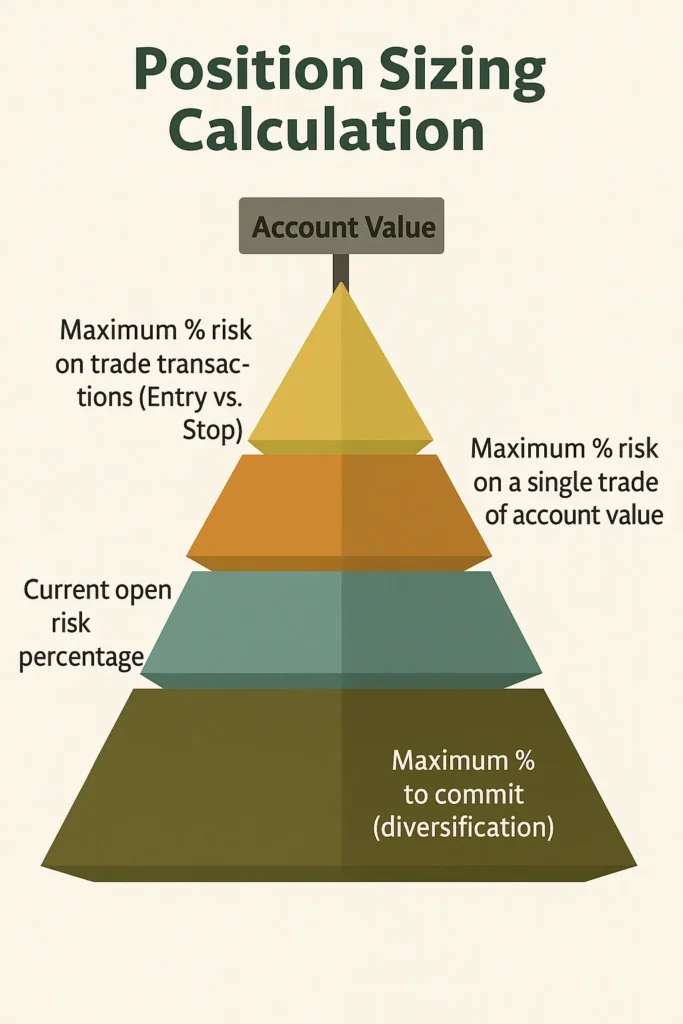

5. Risk management strategies for trading currency pairs

Effective risk management is crucial for success in the Forex market, which operates 24 hours a day, five days a week. By protecting capital and enhancing profit potential, robust strategies help traders navigate the volatile environment of various currency pairs, from major to exotic, in the FX markets. Understanding and applying these strategies significantly improves a trader’s ability to manage risks and achieve consistent results.

5.1. Stop-loss orders

A key risk management tool is the stop-loss order, which automatically closes a trade at a predetermined price to limit losses. For example, setting a stop-loss 50 pips below the entry point on a EUR/USD trade ensures losses stay within a predefined limit. This method fosters disciplined trading, preventing emotional decisions during market fluctuations, particularly for volatile pairs like those involving the Canadian Dollar or Australian Dollar.

5.2. Position sizing

Position sizing is another critical aspect of risk management. Traders should allocate capital based on their account size and risk tolerance, typically risking no more than 1-2% of their total account balance per trade. For instance, with a $10,000 account, risking 1% limits losses to $100 per trade, whether trading USD/CAD or other pairs. This approach helps preserve capital and maintain long-term trading sustainability.

5.3. Diversification

Diversifying across multiple currency pairs reduces risk by spreading exposure across different assets. Focusing solely on one pair, like EUR/USD, leaves traders vulnerable to adverse economic shifts in Europe or the US. Including pairs like GBP/USD or those with the Australian Dollar mitigates risks tied to a single currency’s movements, enhancing portfolio stability.

5.4. Correlation awareness

Understanding currency pair correlations is vital for effective diversification. Pairs like EUR/USD and USD/CAD often show strong correlations due to shared currencies. Trading multiple positively correlated pairs amplifies risk rather than reducing it. By analyzing correlations, traders can avoid redundant exposure and build a balanced portfolio, minimizing the impact of adverse market moves.

5.5. Staying informed

Monitoring economic indicators and political events is essential, as these factors drive exchange rate fluctuations across all currency pairs. Unexpected events, like interest rate changes, can cause sharp price swings. Regularly reviewing economic calendars and news allows traders to adjust strategies and anticipate risks, ensuring preparedness for market volatility in the FX markets.

5.6. Risk-reward ratios

Employing risk-reward ratios helps evaluate trade setups. A favorable ratio, such as 1:3, means a potential $3 gain for every $1 risked. By prioritizing trades with high risk-reward ratios, traders can boost overall profitability, even with a lower win rate, making this a cornerstone of effective risk management.

Robust risk management is the backbone of successful Forex trading. By leveraging stop-loss orders, managing position sizes, diversifying across currency pairs, understanding correlations, staying informed on economic developments, and using risk-reward ratios, traders can navigate the complexities of the FX markets with confidence. These principles, refined over 20+ years of institutional trading experience, have protected billions in client assets and remain essential for achieving consistent trading success.

See more related articles: The best forex trading software

6. Common mistakes to avoid when trading currency pairs

Several common errors can undermine trading success, often due to inadequate preparation, lack of discipline, or misunderstanding market dynamics. These include:

- Lack of a trading plan: Entering trades without a strategy leads to impulsive, emotion-driven decisions. A solid plan should define entry/exit points, risk parameters, and objectives. For example, holding a losing EUR/USD position too long without a plan can amplify losses.

- Poor risk management: Failing to use stop-loss orders or risking over 1-2% of account balance per trade can quickly deplete capital, especially with volatile pairs like AUD-related ones. Effective risk management sets loss limits and adjusts position sizes based on pair volatility.

- Ignoring market hours: Not all sessions offer equal opportunities. USD/CAD is more active during North American hours, while AUD pairs thrive in Asian sessions. Misjudging timing can lead to suboptimal trades.

- Incomplete market analysis: Relying only on technical indicators, like a moving average crossover for EUR/USD, without economic context can lead to poor decisions. Combining technical and fundamental analysis is essential for informed trading.

- Emotional trading: Fear or greed can prompt irrational moves, such as increasing position sizes after losses to recover quickly. High-liquidity major pairs tempt over-leveraging, increasing risks.

- Inflexibility: Currency pairs are influenced by economic data, central bank policies, and global events. Rigidly sticking to outdated strategies during market shifts harms performance.

- Overlooking correlations: Ignoring links, like CAD with oil prices or AUD with commodities, can result in unintended risk concentration.

To avoid these pitfalls, traders should prioritize continuous education and self-reflection. Keeping a detailed trade journal to analyze decisions and emotional states helps identify patterns in successes and failures. This guidance, based on our client support team’s analysis of thousands of traders, provides practical solutions to overcome these challenges and build a disciplined approach.

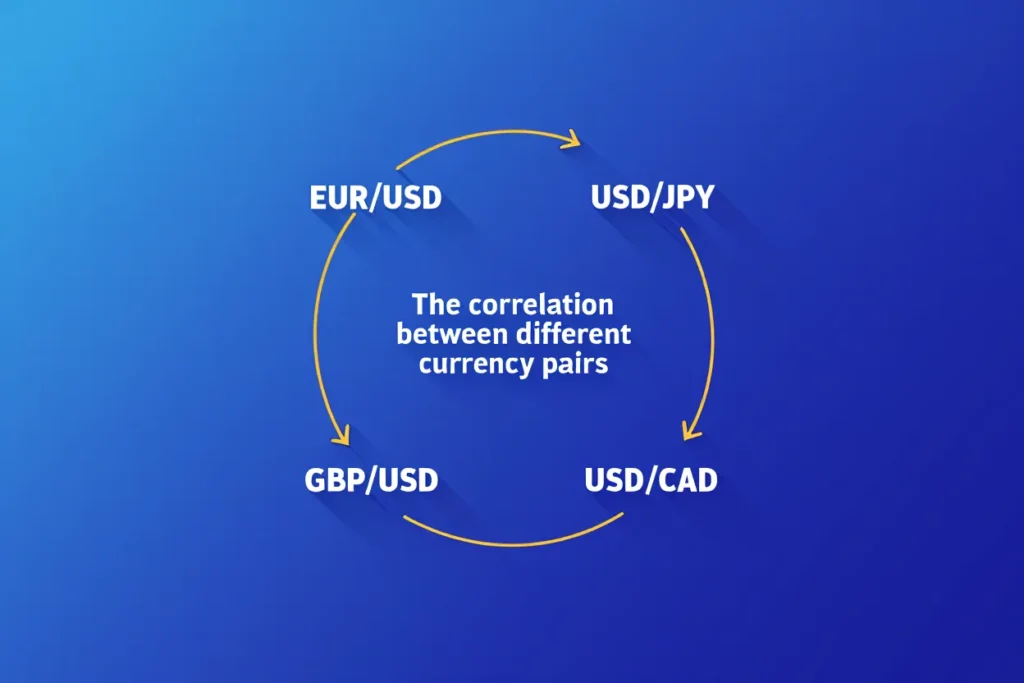

7. The importance of currency pair correlations in trading

Currency pair correlations are vital in Forex trading, helping traders understand how pairs move relative to one another in the 24/5 FX markets. By analyzing these relationships, traders can make informed decisions, optimize strategies, and manage risks effectively, enhancing overall trading performance.

7.1. Understanding correlations

Correlations indicate potential price movements, with pairs moving together (positive correlation) or oppositely (negative correlation). Key examples include:

- Positive correlation: EUR/USD and GBP/USD often move similarly.

- Negative correlation: EUR/USD and USD/CHF typically move inversely due to USD’s opposing roles. Recognizing these patterns helps traders anticipate price shifts and adjust positions.

7.2. Commodity correlations

Certain currencies correlate with commodities, creating predictable patterns:

- USD/CAD: Moves inversely to oil prices due to Canada’s oil exports.

- AUD/USD: Tracks gold and mineral prices, reflecting Australia’s mining industry. These relationships allow traders to leverage commodity trends in their strategies.

7.3. Impact of economic events

Major economic events, like interest rate changes or political developments, can alter correlations. For instance, a Federal Reserve rate hike may strengthen USD, affecting pairs like EUR/USD and USD/CAD differently, requiring traders to adapt strategies accordingly.

7.4. Risk management and diversification

Correlation awareness enhances risk management by enabling diversification:

- Hedging: A long EUR/USD position can be offset with a short USD/CHF position to reduce risk.

- Portfolio balance: Avoiding overexposure to correlated pairs minimizes unintended risk concentration. This approach mitigates volatility-related losses in the FX markets.

7.5. Trading efficiency and market sentiment

Focusing on correlated pairs improves trading efficiency, reducing the need to monitor unrelated instruments. Correlation analysis also reveals market sentiment, helping identify trends or reversals. For example, a sudden decorrelation between USD/CAD and USD/MXN may signal shifts in regional economic factors.

Understanding currency pair correlations is crucial for effective Forex trading. By leveraging these relationships for risk management, strategy optimization, and market insight, traders can navigate the FX markets with greater confidence. Our quantitative analysis team provides clients with up-to-date correlation matrices, invaluable for portfolio diversification and informed decision-making.

8. Tools and resources for analyzing currency pairs

A range of tools supports traders in analyzing currency pairs, each offering unique benefits:

- Charting software: Platforms like MetaTrader 4/5, TradingView, and NinjaTrader offer advanced charting for pairs like EUR/USD or USD/CAD, with indicators like Moving Averages, RSI, and Bollinger Bands to pinpoint entry/exit points.

- Economic calendars: Sites like Forex Factory and Investing.com track events like interest rate decisions, employment reports, and GDP releases, helping traders anticipate volatility and manage risk.

- Currency strength meters: Visualize relative currency strength, useful for pairs involving CAD or AUD, to identify high-probability trading opportunities.

- Correlation matrices: Show relationships between pairs, aiding diversification and risk management by avoiding redundant positions, e.g., overexposure to EUR/USD-correlated pairs.

- News aggregation services: Bloomberg, Reuters, and specialized Forex platforms provide real-time updates on political events, economic shifts, and market sentiment for informed predictions.

- Currency converters/calculators: Calculate position sizes, pip values, and profit/loss scenarios, crucial for risk management across pairs like AUD/JPY with varying pip values.

- Algorithmic platforms: Enable strategy creation and backtesting with historical data, refining approaches before live trading.

- Educational resources: Online courses, webinars, and forums from sites like BabyPips offer knowledge on basic to advanced trading strategies for all pair types.

Combining charting software, economic calendars, strength meters, correlation matrices, news services, calculators, algorithmic platforms, and educational resources empowers traders to analyze currency pairs effectively. These tools, integrated into our platform, provide comprehensive data analysis, earning recognition from independent Forex review organizations for supporting informed trading decisions and improved outcomes in the FX markets.

9. Frequently asked questions about currency pairs (FAQs)

9.1. What makes major currency pairs different from minor and exotic pairs?

Major currency pairs are the most popular because they involve the US dollar paired with other significant world currencies (EUR, GBP, JPY, CHF, CAD, AUD, NZD). They offer the highest liquidity, tightest spreads (often 1-3 pips), and most stable trading conditions.

Minor pairs (cross-currency pairs) don't include the USD but involve major currencies trading against each other, offering good liquidity but slightly wider spreads. Exotic pairs pair major currencies with emerging market currencies, featuring lower liquidity, wider spreads (sometimes 5-15 pips), and higher volatility.

9.2. How does the USD/CAD exchange rate relate to oil prices?

The USD/CAD pair (US Dollar/Canadian Dollar) typically shows an inverse relationship with oil prices because Canada is a major oil exporter. When oil prices rise, Canada's economy often benefits, strengthening the Canadian Dollar and causing the USD/CAD exchange rate to fall.

Conversely, falling oil prices typically weaken the Canadian Dollar, causing USD/CAD to rise. This correlation isn't perfect but ranges from moderate to strong depending on market conditions and can be a valuable consideration when trading this pair.

9.3. What are the best trading hours for the EUR/USD currency pair?

The EUR/USD currency pair typically experiences its highest liquidity and trading volume during the overlap of European and American trading sessions (8:00 AM to 12:00 PM EST). This period offers the tightest spreads and most market participants.

However, significant volatility can also occur during major economic announcements from either the Eurozone or United States. The forex market's 24 hours a day, five days a week operation means you can trade EUR/USD around the clock, but these peak hours often provide the best trading conditions.

9.4. How do central bank policies affect currency pairs?

Central bank policies dramatically impact currency values in the FX markets through interest rate decisions, quantitative easing/tightening programs, and forward guidance about future policy. Higher interest rates typically strengthen a currency by attracting foreign capital seeking better returns.

For example, if the Federal Reserve raises rates while the European Central Bank holds steady, the EUR/USD currency pair would likely fall as the dollar strengthens against the euro. Central bank statements and economic outlooks can create immediate volatility and influence long-term exchange rate trends.

9.5. What strategies work best for trading the Australian Dollar?

Trading pairs involving the Australian Dollar often benefits from awareness of commodity price movements, particularly gold, iron ore, and coal, as Australia is a major exporter of these resources. Technical strategies that include support/resistance levels and trend following work well, especially during the Asian and early European sessions when AUD pairs are most active.

Fundamental strategies should monitor Reserve Bank of Australia policy decisions, Chinese economic data (as China is Australia's largest trading partner), and overall market risk sentiment, as the AUD is considered a "risk-on" currency that typically strengthens in positive economic conditions.

9.6. How important is understanding exchange rate correlations for portfolio diversification?

Understanding currency pair correlations is extremely important for proper portfolio diversification in the FX markets. Without this knowledge, traders might believe they're diversified when they're actually taking essentially the same position multiple times.

For example, going long EUR/USD, GBP/USD, and short USD/CHF simultaneously exposes you to USD weakness three times. Instead, truly diversified portfolios might include unrelated pairs like EUR/USD currency pair and AUD/JPY, or pairs with different fundamental drivers like USD/CAD (influenced by oil) and USD/JPY (influenced by interest rate differentials and risk sentiment). Proper correlation analysis can reduce overall portfolio volatility and improve risk-adjusted returns.

9.7. What factors most influence the trading of exotic currency pairs?

Exotic currency pairs are most heavily influenced by local political stability, economic policies, inflation rates, and country-specific risks that may not affect major currencies as significantly. While major pairs like the EUR/USD currency pair respond primarily to global economic trends and central bank policies, exotic pairs can make dramatic moves based on local elections, regulatory changes, or economic crises.

Trading exotic pairs requires following both the news regarding the major currency (like USD) and staying informed about local developments in the emerging market country. The liquidity constraints of exotic pairs in the FX markets also mean that spreads can widen dramatically during volatile periods, significantly increasing trading costs.

10. Conclusion

Mastering the types of currency pairs in forex is essential for any trader aiming to succeed in the dynamic FX markets. By understanding the unique characteristics of major, minor, and exotic pairs, you can tailor your strategies, manage risks effectively, and seize profitable opportunities. At H2T Finance, our Forex Basics category equips you with the knowledge and tools to navigate these complexities with confidence. Start applying these insights today to elevate your trading journey with H2T Finance.