If you’re trading with Topstep, one of the most important questions you need answered is topstep trades closed by what time. Knowing the exact topstep trading times and daily cutoff time for closing your trades is essential to comply with topstep trading rules and avoid penalties that could jeopardize your trading progress.

In this comprehensive guide, we will break down Topstep’s trading hours, explain the daily cutoff rules, highlight important holiday schedules via the Topstep holiday calendar, and share best practices to help you succeed. Whether you are participating in the Trading Combine or managing a Funded Account, understanding when to close your trades is critical to passing your challenge and managing your risk effectively.

Stay tuned as we cover everything you need to know about topstep trades closed by what time, topstep trading hours today, and much more.

1. Overview of Topstep trading hours

Understanding the topstep trading hours is crucial for success in Topstep's Trading Combine and Funded Accounts. Topstep enforces specific trading times to promote discipline and risk management among traders.

1.1. Regular trading hours

Topstep's standard trading schedule operates from 5:00 PM CT (Sunday) to 3:10 PM CT (Friday). This schedule aligns with the CME Group's trading hours, allowing traders to participate in various futures markets.

1.2. Daily cutoff time

A key rule is that all positions must be closed by 3:10 PM CT each trading day. Topstep's Risk Managers begin monitoring for open positions at 3:08 PM CT and will attempt to flatten any remaining trades as a courtesy. However, it is the trader's responsibility to ensure all positions are closed by the cutoff time to avoid violations.

1.3. Weekend trading

Trading resumes at 5:00 PM CT on Sundays, marking the start of the new trading week. This allows traders to prepare for the upcoming week's market activities.

2. Topstep trades closed by what time? Daily cutoff rule explained

Understanding Topstep trades closed by what time is essential to avoid violations and stay eligible for funding. The daily cutoff rule is one of the most critical compliance standards in the Topstep ecosystem.

Why is the 3:10 PM CT cutoff important?

Topstep is designed for day trading, meaning traders must not carry open positions overnight. The 3:10 PM Central Time cutoff ensures all trading activity is wrapped up before market volatility increases during illiquid hours. This rule protects both traders and the firm from overnight risk exposure.

What happens if you don’t close trades on time?

If you hold a position past 3:10 PM CT, you risk a rule violation, which can result in:

- Automatic disqualification from your Trading Combine or Express Funded Account

- Loss of funded status in the Live Funded Account

- In some cases, a reset fee may apply

Topstep’s risk team begins flattening trades at 3:08 PM CT, but this is not guaranteed. You are fully responsible for ensuring all trades are closed by the hard cutoff.

Special note for contracts with earlier close times: Some futures contracts like CBOT Commodities (e.g., Corn, Soybeans) or CME Livestock products close before 3:10 PM CT. In these cases, you must exit positions according to the product-specific close time, not the standard cutoff. Always check your product's session end to avoid accidental violations.

Summary: Topstep trades closed by what time?

All Topstep trades must be closed by 3:10 PM CT (Central Time) each trading day. Holding positions past this cutoff violates the Daily Close Rule and can disqualify you from the Trading Combine or funded account.

- Key time: 3:10 PM CT (Chicago time)

- Applies to: Both evaluation (Combine) and funded accounts

- Tip: Set an alarm at 3:00 PM CT to manage positions in time

3. Topstep trading rules you must follow

To succeed with Topstep, traders need more than just a good strategy they must strictly follow the platform’s trading rules. These rules are designed to simulate real capital risk and develop professional discipline, both during the Trading Combine and in funded accounts.

3.1. Key Topstep trading rules

Here’s a breakdown of the most important rules every Topstep trader must follow:

| Rule | Description |

| Daily Loss Limit | If your account hits a predefined daily loss (e.g., $1,000 for a $50k account), trading is halted for the day. |

| Max Drawdown | You must not exceed the trailing drawdown set for your account. Going below this threshold results in disqualification. |

| Trade Close Time | All trades must be closed by 3:10 PM CT, unless the product’s close is earlier. |

| No Swing Trading | Overnight positions are not allowed. You must be flat at the end of each session. |

| Scaling Plan | Funded traders may need to follow a scaling plan limits on max contracts traded, depending on account balance. |

| One Active Combine at a Time | You can’t trade multiple Combines simultaneously for the same product group. |

| No Copy Trading or Automation | Using trade copiers, bots, or signals is strictly prohibited in most account types. |

3.2. Why these rules matter

These trading rules are more than just formalities. Violating them even accidentally can result in immediate disqualification. Following the rules ensures:

- You're building habits that mirror real professional trading

- Risk management remains a core focus

- Topstep can fairly evaluate your consistency and discipline

By committing to these guidelines, you increase your odds of passing the challenge and retaining your funded account long-term.

See more related articles:

- What is a trailing stop order? Smart risk control 2025

- What is forex exchange trading? Explained for total beginners

- How do financial advisors get paid: Key models and pay structures

4. Holiday hours and special closures

Topstep’s trading schedule can change during holidays, especially when the CME Group adjusts market hours. Being aware of these special sessions is crucial to avoid rule violations particularly the cutoff time for closing trades.

How Topstep handles holidays: Topstep follows the CME holiday calendar. During these periods, markets may open late, close early, or remain shut entirely. The exact adjustments vary depending on the holiday and product.

To help traders plan, Topstep provides two updated holiday calendars:

- Holiday Trading Hours – Trading Combine and Express Funded Account

- Holiday Trading Hours – Live Funded Account

These links are typically updated a few weeks in advance of each major U.S. holiday.

Examples of impacted holidays:

| Holiday | Typical Adjustment |

| Christmas Day | Markets usually close early on Dec 24 and remain closed on Dec 25 |

| Thanksgiving | Early close on Wednesday, full closure Thursday, limited hours Friday |

| Independence Day | If July 4th falls midweek, expect early close or no session that day |

| Memorial Day / Labor Day | Late Sunday open, early Monday close |

| New Year’s Day | Markets closed on Jan 1, early close on Dec 31 |

Important note: Even if the markets are open, Topstep may still require trades to be closed earlier than usual. Always check the official calendar and confirm on your Resources Page in your account dashboard.

Why this matters for your Combine or Funded Account?

Failing to comply with altered trading hours during holidays can break the 3:10 PM CT close rule or lead to trading during restricted times both violations that can disqualify you from a funded opportunity.

Set calendar reminders and check Topstep’s notices to stay ahead of schedule changes.

5. Common mistakes traders make with Topstep hours

Understanding and adhering to Topstep’s trading hours is essential, but many traders still fall into common pitfalls that can jeopardize their progress. Recognizing these mistakes will help you stay compliant and avoid unnecessary setbacks.

- Holding positions past the daily cutoff time

One of the most frequent errors is not closing trades before 3:10 PM Central Time (CT) on trading days. Topstep’s Trading Combine and Funded Accounts require all positions to be flat by this time to prevent overnight or weekend exposure. Holding trades beyond this cutoff may lead to automatic liquidation by risk managers or account penalties.

- Ignoring market-specific early closes

Certain futures products, such as some CBOT commodity contracts, close before 3:10 PM CT (e.g., 1:20 PM CT for wheat or corn). Traders sometimes overlook these early closes and fail to exit positions on time, which violates the rules.

- Trading during market pauses or holidays without checking schedules

Markets occasionally pause during the trading day (like the CBOT commodity market pause between 7:45 AM and 8:30 AM CT) or close early on holidays. Not verifying these periods can result in placing orders during unavailable times or missing important trading windows.

- Confusing time zones or daylight saving changes

Topstep’s hours are always based on Central Time (CT). Some traders mistakenly use their local time zones or forget to adjust for daylight saving time, causing them to trade too late or early.

- Failing to monitor the Topstep Resources Page

Topstep provides real-time updates and countdown timers for trading sessions on the Resources Page. Ignoring this tool reduces awareness of deadlines and market status, increasing the chance of mistakes.

6. Best practices to stay compliant and pass your challenge

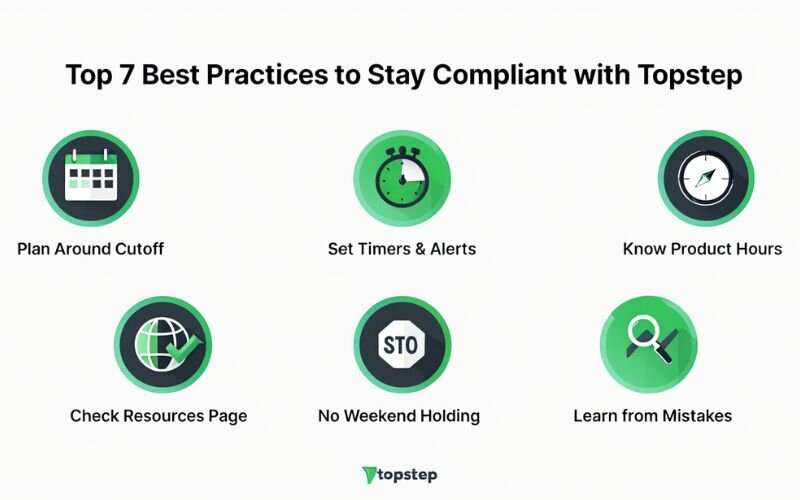

Staying within Topstep’s trading hours and following the rules can feel challenging at first, but adopting the right habits will help you maintain compliance and improve your chances of passing the Trading Combine or Funded Account challenge.

- Plan your trading day around cutoff times: Knowing that all trades must be closed by 3:10 PM Central Time (CT), structure your trading schedule accordingly. Avoid opening new positions late in the session that you might struggle to close on time.

- Use alerts and timers: Set alarms or reminders for key cutoff times, such as the 3:08 PM CT warning before mandatory position closure. Use calendar tools or trading platform features to alert you well before the deadline.

- Familiarize yourself with product-specific hours: Review the trading hours for the specific futures contracts you trade, including any early closes or market pauses. This knowledge helps you avoid accidental rule violations and plan exits appropriately.

- Monitor the Topstep Resources Page: Regularly check Topstep’s Resources Page for real-time market status, holiday schedules, and announcements. Staying informed will keep you ahead of unexpected changes.

- Avoid holding trades over weekends and holidays: Topstep prohibits swing trading or holding positions over non-trading days. Make sure to close all positions before the weekend and any holiday breaks specified in the holiday calendar.

- Practice disciplined risk management: By managing risk carefully and using stop-loss orders, you can better control your trades and avoid last-minute forced exits close to cutoff times.

- Review and learn from mistakes: If you receive feedback or penalties related to trading hours, study them carefully. Adjust your trading routine to avoid repeating the same errors.

7. FAQs – quick answers for busy traders

To help you stay sharp and compliant, here are quick answers to some of the most common questions about Topstep trading hours and rules.

7.1. What time do Topstep trades close daily?

Trades must be closed by 3:10 PM Central Time (CT) every trading day, Monday through Friday.

7.2. Can I hold trades overnight or over the weekend?

No, Topstep does not allow holding positions overnight or through weekends. All trades must be flat before the daily cutoff.

7.3. What happens if I miss the 3:10 PM cutoff?

Topstep’s Risk Managers may forcibly flatten your positions starting at 3:08 PM CT, and failing to comply can affect your challenge results.

7.4. Are there special hours during holidays?

Yes, Topstep follows the CME holiday calendar. Trading hours may be shortened or markets closed during these days. Check Topstep’s holiday calendar regularly.

7.5. Can I trade Forex with Topstep?

No, Topstep focuses solely on futures trading and does not support Forex trading.

7.6. How do I know if a market is open or paused on TopstepX™?

The TopstepX™ platform uses color codes: Light Blue for Pre-Open, Orange for Paused, Green for Open, and Red for Closed.

7.7. Does Topstep have a time limit?

Yes. Topstep’s Trading Combine has no overall time limit, but to pass a phase, you must meet the objectives without violating any rules, such as closing trades by 3:10 PM CT.

7.8. What is the minimum trade time in Topstep?

There is no minimum holding time required. You can open and close trades quickly scalping is allowed as long as you follow all risk and timing rules.

Read more:

- How to get money from forex? A 7-step guide you need in 2025

- What is a pennant pattern in Forex? Guide to this key chart pattern

8. Conclusion – stay sharp with your trading clock

Understanding Topstep trades closed by what time is crucial for every trader aiming to succeed in the Topstep Trading Combine or Funded Account. Closing your trades by 3:10 PM Central Time (CT) daily, following the trading rules, and staying updated on holiday schedules will help you avoid unnecessary risks and improve your chances of passing your challenge.

Remember, Topstep’s strict cutoff times ensure a level playing field and help manage risk effectively. By adhering to these guidelines and using the resources available like the TopstepX™ color-coded market status you can trade confidently and strategically.

Stay disciplined, plan your trades with these trading hours in mind, and keep growing your trading skills. For more valuable knowledge, tools, and strategies on futures and Forex trading, don’t forget to explore our Forex Basics category at H2T Finance, where you can build a strong foundation for your trading journey.