In the fast-paced world of forex trading, identifying key price levels can make the difference between a winning trade and a missed opportunity. The round numbers above and below indicator MT4 is a game-changer for traders looking to pinpoint psychological price levels those round numbers like 1.2000 or 150.00 that often dictate market reactions.

These levels, steeped in trader psychology, act as invisible barriers where prices hesitate, reverse, or break through, offering strategic entry and exit points. Whether you’re a day trader, scalper, or swing trader, this free MT4 tool simplifies technical analysis by highlighting these critical zones on your charts.

In this guide, I dive deep into how to use the round numbers indicator, from setup to advanced strategies, empowering you to trade smarter without the clutter of complex tools. Ready to unlock the power of psychological levels? Let’s explore how this indicator can elevate your forex trading journey.

Key takeaways:

- Psychological price levels: Round numbers (e.g., 1.2000, 150.00) are significant in forex trading due to trader psychology, acting as key support and resistance zones where price reactions like reversals or breakouts often occur.

- Round numbers indicator: This free MT4 tool automatically plots horizontal lines at psychological price levels, simplifying technical analysis and aiding in trade planning across all timeframes and currency pairs.

- Versatile trading strategies: The indicator supports breakout, reversal, and scalping strategies by highlighting critical zones for entries, exits, and stop-loss placement.

- Easy setup and customization: Installation is straightforward, with adjustable settings like pip intervals and line styles to suit various trading styles, from scalping to swing trading.

- Enhanced with other tools: Combining the indicator with MT4 tools like moving averages, Fibonacci retracement, or Bollinger Bands improves trade accuracy by confirming signals.

- Risk management is crucial: Effective use requires disciplined stop-loss placement, proper position sizing, and avoiding overtrading to manage volatility and false signals.

- Limitations to consider: Round numbers are not foolproof; they require confluence with other indicators and may be less reliable in low-liquidity markets or during unexpected market shifts.

- Universal applicability: Suitable for all traders, from beginners to professionals, across various strategies, but always use in conjunction with other technical signals for best results.

1. What are round numbers in forex trading?

Round numbers in forex trading are price levels that are psychologically significant, often acting as key support and resistance zones where traders tend to make decisions. These levels, such as 1.0000, 1.0500, or 1.1000, are easy to remember and frequently influence market behavior due to their simplicity and prominence.

Understanding round numbers is essential for traders using tools like the round numbers above and below indicator MT4, as these levels can shape trading strategies and price action.

1.1. Why round numbers matter in forex

Round numbers, sometimes called psychological levels, attract attention because traders, institutions, and algorithms often place orders around them. For instance, a currency pair like EUR/USD approaching 1.2000 may see increased buying or selling pressure as traders anticipate reversals or breakouts.

Round numbers tend to act as psychological magnets in the forex market. They simplify decision-making and appeal to our natural preference for clean, memorable figures like 1.2000 or 150.00 rather than more complex values.

In practice, these levels often become zones where price consolidates, reverses, or breaks through, as many traders intuitively place their entries, exits, or stop-loss orders around them.

We can clearly see that price frequently reacts at these levels, either pausing, bouncing, or accelerating through, depending on market sentiment and order flow. This recurring behavior makes round numbers especially significant for technical analysis and market timing.

1.2. How round numbers function as support and resistance

Support and resistance occur at round numbers due to order clustering. For example, when GBP/USD nears 1.3000, traders may set buy orders below this level (support) or sell orders above (resistance), expecting price reactions.

This behavior stems from market participants’ tendency to focus on clean, memorable price points. These levels are not just integers but can include significant decimals (e.g., 1.2050 or 1.2100) depending on the currency pair and timeframe.

1.3. Practical examples in forex trading

Consider USD/JPY trading at 149.80 and approaching 150.00. Traders often observe hesitation or sharp movements at this round number due to accumulated orders. By recognizing these levels, you can anticipate potential price action and align your strategy accordingly.

Tools like the round numbers above and below indicator MT4 help visualize these zones, making it easier to plan trades.

2. Understanding the round numbers above and below indicator MT4

The round numbers above and below indicator MT4 is a powerful tool designed to help forex traders identify psychological price levels on their charts. By marking key round number levels, such as 1.0000 or 1.0500, this indicator simplifies the process of spotting potential support and resistance zones, enabling traders to make informed decisions.

In this section, we’ll explore the indicator’s functionality, features, and benefits for enhancing your trading strategy.

What is the round numbers above and below indicator?

This MT4 indicator automatically plots horizontal lines at round number price levels, often referred to as psychological levels, where market reactions are likely to occur.

The indicator highlights levels like 1.1000 or 1.1500, which act as magnets for price action due to order clustering. It’s particularly useful for traders who rely on technical analysis to anticipate breakouts, reversals, or consolidations at these key zones.

The round numbers above and below indicator offers several customizable features, making it adaptable to various trading styles:

- Customizable intervals: Adjust the spacing between lines (e.g., 50 pips or 100 pips) to suit your preferred timeframe or currency pair.

- Visual clarity: Displays clear, color-coded lines on the MT4 chart for easy identification of round numbers.

- Multi-timeframe compatibility: Works effectively on all timeframes, from M1 to D1, catering to scalpers, day traders, and swing traders.

- Lightweight design: Does not slow down the MT4 platform, ensuring smooth performance.

These features make the indicator a valuable addition to any trader’s toolkit, especially for those focusing on price action strategies.

Using the round numbers above and below indicator MT4 provides several advantages:

- Simplifies analysis: Automatically identifies key levels, saving time compared to manual charting.

- Enhances trade planning: Helps traders set entry, exit, and stop-loss levels around psychological zones.

- Improves strategy precision: Aligns with price action patterns, increasing the accuracy of breakout or reversal trades.

For example, a trader analyzing EUR/USD can use the indicator to spot 1.2000 as a potential resistance level and plan trades accordingly.

Key takeaway: The round numbers above and below indicator MT4 is a user-friendly tool that highlights psychological price levels, streamlining technical analysis and trade planning.

View more:

- Is margin still used when in floating profit? Full guide

- How to read currency exchange charts: Guide for beginners

- How to exclude hline from autofit pricescale on an indicator

3. Practical applications of the round levels tool in forex trading

The Round Levels Indicator for MT4 not only helps identify psychological price levels but also serves as a powerful tool for implementing practical trading strategies. Round price levels, such as 1.2000 or 150.00, often attract traders’ attention, creating opportunities for setting profit targets, identifying entry points, and managing risk through stop-loss orders. Below is a detailed guide on how to apply this indicator in specific trading scenarios, complete with illustrative examples.

3.1. Setting profit targets using round levels

Round levels are commonly used as natural profit-taking targets, especially when analysis identifies potential support or resistance zones. The Round Levels Indicator highlights these levels on the chart, making it easier to pinpoint profit objectives.

Steps to follow:

- Identify support or resistance zones: Leverage the Round Levels Indicator to identify psychological price points, like 1.2000 on the EUR/USD currency pair. Observe price action signals, such as long candlestick shadows, indicating a shift from selling to buying pressure or vice versa.

- Set profit target: Choose the closest round level as the target for taking profits. For example, if the price bounces from a support zone at 1.1950, the 1.2000 level could be a reasonable target.

- Evaluate risk-to-reward ratio: Before entering a trade, ensure the profit target aligns with a favorable risk-to-reward ratio (e.g., 1:2 or 1:3) based on the distance from the entry point to the stop-loss level.

Illustrative example: On the EUR/USD chart, if the price hits a support zone at 1.1950 with long candlestick shadows indicating buying pressure, you might open a buy trade and set a take-profit target at 1.2000. The Round Levels Indicator will display a clear horizontal line at 1.2000, helping you visualize this target.

3.2. Identifying entry points using round levels

Round levels often align with support or resistance zones, making them ideal entry points when combined with other technical signals, such as trend breakouts or candlestick patterns.

Steps to follow:

- Spot psychological price points: Utilize the Round Levels Tool to detect levels such as 1.3000 on the GBP/USD currency pair.

- Confirm entry signals: Look for additional signals, such as a downtrend breakout or a bullish candlestick pattern, indicating a shift in market sentiment from selling to buying.

- Enter the trade: Open a trade when the price retests the round level, especially if it previously acted as support or resistance.

Illustrative example: On the GBP/USD pair, if the price breaks a downtrend and reclaims the 1.3000 level (previously a resistance), the Round Levels Indicator will mark this level with a horizontal line. A breakout accompanied by a strong bullish candle signals a buy trade. The indicator’s visualization of the 1.3000 level helps you confirm the entry point accurately.

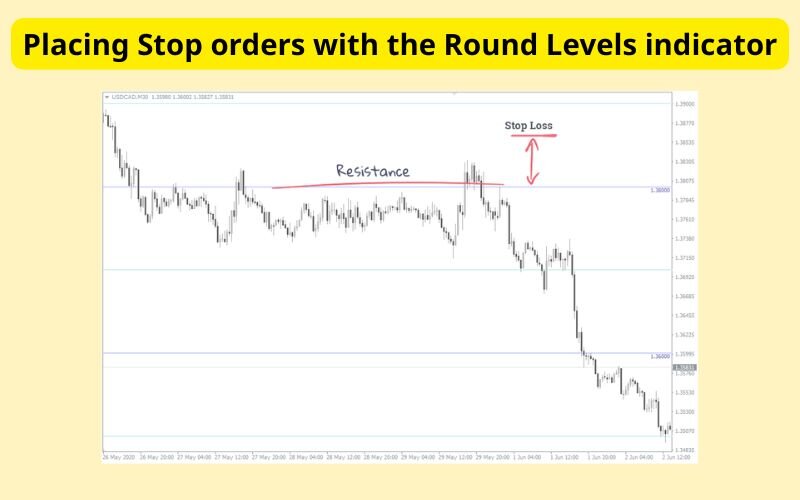

3.3. Placing stop-loss orders with the round levels indicator

Proper stop-loss placement is critical for risk management. However, placing a stop-loss directly at a round level can make you vulnerable to “stop hunting” by institutional traders or algorithms.

Steps to follow:

- Avoid placing stops at round levels: Psychological levels like 1.3800 on GBP/USD often attract clusters of stop-loss orders, making them prone to manipulation.

- Position stop-losses beyond psychological thresholds: Set stop-loss orders 10–20 pips from the round level to steer clear of small price swings or deceptive breakouts. For instance, if you initiate a buy trade around 1.3800, place the stop-loss at 1.3780 or below.

- Combine with other signals: Use tools like RSI or Bollinger Bands to confirm the safety of the stop-loss zone.

Illustrative example: On the GBP/USD chart, if you open a sell trade at 1.3800 (a resistance level), instead of placing the stop-loss directly at 1.3800, set it at 1.3820 to protect against sudden price spikes. The Round Levels Indicator will display a horizontal line at 1.3800, helping you determine a safe distance for the stop-loss.

Important note: For maximum effectiveness, always combine the Round Levels Indicator with other technical signals, such as moving averages, Fibonacci retracement levels, or candlestick patterns, to enhance the reliability of your trading setups. The strongest round levels are those supported by a combination of various technical indicators.

3.4. Universal applicability in forex trading

Round levels are used across all timeframes and currency pairs from scalpers to institutional traders. Their universal recognition makes them a reliable reference point for market structure, especially when paired with tools like Fibonacci retracement or moving averages.

A final word of caution: Never treat a round number as an infallible signal on its own. A level's true strength is only revealed through confluence when it aligns with other factors like a trendline, a moving average, or a key Fibonacci level. Trading these levels in isolation is a common and costly trap for novice traders.

4. How to install and set up the round numbers indicator on MT4

The round numbers above and below indicator MT4 is a straightforward tool that can be easily installed and customized to enhance your forex trading experience. By plotting psychological price levels on your MetaTrader 4 platform, it helps traders identify key support and resistance zones with minimal effort.

This section provides a step-by-step guide to downloading, installing, and configuring the indicator, ensuring you can start using it effectively in your trading strategy.

4.1. Finding a reliable source for the indicator

To begin, you’ll need to download the round numbers indicator from a trusted source. The Forex Station thread highlights a popular version called the “Round Numbers Grid,” available for free download.

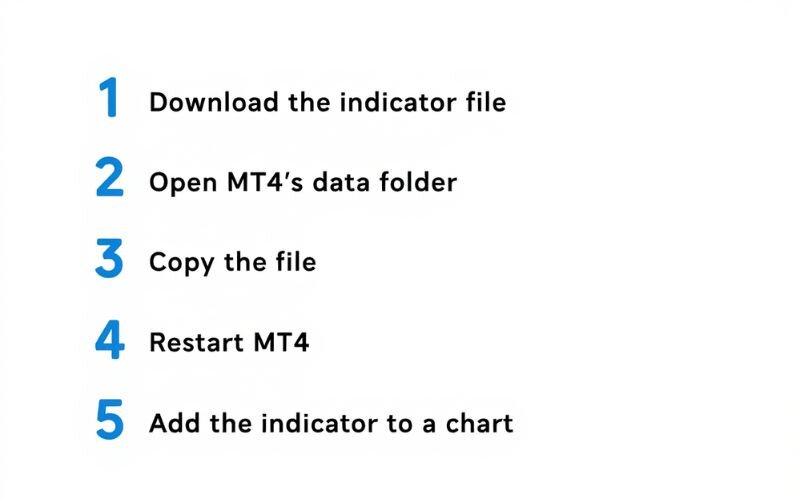

4.2. Step-by-step installation process

Follow these steps to install the round numbers above and below indicator on MT4:

- Download the indicator file: Obtain the .mq4 or .ex4 file from a reputable source.

- Open MT4’s data folder: Launch MetaTrader 4, go to “File” > “Open Data Folder” in the platform’s menu.

- Copy the file: Navigate to the “MQL4” folder, then the “Indicators” subfolder. Paste the downloaded indicator file here.

- Restart MT4: Close and reopen MetaTrader 4 to refresh the indicator list.

- Add the indicator to a chart: Open a chart (e.g., EUR/USD), go to “Navigator” > “Indicators,” and drag the round numbers indicator onto the chart.

4.3. Configuring the indicator settings

Once installed, customize the indicator to suit your trading needs:

- Set pip intervals: Adjust the spacing between round number lines (e.g., 50 pips or 100 pips) to match your timeframe or strategy.

- Customize visuals: Change line colors or styles (e.g., solid or dashed) for better chart visibility.

- Apply to specific timeframes: Test the indicator on different timeframes (M15, H1, D1) to find the best fit for your trading style.

4.4. Troubleshooting common issues

If the indicator doesn’t appear on your chart, try these fixes:

- Ensure the file is in the correct “Indicators” folder.

- Check that the indicator is enabled in the chart settings.

- Verify compatibility with your MT4 version, as older indicators may require updates.

For a visual guide, see the screenshot below showing the indicator applied to a chart.

5. Using the round numbers indicator in forex trading strategies

Simply identifying round numbers is one thing; knowing how to build a strategy around them is what truly matters. This indicator becomes especially valuable when integrated into a trading plan. Because these psychological levels are natural focal points for order flow, they are ideal for developing breakout, reversal, and even scalping strategies.

This section explores how to leverage the indicator in breakout, reversal, and scalping strategies, drawing on insights from trading communities and technical analysis principles to help you make informed trading decisions.

5.1. Breakout strategy with round numbers indicator MT4

Breakout trading involves entering a position when the price moves decisively through a key level, such as a round number. The round numbers above and below indicator MT4 simplifies this by clearly marking levels like 1.2000 or 150.00, where breakouts are likely due to accumulated orders.

For example, on USD/JPY, if the price approaches 150.00 and shows strong momentum (confirmed by high volume or a candlestick pattern like a bullish engulfing), you can enter a buy trade expecting a breakout. To strengthen your strategy, combine the indicator with volume-based tools.

Steps for breakout trading:

- Identify a round number level (e.g., 1.1000 on EUR/USD) using the indicator.

- Wait for confirmation of a breakout (e.g., a strong candle closing above the level).

- Enter the trade with a stop loss below the round number to protect against false breakouts.

5.2. Reversal strategy with round numbers indicator MT4

Round numbers often act as psychological barriers where prices may reverse due to selling or buying pressure. The indicator helps pinpoint these levels for reversal trades.

For instance, if GBP/USD approaches 1.3000 and shows signs of rejection (e.g., a pin bar or overbought RSI), you can enter a sell trade anticipating a reversal. Combining the indicator with RSI or candlestick patterns, increases the reliability of these setups.

Steps for reversal trading:

- Use the indicator to locate a round number (e.g., 1.2500).

- Look for reversal signals like doji candles or RSI divergence.

- Place a stop loss above the round number to manage risk.

5.3. Scalping around round numbers

Scalping involves quick, short-term trades, and round numbers are ideal for this approach due to frequent price reactions at these levels.

The Forex Station thread highlights the indicator’s effectiveness in scalping by marking levels where price often hesitates. For example, on a 5-minute EUR/USD chart, you might scalp around 1.1050, buying slightly below and selling slightly above as the price oscillates.

6. Combining the round numbers indicator with other MT4 tools

The round numbers above and below indicator MT4 is a powerful tool for identifying psychological price levels, but its effectiveness can be significantly enhanced when paired with other MetaTrader 4 tools.

By combining it with complementary indicators, traders can confirm signals, improve trade accuracy, and develop robust strategies. This section explores how to integrate the indicator with popular MT4 tools, drawing on insights from trading communities and technical analysis principles to optimize your forex trading approach.

6.1. Enhancing analysis with moving averages

Moving averages (MAs) help identify the overall trend direction, making them an excellent complement to the round numbers indicator. For example, if the price approaches a round number like 1.2000 on EUR/USD and aligns with a 50-period exponential moving average (EMA), it strengthens the level’s significance as support or resistance.

Casombining trend indicators with round numbers ensures you trade in the direction of the market’s momentum, reducing false signals.

How to combine: Use a 20-period or 50-period EMA to confirm whether a round number level is likely to hold or break. For instance, a price bouncing off 1.2500 with the EMA sloping upward suggests a strong support level for a buy trade.

6.2. Aligning with Fibonacci retracement

Fibonacci retracement levels often coincide with round numbers, creating high-probability trade setups.

For example, if GBP/USD retraces to 1.3000 and this level aligns with the 61.8% Fibonacci retracement, it indicates a potential reversal zone. The round numbers indicator makes it easy to spot these overlaps on your MT4 chart.

How to combine: Apply the Fibonacci tool to a recent price swing and check for confluence with round numbers marked by the indicator. Enter trades when price action confirms the setup (e.g., a bullish pin bar at the level).

6.3. Using the accumulation/distribution line

The accumulation/distribution (A/D) line, measures buying and selling pressure, making it a valuable tool for confirming round number levels. When the A/D line shows strong buying pressure near a round number like 150.00 on USD/JPY, it suggests the level may act as support. Conversely, declining A/D values near a round number indicate potential resistance.

How to combine: Monitor the A/D line’s trend as the price approaches a round number. A rising A/D line near a support level signals a potential buying opportunity.

6.4. Pairing with Bollinger Bands for volatility

Bollinger Bands help identify volatility and potential breakout or reversal zones, complementing the round numbers indicator.

For scalping or breakout trades, a price touching a round number while also hitting the upper or lower Bollinger Band can signal overextension or a breakout opportunity. This combination is particularly effective for short-term traders.

How to combine: Use Bollinger Bands to gauge volatility at a round number. For example, if EUR/USD tests 1.1000 and the price touches the lower Bollinger Band with a bullish candle, it may indicate a reversal.

7. Risk management when trading round numbers

Using the round numbers above and below indicator MT4 to identify key price levels can significantly enhance your forex trading strategy, but success depends on effective risk management. Round numbers, while powerful, are not infallible, and market volatility or sentiment can lead to unexpected price movements.

This section outlines practical risk management techniques to protect your capital when trading around psychological levels, ensuring disciplined and sustainable trading.

7.1. Setting stop loss and take profit levels

Round numbers often act as magnets for price action, but false breakouts or reversals can occur. To mitigate risks, place stop-loss orders strategically around round number levels.

For example, in a buy trade near 1.2000 on EUR/USD, set a stop loss slightly below (e.g., 1.1980) to account for potential false breakdowns. Similarly, use round numbers to set take-profit levels, targeting the next psychological level (e.g., 1.2100) for a breakout trade.

Tips for stop loss and take profit:

- Place stops 10–20 pips beyond the round number to avoid being triggered by minor fluctuations.

- Use trailing stops to lock in profits as the price moves toward the next round number.

7.2. Position sizing for round number trades

Proper position sizing is critical when trading with the round numbers indicator. Since psychological levels can attract high volatility, avoid risking more than 1–2% of your account per trade. Calculate your position size based on the distance between your entry and stop loss.

For instance, if your stop loss is 20 pips away from a round number like 150.00 on USD/JPY, adjust your lot size to align with your risk tolerance.

Position sizing example:

- Account balance: $10,000

- Risk per trade: 1% ($100)

- Stop loss: 20 pips

- Pip value: Adjust lot size to ensure a 20-pip loss equals $100.

7.3. Avoiding overtrading at psychological levels

The clarity of the round numbers above and below indicator MT4 can tempt traders to take excessive trades, especially during volatile market conditions.

To maintain discipline, limit the number of trades per session and only act on high-probability setups confirmed by additional indicators, such as RSI or moving averages. Overtrading increases exposure to losses, particularly when market sentiment overrides round number levels.

8. Advantages and limitations of the round numbers indicator MT4

The round numbers above and below indicator MT4 is a valuable tool for forex traders, offering a simple way to identify psychological price levels that influence market behavior. However, like any trading tool, it has its strengths and weaknesses.

This section provides a balanced overview of the indicator’s benefits and limitations, helping you understand when and how to use it effectively in your trading strategy.

8.1. Advantages

The round numbers indicator offers several benefits that make it a popular choice among MT4 users:

- Simplifies technical analysis: By automatically plotting round number levels (e.g., 1.1000, 150.00), the indicator saves time and reduces the need for manual charting, making it ideal for traders of all levels.

- Customizable and versatile: Traders can adjust pip intervals and line styles to suit their strategies. It works across all currency pairs and timeframes, from M1 to D1.

- Free and accessible: The indicator is available for free download from trusted sources like Forex Station, ensuring accessibility for traders without additional costs.

- Enhances trade planning: It helps identify key support and resistance zones, enabling precise entry and exit points for breakout or reversal trades.

These advantages make the indicator a go-to tool for traders seeking to capitalize on psychological levels in forex trading.

8.2. Limitations

Despite its strengths, the round numbers above and below indicator MT4 has limitations that traders should consider:

- Not foolproof: Round numbers are psychological levels, but market sentiment or unexpected events can override their significance, leading to false signals.

- Requires confluence: The indicator should not be used in isolation. A round number level gains significant predictive power only when it aligns with other technical signals a concept known as "confluence." Therefore, always seek confirmation from other tools like RSI, Fibonacci levels, or candlestick patterns before committing to a trade, as relying solely on psychological levels is an incomplete strategy.

- Less effective in low-liquidity markets: During periods of low trading volume, round number levels may not attract sufficient order flow, reducing their reliability.

| Aspect | Advantages | Limitations |

|---|---|---|

| Ease of use | Automatically plots round numbers, saving time | Requires confirmation from other indicators |

| Customization | Adjustable pip intervals and visuals | May produce false signals in volatile markets |

| Applicability | Works on all pairs and timeframes | Less reliable in low-liquidity conditions |

| Cost | Free to download and use | Dependent on reliable sources for safe files |

9. Frequently asked questions (FAQs)

The round numbers above and below indicator MT4 is a popular tool among forex traders, but it often raises questions about its functionality, setup, and application. This section addresses common queries to help you understand how to use the indicator effectively in your trading strategy.

9.1. What is the round numbers above and below indicator MT4?

The round numbers above and below indicator MT4 is a free tool that automatically plots horizontal lines at psychological price levels, such as 1.0000 or 150.00, on MetaTrader 4 charts.

These levels, often called round numbers, act as key support and resistance zones due to trader psychology and order clustering. The indicator simplifies identifying these levels, helping traders plan entries and exits.

9.2. How do I download the round numbers indicator for MT4 for free?

You can download the round numbers indicator for free from trusted sources like Forex Station, where the “Round Numbers Grid” is shared.

Ensure you download from reputable platforms to avoid malware.

9.3. Can the indicator be used for scalping or day trading?

Yes, the round numbers above and below indicator MT4 is suitable for both scalping and day trading. Its ability to highlight psychological levels makes it ideal for short-term trades. Scalpers can use it to target quick price movements around levels like 1.1050, while day traders can combine it with indicators like RSI for intraday setups.

9.4. How do round numbers differ from other support/resistance levels?

Round numbers, such as 1.2000 or 150.00, are psychological levels driven by trader behavior and order clustering.

Unlike other support/resistance levels (e.g., Fibonacci or pivot points), round numbers are inherently simple and widely recognized, making them more prone to price reactions. However, they should be confirmed with other tools for accuracy.

9.5. Does the indicator work on MT5 or other platforms?

The round numbers above and below indicator is designed specifically for MT4. While similar indicators exist for MT5 or platforms like TradingView, you may need to source platform-specific versions.

Read more:

- Forex currency trading hours: What time does the forex market open?

- The difference: What is ask price vs bid price?

- Best support and resistance indicators for smarter trading

10. Conclusion

The round numbers above and below indicator MT4 is a must-have tool for forex traders seeking to harness the power of psychological price levels. By simplifying the identification of support and resistance zones, it enables precise trade planning, whether you’re chasing breakouts, spotting reversals, or scalping quick profits.

Want to dive deeper? Explore H2T Finance's Forex Basics section on our blog for foundational guides.