Explore the fast-paced realm of Forex trading, where selecting the right account can significantly shape your path to financial success. Raw spreads vs no commission two powerful options, each with unique strengths, ignite curiosity among traders.

Will the ultra-tight margins of raw spreads propel your high-speed strategies, or will the straightforward simplicity of no commission accounts pave the way for your success? Let’s uncover the differences and guide you to the account that perfectly fuels your trading ambitions!

Key takeaways:

- Raw spread accounts: Offer ultra-tight spreads (as low as 0.0 pips) with a fixed commission per trade, ideal for high-frequency traders and scalpers who prioritize precision and transparency.

- No commission accounts: Feature wider spreads (typically 1.0–1.5 pips) with no separate commission, making them beginner-friendly and simpler for swing or long-term traders.

- Cost structure: Raw spread accounts may be more cost-efficient for frequent trades due to lower spreads, while no commission accounts embed costs in wider spreads, which can be less transparent.

- Execution and transparency: Raw spread accounts use ECN/STP models for direct market access and better pricing transparency, while standard accounts may involve broker markups.

- Trading style fit: Scalpers benefit from raw spreads’ tight pricing and fast execution; swing traders and beginners may prefer no commission accounts for simplicity and lower entry barriers.

- Platform impact: MT4, MT5, and TradingView support different trading needs, with MT4/MT5 better for automation and TradingView excelling in charting, but costs depend on the broker’s account type.

- Risk management: Tighter spreads in raw accounts allow for precise stop-loss/take-profit settings, while wider spreads in standard accounts may require adjusted position sizing to manage risk.

- Choosing the right account: The best account depends on your trading frequency, strategy, experience, and budget test both types to find the best fit for your goals.

1. How do commission-free and raw spread accounts differ?

When choosing a forex trading account, one of the first decisions traders must make is whether to go with a raw spread account or a no commission (also called “standard”) account. Each account type comes with its own fee structure, execution style, and ideal use case, making the choice highly dependent on your trading strategy and priorities.

In this section, we’ll explore what these two account types mean, how they operate, and why understanding the difference is essential for managing trading costs effectively.

1.1. What are raw spread accounts?

Raw spread accounts also known as ECN or RAW ECN accounts feature ultra-tight spreads that can begin at 0.0 pips. Brokers apply a fixed commission fee per trade usually based on the number of lots rather than widening the spread. This type of account gives traders direct access to interbank pricing, ensuring transparent and market-driven quotes.

Key characteristics:

- During peak trading sessions, spreads can narrow down to as little as 0.0 pips

- A commission fee is charged (e.g., $3.5 per side per lot)

- Typically used by advanced or high-frequency traders

- Often integrated with ECN or STP execution models

Raw accounts are ideal for traders who prioritize precision, tighter spreads, and transparency, especially during volatile market conditions.

1.2. What are no commission (standard) accounts?

Standard accounts, also known as no-commission accounts, don't apply a separate commission charge. Rather than charging a separate commission, the broker includes their fee within the spread the gap between the bid and ask prices which is typically wider.

Key characteristics:

- No separate commission fee

- Spreads tend to be broader, typically beginning at around 1.0 to 1.5 pips

- More beginner-friendly and easier to understand

- Typically suited for lower-frequency trading strategies

These accounts are popular among new traders who prefer a simplified cost structure without worrying about calculating commission fees on every trade.

2. Main distinctions between raw spread and commission-free accounts

While both account types are designed to accommodate different trading styles, the cost mechanics, accessibility, and transparency can vary significantly. Understanding these differences is crucial when choosing between raw spreads or no commissions, especially if you’re aiming to optimize your trading strategy.

Let’s break down the key aspects that set these two account types apart.

2.1. Spread size comparison

One of the most noticeable distinctions lies in the spread itself. Raw spread accounts offer minimal spreads, sometimes close to zero, while standard accounts compensate for the lack of commissions with wider spreads.

| Feature | Raw Spread Account | No Commission (Standard) Account |

|---|---|---|

| Average Spread (EUR/USD) | 0.0 – 0.3 pips | 1.0 – 1.5 pips |

| Spread Volatility | Lower during peak hours | More stable across sessions |

| Best For | Scalpers, intraday traders | Beginners, swing traders |

Note: A tighter spread means better pricing, especially for short-term strategies like scalping.

2.2. Cost structure

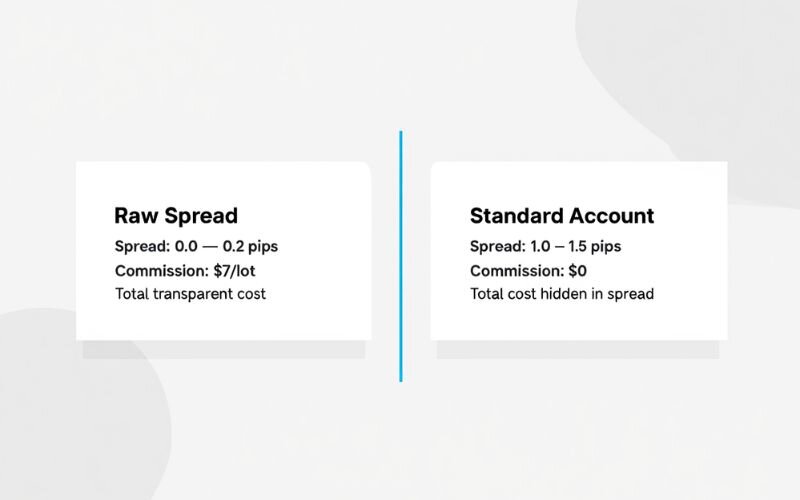

With raw spread accounts, traders pay a fixed commission per trade, while standard accounts embed the broker’s fee directly into the spread.

- Raw spreads: Lower spread + fixed commission per lot (e.g., $7 round trip per lot)

- No commission: No extra fee, but cost is hidden in wider spreads

Raw spread accounts may offer better long-term cost efficiency for traders who execute frequent or high-volume trades.

2.3. Transparency and execution

Raw accounts often use ECN or STP execution, connecting traders directly to liquidity providers. This improves pricing transparency and reduces potential conflicts of interest.

- Raw spreads: Market pricing, minimal broker intervention

- Standard accounts: Broker sets the spread, potential for markup

For those who value execution speed and transparency, raw accounts offer a clear advantage.

2.4. Minimum deposit and accessibility

Depending on the broker, raw spread accounts often come with higher minimum deposit requirements, whereas standard accounts are generally more beginner-friendly and accessible.

- Raw spreads: Typically $200–$500 minimum

- Standard accounts: Can start as low as $10–$100

This setup makes commission-free accounts more suitable for beginners, particularly those starting with a limited budget.

2.5. Skill level and learning curve

Because of their complexity and direct market access, raw spread accounts are better suited for experienced traders. In contrast, standard accounts offer simplicity that aligns well with novice traders who are still learning the ropes.

- Raw spreads: Steeper learning curve, ideal for those with trading experience

- Standard accounts: Easier to manage, great for demo-to-live transitions

View more: Topstep trades closed by what time

2.6. Leverage in raw spread accounts vs. standard accounts

Leverage allows traders to control larger positions with less capital, but the available leverage may vary between raw spread accounts and standard accounts, depending on the broker.

Raw spread accounts: Typically offer high leverage, for example, up to 1:500 or higher (depending on regulations and the broker). This is suitable for high-frequency traders, such as scalpers, as it optimizes capital with low transaction costs. However, high leverage comes with greater risk, requiring strict risk management.

Commission-free accounts: Also offer high leverage, sometimes up to 1:1000 or even unlimited with certain brokers, making them particularly suitable for beginners trading with small capital. However, wider spreads can increase trading costs, affecting the effectiveness of leverage.

Benefits of high leverage:

- Increases profit potential by allowing larger positions.

- Enables efficient capital use, allowing more positions to be traded.

Risks of high leverage:

- Heightens the potential for substantial losses, particularly in unpredictable markets.

- Requires strict risk management, such as using stop-loss orders and determining appropriate position sizes.

Traders should choose a leverage level that matches their experience and strategy while considering spread costs when using leverage on each account type.

3. Which account type matches your trading strategy?

Choosing between raw spreads vs no commission accounts isn't just about cost it’s about how well the account type fits your trading strategy. Different strategies have different needs when it comes to spread size, execution speed, and total trading costs. Let’s look at how raw spread and standard accounts align with various trading styles.

3.1. Scalping & high-frequency trading

Scalping is a fast-paced trading strategy that involves entering and exiting trades within seconds or minutes to capitalize on small price changes. For this reason, scalpers require the tightest possible spreads and fast execution.

Raw spread accounts are ideal for scalpers because:

- Spreads are near zero, reducing cost per trade

- Faster execution through ECN/STP models

- Lower slippage during volatile sessions

If you're trading dozens or hundreds of times per day, the cost savings from raw spreads will quickly outweigh any commission fees.

3.2. Trend trading, swing trading

Swing traders and trend followers hold positions for longer usually from several hours to a few days or weeks. This reduces sensitivity to small spread differences and puts more emphasis on market conditions and timing.

Standard (no commission) accounts work well here because:

- Wider spreads don’t significantly impact longer-term trades

- No added commission simplifies cost calculation

- Slower-paced trading makes precision spreads less critical

However, experienced swing traders may still prefer raw spreads for tighter entry and exit points.

3.3. Beginners learning to trade

If you're just starting out in Forex, ease of use and simplicity matter more than execution speed or spread precision. That's where no commission accounts shine.

Benefits for beginners include:

- No separate commission fees to track

- Predictable trading costs

- Often paired with low minimum deposit requirements

New traders can focus on strategy and discipline without worrying about spread micro-optimizations.

4. How trading platforms affect your experience

Beyond choosing between raw spreads vs no commission, the platform you trade on plays a major role in execution, analysis, and overall performance. Different platforms offer unique features, pricing structures, and compatibility with account types. Let’s explore how MT4, MT5, and TradingView stack up and how each one influences your cost depending on account type.

4.1. MT4 vs MT5 vs TradingView – platform overview

Choosing the right platform depends on your trading needs and personal preferences. Here’s how the most popular platforms compare:

| Feature | MetaTrader 4 (MT4) | MetaTrader 5 (MT5) | TradingView |

|---|---|---|---|

| Release Year | 2005 | 2010 | 2011 |

| Charting Tools | Basic | Advanced | Highly advanced |

| Strategy Tester | Single-threaded | Multi-threaded + faster | No native backtesting (requires add-ons) |

| Asset Classes | Mostly Forex | Forex, stocks, futures, crypto | Multi-asset (view only, not execution) |

| Execution | Broker-dependent (fast) | Broker-dependent (fast) | No execution; used via broker plugin |

| Custom Indicators/EA | Supported (MQL4) | Supported (MQL5) | Limited (Pine Script) |

| Mobile App | Yes | Yes | Yes |

If you rely heavily on automated strategies or expert advisors (EAs), MT4 and MT5 are best. For visual traders or analysts, TradingView offers unmatched charting tools.

4.2. Platform-specific commissions

While trading platforms themselves don’t charge spreads or commissions, your broker’s pricing model interacts differently with each platform:

- MT4/MT5 + Raw Spreads: Brokers often add fixed commissions (e.g., $3.5 per side) directly in your account. This is common in ECN-style raw accounts.

- MT4/MT5 + Standard Accounts: Brokers widen the spread instead of charging commission more straightforward but potentially costlier over time.

- TradingView: Executes trades via connected brokers (e.g., via cTrader, OANDA, etc.). The commission/spread structure depends on the broker you integrate, not TradingView itself.

Always confirm how your broker structures pricing on each platform, as not all platforms support both account types equally.

5. Brokers offering both raw spread and commission-free accounts

Numerous trusted brokers offer both raw spread and commission-free (standard) accounts, allowing traders to select the account type that best suits their trading preferences. Here's a look at some prominent brokers that offer these two account types, along with details on their cost structures and platforms.

5.1. Pepperstone

Pepperstone, a well-known global broker, provides a Standard account featuring spreads from 1.0 pips without any commission charges. Its Razor account, a raw spread option, has spreads as low as 0.0 pips but includes a fixed commission, such as $3.50 per lot per side on MT4/MT5.

The broker supports popular platforms like MT4, MT5, cTrader, and TradingView, and is regulated by top-tier authorities including ASIC, FCA, and CySEC.

5.2. Exness

Exness is a favored broker, offering a Standard account with spreads starting at 0.2 pips and no commission fees. The Raw Spread account offers spreads starting from 0.0 pips, with commissions of up to $3.50 per lot for each side of a trade.

The Standard account requires a minimum deposit of only $10, while the Raw Spread account demands at least $200. Traders can access various assets through platforms like MT4, MT5, the Exness Terminal, and the Exness Trader app. The broker operates under the supervision of regulators including the FCA, CySEC, and FSCA.

5.3. FP Markets

FP Markets provides a Standard account with spreads starting at 1.0 pips and no commission, alongside a Raw Spread account featuring spreads from 0.0 pips and a $3 commission per lot per side. Each account type has a minimum deposit requirement of $100.

Renowned for its diverse offerings, FP Markets allows trading on over 10,000 CFDs through platforms like MT4, MT5, cTrader, and TradingView. The broker is regulated by ASIC, CySEC, and FSCA.

5.4. Forex.com

Forex.com caters to traders in the U.S. and globally, offering Standard and Raw Spread accounts. The Standard account features spreads starting at 0.8 pips with no commission, while the Raw Spread account provides spreads from 0.0 pips, with commissions of $7 per $100,000 traded for U.S. clients and $5 for international clients.

Each account type has a minimum deposit requirement of $100. International clients can access a wide variety of CFDs, whereas U.S. clients are restricted to forex, futures, and futures options. Trading is supported on platforms such as MT4, MT5, Forex.com Trader, and TradingView. The broker is licensed and monitored by regulatory bodies such as the CFTC, NFA, ASIC, CySEC, and FCA.

5.5. Tickmill

Tickmill provides a Standard account with spreads starting at 1.6 pips and no commission. Additionally, it offers two raw spread options - Raw and Tickmill Trader Raw with spreads from 0.0 pips and commissions of $3 and $3.50 per lot per side, respectively.

All account types have a minimum deposit requirement of $100, with trading available on MT4, MT5, or Tickmill’s mobile app. The broker is regulated by authorities such as the FCA, CySEC, ASIC, and the FSA.

6. Risk management differences between account types

Effective risk management is essential for every trader, regardless of whether you use raw spreads or no commission accounts. The type of account you choose can impact how you set stop-loss orders, manage position sizes, and ultimately control your trading risk. Let’s dive into the key risk management considerations linked to each account type.

6.1. How spread affects stop-loss and take-profit

Spreads directly influence the price levels where your stop-loss (SL) and take-profit (TP) orders execute:

- Raw spread accounts usually provide extremely narrow spreads, often mirroring interbank pricing. This precision allows traders to place SL and TP closer to their entry price, improving risk-to-reward ratios.

- No commission accounts have wider spreads built into the price. This means your SL or TP orders may trigger earlier or later than intended due to spread volatility, especially during volatile market conditions.

Understanding this difference is crucial because a wider spread can cause “stop hunting” where your stop-loss is hit prematurely, impacting your trade outcomes.

6.2. Position sizing implications

Position sizing is closely tied to your risk tolerance and account type:

- On raw spread accounts, because spreads are smaller, traders can use tighter SL orders, which may allow slightly larger position sizes while controlling risk.

- On no commission accounts, the wider spreads mean you might need to increase SL distances, effectively reducing the maximum position size to maintain the same risk percentage.

This subtle difference means your capital management strategy should adjust according to the spread environment of your account.

7. FAQs about raw spreads vs no commission

7.1. How do raw spread accounts differ from commission-free accounts?

Raw spread accounts offer ultra-low spreads often close to 0.0 pips but charge a separate commission per trade. No commission accounts, on the other hand, include the broker’s fee within the spread, resulting in slightly wider spreads but no extra commission.

7.2. Are raw spread accounts better for scalping?

Yes. Raw spreads are ideal for scalpers and high-frequency traders who rely on tight spreads and fast execution. Just keep in mind the added commission fees.

7.3. Do no commission accounts have hidden fees?

Generally, no. However, since the cost is embedded in the spread, it's less transparent compared to raw spreads. It’s still crucial to read the broker’s terms carefully.

7.4. Which is more beginner-friendly: raw spreads or no commissions?

No commission accounts are typically better for beginners. They offer simplicity in pricing and are easier to understand without needing to calculate external commission fees.

7.5. Can I switch between raw spread and no commission accounts?

Yes, many brokers allow you to open both types or switch between them. This flexibility helps you test and find what suits your strategy best.

7.6. Are there any trusted brokers that offer both?

Absolutely. Many top-tier brokers like IC Markets, Pepperstone, and FP Markets offer both raw spread and no commission options, allowing traders to choose what works best.

7.7. Raw spreads vs. no-commission accounts: Which one is more suitable?

Neither is inherently better; it depends on your trading style and goals. Raw spread accounts are ideal for high-frequency traders, scalpers, or those who prioritize tight spreads and transparency, despite the commission fees

No commission accounts suit beginners, swing traders, or those who prefer simpler cost structures with no separate fees, even if spreads are wider. Consider your trading frequency, strategy, and budget when choosing.

Read more:

- Maximize Your Trades: 5 Must-Have Tools for Forex Market Hour Conversion

- What Is Leverage In Forex? How To Use Leverage In Forex Safely

8. Final thoughts – raw spreads or no commissions?

Choosing between raw spreads vs no commission accounts depends on your trading style and experience. Raw spreads usually offer very tight pricing but charge a commission per trade. No commission accounts include all fees in the spread, making costs simpler to understand.

At H2T Finance, we aim to help traders find the best fit for their needs. Our Forex Basics section provides clear, reliable information about trading accounts, strategies, and tools. This helps you make smart decisions based on facts, not assumptions.

Remember, whether you pick raw spreads or no commissions, your success also depends on your trading strategy and risk management. Using trusted platforms and gaining knowledge are key to trading well.

Explore the blog of H2T Finance and expert guides for more insights on trading platforms, strategies, and managing risk. Understanding your options is the first step toward becoming a confident trader.