Choosing a legal forex trading app in India can be overwhelming, especially with the maze of RBI and SEBI regulations. With so many platforms available, how can you tell which ones are genuinely compliant and which may expose you to unnecessary risks?

This guide will walk you through the top 10+ legal forex trading app in India, along with practical insights to help you avoid regulatory pitfalls and make confident investment decisions. Let’s break down what truly matters: legality, transparency, and security, with H2T Finance.

Key takeaway:

- Regulatory compliance is critical: Forex trading in India must adhere to RBI’s FEMA and SEBI regulations, restricting legal trading to SEBI-registered brokers offering INR-based currency derivatives (USD/INR, EUR/INR, GBP/INR, JPY/INR) on recognized exchanges like NSE, BSE, or MSEI.

- SEBI-registered apps ensure safety: Platforms like Zerodha Kite, Upstox Pro, Angel One, and others listed are SEBI-registered, providing a legal and secure environment for trading currency derivatives, unlike non-SEBI-registered international apps like AvaTrade and Exness, which pose legal risks.

- Key features to evaluate: Choose apps based on user-friendly interfaces, real-time charting tools, fast order execution, robust security (e.g., 2FA, fund segregation), and reliable customer support to align with your trading needs.

- Avoid non-compliant platforms: International apps offering spot forex or CFDs are generally not compliant with FEMA, and using them may lead to penalties under FEMA, including fines up to three times the transaction amount.

- Due diligence is essential: Always verify a broker’s SEBI registration, review fee structures, and ensure transparency in operations before trading. Use demo accounts to practice and prioritize risk management to trade responsibly.

1. Understanding the legal framework for Forex trading in India

Navigating the world of forex trading in India requires a clear understanding of the regulatory landscape. Several key authorities and laws govern foreign exchange transactions, and knowing their roles is crucial for any aspiring trader seeking to operate legally and safely. This section will break down the primary regulatory bodies and the rules they enforce.

1.1. The role of the Reserve Bank of India (RBI) and FEMA

The Reserve Bank of India (RBI) stands as the central banking institution and the primary regulator of foreign exchange in the country. Its authority stems largely from the Foreign Exchange Management Act, 1999 (FEMA), which replaced the earlier, more restrictive Foreign Exchange Regulation Act (FERA).

Under FEMA, the RBI has the overall responsibility for managing India's foreign exchange reserves and overseeing capital account transactions. For retail traders, the FEMA regulations for forex trading in India are particularly pertinent.

FEMA dictates how Indian residents can engage in foreign exchange transactions. A key aspect of these regulations is that remitting funds abroad for speculative forex trading purposes, especially on unauthorised platforms, is generally prohibited.

The Liberalised Remittance Scheme (LRS) allows Indian residents to remit a certain amount of money abroad for permissible current or capital account transactions, but speculative forex trading is usually not covered under this scheme for unauthorised international brokers.

Therefore, any forex trading activity must align with the specific provisions and guidelines issued by the RBI under FEMA. Violations can lead to significant penalties.

1.2. The Securities and Exchange Board of India (SEBI) and its mandate

While the RBI governs the broader aspects of foreign exchange management, the Securities and Exchange Board of India (SEBI) is the regulatory authority for the securities market in India. This includes the regulation of currency derivatives, which are the primary instruments for legal forex trading by retail individuals in India.

SEBI's mandate is to protect the interests of investors in securities and to promote the development of, and to regulate, the securities market. It achieves this by setting rules for stock exchanges, brokers, and other market intermediaries.

For forex trading, SEBI ensures that any trading in currency derivatives occurs on recognised stock exchanges and through SEBI-registered brokers. This framework provides a transparent and regulated environment, helping to safeguard investor funds and maintain market integrity.

2. Forex trading allowed via apps in India: Focus on compliance

To legally trade Forex in India, you must use mobile applications from brokers registered with SEBI, focusing solely on permitted currency derivative products.

2.1. Currency derivatives: The legal path

Retail traders in India can trade currency derivatives through SEBI-approved apps, including:

- Currency futures: Standardized contracts to buy or sell a currency pair (such as USD-INR) at a fixed price on a future date.

- Currency options: Contracts that grant (but do not obligate) the right to buy or sell a currency pair at a predetermined price on or before the expiry date.

These products are primarily based on the Indian Rupee (USD-INR, EUR-INR, GBP-INR, JPY-INR) and are traded on recognized exchanges such as NSE, BSE, or MSEI. Apps from SEBI-registered brokers connect you to these exchanges, allowing order placement and position management.

2.2. Note on international apps

International apps offering spot forex or CFD trading typically do not comply with SEBI and FEMA regulations, and are therefore not permitted for use by Indian residents. To ensure safety and legality, choose apps from SEBI-registered brokers that offer exchange-traded currency derivatives.

3. 10+ Popular SEBI-registered mobile apps for Legal Forex trading in India

This section introduces some mobile applications from SEBI-registered brokers that facilitate legal currency derivatives trading in India. The choice of a specific application depends entirely on your individual needs, preferences, and due diligence process.

IMPORTANT DISCLAIMER: The list below is provided for informational and reference purposes only. It is not a "top" or "best" ranking, not investment advice, and not an endorsement or preferential evaluation by H2T Finance. The order of listing does not imply any ranking.

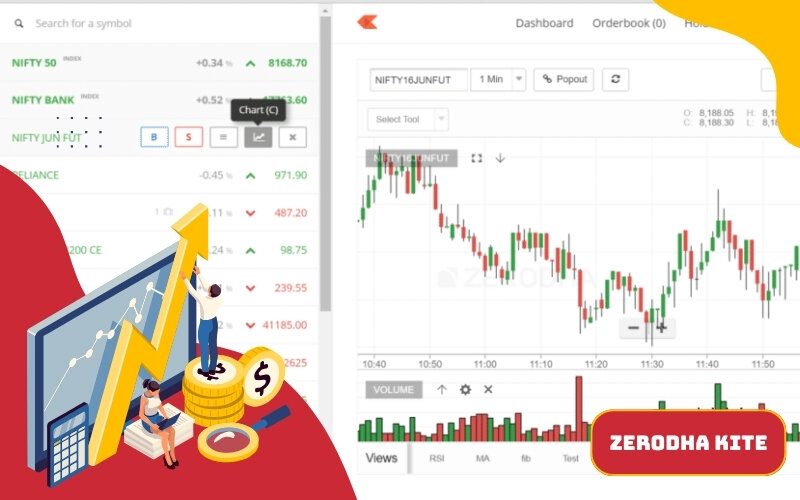

3.1. Zerodha Kite

-

Broker: Zerodha Broking Ltd. (a leading discount broker).

-

App: Kite (its flagship trading platform).

-

Claimed Legality: Zerodha is registered with SEBI. It allows trading in currency derivatives on recognized exchanges.

Kite is widely recognized for its user-friendly interface, advanced charting tools (TradingView charts), and overall speed and stability. It integrates well with Zerodha's ecosystem, including platforms like Console for analytics and Coin for mutual fund investments. Zerodha also provides extensive educational resources through Varsity. Some key features & considerations of Zerodha Kite:

- Account Opening Fee: Typically around INR 200.

- Annual Maintenance Charges (AMC): Generally around INR 300 per annum.

- Brokerage: For currency futures and options, it is often INR 20 or 0.03% per executed order, whichever is lower.

| Pros | Cons |

|---|---|

| User-friendly interface | Limited advanced research tools |

| Advanced TradingView charts | Inactivity fees may apply |

| Extensive educational resources |

It is strongly recommended to visit the official Zerodha website at https://zerodha.com/ and the SEBI website to verify current registration details, services offered, fee structures, and terms and conditions before making any decisions.

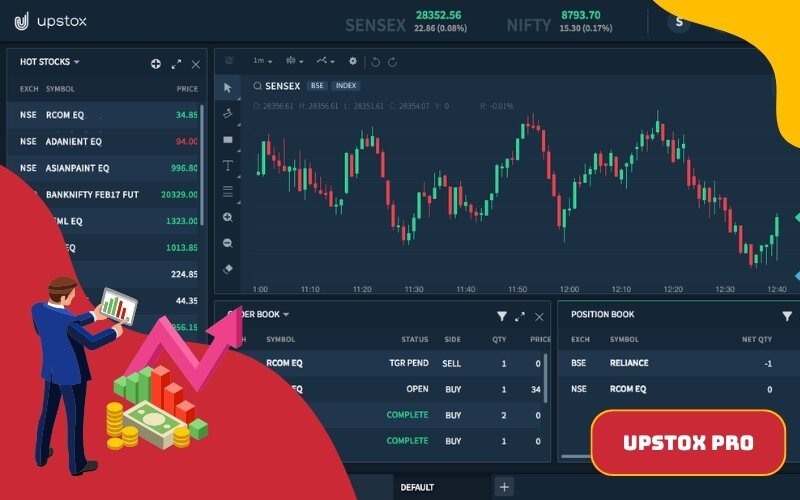

3.2. Upstox Pro

- Broker: RKSV Securities India Pvt. Ltd. (trading as Upstox, a discount broker).

- App: Upstox Pro.

- Claimed Legality: Upstox is registered with SEBI. It supports trading in currency derivatives on recognized exchanges. (Note: It is crucial to verify Upstox's specific SEBI registration details.

Upstox Pro delivers a high-speed trading platform with competitive brokerage fees, positioning itself as a strong competitor in the Indian currency derivatives market. Its comprehensive educational materials and technical analysis tools are valuable assets for both novice and seasoned traders. A notable feature is its customizable trading interface. Some key features & considerations of Upstox Pro:

- Account Opening Fee: Typically INR 249 (subject to change, may have free offers periodically).

- Annual Maintenance Charges (AMC): Generally INR 150 per annum (plus taxes).

- Brokerage: For currency derivatives, often a flat fee of INR 20 per executed order.

| Pros | Cons |

|---|---|

| High-speed platform | Limited research tools |

| Customizable interface | Possible inactivity fees |

| Competitive brokerage |

On the downside, Upstox Pro may have an inactivity fee under certain conditions, and some users might find its research tools more limited compared to full-service brokers, which might not suit traders who rely heavily on detailed market analysis.

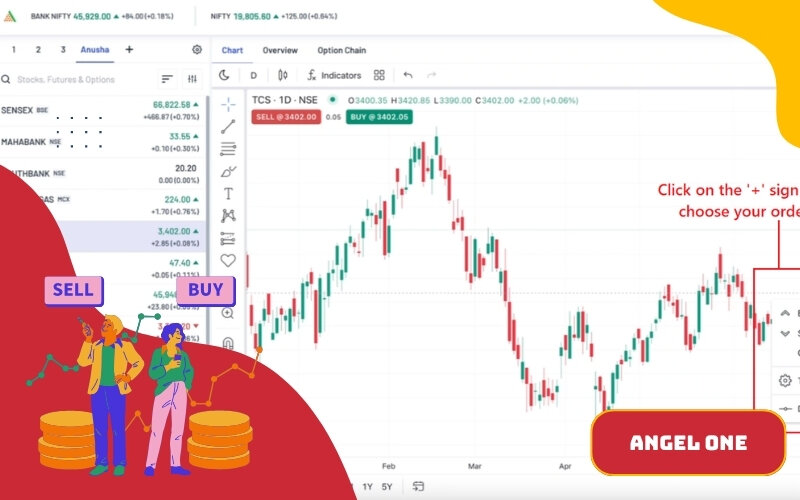

3.3. Angel One (formerly Angel Broking)

- Broker: Angel One Ltd. (a full-service broker that has significantly adopted a discount brokerage model).

- App: Angel One Super App.

- Claimed Legality: Angel One is registered with SEBI. It allows trading in currency derivatives on recognized exchanges.

Angel One is known for its robust advisory services and frequent promotions, such as free account opening offers.

The platform, particularly the Angel One Super App, aims to be user-friendly and offers a range of tools for technical analysis. Its strong customer support and extensive research capabilities are often highlighted. Some key features & considerations of Angel One:

- Account Opening Fee: Often INR 0 (frequently offers free account opening).

- Annual Maintenance Charges (AMC): Typically around INR 240 per annum (for Demat accounts, subject to their specific plan).

- Brokerage: For currency derivatives, often a flat INR 20 per executed order under popular plans.

However, some users have reported occasional app lag during high traffic periods, and the account maintenance charges might be perceived as higher when compared to some pure discount brokers, especially if one doesn't utilize the advisory services.

| Pros | Cons |

|---|---|

| Robust advisory services | Occasional app lag |

| Free account opening offers | Higher AMC vs. discount brokers |

| Strong customer support |

It is strongly recommended to visit the official Angel One website at https://www.angelone.in/ and the SEBI website to verify current registration details, services offered, fee structures, and terms and conditions before making any decisions.

3.4. ICICIdirect Markets App (ICICI Securities)

- Broker: ICICI Securities Ltd. (the brokerage arm of ICICI Bank).

- App: ICICIdirect Markets.

- Claimed Legality: ICICI Securities is registered with SEBI. It offers trading in currency derivatives on recognized exchanges.

ICICIdirect is often favored for its seamless integration with ICICI Bank accounts, which can simplify fund transfers and provide a sense of high security for users.

It is also known for providing comprehensive research reports and investment recommendations, making it an attractive option for traders who prioritize in-depth market analysis and guidance. Some key features & considerations of ICICIdirect:

- Account Opening Fee: Can be around INR 975 (varies based on schemes, sometimes waived or bundled).

- Annual Maintenance Charges (AMC): Typically around INR 700 per annum (for Demat account, can vary).

- Brokerage: For currency derivatives, brokerage can be around 0.05% per trade, though they also offer plans with lower, fixed brokerage (e.g., INR 20 per order under some prepaid plans or Neo plans). It's essential to check their current brokerage structures carefully, as they have multiple plans.

However, the standard brokerage fees can be higher compared to discount brokers, and the account maintenance costs might also be considered expensive by cost-conscious traders, particularly if they do not fully utilize the add-on services like extensive research.

| Pros | Cons |

|---|---|

| Seamless ICICI Bank integration | Higher brokerage fees |

| Comprehensive research reports | Expensive AMC |

| High security |

It is strongly recommended to visit the official ICICIdirect website at https://www.icicidirect.com/ and the SEBI website to verify current registration details, services offered, various fee structures and plans, and terms and conditions before making any decisions.

Understood, I will omit that specific note about verifying SEBI registration details in the "Claimed Legality" part for the subsequent sections, as the general disclaimer at the end of each H3 already advises readers to check official sources.

Here's the content for subsection 3.5, HDFC Securities App.

See more related articles:

- Does Blusky allow scalping? Explore the trading methods available at Blusky for investors

- 10 Best Forex Brokers US For Safe Online Market Trading 2025

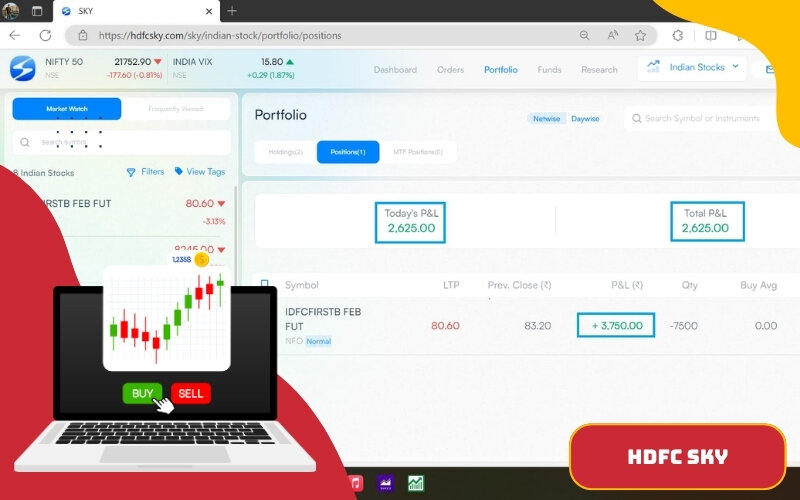

3.5. HDFC Sky / HDFC Securities App

- Broker: HDFC Securities Ltd. (the brokerage arm of HDFC Bank).

- App: HDFC Sky (newer platform) or the traditional HDFC Securities app.

- Claimed Legality: HDFC Securities is registered with SEBI. It facilitates trading in currency derivatives on recognized exchanges.

HDFC Securities offers a secure trading platform backed by the strong reputation of HDFC Bank, often appealing to users who prioritize reliability and brand trust. It provides extensive research reports and boasts seamless integration with HDFC Bank accounts.

Their customer service is also often cited as a positive. This makes it a potentially reliable choice for traders who value detailed research and high security. Some key features & considerations of HDFC Securities:

- Account Opening Fee: Can be around INR 999 (may vary based on ongoing offers or account types).

- Annual Maintenance Charges (AMC): Typically around INR 750 per annum (for Demat account, subject to change).

- Brokerage: For currency derivatives, standard brokerage might be around 0.05% per trade. However, like other bank-led brokers, they may offer different plans, including potentially lower flat-fee options (e.g., with HDFC Sky). Users should carefully examine the current brokerage plans.

| Pros | Cons |

|---|---|

| Seamless HDFC Bank integration | Higher fees vs. discount brokers |

| Extensive research reports | Slower app update cycle |

| Reliable customer service |

Similar to other full-service bank-led brokers, HDFC Securities may have comparatively higher brokerage fees and account maintenance costs than discount brokers. This might not appeal to highly budget-conscious traders or very active traders, where costs can accumulate.

It is strongly recommended to visit the official HDFC Securities website at https://www.hdfcsec.com/ (and HDFC Sky website) and the SEBI website to verify current registration details, services offered, all fee structures and plans, and terms and conditions before making any decisions.

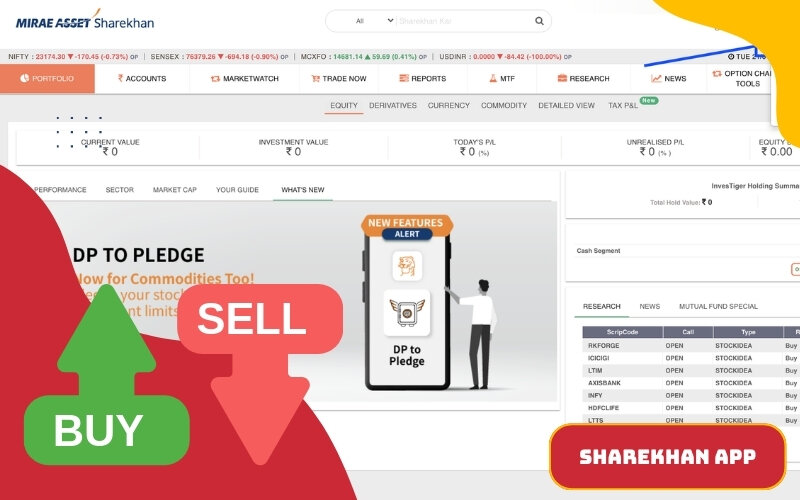

3.6. Sharekhan App

- Broker: Sharekhan Ltd. (now part of BNP Paribas).

- App: Sharekhan App (and Sharekhan Mini for lighter access).

- Claimed Legality: Sharekhan is registered with SEBI. It allows trading in currency derivatives on recognized exchanges.

Sharekhan is a well-established name in the Indian brokerage industry, known for its strong research and advisory services and a relatively user-friendly interface.

They aim to provide a comprehensive trading experience with a suite of technical and fundamental analysis tools, including their advanced trading platform "TradeTiger" (desktop-based, but features often influence app development). Good customer support through various channels is also often highlighted. Some key features & considerations of Sharekhan:

- Account Opening Fee: Can be around INR 0 to INR 750, often depending on promotions.

- Annual Maintenance Charges (AMC): Typically around INR 400-500 per annum (plus taxes, for a Demat account).

- Brokerage: Sharekhan has various brokerage plans. While equity delivery can be higher (e.g., 0.5%), brokerage for currency derivatives is usually structured differently (e.g., per lot or a small percentage of turnover) and is competitive for that segment. It's crucial to check their specific current plans for currency futures and options.

| Pros | Cons |

|---|---|

| Strong research and advisory | Higher brokerage for some trades |

| Good customer support | Less intuitive app interface |

| Advanced analysis tools |

The standard brokerage for equity delivery trades can be higher compared to discount brokers, and account maintenance charges might also be considered relatively high by some, especially if not leveraging their research and advisory.

It is strongly recommended to visit the official Sharekhan website at https://www.sharekhan.com/ and the SEBI website to verify current registration details, services offered, all specific brokerage plans (especially for currency derivatives), fee structures, and terms and conditions before making any decisions.

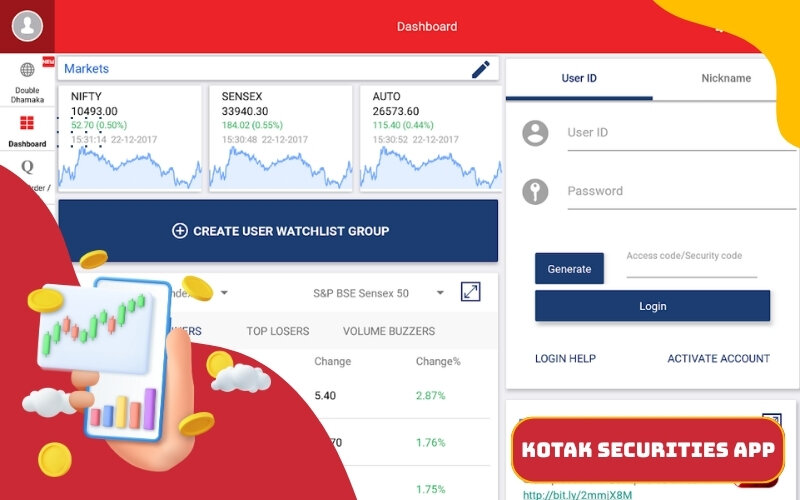

3.7. Kotak Securities App (Kotak Neo / Kotak Stock Trader)

- Broker: Kotak Securities Ltd. (the brokerage arm of Kotak Mahindra Bank).

- App: Kotak Neo (newer platform) or the Kotak Stock Trader app.

- Claimed Legality: Kotak Securities is registered with SEBI. It facilitates trading in currency derivatives on recognized exchanges.

Kotak Securities provides a robust trading platform, leveraging the strength and integration with Kotak Mahindra Bank, which adds a layer of convenience and perceived security for its users. They are known for offering strong research and advisory services. Good customer support is also a feature often associated with them. Some key features & considerations of Kotak Securities:

- Account Opening Fee: Can be up to INR 750, but they often have plans with waived or reduced opening fees (e.g., their "Zero Brokerage Plan" for intraday trades might have a one-time subscription fee instead of a traditional account opening fee for that benefit).

- Annual Maintenance Charges (AMC): Typically around INR 50-600 per annum (Demat AMC, varies significantly based on the plan selected, e.g., may be free for the first year under some plans).

- Brokerage: Under their popular "Trade Free Plan" or similar offerings, brokerage for currency derivatives can be a flat INR 20 per executed order. Other plans might have percentage-based brokerage. It is essential to understand the specifics of the chosen plan.

| Pros | Cons |

|---|---|

| Kotak Bank integration | Higher fees for non-plan users |

| Strong research and advisory | Less advanced charting tools |

| Good customer support |

While Kotak Securities offers competitive plans (like the flat fee per trade), their traditional brokerage structures or fees for non-plan users could be higher. Some users might find that the range of advanced trading features or charting tools, while comprehensive, may not be as cutting-edge as some platforms focused purely on hyperactive traders, though Kotak Neo aims to address this.

It is strongly recommended to visit the official Kotak Securities website at https://www.kotaksecurities.com/ and the SEBI website to verify current registration details, services offered, all available brokerage plans, fee structures, and terms and conditions before making any decisions.

3.8. 5Paisa Mobile App

- Broker: 5Paisa Capital Ltd. (a prominent discount broker).

- App: 5Paisa Mobile App.

- Claimed Legality: 5Paisa is registered with SEBI. It allows trading in currency derivatives on recognized exchanges.

5Paisa is well-regarded as a cost-effective option in the Indian brokerage space, primarily due to its very low brokerage fees (often one of the lowest flat fees per order) and frequent free account opening offers. Its mobile app generally offers a simple, easy-to-use interface, making it accessible for beginners and budget-conscious traders. Some key features & considerations of 5Paisa:

- Account Opening Fee: Often INR 0 (frequently offers free account opening).

- Annual Maintenance Charges (AMC): Can be around INR 300-540 per annum (plus taxes, may vary based on the chosen plan or if only a trading account is active without a Demat account for specific periods). They also have add-on packs that affect overall costs.

- Brokerage: For currency derivatives, typically a flat fee of INR 10 or INR 20 per executed order, depending on the subscription pack chosen.

| Pros | Cons |

|---|---|

| Low brokerage fees | Basic trading tools |

| Free account opening | Limited customer support |

| Beginner-friendly interface |

While 5Paisa excels in affordability, some users might find the platform’s trading tools relatively basic compared to brokers offering more sophisticated charting and analytical capabilities. Additionally, customer support, while available, might be perceived as more limited or less responsive than what is offered by full-service brokers or larger discount brokers, which could be a concern for traders needing extensive assistance.

It is strongly recommended to visit the official 5Paisa website at https://www.5paisa.com/ and the SEBI website to verify current registration details, services offered, different subscription packs, fee structures, and terms and conditions before making any decisions.

3.9. Motilal Oswal MO Investor/MO Trader App

- Broker: Motilal Oswal Financial Services Ltd. (a well-known full-service financial services firm).

- App: MO Investor or MO Trader.

- Claimed Legality: Motilal Oswal is registered with SEBI. It allows trading in currency derivatives on recognized exchanges.

Motilal Oswal Financial Services is highly regarded for its extensive and comprehensive market research and strong advisory capabilities. They also generally offer good customer support and a reliable trading platform with a range of tools suitable for both investors and traders. This makes it a strong choice for traders who value detailed analysis and personalized assistance. Some key features & considerations of Motilal Oswal:

- Account Opening Fee: Can be up to INR 1000, though they often have offers for free or reduced account opening.

- Annual Maintenance Charges (AMC): Typically around INR 400-600 per annum (for Demat account, can vary based on the scheme; sometimes waived for the first year).

- Brokerage: While standard equity brokerage can be higher (e.g., 0.5% for delivery), brokerage for currency derivatives is usually structured differently and more competitively (e.g., per lot or a percentage of turnover, or flat fee under specific plans). It is crucial for users to check the applicable brokerage for currency derivatives under their chosen plan.

| Pros | Cons |

|---|---|

| Extensive market research | High fees for non-plan users |

| Strong advisory services | Expensive account opening |

| Reliable trading tools |

The primary consideration for many traders with Motilal Oswal can be the potentially high brokerage fees if not on a specialized plan, and account opening/maintenance costs can also be perceived as expensive, especially when compared to discount brokers.

These factors might deter those looking for more affordable trading options, particularly if they don't heavily rely on the extensive research and advice provided.

It is strongly recommended to visit the official Motilal Oswal website at https://www.motilaloswal.com/ and the SEBI website to verify current registration details, services offered, all specific brokerage plans (especially for currency derivatives), fee structures, and terms and conditions before making any decisions.

3.10. IIFL Securities Markets App

- Broker: IIFL Securities Ltd. (formerly India Infoline).

- App: IIFL Markets App.

- Claimed Legality: IIFL Securities is registered with SEBI. It facilitates trading in currency derivatives on recognized exchanges.

IIFL Securities offers a reliable trading platform, often highlighted by its robust mobile trading app. They provide good research support and advisory services, making it a solid choice for traders who appreciate market insights. A key attraction for many is their offering of flat brokerage fees (e.g., INR 20 per trade) under certain plans, which provides cost consistency. The platform generally ensures access to currency derivatives with efficient price discovery, indicative of good liquidity on the underlying exchanges. Some key features & considerations of IIFL Securities:

- Account Opening Fee: Can be around INR 0 to INR 750 (often have promotional offers for free account opening).

- Annual Maintenance Charges (AMC): Typically around INR 250-450 per annum (for Demat account, sometimes waived for the first year or under specific conditions).

- Brokerage: For currency derivatives, they commonly offer a flat fee, such as INR 20 per executed order, under popular plans.

| Pros | Cons |

|---|---|

| Flat brokerage fees | Limited advanced features |

| Good research support | Potential account opening fees |

| Reliable platform |

While the flat brokerage is appealing, the standard account opening fee (if applicable outside of offers) might be considered high by some. Additionally, traders seeking very sophisticated or highly customizable advanced trading features and tools might find the offering somewhat limited compared to platforms specifically designed for professional or algorithmic traders.

It is strongly recommended to visit the official IIFL Securities website at https://www.indiainfoline.com/ and the SEBI website to verify current registration details, services offered, all brokerage plans, fee structures, and terms and conditions before making any decisions.

3.11. Dhan App

- Broker: Moneylicious Securities Pvt. Ltd. (operating under the brand "Dhan")

- App: Dhan (available on Android, iOS, and Web)

- Claimed Legality: SEBI-registered broker (INZ000006031), licensed to facilitate currency derivatives trading on recognized Indian exchanges like NSE and BSE.

Dhan is designed for modern Indian traders who seek speed, simplicity, and access to cutting-edge tools. With zero brokerage on delivery trades and advanced features like integrated TradingView charts, fast execution, and developer-friendly APIs, it caters to both beginners and experienced forex traders. Some key features & considerations of IIFL Securities:

- Account Opening Fee & AMC: Free account opening; zero annual maintenance charges (AMC) for lifetime on personal Demat accounts.

- Brokerage:

- Free for equity delivery, ETFs, IPOs, and mutual funds

- INR 20 per executed order or 0.03% (whichever is lower) for intraday and F&O (currency & equity derivatives)

- Standout Features:

- Advanced charting tools with multiple indicators and timeframes.

- Integrated TradingView access across web and mobile.

- Flash Trade, Iceberg, Basket, Bracket & Cover Orders.

- Free developer APIs with live data and webhook support.

| Pros | Cons |

|---|---|

| Free account opening and AMC | Limited currency pairs |

| Advanced TradingView charts | Relatively new platform |

| Fast order execution |

It is strongly recommended to visit the official Dhan website at https://dhan.co/ and the SEBI website to verify current registration details, services offered, all brokerage plans, fee structures, and terms and conditions before making any decisions.

3.12. Avatrade

- Broker: AvaTrade Ltd. (an internationally regulated broker across multiple jurisdictions)

- App: AvaTradeGo and AvaTrade WebTrader (Android, iOS, Web)

- Claimed Legality: Not SEBI-registered — availing services from foreign brokers via international financial regulations.

AvaTrade is tailored for professional traders who prioritize speed, precision, and secure trading. With lightning-fast order execution, deep market liquidity, and institutional-grade fund protection, it serves serious traders while offering advanced charts, oscillators, and indicators like SMA and Parabolic SAR. Some key features & considerations of IIFL Securities:

- Account Opening Fee & AMC: No setup or annual maintenance fees for trading accounts.

- Brokerage: Minimal intraday and spread-based pricing; no hidden costs.

- Standout Features:

- Cutting-edge charting tools with technical indicators (oscillators, SMA, Parabolic).

- AI-powered trading bots and free demo accounts for strategy testing.

- High-security encryption for fund protection.

- Fast deposits and withdrawals with robust mobile UX.

| Pros | Cons |

|---|---|

| Fast order execution | Not SEBI-registered |

| Advanced charting tools | Limited currency pairs |

| No account fees | Less accessible for Indian users |

AvaTrade is a powerful platform for experienced forex traders seeking fast, reliable execution and advanced charting infrastructure, but it may be less accessible for Indian residents since it's not SEBI-registered and offers a limited selection of currency pairs.

It is strongly recommended to visit the official Avatrade website at https://www.avatrade.com/ and the SEBI website to verify current registration details, services offered, all brokerage plans, fee structures, and terms and conditions before making any decisions.

3.13. Exness

- Broker: Exness Group (a globally recognized forex broker regulated in multiple jurisdictions including CySEC, FCA, FSCA, and FSA)

- App: Exness Trader (available on Android, iOS, and Web)

- Claimed Legality: Not registered with SEBI; operates as an international broker accessible to Indian users under global compliance.

Exness has built a strong following among Indian traders thanks to its clean, beginner-friendly app interface and a powerful suite of trading tools. With real-time data, high leverage, and access to a wide range of instruments, including major forex pairs and cryptocurrencies, the platform supports both casual and professional traders. Some key features & considerations of IIFL Securities:

- Account Opening Fee & AMC: No setup or annual maintenance charges

- Brokerage & Spreads: Tight spreads and commission-free trading on many instruments; dynamic pricing varies by account type

- Standout Features:

- User-friendly interface tailored for all experience levels.

- Multiple account types to suit varying trading strategies (Standard, Raw Spread, Zero, Pro).

- Advanced charting tools and real-time market data.

- 24/7 multilingual customer support via live chat and email.

- Quick deposit and withdrawal processing across various payment channels.

| Pros | Cons |

|---|---|

| Beginner-friendly interface | Not SEBI-registered |

| Competitive spreads | Legal risks for Indian users |

| 24/7 customer support |

Exness offers high-leverage trading, competitive spreads, and a reliable mobile platform, making it a favored choice among Indian users seeking international forex exposure. However, it’s important to note that the broker is not SEBI-regulated, and traders should fully understand the implications of using an offshore platform.

It is strongly recommended to visit the official Exness website at https://www.exness.com and the SEBI website to verify current registration details, services offered, all brokerage plans, fee structures, and terms and conditions before making any decisions.

Important: Users MUST conduct their own thorough due diligence, verify the latest and complete information directly from the SEBI website, the respective broker's website, and other official sources before making any trading decisions or opening an account.

H2T Finance is not responsible for any decisions or actions taken by readers based on the information presented in this article.

This list is not exhaustive, and there are other SEBI-registered brokers offering currency derivatives trading apps in India. The selection of a legal forex trading app in India should always be preceded by careful personal research and alignment with your trading needs and risk appetite.

4. Comparison of legal forex trading apps in India

Below is a comprehensive comparison table of the Forex trading apps discussed, helping you evaluate and choose the platform that best suits your trading needs. All listed apps comply with SEBI regulations, except AvaTrade and Exness, which are international platforms not registered with SEBI.

| App | Broker | Account Opening Fee | Annual Maintenance Charge (AMC) | Brokerage (Currency Derivatives) | Key Features | Legality |

|---|---|---|---|---|---|---|

| Kite | Zerodha Broking Ltd. | ~200 INR | ~300 INR/year | 20 INR or 0.03%/order | User-friendly interface, TradingView charts, educational content (Varsity) | SEBI Registered |

| Upstox Pro | RKSV Securities (Upstox) | ~249 INR | ~150 INR/year | 20 INR/order | High speed, customizable interface, training resources | SEBI Registered |

| Angel One | Angel One Ltd. | 0 INR (usually free) | ~240 INR/year | 20 INR/order | Advisory services, technical tools, strong customer support | SEBI Registered |

| ICICIdirect Markets | ICICI Securities Ltd. | ~975 INR | ~700 INR/year | ~0.05% or 20 INR/order (plan-based) | Integrated with ICICI Bank, in-depth research reports | SEBI Registered |

| HDFC Sky/Securities | HDFC Securities Ltd. | ~999 INR | ~750 INR/year | ~0.05% or plan-based | Integrated with HDFC Bank, research reports, good customer service | SEBI Registered |

| Sharekhan | Sharekhan Ltd. | 0–750 INR | ~400–500 INR/year | Lot-based or % of turnover | Analysis tools (TradeTiger), multi-channel customer support | SEBI Registered |

| Kotak Neo/Stock Trader | Kotak Securities Ltd. | ~750 INR | ~50–600 INR/year | 20 INR/order (plan-based) | Integrated with Kotak Bank, detailed research, customer assistance | SEBI Registered |

| 5Paisa | 5Paisa Capital Ltd. | 0 INR (usually free) | ~300–540 INR/year | 10–20 INR/order (plan-based) | Low cost, simple interface, beginner-friendly | SEBI Registered |

| MO Investor/Trader | Motilal Oswal Financial Services | ~0–1000 INR | ~400–600 INR/year | Lot-based or % of turnover | In-depth research, personalized support, reliable trading tools | SEBI Registered |

| IIFL Markets | IIFL Securities Ltd. | 0–750 INR | ~250–450 INR/year | 20 INR/order | Fixed fee, strong research, high liquidity | SEBI Registered |

| Dhan | Moneylicious Securities | 0 INR | 0 INR (lifetime free) | 20 INR or 0.03%/order | TradingView charts, developer API, fast order execution | SEBI Registered |

| AvaTradeGo/WebTrader | AvaTrade Ltd. | 0 INR | 0 INR | Spread-based, no hidden fees | Advanced charts, AI trading bots, demo accounts | Not SEBI Registered |

| Exness Trader | Exness Group | 0 INR | 0 INR | Tight spreads, zero commissions | User-friendly interface, high leverage, 24/7 multilingual support | Not SEBI Registered |

Note:

- Apps registered with SEBI (like Zerodha, Upstox, etc.) ensure legal compliance and safety for Indian traders, and only support INR-based currency pairs (USD/INR, EUR/INR, GBP/INR, JPY/INR).

- AvaTrade and Exness, while globally reputed, are not regulated by SEBI and may pose legal risks when used in India.

Always verify the latest details on the official websites of the brokers and SEBI regarding registration, fees, and trading conditions before making a decision.

5. Identifying a genuine legal forex trading app in India: a checklist

Choosing a legal forex trading app in India from many options requires careful checks. A systematic approach is vital to avoid non-compliant or fraudulent platforms. This checklist helps you assess an app's legitimacy.

5.1. SEBI registration is non-negotiable

The broker's SEBI registration is the most critical check. Any entity offering currency derivatives in India must be SEBI-registered.

- How to verify: Check the broker's status on the official SEBI website (www.sebi.gov.in). The app or broker's site should display their SEBI registration number.

- Check permitted segments: The broker must be authorised for the "currency derivatives segment". This can also be verified on SEBI's portal. Using forex trading apps approved by SEBI from SEBI-registered forex brokers in India, app providers are key.

Lack of verifiable SEBI registration for currency derivatives is a major red flag.

5.2. Product offerings: Stick to permitted currency pairs

A genuine app will focus on legally permitted products.

- INR-based currency derivatives: The app must clearly offer derivatives (futures and options) on INR pairs like USD/INR, EUR/INR, GBP/INR, and JPY/INR, as these are traded on Indian exchanges.

- Caution with international spot forex: Be wary of apps heavily promoting spot trading or CFDs on international pairs (e.g., EUR/USD) for Indian residents. This is generally not compliant with FEMA/RBI rules if offered through unauthorised platforms.

5.3. Transparency in operations and disclosures

Legitimate providers are transparent.

- Clear fee structure: The app must detail all brokerage charges, transaction fees, and taxes. Vague fees are a warning.

- Comprehensive risk disclosures: Compliant apps will have clear risk disclosure statements, as SEBI mandates.

- Accessible support and grievance redressal: The broker should offer easy-to-reach customer support and clear complaint procedures.

5.4. Red flags: warning signs of an illegal or unsafe forex app

Be alert to common signs of illegal operations.

- Guarantees of high profits: No legitimate platform guarantees profits. Claims of "no-loss" or unrealistic returns are scams.

- Pressure to deposit large sums: Caution is needed if pressured to make large, quick deposits.

- Lack of clear operator information: The app must clearly state the SEBI-registered broker's name and details. Vague information is a concern.

- Foreign-based without SEBI registration for India: An app from a foreign entity not SEBI-registered to serve Indian clients for currency derivatives is likely non-compliant for these services here.

- Difficulty in withdrawing funds: Reports of issues with fund withdrawals are serious warnings. Research user experiences.

6. Key features to consider in a SEBI-compliant forex trading app

Once you've confirmed an app's legitimacy by verifying its SEBI compliance, the next step is to evaluate its features. The right app should align with your trading style and needs. Here are the key aspects to consider when choosing from authorised forex trading platforms in India.

6.1. User interface (UI) and user experience (UX)

The app should be easy to use, even for beginners.

- Intuitive navigation: Look for a clean layout and straightforward navigation. You should be able to find tools and place orders without confusion.

- Suitability for all levels: A good app caters to both newcomers and experienced traders.

6.2. Trading tools and analytical resources

Effective trading often relies on good tools.

- Real-time charts and indicators: The app should provide access to live charts and a variety of technical indicators to help with market analysis.

- Market news and research: Some apps integrate market news feeds, research reports, or analytical insights, which can be valuable for decision-making.

6.3. Order execution and platform stability

The app's performance is critical during active trading.

- Speed and reliability: Orders should be executed quickly and accurately. Check for reviews on platform stability.

- Minimal downtime: Frequent technical glitches or extended downtime can be costly. Look for a platform known for its reliability.

6.4. Security and fund safety measures

Protecting your account and funds is crucial.

- Account security: Features like two-factor authentication (2FA) and data encryption are essential for protecting your account from unauthorised access.

- Segregation of client funds: SEBI mandates that brokers keep client funds separate from their own operational funds. Ensure the broker adheres to this.

6.5. Customer support and educational content

Good support can be invaluable, especially for new traders.

-

Responsive support channels: Check the availability and responsiveness of customer support (e.g., chat, phone, email).

-

Educational materials: Many brokers offer educational resources on currency derivatives trading, which can be very helpful for learning.

Considering these features will help you select a SEBI-compliant app that not only allows you to trade legally but also provides a user-friendly and secure environment.

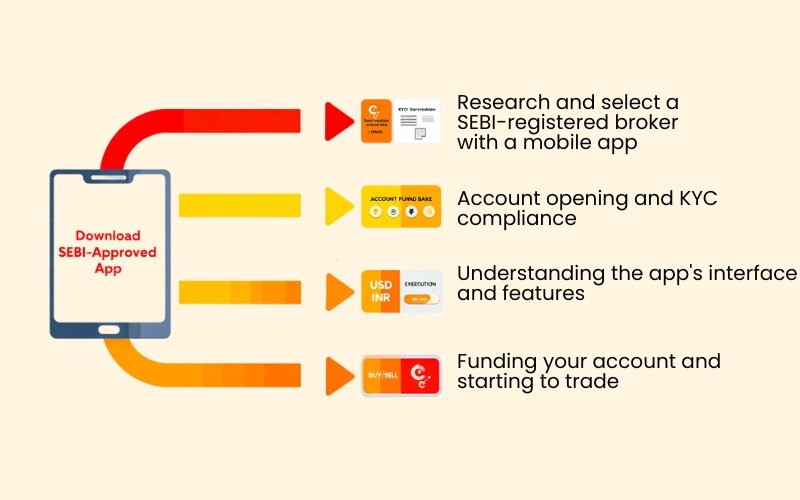

7. How to trade forex legally in India using a mobile app: step-by-step

Once you've identified a compliant app, starting your journey into legal forex (currency derivatives) trading in India involves a few straightforward steps. This section outlines how to trade forex legally in India using a mobile application.

7.1. Research and select a SEBI-registered broker with a mobile app

This is the foundational step. Thorough due diligence is crucial.

- Revisit the checklist from the previous section to ensure the broker offering the app is SEBI-registered and authorised for currency derivatives.

- Compare features, brokerage fees, and user reviews of different authorised forex trading platforms India before making a choice. Your goal is to find a platform that aligns with your trading needs and risk tolerance.

7.2. Account opening and KYC compliance

To trade, you'll need to open a trading and demat account with the chosen broker.

- Required documents: Typically, you will need your PAN card, Aadhaar card (for eKYC and address proof), bank account details (cancelled cheque/bank statement), and photographs/signatures.

- KYC process: Most brokers now offer an online, paperless Know Your Customer (KYC) process, often using Aadhaar-based OTP verification. Some may still have offline options or require In-Person Verification (IPV).

7.3. Understanding the app's interface and features

Before trading with real money, familiarize yourself with the app.

- Practice with a demo account: If the app offers a demo or virtual trading account, use it extensively. This allows you to practice placing orders and testing strategies without financial risk.

- Learn order types and margin requirements: Understand the different types of orders (market, limit, stop-loss) and the margin requirements for trading currency derivatives.

7.4. Funding your account and starting to trade (responsibly)

Once comfortable, you can fund your account.

- Permitted funding methods: Use approved methods like net banking, UPI, or NEFT/RTGS from your linked bank account to transfer funds to your trading account. Avoid using unverified third-party payment methods.

- Emphasize risk management: Always trade responsibly with a clear risk management strategy. Never trade with money you cannot afford to lose, and consider using stop-loss orders to limit potential losses.

Following these steps will help ensure you begin your currency derivatives trading journey in India in a compliant and informed manner.

8. Can you use Indian bank apps for forex trading?

A common question among those new to forex is whether their existing Indian bank's mobile app can be used for speculative forex trading. The answer requires understanding the distinction between banking forex services and dedicated trading platforms.

8.1. Distinction: banking forex services vs. retail trading platforms

Indian bank apps primarily facilitate forex transactions related to traditional banking needs, not speculative retail trading.

- Banking forex services: Bank apps are typically used for services like outward/inward remittances (e.g., for education, travel), forex travel cards, and trade finance transactions for businesses. These are utility-focused forex conversions.

- Brokerage arms of banks: Some banks have subsidiary brokerage firms (e.g., ICICI Securities, HDFC Securities, Kotak Securities). These brokerage entities, if SEBI-registered for currency derivatives, will offer separate dedicated trading apps or platforms (like those discussed in section 3) for clients to trade SEBI-approved currency derivative products. These are distinct from the bank's primary netbanking or mobile banking app.

8.2. Limitations for speculative retail trading

Standard Indian bank apps are generally not designed or authorised for direct speculative forex trading by retail clients.

- No direct trading interface: Your usual mobile banking app will not provide an interface to place buy/sell orders on currency futures or options in the way a broker's trading app does.

- FEMA compliance: Banks adhere strictly to FEMA regulations. Facilitating direct speculative forex trading for retail clients on international OTC markets through their primary banking app would likely contravene these regulations regarding outward remittances for such purposes.

In summary, while your bank app is useful for forex-related banking transactions, for actual speculative trading in currency derivatives, you need to use a dedicated trading app provided by a SEBI-registered stockbroker, which could be a brokerage arm of a bank or an independent discount/full-service broker.

Okay, here is the FAQ section followed by the Conclusion, aiming for conciseness and adherence to all previous guidelines.

9. FAQ about legal forex trading apps in India

Here are answers to some common questions regarding legal forex trading apps in India:

9.1. Is Exness legal in India?

No, Exness is not SEBI-registered, so it is not legally regulated in India. However, Indian traders can access it at their own discretion under international regulations, which carries certain legal and financial risks.

9.2. If an app claims to be regulated by an international authority (e.g., FCA, CySEC), is it legal for me to use it in India for all forex products?

No. Only SEBI-registered brokers can legally offer forex trading in India. Using international apps for non-SEBI-compliant forex products may violate FEMA regulations.

9.3. What are the specific penalties for engaging in illegal forex trading in India?

Engaging in illegal forex trading can lead to significant penalties under the FEMA. These penalties can be up to three times the sum involved in the contravention where the amount is quantifiable, or up to two lakh rupees where the amount is not quantifiable. Repeat offences can attract further penalties. Enforcement agencies like the Directorate of Enforcement (ED) can also initiate proceedings.

9.4. Are there any specific mobile forex trading India regulations I should be most aware of?

Yes. Forex trading must comply with FEMA (RBI) and SEBI rules. Legal trading is allowed only via SEBI-registered apps offering exchange-traded currency derivatives.

9.5. How can I trade forex in India?

Trade only through SEBI-registered brokers on recognized exchanges (like NSE or BSE) using INR-based currency pairs. Offshore or OTC forex platforms are not permitted.

9. Conclusion

Choosing a legal forex trading app in India is the first and most crucial step towards ensuring safety and compliance with the law. By understanding the regulations set forth by the RBI, FEMA, and SEBI, and by knowing how to verify the legitimacy of a broker and their application, you can participate in India's currency derivatives market with greater confidence.

Always prioritise platforms registered with SEBI and focus on trading only the permitted products. Remember that diligence in selection and adherence to regulatory guidelines are key to a secure trading experience. Stay informed and trade responsibly. For the latest updates and analyses on financial markets, keep following our Forex Brokers category!

Learn more about risk management in currency trading and explore tools for market analysis. Join the H2T Finance community to discuss safe trading strategies.