In the fast-paced world of forex, we all know that success often comes down to one thing: precision in our entries and exits. Getting this right is tough, and it's exactly where the lead pip vs trailing pip dynamic comes into play, offering a smarter way to manage your trades.

Far from mere technical terms, these pip strategies are your allies in outsmarting market volatility. Lead pips act like a gatekeeper, ensuring you enter trades only when the momentum is real, while trailing pips guard your profits as prices dance. Curious about how lead pip vs trailing pip can sharpen your edge?

Let’s dive into their mechanics and discover how to harness them for smarter, more confident trading.

1. What is a pip and how lead pips work in forex trading

Understanding pips is essential for any trader navigating the forex market. A pip is more than just a unit of measurement; it plays a central role in calculating price movement, determining risk levels, and setting accurate entries or exits. To grasp the difference between lead pip vs trailing pip, we must first break down the fundamentals of what a pip is, and how lead pips specifically function in practical scenarios.

1.1. What is a pip?

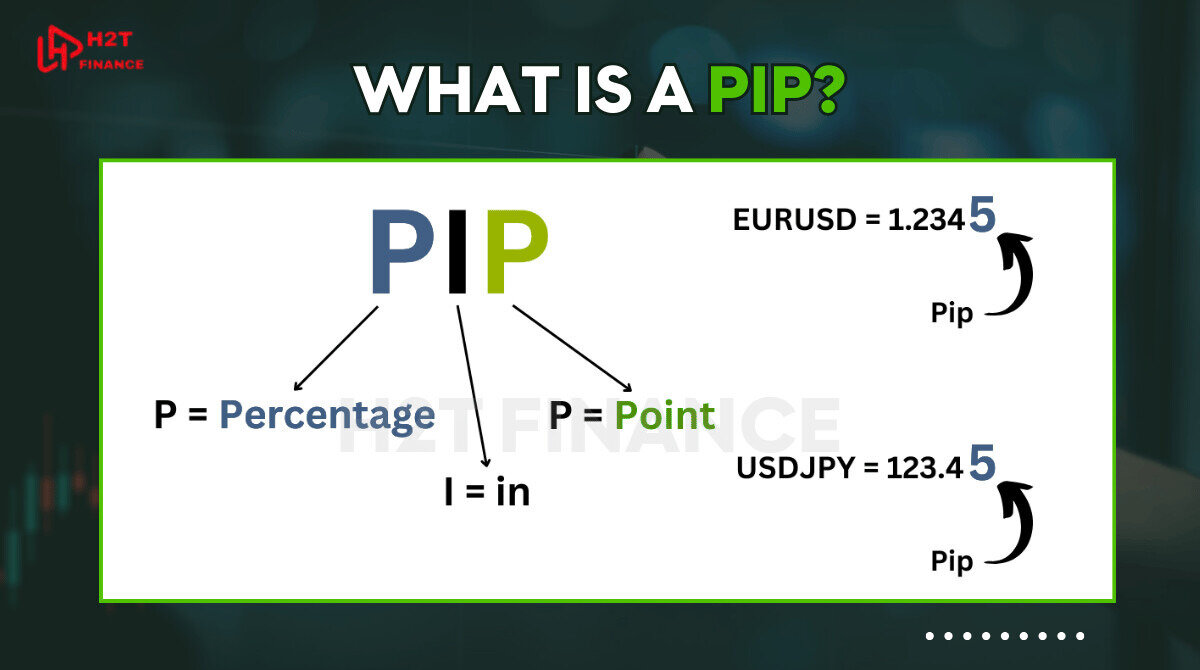

In forex trading, a pip (short for “percentage in point”) represents the smallest price movement that a currency pair can make based on market convention. For most currency pairs, one pip equals 0.0001. For yen-based pairs like USD/JPY, one pip equals 0.01 due to the smaller decimal convention.

Some platforms also use pipettes, which are 1/10th of a pip, allowing for even more precise pricing particularly useful for high-frequency strategies or fine-tuning automated trading systems.

For example, if EUR/USD moves from 1.1050 to 1.1051, that’s a one-pip movement.

See more about what is a pip in forex trading!

1.2. Why pips matter in forex

Pips are the foundational unit used to measure:

-

Price movement: the difference between entry and exit

-

Spread: the cost of entering a trade

-

Stop loss and take profit levels: critical for risk management

Without understanding pips, traders cannot accurately calculate profit, loss, or potential risk exposure. This becomes especially important when designing entry or exit strategies involving tools like lead pips or trailing pips.

2. What is the ‘lead pip’ strategy?

The term ‘Lead Pip’ describes a strategic technique rather than a built-in platform tool. It refers to the practice of creating a buffer zone, typically 5 to 10 pips, that traders apply above or below key price levels when setting pending orders.

This margin helps ensure the trade is triggered only when the price moves decisively in the intended direction, avoiding false breakouts.

Lead pips are most commonly used in:

-

Breakout strategies: Traders set a buy stop order 10 pips above resistance or a sell stop order 10 pips below support to confirm a breakout with momentum.

-

Expert Advisors (EAs): In automated trading systems, lead pips are often pre-coded to delay order execution until a certain pip threshold is crossed.

This approach adds a layer of confirmation and helps reduce the chances of premature entries in volatile conditions.

Example: Suppose resistance is at 1.2500. Instead of setting a buy stop at 1.2500, a trader places the order at 1.2510, using a 10-pip lead buffer to validate the breakout.

By applying a lead pip, traders increase the likelihood that the breakout is genuine improving the quality of entries and helping manage risk more effectively.

3. What is a trailing pip and how does it work

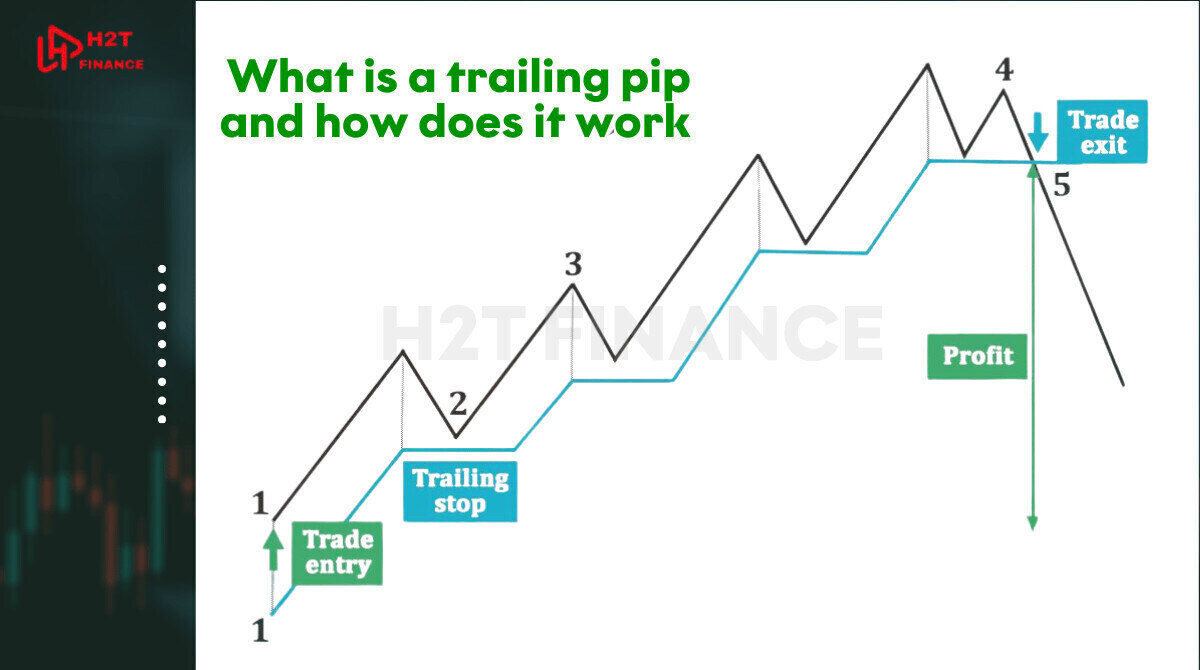

While lead pips focus on enhancing trade entries, trailing pips are designed to optimize trade exits. A trailing pip, used within a trailing stop mechanism, is a dynamic tool that adapts to market movements protecting profits while giving trades room to grow. Understanding how trailing stops function is key to mastering risk management and exit timing in forex trading.

3.1. Definition of a trailing pip

A trailing pip refers to the pip-based distance used in a trailing stop loss. Unlike fixed stop losses, which remain static, a trailing stop adjusts in real time as the trade moves in your favor. The stop loss "trails" the market price at a set pip distance, helping traders lock in profits without manually updating the order.

For example, if a trader enters a long trade at 1.1000 and sets a trailing stop of 20 pips, the stop will follow the price upward, always staying 20 pips behind the current market price. If the price rises to 1.1050, the stop would move up to 1.1030. However, if the price reverses, the stop stays in place and protects profits.

3.2. How trailing pips work in real trading

Trailing stops are most effective in trending markets, where prices move strongly in one direction. They provide an automatic way to capture gains while minimizing the emotional decision-making involved in closing trades.

Trailing pips are supported in major platforms like MetaTrader 4 (MT4) and MetaTrader 5 (MT5), where traders can:

-

Set a fixed trailing distance in pips

-

Combine with indicators or custom scripts for more advanced trailing logic

-

Apply manually or through Expert Advisors (EAs)

3.3. Benefits of using trailing pips

Using trailing pips offers multiple advantages:

-

Locks in profits as the market moves in your favor

-

Reduces emotional exits, since the stop adjusts automatically

-

Allows trades to breathe, especially in volatile sessions

-

Supports hands-off trading strategies with automation

By integrating trailing pip logic into your trading plan, you give profitable trades a chance to grow while still maintaining a safety net in case the market reverses.

4. Lead pip vs trailing pip: key differences

Now that we’ve explored what lead pips and trailing pips are, it’s time to examine how they differ and why choosing the right one matters. Although both involve pips and are used to enhance trade performance, lead pips and trailing pips serve completely different purposes in the trading process.

4.1. Comparing lead pip and trailing pip

The table below outlines the core distinctions between these two pip-based tools:

|

Criteria |

Lead pip |

Trailing pip |

|

Purpose |

Entry trigger or buffer |

Dynamic stop loss management |

|

Use case |

Pending orders, strategy entry |

Risk management during open trades |

|

Market condition focus |

Pre-trade planning |

Post-entry trade protection |

|

Adjusts with price? |

No |

Yes |

|

Tool/platform usage |

EA rules, manual pending orders |

Built-in MT4/MT5, EAs, manual SL trailing |

4.2. Key takeaway

Here’s the simplest way to remember the lead pip vs trailing pip difference: The ‘Lead pip’ strategy is your gatekeeper, deciding if and when you enter the party. The trailing pip is your bodyguard, making sure you get out with your profits intact once you're inside.

By understanding the lead pip vs trailing pip dynamic, you can build more flexible strategies, combining clean entries with adaptive exits especially when using platforms like MT4 or MT5 that support both pending orders and trailing stops.

5. When to use lead pip vs trailing pip

Knowing when to apply a lead pip or a trailing pip depends largely on your trading style, market conditions, and platform capabilities. Each serves a distinct purpose within a trade cycle, and using them effectively can greatly improve your execution and risk management.

5.1. Selecting based on trading style

Different trading approaches naturally align with one pip technique more than the other. Below are typical use cases for each:

Scalping:

-

Preferred tool: Trailing pip

-

Reason: Scalpers operate in fast-moving markets and need to secure profits quickly. A small trailing stop (e.g., 5–10 pips) allows them to lock in gains while minimizing downside.

Breakout trading:

-

Preferred tool: Lead pip

-

Reason: To avoid false breakouts, breakout traders use a lead pip buffer (e.g., 10 pips) above resistance or below support to confirm a genuine price move before order execution.

Swing trading:

-

Preferred tool: Trailing pip

-

Reason: Swing traders aim to ride trends for days or even weeks. A wide trailing pip (e.g., 30–50 pips) allows flexibility for price fluctuation while gradually securing profits.

5.2. Tool compatibility

Both pip strategies can be used effectively depending on your platform:

-

MT4/MT5: Support built-in trailing stop functionality and allow pending orders with manual pip buffers. Many EAs also support lead pip configuration.

-

cTrader: Offers visual order placement with customizable trailing stops.

-

TradingView: While it doesn’t support trailing stops natively, it can be integrated with broker APIs or used for alerts in conjunction with external platforms.

Knowing when to apply lead pip vs trailing pip in the right trading environment allows you to balance proactive entries with reactive exits maximizing edge in both volatile and trending markets.

Continue learning with these articles: MT4 MT5 trading software forex ratings

6. Platform support: MT4, MT5, and beyond

The effectiveness of both lead pip and trailing pip strategies depends not only on the trader’s approach but also on the platform’s capabilities. Fortunately, popular trading platforms like MetaTrader 4 (MT4), MetaTrader 5 (MT5), and cTrader offer varying levels of support for pip-based tools. Let’s break down how these platforms handle each strategy.

6.1. How to set trailing pips in MT4 and MT5

Both MT4 and MT5 offer built-in trailing stop functions that allow you to define a specific pip distance from the current price. Once activated, the stop loss automatically adjusts as the trade becomes profitable.

Steps to set a trailing stop in MT4/MT5:

-

Right-click on an open order in the Trade tab.

-

Select Trailing Stop.

-

Choose a predefined pip value (e.g., 20 pips), or enter a custom number.

Trailing stops only activate after the trade moves into profit, and they must remain online (especially in MT4) to function properly unless managed by an EA.

6.2. Using custom scripts or eas for lead pip logic

Unlike trailing stops, lead pip configurations are not built into MT4/MT5 natively. However, they can be implemented via:

-

Manual input when setting pending orders (e.g., placing a buy stop 10 pips above resistance)

-

Custom EAs (Expert Advisors) that allow traders to programmatically include a pip buffer in order execution logic

This makes lead pip strategies particularly suitable for automated systems, breakout strategies, and high-frequency logic.

6.3. What about tradingview?

TradingView does not support native trailing stop execution or lead pip configuration within its charting tools. However, it can still serve as a planning tool:

-

Use alerts to notify when price moves beyond a pip buffer (lead pip logic)

-

Combine with broker platforms (like MT4 or cTrader) for actual trade execution

For pip-based execution, TradingView needs to be paired with a supported trading platform through API or broker integration.

Trust me on this one, I've been there: a perfect lead pip vs trailing pip strategy on paper can fall apart if your platform doesn't execute it correctly. That's why truly understanding the strengths and limitations of your platform isn't just theory, it's crucial for making your strategies work in the real world.

7. Risk management insights from using pips smartly

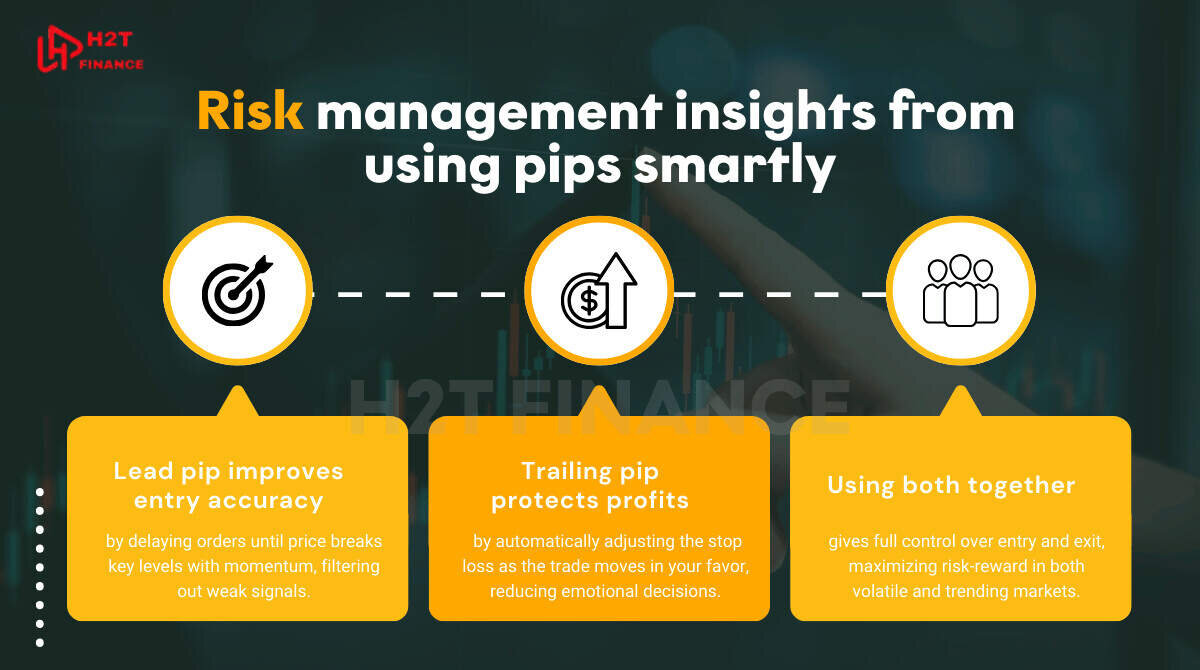

Effective risk management is the cornerstone of consistent trading, and pips play a central role in that process. When used correctly, both lead pip and trailing pip techniques help traders manage their exposure, control losses, and protect profits. The key lies in understanding when and how to use each pip type strategically.

7.1. How lead pip improves entry precision

One of the biggest risks in trading especially during volatile sessions is entering a trade too early. Lead pips act as a safeguard by delaying entry until price action confirms the intended direction.

-

Avoids false breakouts: By adding a buffer (e.g., 10 pips) to your pending order, you filter out weak price movements that don’t sustain momentum.

-

Improves trade quality: You enter trades only when price breaks a level decisively, reducing the chances of whipsaws or fake signals.

Example: If a key resistance is at 1.3000, placing a buy stop at 1.3010 ensures the market must break that level and show commitment before executing your trade.

7.2. How trailing pip protects profits

Trailing pips bring dynamic control to your open positions. Instead of relying on fixed take-profit levels or manual monitoring, a trailing stop automatically secures gains as the market moves in your favor.

-

Locks in profit while letting trades run

-

Reduces emotional decision-making

-

Protects against sudden reversals

This is especially valuable for traders who want to ride trends but still keep downside risk under control. You can “let your winners run” without leaving the position totally exposed.

7.3. Combining both for optimal risk/reward

Advanced traders often use lead pip and trailing pip together for more complete trade coverage:

-

Use a lead pip to enter the market only when conditions are favorable.

-

Use a trailing pip to adjust your exit as the trade progresses.

This combination gives traders full control across both entry and exit stages turning each trade into a strategic, risk-aware decision.

8. Common mistakes to avoid with lead and trailing pips

Even the most powerful trading tools can backfire when used incorrectly. Both lead pip and trailing pip strategies offer significant advantages but only when applied with precision and awareness of market context. Below are the most common mistakes traders make when using pip-based techniques, and how to avoid them.

8.1. Using an inappropriate lead pip buffer

A common pitfall is setting the lead pip distance too close or too far from the key price level:

-

Too narrow: May trigger trades on false breakouts or market noise

-

Too wide: Delays entry too much, reducing reward-to-risk ratio

Best practice:

Base your lead pip buffer on current volatility. For high-volatility pairs like GBP/JPY, you may need a larger buffer (10–15 pips). For stable pairs like EUR/USD, 5–7 pips may suffice.

8.2. Setting trailing stops too tight

While trailing pips help secure profits, setting the distance too tight can lead to early stop-outs especially in volatile sessions where price fluctuates before trending.

Best practice:

Use Average True Range (ATR) or recent price swings to determine a reasonable trailing pip value. Scalpers may use 5–10 pips, while swing traders might go up to 50 pips.

8.3. Ignoring market structure or price behavior

Many traders rely solely on pip values without considering the bigger picture like support/resistance levels, trend strength, or economic events.

Best practice:

Combine pip strategies with technical analysis. A lead pip is more effective when placed near a confirmed breakout zone. Trailing stops perform better when aligned with moving averages or Fibonacci retracements.

Pip strategies don’t work in isolation they must be integrated into a broader trade plan to succeed.

By avoiding these mistakes, you can maximize the effectiveness of lead pip vs trailing pip tactics and enhance the consistency of your trading outcomes.

Explore more trading insights:

- Flag and pennant patterns in trading: A complete guide

- How many pips is a point in YM? – Compare points, ticks & pips

- USD currency index chart: What it is & how to use it

9. Related questions (FAQs)

To help deepen your understanding of lead pip vs trailing pip and how they fit into real-world forex trading, here are answers to some of the most frequently asked questions. These practical insights can guide both beginners and experienced traders toward smarter decision-making.

9.1. What is the best pip distance for trailing stops?

The ideal trailing pip distance varies based on your trading style and current volatility. A good rule of thumb is to use recent Average True Range (ATR) readings:

-

Scalpers might trail every 5–10 pips

-

Swing traders may prefer 30–50 pips

Adjust dynamically depending on pair volatility and time frame.

9.2. Can I use both lead pip and trailing pip in one trade?

Yes you can combine them for full-cycle risk control:

-

Use a lead pip to enter after confirming momentum.

-

Activate a trailing pip once the trade moves into profit to lock in gains.

This duo ensures cleaner entries and adaptive exits, improving overall trade quality.

9.3. Do all brokers support trailing stops?

Most brokers on MT4/MT5 or cTrader support trailing stops. However, some brokers may have restrictions such as disabling trailing stops during weekends or near major news events. Always check broker policies and test on a demo.

9.4. Can the ‘Lead pip’ technique be implemented on TradingView?

The ‘Lead pip’ strategy is not an automated feature in TradingView. However, you can implement its logic manually by setting an alert at your desired entry price plus the buffer (e.g., resistance at 1.2000, set alert at 1.2010).

When the alert triggers, you would then manually execute the trade on your connected broker platform.

9.5. Is a pip‑based strategy more effective than ATR‑based stops?

Not necessarily they serve different purposes:

-

Pip-based stops are straightforward and easy to implement.

-

ATR-based stops adapt to current market volatility.

Many traders prefer combining both: using pip buffers for entries and ATR‑based trailing stops for exits.

10. Final thoughts: Choosing the right pip strategy for your trading plan

So, when faced with the lead pip vs trailing pip choice, don't look for a single 'best' answer. Instead, think of them as two different tools for two different jobs in your trading journey.

Your goal is to become the skilled mechanic who knows exactly when to use each one to build a disciplined and adaptable trading approach. Here’s a quick recap of their key differences:

-

Lead pip: A proactive buffer for precise trade entries, perfect for breakout strategies and avoiding false signals.

-

Trailing pip: A dynamic stop-loss tool that locks in profits while letting trades breathe, ideal for trending markets.

To find what works best for you, start experimenting with these techniques on a demo account. Platforms like MT4 or MT5 make it easy to test lead pip vs trailing pip strategies without risking real capital.

Dive deeper into our Pips & Lots series for more tips on building a robust trading plan. Ready to take control of your trades? Explore our resources at H2T Finance and start refining your strategy today!