Is currency trading halal in Islam? For Muslims stepping into the vibrant world of forex, this question carries profound weight, blending financial ambition with spiritual integrity.

Forex, the global marketplace where currencies dance in pairs like EUR/USD, captivates millions with its promise of opportunity. Yet, for those guided by Shariah, the path to trading must align with ethical principles that prohibit interest, uncertainty, and speculation.

This article will delve into the core Islamic finance principles that apply to forex trading and offer a practical roadmap. Our goal is to help you understand how you can engage with this market confidently while upholding your faith.

Key takeaways:

- Forex trading can be halal if it adheres to Shariah principles, avoiding riba (interest), gharar (excessive uncertainty), and maysir (gambling).

Swap-free accounts (Islamic accounts) eliminate interest-based fees, making them essential for halal trading. - Spot trading ensures immediate currency exchange, aligning with Shariah by avoiding delayed settlements that may involve riba.

- Informed decisions based on market analysis reduce speculation, ensuring trading aligns with Islamic ethics.

- Haram practices include interest-based transactions, excessive speculation, delayed settlements, and trading derivatives without owning assets.

- Beginners should choose Shariah-compliant brokers, practice with demo accounts, and focus on ethical intent to trade responsibly.

- No universal consensus exists among Islamic scholars on modern forex trading, so consulting a trusted scholar is recommended.

1. What is currency trading (Forex)?

Forex trading, often called currency trading, is the process of buying and selling currencies to profit from changes in their exchange rates.

As a beginner, understanding the basics of this market is crucial before exploring whether is trading in currency halal? or if currency trading aligns with Islamic principles. Forex is the largest financial market globally, operating 24 hours a day, five days a week, with a daily trading volume exceeding $7 trillion.

It’s a dynamic space where individuals, businesses, and institutions exchange currencies for various purposes, such as investment or hedging against currency fluctuations.

In the dynamic forex market, currencies are traded in pairs, such as EUR/USD (Euro and US Dollar). It’s an exciting playing field. For instance, if you expect the Euro to gain value compared to the Dollar, you would purchase the EUR/USD pair and patiently wait to sell it at a profit. The feeling of making the right prediction and reaping the reward is truly amazing!

One powerful yet risky tool in forex is leverage. It allows you to control a position much larger than your initial capital, offering the potential for substantial profits. Nevertheless, it carries the potential for substantial losses. I’ve seen many beginners drawn in by the accessibility of forex trading, but the market’s intense volatility demands serious learning and extreme caution.

For my Muslim friends, the most important question is always whether these activities align with Islamic principles. Together, we’ll take a deeper look into this matter.

2. Is forex trading halal in Islam? Understanding Shariah principles

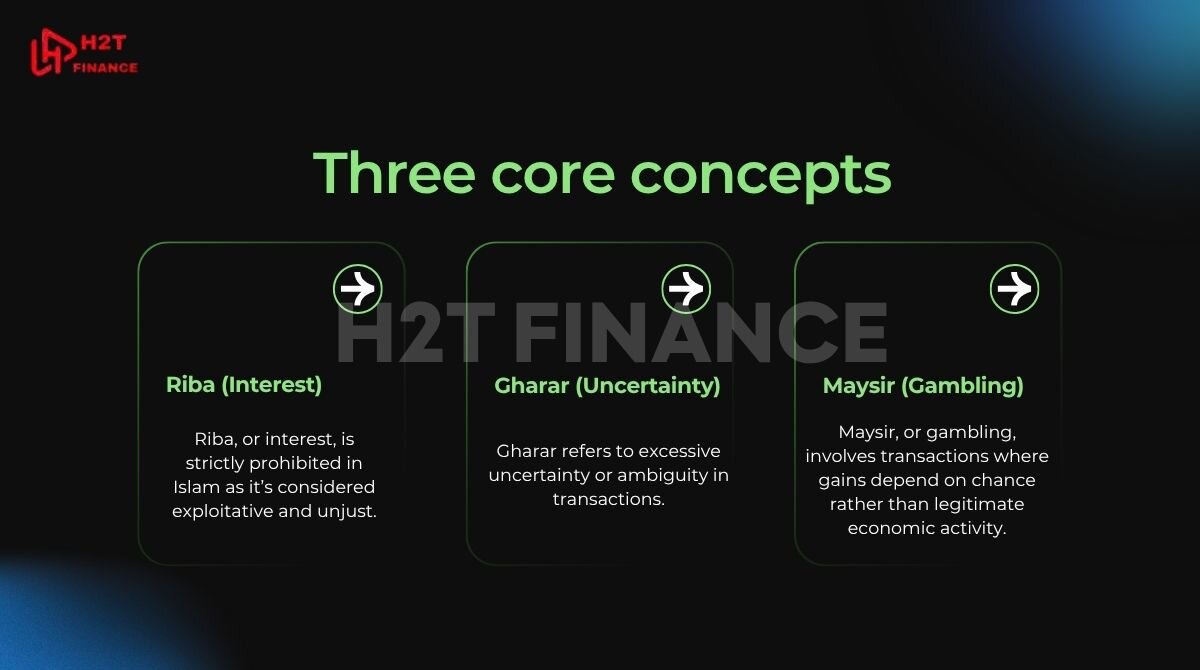

To determine if forex trading is permissible under Islamic law, it is essential to understand the foundational principles of Shariah. Whether forex trading is allowed for Muslims depends on three fundamental principles: Riba (interest), Gharar (uncertainty), and Maysir (gambling).

2.1. Riba (Interest)

Riba, or interest, is strictly prohibited in Islam as it’s considered exploitative and unjust. In forex trading, riba often appears as swap fees, interest charged or earned for holding positions overnight.

These fees conflict with Shariah principles, making standard forex accounts problematic for Muslims.

To ensure trading in currency is halal, traders must use swap-free accounts, also called Islamic accounts, which eliminate interest-based charges and align with Islamic finance.

2.2. Gharar (Uncertainty)

Gharar means a high level of uncertainty or vagueness in deals, which is forbidden in Shariah because it is similar to gambling. Forex trading’s high volatility can introduce gharar if trades are based on speculation without analysis.

For instance, predicting currency movements without research is risky and may be considered haram.

To adhere to Shariah, a trader must rely on thorough market analysis. This approach helps mitigate the element of uncertainty (gharar) and transforms trading into a calculated and responsible investment activity.

2.3. Maysir (Gambling)

Maysir, or gambling, involves transactions where gains depend on chance rather than legitimate economic activity. Some view forex trading as maysir due to its potential for speculative bets, especially without proper knowledge.

Shariah-compliant trading requires strategies grounded in analysis, such as studying currency trends or economic news, to avoid resembling gambling. By focusing on informed strategies, traders can ensure is forex trading halal in Islam. This approach transforms forex into a legitimate investment rather than a game of chance.

2.4. What do halal and haram mean in forex trading?

In Islamic finance, halal and haram are more than just legal terms; they are moral boundaries that define the spiritual dimension of every financial decision, (according to information from Dukascopy). Halal refers to practices that are permissible under Shariah law, rooted in fairness, transparency, and ethical intent. Haram, by contrast, includes activities that involve exploitation, uncertainty, interest (riba), or gambling (maysir), and are therefore forbidden.

When applied to forex trading, these terms take on critical significance. A halal forex transaction is not just one that avoids interest, but one that embodies honesty, immediate exchange, and genuine economic purpose. It transforms trading from a profit-only pursuit into an act of ethical responsibility.

Conversely, haram trading involves elements like delayed settlements, interest-bearing accounts, or blind speculation all of which undermine the trust and clarity required in Islamic financial dealings.

Understanding the difference between halal and haram in forex helps Muslim traders not only comply with Shariah but also uphold personal integrity in every transaction. It's about aligning your financial strategy with your faith, ensuring that every trade reflects both opportunity and accountability.

3. When is currency trading halal?

Finding your footing in the world of forex can be thrilling, but for our Muslim friends, it’s also essential to ensure your trading journey aligns with your faith. Understanding when currency trading is halal is the first, crucial step. It's about finding a way to participate in this exciting market while staying true to Islamic principles, and thankfully, it's absolutely possible.

Shariah-compliant trading isn't just a set of rules; it's a way of ensuring every transaction is ethical and fair. This means passionately avoiding forbidden elements like riba (interest) and gharar (excessive uncertainty). The aim is to ensure openness and fairness in every trade.

By focusing on these core values, you can confidently navigate the market. We've laid out the key conditions that make forex trading halal, so you can trade with a clear conscience and a full heart.

3.1. Spot trading

Spot trading entails the instant buying and selling of currencies at the prevailing market rate, usually settled on the same day (T+0). This aligns with Shariah principles as it avoids delayed settlements that could accrue interest (riba).

For example, buying EUR/USD and exchanging currencies instantly ensures no riba or gharar is involved. Spot trading is the most straightforward way for beginners to ensure is forex trading halal in Islam, as it focuses on real economic activity rather than speculative delays.

3.2. Swap-free accounts

Swap-free accounts, also known as Islamic accounts, were created as a great solution to eliminate overnight interest fees. With these accounts, you no longer have to worry about paying swap fees, providing peace of mind for traders who follow Islamic law.

Instead of charging interest, these accounts apply alternative fee structures, such as fixed administrative fees or wider spreads. It's a smart adjustment that allows you to stay true to your faith while still participating in the market.

However, it's important to understand that this remains a subject of debate among Islamic scholars. Some argue that higher spreads or other fees could be seen as disguised interest, while others accept the model as long as no explicit interest is charged.

This means you must be extremely cautious. Take the time to thoroughly review the terms and conditions to ensure the account truly aligns with your beliefs.

3.3. Informed decisions

To be halal, forex trading must be based on thorough research and analysis, not guesswork or excessive speculation. Shariah discourages transactions resembling gambling (maysir), so traders should study market trends, economic news, and technical indicators.

For instance, analyzing currency pair movements using tools like candlestick charts can reduce uncertainty (gharar). This approach ensures is trading in currency halal? is answered affirmatively when decisions are informed and strategic.

3.4. Ethical intent

The intention behind trading matters in Islamic finance. Trading should aim for legitimate wealth-building or economic purposes, not pure speculation or greed. Halal trading avoids supporting industries that violate Islamic values, such as alcohol or gambling.

I recommend beginners focus on ethical goals, like diversifying investments, to ensure their trading aligns with Shariah principles. This mindset helps confirm that currency trading is halal when conducted with integrity.

| Feature | Halal Forex Trading | Standard Forex Trading |

|---|---|---|

| Interest (Riba) | No swap fees (swap-free accounts) | Includes swap fees for overnight positions |

| Settlement | Immediate (T+0, spot trading) | May involve delayed settlement |

| Speculation | Based on analysis, minimal gharar | May involve high speculation |

| Ethical Intent | Wealth-building, ethical focus | May prioritize profit over ethics |

4. When is currency trading haram?

While currency trading can be halal under specific conditions, certain practices make it impermissible (haram) in Islam. For beginners exploring whether is forex trading halal or if currency trading aligns with Islamic values, understanding what violates Shariah principles is just as important as knowing what’s permissible.

Islamic finance prohibits transactions involving exploitation, uncertainty, or unethical behavior. Below, we outline the key practices that render forex trading haram, helping you avoid pitfalls and maintain ethical trading.

4.1. Interest-based transactions

Riba, or interest, is a core prohibition in Islamic finance, making any forex transaction involving interest haram. Standard forex accounts often charge swap fees interest for holding positions overnight which directly conflicts with Shariah law.

For example, keeping a trade open past a trading day may incur riba, rendering it impermissible. Many beginners unknowingly engage in such trades, assuming all forex is halal. To ensure is forex trading halal in Islam, avoid interest-based accounts and opt for swap-free alternatives.

4.2. Excessive speculation

Excessive speculation, resembling gambling (maysir), is prohibited in Islam. Forex trading becomes haram when trades are based on guesswork or high-risk bets without analysis.

For instance, trading currency pairs without studying market trends or economic indicators introduces excessive uncertainty (gharar).

Shariah emphasizes informed decisions over chance-based gains. Traders who prioritize quick profits over research often fall into this trap, making their trading haram. To keep currency trading halal, focus on strategic, data-driven trades.

4.3. Unethical practices

Forex trading is haram if it involves unethical practices or supports industries that violate Islamic values, such as alcohol, gambling, or pork. Shariah also prohibits deceptive behaviors like price manipulation, insider trading, or misleading claims (tadlis).

For example, participating in schemes promising unrealistic returns, like pyramid schemes, is impermissible.

4.4. Delayed settlement

Shariah requires immediate currency exchange (T+0) in forex to avoid riba and gharar. Transactions with delayed settlement, such as forward contracts involving interest or deferred delivery, are haram.

For instance, agreeing to exchange currencies at a future date with interest-based terms violates Islamic principles. Spot trading, which settles instantly, is the preferred method to ensure currency trading is halal.

4.5. Trading derivatives without owning the asset

Much of modern retail forex trading is conducted through financial derivatives like Contracts for Difference (CFDs). When trading CFDs, the trader does not actually own the currencies but is merely speculating on their price movements.

Many Islamic scholars consider this form of trading to be haram because it lacks the element of "real ownership" (qabd) and its nature is very close to gambling (Maysir), as it is based solely on price differences without any exchange of the underlying asset.

5. How to start halal currency trading as a beginner

Starting your halal forex journey as a beginner can feel both exciting and overwhelming, I’ve been there myself. For Muslims asking “Is currency trading halal in Islam?”, the answer lies not just in the market itself, but in how you approach it.

To trade in a way that aligns with your values, it’s important to take careful, intentional steps from the very beginning. That means learning the basics, understanding Shariah principles, and making sure every decision respects the ethics of Islamic finance.

This section is here to walk you through that process not by pushing any specific broker or account, but by offering a practical, ethical, and beginner-friendly guide. Below, we outline the essential steps to help you start your forex journey in a way that’s not only responsible, but spiritually grounded as well.

5.1. Choose a Shariah-compliant broker

Selecting a broker that offers Shariah-compliant services is the first step to ensure is forex trading halal in Islam. Look for brokers providing Islamic accounts that adhere to principles like avoiding riba (interest) and gharar (uncertainty).

Verify their credentials, such as regulatory oversight and clear terms for halal trading. For beginners, thoroughly researching a broker's reputation and carefully reading their Shariah compliance statements is a critically important first step. This ensures your trading aligns with Islamic values from the start.

5.2. Open a swap-free account

A swap-free account, or Islamic account, eliminates interest-based swap fees, making it essential for currency trading halal. These accounts are structured to comply with Shariah by using alternative fee models or waiving overnight charges.

To open one, visit a broker’s website, select the Islamic account option, and review its terms. The account avoids riba entirely, as some brokers may have hidden fees. This step ensures is trading in currency halal? is answered affirmatively.

5.3. Practice with paper trading

Paper trading allows beginners to practice forex without risking real money, making it an ideal way to learn halal trading. Using a demo account, you can simulate trades, test strategies, and understand market movements. This reduces gharar by building knowledge before live trading.

Paper trading helps beginners gain confidence while ensuring their practice aligns with Shariah principles. Start with a virtual platform to explore currency trading halal safely.

5.4. Learn market analysis

To make informed decisions and avoid speculative trading (maysir), learning market analysis is crucial.

Study fundamental analysis (e.g., economic news, interest rate changes) and technical analysis (e.g., candlestick charts, support/resistance levels).

These tools help predict currency movements, reducing uncertainty and ensuring is currency trading halal. For example, analyzing EUR/USD trends with charts can guide ethical trades. Dedicating time to resources like online tutorials to master analysis for Shariah-compliant trading.

| Step | Description | Why It’s Halal |

|---|---|---|

| Choose a Shariah-compliant broker | Select a broker with Islamic accounts | Ensures no riba or unethical practices |

| Open a swap-free account | Use an account without interest fees | Eliminates riba, complies with Shariah |

| Practice with paper trading | Simulate trades with virtual funds | Reduces gharar, builds knowledge |

| Learn market analysis | Study fundamental and technical analysis | Avoids maysir, supports informed decisions |

6. Common misconceptions about forex trading in Islam

Many beginners exploring currency trading halal encounter misconceptions that create confusion about its permissibility in Islam. These myths can discourage potential traders or lead to uninformed decisions.

For those asking is currency trading halal in Islam, clarifying these misunderstandings is key to understanding how forex can align with Shariah principles. Here, we clarify three widespread misconceptions to help you understand forex better and trade with confidence.

6.1. Myth 1: All forex is haram

Many people assume that all forex trading is haram simply because it's part of the financial markets. I thought the same at first, but then I examined it more closely. The truth is, whether forex trading is halal in Islam really depends on how it’s done. When practiced correctly, it can align with Islamic principles.

Forex becomes halal when it avoids riba (interest), gharar (excessive uncertainty), and maysir (gambling). That’s why methods like spot trading and using swap-free accounts designed specifically for Muslim traders are so important.

This common misconception often comes from a lack of knowledge about Islamic forex accounts, which are structured to follow Shariah law. Once you understand the reasoning and tools available, you’ll see that forex trading doesn’t have to go against your beliefs—it just has to be done the right way.

6.2. Myth 2: Leverage is always haram

Some assume that leverage is always haram because it increases risk. While it is true that leverage is not necessarily haram if it is offered as an interest-free loan (qard hasan) from the broker, the use of excessive leverage is discouraged by many scholars.

The reason is that it can lead to extreme risk, turning trading into a form of gambling (Maysir) and encouraging recklessness rather than prudent investment. Therefore, using leverage modestly and responsibly is a key factor in keeping the trade Shariah-compliant.

6.3. Myth 3: Forex equals gambling

Another false belief is that forex trading is merely gambling, comparing it to maysir. While speculative trades without analysis resemble gambling, forex can be a legitimate investment when based on research, such as studying economic indicators or technical charts.

Shariah-compliant trading emphasizes informed decisions to minimize uncertainty. Traders who treat forex like a game risk haram practices, but strategic trading ensures currency trading is halal as an ethical endeavor.

Check out more similar blog posts here:

7. Frequently asked questions about halal currency trading

Exploring forex trading often raises many questions for Muslims. This FAQ section addresses some of the most common concerns to provide clarity on how to trade ethically according to Shariah law.

7.1. Is trading in currency halal?

Yes, trading in currency is halal if it adheres to Shariah principles. This includes avoiding riba (interest) through swap-free accounts, minimizing gharar (uncertainty) with informed decisions, and steering clear of maysir (gambling) by using analysis-based strategies.

Spot trading, where currencies are exchanged instantly, is a common halal method. I’ve noticed that beginners often find clarity by focusing on these conditions to ensure currency trading is halal.

7.2. Can Muslims trade forex without an Islamic account?

While possible, trading forex without an Islamic account is risky for Muslims, as standard accounts typically involve swap fees (riba), which are haram. Without a swap-free account, overnight positions may accrue interest, violating Shariah.

I suggest choosing Islamic accounts to make sure that forex trading aligns with halal principles in Islam. If a broker doesn’t offer such accounts, carefully review their terms to confirm no riba is involved, though this is rare.

7.3. Is day trading halal in Islam?

Day trading, where positions are opened and closed within the same day, can be halal if conducted responsibly. It aligns with Shariah by avoiding overnight swap fees (riba) and focusing on immediate settlements.

However, day trading must avoid excessive speculation (maysir) by relying on market analysis. I’ve found that disciplined day traders using technical tools can ensure currency trading halal practices, making it a viable option for Muslims.

7.4. How do I find a halal forex broker?

To find a halal forex broker, research those offering swap-free or Islamic accounts that comply with Shariah principles. Check their regulatory status with bodies like the CFTC or FCA and review their Shariah compliance policies.

Look for transparent terms, such as no hidden interest fees. I suggest comparing brokers’ Islamic account features to ensure is currency trading halal in Islam with their platform. Online reviews and educational resources can guide your choice.

7.5. Can leverage be used in halal forex?

Leverage can be used in halal forex trading if it avoids interest-based fees. Many Islamic accounts offer leverage without riba, allowing traders to control larger positions ethically.

However, excessive leverage increases risk and may lead to speculative trading (maysir), which is haram. Beginners should use leverage cautiously, prioritizing risk management to ensure is trading in currency halal? remains true in their trading approach.

7.6. What kinds of trading are considered halal in Islam?

Trading is halal if it avoids riba (interest), gharar (uncertainty), and maysir (gambling). Halal types include:

- Spot trading: Immediate asset exchange (e.g., currencies, commodities) without interest or delay.

- Shariah-compliant stocks: Investing in permissible industries (e.g., tech, healthcare), avoiding haram sectors (e.g., alcohol).

- Commodity trading: Trading assets like gold with instant delivery and transparency.

- Islamic mutual funds/ETFs: Shariah-compliant investments avoiding riba and haram industries.

Trades must rely on analysis and ethical intent to ensure compliance.

7.7. Is Binance trading halal in Islam?

Binance trading can be halal if limited to spot trading of Shariah-compliant cryptocurrencies, avoiding riba, gharar, or maysir. Futures, margin trading, staking, or lending often involve interest or speculation, making them haram. To trade halal on Binance:

- Use spot trading without leverage.

- Verify cryptocurrencies avoid haram links.

- Avoid interest-based services.

Consult scholars, as Binance lacks a Shariah advisory board, requiring careful navigation.

7.8. Is currency trading haram in Islam?

Currency trading is haram if it involves riba (interest), excessive speculation (maysir), delayed settlement, or unethical practices. For example, standard forex accounts with swap fees are not Shariah-compliant.

7.9. Which type of trading is halal in Islam?

Halal trading includes spot trading (immediate exchange), using swap-free Islamic accounts, investing in Shariah-compliant stocks or commodities, and trading with ethical intent that avoids gambling or haram industries.

7.10. Is cryptocurrency trading halal in Islam?

Cryptocurrency trading can be halal if limited to spot trading of Shariah-compliant coins without leverage, interest, or speculative gambling. Futures, margin trading, or staking that involve riba or gharar are considered haram by many scholars.

7.11. Is day trading currency halal?

Day trading can be halal if positions are opened and closed within the same day, avoiding overnight interest (riba). However, traders must rely on analysis instead of speculation to avoid maysir, ensuring the practice remains Shariah-compliant.

8. Conclusion

Is currency trading Halal in Islam? Forex trading offers immense financial opportunities, but for Muslims, adhering to Shariah principles is paramount. The answer to whether currency trading is halal depends heavily on how it is conducted.

However, it is crucial to emphasize that there is no absolute consensus among all Islamic scholars regarding the permissibility of modern retail forex trading, even with the use of Islamic accounts.

Due to this complexity and the differing opinions, it is the individual's responsibility to conduct further research and consult with a trusted Islamic scholar before entering the market.

By using swap-free accounts, prioritizing spot trading, and making decisions based on thorough market analysis, you can confidently engage in the forex market while upholding your religious values.

If you want to start trading in a halal way, here are five key steps to help you get started:

- Choose a Shariah-compliant broker: Seek brokers offering Islamic accounts with transparent terms and no interest charges.

- Open a swap-free account: Ensure the account eliminates overnight fees (swap fees) to avoid riba.

- Practice with a demo account: Use paper trading to familiarize yourself with the market without financial risk.

- Learn market analysis: Master fundamental and technical analysis to minimize gharar and maysir.

- Maintain ethical trading intentions: Focus on building wealth legitimately, avoiding haram industries like gambling or alcohol.

At H2T Finance, our mission is to empower beginners with knowledge, not to promote trading accounts.

As a platform dedicated to sharing forex insights, tools, and strategies, we invite you to dive deeper into our Forex Basics category to build a strong foundation. Ready to learn more?