Understanding how to trade VIX index is essential for traders who want to navigate market volatility effectively. The VIX, often referred to as the “fear gauge,” measures market expectations of near-term volatility and provides unique insights into investor sentiment.

Unlike traditional assets, trading the VIX requires a different approach, combining specialized instruments, strategic timing, and strong risk management.

In this article, we will guide you through the key concepts of the VIX, explore popular trading platforms, examine proven strategies, and highlight essential technical tools.

Whether you are a seasoned trader or just beginning to explore volatility trading, mastering how to trade the VIX index can help you enhance your portfolio and manage risks in unpredictable markets.

1. What is the VIX index and why it matters

Before learning how to trade the VIX index effectively, it's essential to understand what it represents and why it plays a central role in modern market analysis.

Often referred to as the "fear gauge" or "fear index," the VIX short for the CBOE Volatility Index measures market expectations of near-term volatility conveyed by S&P 500 index options.

When the VIX is high, it indicates that traders anticipate major price swings, often due to uncertainty or market stress. Conversely, a low VIX suggests relative calm and stability.

Introduced by the Chicago Board Options Exchange (CBOE) in 1993, the VIX does not track actual price movement but instead quantifies expected volatility over the next 30 days. This forward-looking nature makes it an invaluable tool for traders seeking to hedge risks, time market entries, or capitalize on swings in sentiment.

Understanding the VIX index helps investors interpret broader market psychology. For instance, a sudden spike in the VIX usually corresponds with a market sell-off, prompting the famous phrase: “When the VIX is high, it’s time to buy.”

This inverse correlation with equities, especially the S&P 500 makes it a powerful indicator not just of volatility, but of potential turning points in the market.

By grasping the fundamentals of the VIX, traders can better prepare to navigate volatile environments and use it to inform strategic decisions. In the sections that follow, we’ll explore in detail how to trade the VIX index, the platforms best suited for it, and key strategies you can apply.

2. How to Trade VIX Index

Trading the VIX index requires a different mindset than trading traditional assets like stocks or forex. Because you can't buy the VIX directly, traders typically use derivative instruments that track VIX futures to express their market views.

Whether you're aiming to hedge against volatility or profit from market fear, understanding how to trade the VIX index is essential for building a more resilient trading strategy.

2.1. Can you trade the VIX directly?

No, you cannot trade the VIX index itself like a stock or ETF. Instead, you trade financial products that derive their value from VIX futures. These instruments include:

- VIX futures: These are the most direct way to gain exposure to expected volatility, but they are often better suited for experienced traders due to their complexity and pricing behavior.

- Options on VIX futures: These offer leveraged exposure and can be used to hedge or speculate on volatility changes.

- Exchange-traded products (ETPs): These are designed to mimic the performance of VIX futures. Examples include:

- VXX (iPath Series B S&P 500 VIX Short-Term Futures ETN)

- UVXY (ProShares Ultra VIX Short-Term Futures ETF)

- SVXY (ProShares Short VIX Short-Term Futures ETF, for inverse exposure)

These instruments enable traders to go long or short on market volatility. However, it’s crucial to understand that most of these products experience decay over time due to the futures curve structure (contango and backwardation), making them more suitable for short-term strategies.

2.2. Popular VIX trading instruments

Here’s a quick comparison of the most common instruments used to trade the VIX index:

| Instrument Type | Example Ticker | Suitable For | Notes |

|---|---|---|---|

| Futures | VX | Advanced Traders | Direct exposure, but complex margining |

| Options | VIX Options | Experienced Traders | High leverage, useful for hedging |

| ETNs/ETFs | VXX, UVXY, SVXY | Retail Traders | Easy access, but prone to time decay |

To choose the right product, you must first define your trading objective are you hedging, speculating, or diversifying your portfolio? Each product carries its own set of risks and behaviors that you must account for.

As you explore how to trade VIX index, keep in mind that its value tends to move inversely to the S&P 500. Therefore, these instruments are often used not only to bet on volatility itself but also as a counterweight in broader equity portfolios.

3. Choosing a trading platform – MT4, MT5, or TradingView?

To effectively trade the VIX index through ETFs, ETNs, or options, choosing the right trading platform can make a significant difference in execution, analysis, and overall experience.

While platforms like MT4 and MT5 are staples in forex and CFD trading, TradingView has gained popularity for its advanced charting capabilities and community features. Let’s break down their strengths and how they relate to trading volatility instruments.

Before diving into comparisons, remember that how to trade VIX index isn’t just about strategy it’s also about using the right tools for analysis and execution.

MT4 vs MT5 vs TradingView – which suits VIX traders?

Each platform has distinct features that cater to different trading styles and needs:

| Platform | Strengths | Limitations | Best For |

|---|---|---|---|

| MT4 | Lightweight, fast, supports automated trading (EAs), massive broker support | Fewer timeframes, limited asset classes | Forex traders, basic CFD users |

| MT5 | Broader asset coverage (stocks, ETFs), depth of market data, economic calendar | Slightly heavier, fewer custom indicators compared to MT4 | Traders needing multi-asset access |

| TradingView | Exceptional charting, social trading community, web-based access, custom scripts (Pine Script) | Execution depends on broker integration | Visual/technical analysis, VIX ETF traders |

TradingView is particularly suitable for those looking to analyze VIX-related instruments (like VXX, UVXY, or SVXY) thanks to:

- Real-time access to US market instruments

- Wide selection of VIX overlay indicators and volatility metrics

- Custom strategy scripting with Pine Script

- Built-in community ideas and backtesting

For instance, you can overlay the VIX index against SPX to spot divergence patterns, a technique often used in contrarian strategies.

While you may not execute trades directly on the VIX through MT4 or MT5 (unless your broker offers CFDs on VIX instruments), you can still use them to analyze correlated assets or hedge positions. TradingView, on the other hand, provides a more holistic environment for volatility-focused analysis.

View more:

- Best Book for Day Trading and Forex: Top 10 Picks You Must Read

- Psychological Aspects of Forex Risk Management

- Free Margin vs Used Margin: Explained

4. Popular VIX trading strategies

Understanding how to trade the VIX index goes beyond knowing which instruments to use; it's about choosing the right strategy that fits the nature of volatility. The VIX doesn’t behave like typical assets. It’s mean-reverting, often spikes suddenly, and moves inversely to the S&P 500. These traits open the door to several trading approaches, from trend-following to contrarian plays.

Before applying any strategy, traders must consider the derivative vehicle in use like VXX, UVXY, SVXY, or options and the associated risks. Let’s explore three common strategies used in VIX-based trading.

4.1. Trend-following with VIX

Although the VIX is typically a counter-trend asset, trend-following can still be applied in certain scenarios especially during sustained market fear or major events like financial crises or geopolitical shocks.

How it works:

- Enter long positions on VIX-related ETFs (e.g., VXX or UVXY) when the index breaks above key resistance or a moving average.

- Use a trailing stop or volatility bands to ride the trend and capture upward spikes.

- Pair with confirmation from S&P 500 chart breakdowns or macroeconomic news.

Best for: Traders with high-risk tolerance looking to benefit from prolonged market uncertainty.

4.2. Reversal strategy (contrarian view)

The saying "When the VIX is high, it’s time to buy" stems from the idea that fear in the market is often overdone and that high VIX readings may signal a bottom in equities.

How it works:

- Monitor for VIX spikes 2–3x above its 50-day moving average.

- Enter short positions in VIX ETFs or go long on the S&P 500 as fear peaks.

- Look for technical confirmation like candlestick reversal patterns or divergence on momentum indicators.

Best for: Experienced traders comfortable with timing tops and bottoms.

4.3. VIX-MA ratio strategy

This is a more quantitative approach, comparing the current VIX level to its longer-term moving average to determine if the market is under- or overpricing volatility.

Example setup:

- VIX / 20-day MA of VIX > 1.2 → Market fear is elevated → Potential reversal ahead.

- VIX / 20-day MA of VIX < 0.8 → Complacency → Possible volatility spike soon.

This relative metric helps smooth out noisy signals and is ideal for traders looking for systematic entries and exits.

5. Technical analysis tools for VIX trading

When trading volatility, technical analysis becomes a vital layer of insight. Unlike traditional assets, the VIX index and its derivatives often move in sharp, sudden bursts making it essential to use tools that help traders anticipate spikes or detect momentum shifts. Fortunately, there are a range of free and powerful resources to support your VIX trading journey.

Let’s break down the most useful tools and chart setups that can elevate your ability to trade the VIX index effectively.

5.1. Free tools & indicators for VIX

Before investing in premium software, many traders rely on free indicators to track volatility behavior. These tools can be used on platforms like MT4, MT5, or TradingView.

Essential indicators for VIX trading:

- Moving Averages (MA): A simple 20-day or 50-day MA can help you identify mean-reverting conditions or trend strength.

- Relative Strength Index (RSI): When the RSI on a VIX-related ETF exceeds 70, it may suggest overbought fear potentially a reversal.

- Bollinger Bands: VIX tends to “walk the band” during spikes. Watching for price touching the upper band can help confirm trend continuation.

- MACD (Moving Average Convergence Divergence): Useful for identifying divergence between the VIX and price movements of S&P 500.

These free tools are often enough for intermediate traders to analyze VIX behavior without overcomplicating their strategy.

5.2. Best charting setups on TradingView

TradingView is one of the most user-friendly platforms to visually analyze the VIX. It allows for real-time chart overlays, custom indicators, and easy comparison with other indices like the S&P 500 (SPX).

Recommended VIX charting techniques:

- Overlay SPX and VIX: Helps visualize the inverse correlation in real-time.

- Apply the VIX/MA Ratio as a custom indicator: Build alerts when the ratio crosses critical levels (e.g., 1.2 or 0.8).

- Use Heikin-Ashi candles on VXX or UVXY: These reduce noise and help spot clearer trends during high-volatility periods.

- Set up alerts for Bollinger Band breakouts: Particularly useful for catching early-stage VIX spikes.

TradingView’s free tier offers plenty of capabilities, making it ideal for traders who want to master how to trade the VIX index without paying for advanced charting suites.

6. Risk management when trading VIX

Trading the VIX index or more accurately, its related instruments can be highly rewarding, but also exceptionally risky. Volatility spikes are often abrupt and short-lived, making timing crucial. Without sound risk management, even experienced traders can face significant losses. That’s why developing a risk-conscious approach is critical for anyone learning how to trade the VIX index effectively.

Let’s explore essential techniques to protect your capital while navigating volatile markets.

6.1. Understand instrument-specific risks:

Trading VIX-linked products such as VXX, UVXY, or SVXY involves exposure to futures contracts, not the spot value of the VIX itself. These instruments often suffer from contango, where futures prices are higher than spot prices leading to value erosion over time, especially in long-term holds.

Tip: VIX ETFs/ETNs are often designed for short-term trading, not buy-and-hold strategies.

6.2. Position sizing and leverage control

Because of the explosive nature of volatility products, using excessive leverage or oversized positions can quickly lead to margin calls. Adopt conservative sizing and adjust it based on volatility conditions.

- Risk only 1–2% of your account per trade.

- Reduce size when VIX is above 25 market uncertainty is already elevated.

- Avoid trading during major news releases unless you have a defined strategy.

6.3. Set stop losses and take-profits

Always define a clear exit plan before entering a trade. This reduces emotional decision-making and prevents large drawdowns.

- Place trailing stops when riding strong VIX uptrends.

- For mean-reversion trades, set tight stops to manage risk if the expected reversal fails.

- Consider volatility-adjusted stops based on ATR (Average True Range) to account for larger price swings.

6.4. Diversify your trading approach

Don’t rely solely on VIX trading. Incorporate it as a part of a broader strategy alongside indices, forex pairs, or commodities. Volatility exposure can complement trend-based setups, but should never dominate your entire portfolio.

Pro tip: Think of VIX positions as a tactical hedge or short-term opportunity not a core investment strategy.

7. How do you trade options with VIX?

Trading options on the VIX allows traders to gain leveraged exposure to market volatility, either as a hedge or a speculative tool. However, due to their complexity and sensitivity to multiple factors such as implied volatility, time decay, and futures pricing VIX options require a solid understanding before diving in.

Key characteristics of VIX options:

- European-style expiration: VIX options can only be exercised at expiration, unlike American-style options.

- Cash-settled: These options are settled in cash based on the VIX settlement value, not the index itself.

- Based on VIX futures: They don’t track the spot VIX but are priced from the corresponding VIX futures contract.

Popular strategies to trade VIX options:

- Buying Calls Before Volatility Events: Traders anticipating market turbulence (e.g., elections, Fed announcements) often buy VIX call options to profit from expected spikes in volatility.

- Protective Hedges: Use VIX calls as portfolio insurance. For instance, if you're long S&P 500, buying VIX calls can offset potential losses during a sharp sell-off.

- Vertical Spreads (e.g., Call Spread): This reduces the cost of buying VIX calls by selling a higher strike call. It's useful when you expect a moderate increase in volatility, not a huge spike.

- Selling Options in Calm Markets: In low-volatility environments, experienced traders may sell VIX options (e.g., calls or puts) to capitalize on time decay though this carries significant risk if volatility suddenly rises.

Risk considerations:

- VIX options behave differently from equity options; don’t expect 1:1 correlation with VIX moves.

- Implied volatility can rise even as the VIX stays flat leading to pricing anomalies.

- Always consider the term structure of VIX futures and the expiration date of your option.

In summary, VIX options are powerful tools, but they require precise execution and a clear understanding of volatility dynamics. Start small, backtest your strategy, and always monitor your exposure closely.

8. How much VIX is good for trading?

The CBOE Volatility Index (VIX) measures expected market volatility over the next 30 days. Understanding what level of VIX is “good” for trading depends on your strategy whether you're hedging, speculating, or timing entries/exits based on sentiment.

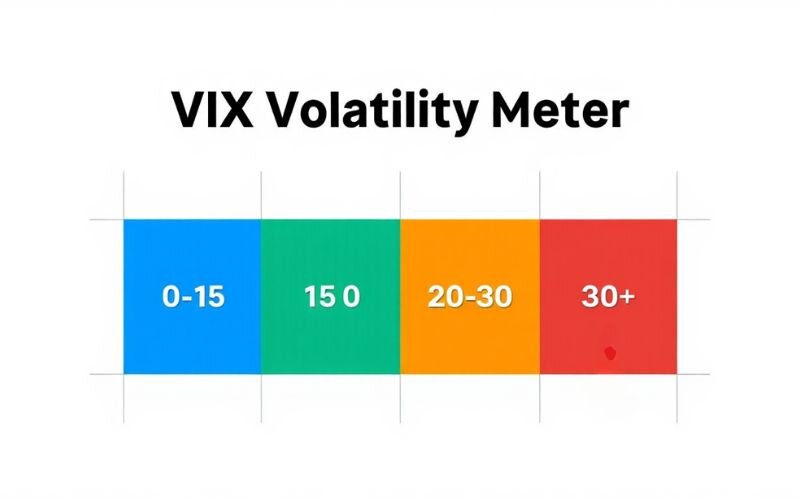

Key VIX level thresholds:

- VIX below 15: Market is calm; implied volatility is low. Options tend to be cheaper. This is typically a favorable environment for selling volatility (e.g., credit spreads, iron condors), but buying options may offer low cost entry especially for directional bets.

- VIX between 15–20: Considered a neutral zone. Markets may be showing mild concern but not panic. This is often viewed as a baseline or “normal” volatility range.

- VIX above 20: Indicates rising uncertainty. Traders may start positioning for larger market moves. Buying volatility becomes more attractive, particularly for those expecting further spikes. However, options become more expensive.

- VIX above 30: This signals high fear or stress in the market. During such periods (e.g., during financial crises or unexpected geopolitical events), intraday swings are large and options are extremely pricey. Ideal for aggressive traders seeking volatility, but the risk is much higher.

How to interpret VIX for your trading:

- Short-term traders often look for a spike in VIX as a signal that panic may be peaking potentially a contrarian buy signal for equities.

- Options traders gauge whether VIX is “rich” or “cheap” relative to historical averages and adjust strategies accordingly (e.g., switching from buying to selling premium).

- Volatility traders may use relative VIX levels (like comparing current VIX to its 10-day or 50-day moving average) to trigger trades.

No single VIX level is “best,” but:

- For premium selling (iron condors, credit spreads): VIX > 20 is often preferable.

- For buying options: VIX < 15 offers lower premiums.

- For VIX-based speculation: Levels above 25–30 can offer explosive moves, but come with elevated risk.

In short, the "best" VIX level depends on your strategy and risk tolerance. Knowing how to adapt your trades to different volatility regimes is more important than waiting for a magic number.

9. Common mistakes to avoid when trading the VIX

While many traders are drawn to the VIX due to its explosive potential and market insight, it’s also one of the easiest instruments to misuse. Misunderstanding how VIX-linked products behave can lead to costly errors. To master how to trade the VIX index successfully, it’s crucial to avoid these common pitfalls.

9.1. Mistaking the VIX for a tradable asset

One of the biggest misconceptions is thinking that the VIX itself can be bought or sold like a stock. In reality, you trade VIX derivatives such as ETFs, ETNs, or futures that track VIX futures prices, not the actual index value.

Avoid this: Don't expect your position to move point-for-point with the VIX index. Understand the underlying structure of your instrument before trading.

9.2. Holding VIX ETFs for too long

Products like VXX or UVXY experience decay over time, especially when the market is in contango. Holding these instruments for weeks or months can erode value even if the VIX stays flat or rises slightly.

- These instruments are meant for short-term trades or hedging.

- Holding them long-term without understanding decay mechanics can lead to slow, steady losses.

9.3. Trading VIX without a broader market context

The VIX is not a standalone signal it reflects fear or complacency in the S&P 500. Trading it in isolation, without tracking equity markets, news flow, or macro sentiment, can lead to misreads.

- Always pair VIX moves with S&P 500 price action.

- Use sentiment indicators or correlation tools for confirmation.

9.4. Ignoring volatility regimes

Trading the VIX the same way in different market environments is a mistake. The index behaves very differently during a market crash compared to a low-volatility grind.

- Use a regime filter: identify if you're in a high, mid, or low volatility phase.

- Strategies that work in a VIX 10–15 environment likely won’t perform well in a VIX 30+ scenario.

9.5. Overleveraging on inverse volatility products

Instruments like SVXY or XIV (now defunct) magnify risk because they move inversely to VIX futures. A sudden VIX spike can destroy these positions overnight.

Case study: In February 2018, the “Volmageddon” event caused XIV to lose over 80% in a single day, leading to its closure.

10. Should you trade the VIX index?

Trading the VIX index isn't for everyone but for the right type of trader, it can be a powerful addition to a diversified strategy. Before diving in, it’s important to consider your risk tolerance, trading style, and understanding of volatility mechanics.

10.1. Who should consider trading the VIX?

VIX-linked instruments can offer attractive short-term opportunities for:

- Active traders seeking to profit from sharp market swings.

- Hedgers looking to protect equity portfolios during periods of uncertainty.

- Contrarian investors betting on mean reversion in market sentiment.

However, due to the complexity of the instruments and the indirect nature of trading the index, VIX trading is best suited for intermediate to advanced traders.

10.2. Pros of trading the VIX

- Diversification: VIX instruments often move inversely to equities, offering a potential hedge.

- Volatility exposure: Ideal for traders who specialize in short-term movements and high-beta instruments.

- Market timing: Allows you to express views on market fear, greed, or complacency.

10.3. Cons of trading the VIX

- Product complexity: Most VIX-related products follow futures, not the index itself, and are subject to roll costs and time decay.

- Volatility drag: Especially with leveraged ETFs, which lose value rapidly if volatility doesn’t move significantly.

- Misuse risks: Trading based on the assumption that “VIX up = market down” can lead to errors if not confirmed by broader analysis.

10.4. Final consideration

Before you jump into learning how to trade the VIX index, take the time to backtest your strategies, understand product specifications, and evaluate if VIX exposure truly aligns with your broader trading goals. Trading volatility isn't just about chasing spikes, it's about managing uncertainty with precision.

11. FAQs

Before wrapping up, let’s address some of the most common questions traders ask when learning how to trade the VIX index. Whether you're new to volatility trading or refining your current strategy, these quick answers can help solidify your understanding.

11.1. Can I trade the VIX directly?

No, the VIX index itself is not directly tradable. Instead, traders use derivatives like VIX futures, options, ETFs, and ETNs that are based on expected VIX values.

11.2. What’s the difference between VIX ETFs and VIX futures?

- VIX futures are contracts on the expected future value of the VIX.

- VIX ETFs/ETNs, such as VXX or UVXY, are easier to access for retail traders but come with drawbacks like time decay and contango risk.

11.3. Is VIX a good hedge for my portfolio?

VIX products can serve as an effective short-term hedge during periods of sharp market sell-offs. However, they are not suitable for long-term protection due to structural decay in most instruments.

11.4. How often should I check the VIX?

While day traders might monitor the VIX throughout the session, swing traders often analyze it at key support/resistance levels, during economic news, or when volatility clusters are forming.

11.5. Do I need a special broker to trade VIX products?

Most brokers that offer access to options or futures markets will allow you to trade VIX-linked instruments. However, always check margin requirements and product availability.

11.6. Is trading VIX risky?

Yes, trading the VIX can be risky due to its nature as a volatility-based instrument. It tends to move sharply during periods of market stress, which can lead to significant gains or losses in a short time.

Additionally, many VIX-related products are derivatives (like futures or options), which involve leverage and decay risks. Proper risk management and a clear understanding of how these instruments work are essential before trading.

12. Final thoughts

Learning how to trade VIX index effectively goes beyond understanding volatility - it requires a solid strategy, disciplined execution, and the right tools. By combining a reliable trading platform with approaches like trend-following or contrarian setups, using technical analysis, and applying sound risk management, you can turn market volatility into trading opportunities.

Remember, the goal is not to predict every spike in the VIX but to navigate market sentiment with clarity and confidence. Whether you're just exploring how to trade the VIX index or looking to fine-tune your current approach, staying informed and practicing sound decision-making will keep you ahead of the curve.

Want to deepen your knowledge? Explore more trading guides, tools, and comparisons in our Forex Strategies section at H2T Finance – your trusted hub for unbiased forex and index trading education.