In the fast-paced world of forex trading, efficiency is everything. For traders, mastering how to save indicators on Sway Markets is a critical skill that can transform your trading experience.

By utilizing the template-saving features on the MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms provided by Sway Markets, you can reuse tailored setups with a single click. This saves time, ensures consistency, and allows you to focus on strategy execution.

We'll show you exactly how to do this, from saving indicators and customizing setups to comparing platforms. Let's get started on streamlining your analysis!

1. What are indicators and why save them on Sway Markets?

Technical indicators are mathematical calculations derived from historical price, volume, or open interest data, visualized on charts to assist traders in making informed decisions.

These calculations transform raw market data into actionable insights, such as identifying trends, momentum, or potential reversals. Common examples include the Relative Strength Index (RSI), Moving Averages (MA), and Bollinger Bands, each tailored to specific aspects of market analysis.

Indicators help traders navigate the complexities of forex markets by providing data-driven signals. In volatile environments like Sway Markets, where prices often oscillate without a clear trend, indicators such as RSI or Bollinger Bands enable traders to spot overbought/oversold conditions or range boundaries, improving decision-making precision.

Benefits of Saving Indicators on Sway Markets:

- Save time: Quickly apply pre-configured indicators to new charts without manual setup.

- Ensure consistency: Maintain uniform analysis across different trading sessions or assets.

- Adapt to volatility: Reuse setups tailored for Sway Markets’ range-bound nature.

Sway Markets, through the MT4 and MT5 platforms, supports a range of technical indicators for real-time analysis. By saving these setups, traders can focus on strategy execution rather than repetitive configuration, making it ideal for both scalping and long-term trading approaches.

2. Step-by-step guide: How to save indicators on sway markets

Saving indicators on the MT4/MT5 platforms offered by Sway Markets streamlines your trading process, allowing you to reuse customized setups across charts and sessions. The MT4 and MT5 platforms make this process straightforward, even for beginners.

Let's walk through the exact steps to set up, save, and apply your indicator templates for maximum efficiency and consistency.

2.1. Step 1: Access the MT4/MT5 Platform

Start by logging into your Sway Markets account and launching the MetaTrader 4 or MetaTrader 5 platform. Open the charting interface on the platform, which offers robust tools for technical analysis.

From the dashboard, select the asset or currency pair you want to analyze. Ensure your chart is set to your preferred timeframe (e.g., 1-hour, 4-hour) to align with your trading style, whether scalping or swing trading.

2.2. Step 2: Add indicators

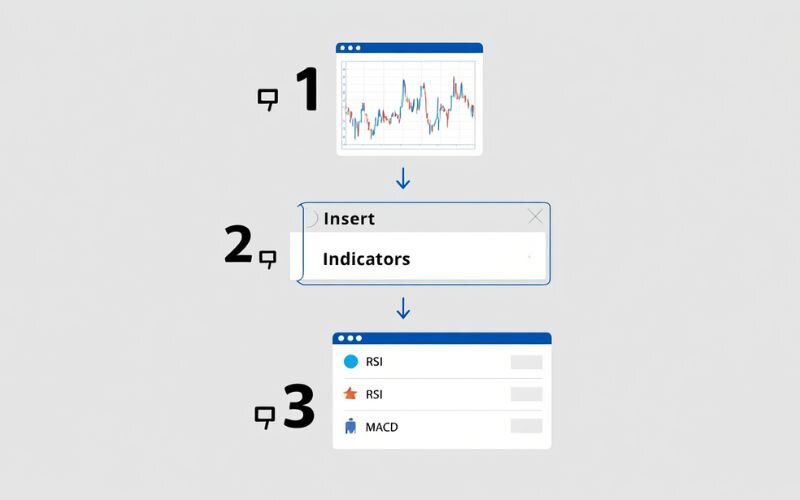

Once your chart is open, add your desired indicators. Click the “Indicators List” icon in the main toolbar, or navigate through the “Insert” -> “Indicators” menu on the MT4/MT5 platform.

Choose from popular options like RSI, MACD, or Bollinger Bands. Customize each indicator’s parameters such as period settings or colors to suit your strategy. For example, adjust the RSI period to 14 for standard analysis or 9 for faster signals.

2.3. Step 3: Save as template

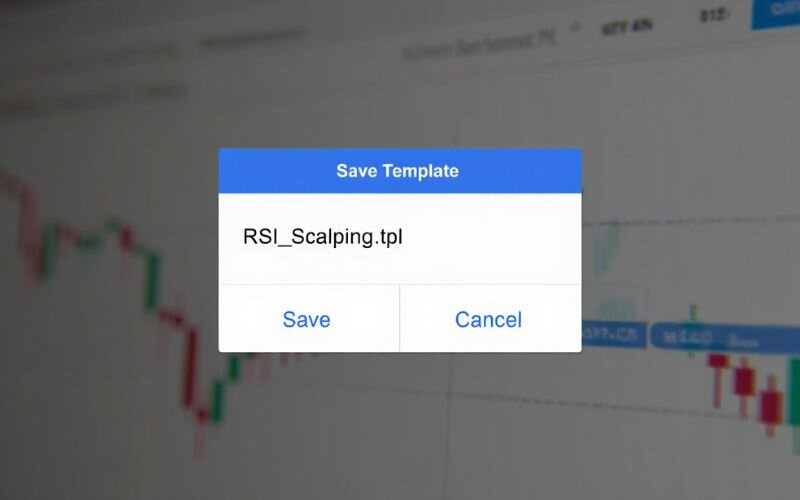

After configuring your indicators, save them as a template for future use. To do this on MT4/MT5, right-click on the chart, select 'Templates', and then click 'Save Template'. Click “Save Template” and proceed to name it. This feature, ensures you can quickly replicate setups without manual adjustments.

2.4. Step 4: Name and organize

Choose a descriptive name for your template, such as “RSI_Scalping” or “MA_Trend_Following,” to reflect its purpose. Organized naming helps you easily identify templates later, especially if you manage multiple strategies.

On MT4/MT5, templates are saved in a dedicated "templates" folder within the platform's data files, helping you keep your setups tidy.

2.5. Step 5: Apply templates

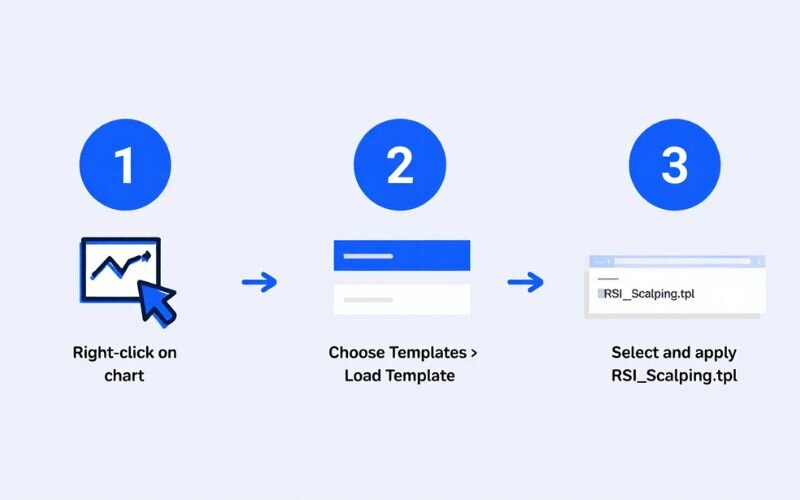

To use your saved template, open a new chart or switch assets. Find the “Load Template” option in the same menu where you saved it, select your template (e.g., “RSI_Scalping”), and apply it.

The chart will instantly display your pre-configured indicators, saving time and ensuring consistency. Test the template in Sway Markets’ demo mode to confirm it aligns with your trading goals.

3. How to customize indicators on Sway Markets for better trading

Customizing indicators on Sway Markets allows traders to tailor their technical analysis to specific strategies. The MT4 and MT5 platforms, the robust charting tools you use, offer flexible options to adjust indicator settings and visuals.

Saving templates is just the start. To get the most out of your indicators, you need to customize them. We'll cover how to do that, some best practices for optimization, and the key MT4/MT5 features that give you more control over your analysis.

3.1. Customization options

The MT4/MT5 platforms provide extensive customization for indicators to suit various trading styles. Traders can adjust parameters like the period for Moving Averages (e.g., 50-day vs. 200-day) or RSI thresholds (e.g., 30/70 for standard overbought/oversold levels).

Visual settings, such as line colors, thickness, or background shading for Bollinger Bands, can be modified for better chart clarity. You can also combine multiple indicators, like MACD with Stochastic, to create comprehensive setups that reflect your strategy, as highlighted in our forex trading strategies guide.

3.2. Best practices

To maximize the effectiveness of customized indicators, align settings with your trading approach. For scalping, use shorter periods (e.g., 9-day MA) to capture quick price movements, while swing traders may prefer longer periods (e.g., 50-day MA) for trend analysis.

Test customized setups in Sway Markets’ demo mode to evaluate performance without risk. Avoid overloading charts with too many indicators to prevent analysis paralysis, focusing on 2–3 complementary tools for clear signals.

3.3. Key features of MT4/MT5 for customization

The MT4/MT5 platforms enhance customization with real-time data feeds. Their interfaces allow seamless adjustments via settings menus.

The platforms support saving customized setups as templates, streamlining the process of how to save indicators on Sway Markets. Additionally, the mobile accessibility of MT4/MT5 lets you tweak indicators on the go.

View more:

- Missing allow modification of signal mt5

- What is a break of structure in trading

- Can you use the heiken ashi candles to scalp options

4. Trading platforms at Sway Markets: Comparing MT4/MT5 with TradingView

Sway Markets provides traders with two of the world's most powerful and popular platforms: MetaTrader 4 (MT4) and MetaTrader 5 (MT5). Understanding how these platforms' indicator management capabilities compare to other top choices like TradingView is crucial. This section compares the platforms based on key indicator-related features.

Corrected comparison table:

| Feature | MT4 / MT5 (offered by Sway Markets) | TradingView |

|---|---|---|

| Indicator Template Saving | Yes, saves as template files locally on your computer. | Yes, cloud-based sync, seamless across devices. |

| Customization Options | High, with many adjustable parameters and settings. | Very high, user-friendly interface with extensive visual options. |

| Mobile Accessibility | Good, with full-featured mobile apps for MT4/MT5. | Excellent, smooth mobile experience with cloud synchronization. |

| Free/Custom Indicators | Massive, through the MQL4/MQL5 community. | Massive, through community-written indicators in Pine Script. |

The MT4 and MT5 platforms offered by Sway Markets are incredibly powerful and reliable choices, especially known for their vast ecosystem of custom indicators. Saving templates is straightforward but is done locally on your device.

TradingView excels with its cloud-based synchronization and modern interface, though some advanced features require a paid subscription. The choice of platform will depend on whether you prioritize a time-tested ecosystem (MT4/MT5) or the convenience of the cloud and a modern interface (TradingView).

5. Popular trading strategies using indicators on Sway Markets

Technical indicators are the backbone of many forex trading strategies, and the MT4/MT5 platforms available through Sway Markets make it easy to implement and save these setups for consistent results.

Now that you can save indicator setups, you can apply popular trading strategies much faster. This is especially useful for capitalizing on the fast-moving, often range-bound nature of the markets at Sway Markets.

5.1. Strategies

Sway Markets supports a variety of trading strategies through its robust indicator library. Here are three popular approaches:

- Trend-following: Use Moving Averages (e.g., 50-day and 200-day MA) to identify and follow market trends. A bullish crossover (50-day MA crossing above 200-day MA) signals a buy, ideal for sustained moves.

- Reversal trading: Employ RSI or Stochastic Oscillator to spot overbought (above 70) or oversold (below 30) conditions, signaling potential price reversals.

- Range trading: Apply Bollinger Bands to trade within Sway Markets’ sideways movements, buying near the lower band and selling near the upper band, perfect for its characteristic price oscillations.

5.2. How to save these setups

To streamline these strategies, save their indicator configurations as templates on the MT4/MT5 platform. For example, create a “Trend_MA_Setup” template with customized 50-day and 200-day MAs or a “Range_Bollinger_Setup” with adjusted Bollinger Bands.

Follow the steps outlined in our guide on how to save indicators on Sway Markets to store these setups. Descriptive naming (e.g., “RSI_Reversal”) ensures quick access, and testing templates in demo mode, helps refine their effectiveness. Saved templates allow you to apply strategies instantly across charts, boosting efficiency. Learn more in our forex trading strategies guide.

6. Risk management when using indicators on Sway Markets

While technical indicators enhance trading decisions on Sway Markets, they are not foolproof and must be paired with solid risk management to protect your capital. Sway Markets’ volatile, range-bound environment demands disciplined strategies to mitigate losses and maximize gains.

This section outlines key risk management techniques to complement your indicator setups, ensuring you trade safely while leveraging the efficiency of how to save indicators on Sway Markets.

Effective risk management is critical in forex trading, especially in unpredictable markets like Sway Markets. Indicators like RSI or Bollinger Bands provide signals, but without proper safeguards, emotional or impulsive decisions can lead to significant losses. The MT4/MT5 platforms offer tools to support disciplined trading, and combining these with proven risk management practices, enhances your long-term success.

Key techniques include:

- Set stop-loss orders: Place stop-losses based on indicator signals, such as below support levels identified by Bollinger Bands, to limit potential losses.

- Use position sizing: Risk only 1–2% of your account per trade to spread risk across multiple positions, ensuring no single loss is devastating.

- Avoid overtrading: Stick to saved indicator templates to maintain consistency and avoid chasing signals, a common pitfall in volatile markets.

The integrated trading journal in MT4/MT5, allows you to track trades and evaluate risk-to-reward ratios. Regularly review your journal to identify patterns and refine your approach, ensuring your indicator-based strategies align with prudent risk management.

7. Free tools to enhance your Sway Markets experience

Maximizing your trading potential on Sway Markets goes beyond mastering how to save indicators on Sway Markets; it involves leveraging free tools to complement your technical analysis.

The MT4/MT5 platforms offer built-in features, but integrating external resources can provide deeper market insights and improve decision-making. This section highlights free tools that enhance your Sway Markets experience, helping you stay informed and efficient in volatile forex markets.

Sway Markets provides a robust platform for technical analysis, but additional tools can elevate your trading strategy. These resources, accessible at no cost, help you monitor market events, analyze trends, and refine your indicator-based setups. By combining the capabilities of MT4/MT5 with external tools, you can create a comprehensive trading toolkit.

Recommended free tools include:

- MT4/MT5's built-in features: Access a wide range of indicators (e.g., RSI, MACD) and the trading journal to track performance, streamlining your analysis process.

- Forex Factory Calendar: Monitor economic events like interest rate decisions that impact Sway Markets’ volatility, ensuring your indicator setups align with market conditions.

- Investing.com news feed: Stay updated on global market trends and geopolitical developments to contextualize your technical signals, available at no cost.

Discover related blog posts in this section:

8. Frequently asked questions (FAQs)

8.1. What are the best indicators for sideways markets?

Sideways markets, like those often seen on Sway Markets, are characterized by price oscillations within a range, lacking a clear trend. The best indicators for these conditions help identify overbought/oversold levels or range boundaries.

Bollinger Bands are highly effective, as they visually define upper and lower price ranges, ideal for range trading strategies. The Relative Strength Index (RSI) is another top choice, signaling potential reversals when prices hit overbought (above 70) or oversold (below 30) levels.

Additionally, the Stochastic Oscillator complements RSI by pinpointing momentum shifts within a range. Save these indicators as templates on the MT4/MT5 platform, to quickly apply them to sideways market conditions.

8.2. What are the best indicators to save on Sway Markets?

Popular indicators like RSI, Moving Averages, and Bollinger Bands are ideal for Sway Markets due to its volatile, range-bound nature. RSI helps identify overbought/oversold conditions, while Bollinger Bands suit range trading.

8.3. Can I use saved indicator templates on multiple devices?

Not by default. Indicator templates on MT4/MT5 are saved locally to the computer where you created them. To use them on another device, you would need to manually copy the template file from one device to the other.

8.4. How do I reset a saved indicator template on Sway Markets?

To manage a template, right-click the chart on MT4/MT5 and select 'Templates'. From there, you can load another template to replace it or save over an existing one. To delete a template permanently, you need to navigate to the platform's data folder (File > Open Data Folder > templates) and delete the corresponding template file.

8.5. What platform does Sway Markets use for trading?

Sway Markets offers the MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms. Therefore, the question isn't which is "better," but rather that you are using MT4/MT5 through Sway Markets. The indicator-saving features are standard functions of MT4 and MT5.

8.6. How do I access and manage indicators on mobile?

Download the MetaTrader 4 or MetaTrader 5 mobile app from the app store, then log in with your Sway Markets account credentials. You can add, customize, and manage indicators directly from the MT4/MT5 mobile app.

9. Conclusion

You now know that mastering how to save indicators on Sway Markets is more than just a technical trick; it's a key step toward trading smarter. By using templates on the MT4 and MT5 platforms, you'll spend less time setting up charts and more time focusing on what truly matters: making disciplined trading decisions.

From customizing indicators to integrating free tools and managing risks, this guide has equipped you with the knowledge to optimize your Sway Markets experience.

At H2T Finance, we’re committed to empowering traders with neutral, high-value insights no sales pitches, just practical education. Explore our Forex Basics section for foundational knowledge to elevate your skills.