Growing a trading account is the dream of every new and intermediate Forex trader. The idea of doubling your trading account sounds exciting yet in reality, it’s a path that demands careful strategy, emotional discipline, and risk management. Many rush in, seeking overnight gains, only to find themselves quickly facing significant losses.

If you're searching for the answer to 'how to double my trading account safely', you're not alone. I'm not going to outline a magic formula, because one doesn't exist. Instead, this article is about sharing real-world experience and proven methods to help committed traders grow their accounts sustainably over time without taking on unnecessary risk.

Let’s take a clear-eyed look at what works and what doesn’t.

Key takeaways:

- Doubling your trading account is possible through consistent, compounding growth—not quick wins.

- Risk management is the foundation: use small position sizes, strict stop-losses, and favorable risk-to-reward ratios.

- Compounding monthly returns of 5–10% can realistically double an account within 8–15 months.

- Proven strategies like trend-following, breakout/pullback trading, and swing trading offer safer paths to growth.

- Choosing the right trading platforms (MT4, MT5, TradingView) and free tools (Myfxbook, Investing.com) can sharpen your edge.

- Discipline, journaling trades, and managing emotions are as important as technical strategies.

- Doubling your account safely requires patience, structure, and long-term commitment, not chasing “home run” trades.

1. Understand the realistic path to how to double my trading account safely

Before you dive into aggressive strategies, it’s essential to set realistic expectations. Doubling your trading account is achievable but not instantly, and not without discipline. Many traders set out to do this in weeks or months, but without a solid foundation, they risk burning out both financially and emotionally.

Let’s explore the truth behind the goal and the traps that often derail it.

1.1. Is it really possible to double your trading account?

Yes, it is possible but not in the way that social media often suggests. The key is to aim for consistent, compounding returns rather than quick wins.

If you grow your account by just 5% per month, a modest yet achievable target for disciplined traders you can double it in approximately 15 months through compound growth. At a 10% monthly return, that timeframe shortens to around 8 months. The math checks out, but the execution depends on your ability to manage risk, follow a system, and avoid emotional trading.

For example, starting with $1,000 and growing at 8% monthly leads to over $2,000 in 9 months.

The takeaway? Focus on realistic, repeatable returns not on hitting a “home run” trade.

1.2. Common pitfalls when trying to double your account

So, why do so many traders fail in their quest to learn 'how to double my trading account safely'? The problem usually isn't that the goal is impossible. Believe me, the problem is that they sabotage themselves with poor decision-making and high-risk behavior. After years of trading and talking with the community, I've seen that these are the most common deadly traps:

- Overleveraging: Using large lot sizes relative to your balance can magnify losses.

- No stop-loss protection: Hoping trades will reverse instead of managing risk properly.

- Revenge trading: Trying to recover losses emotionally instead of objectively.

- Unrealistic expectations: Believing your $500 account should become $5,000 in two months.

These behaviors often stem from a lack of planning, education, or emotional control. In contrast, those who take a measured approach such as using defined strategies, journaling trades, and applying risk management are far more likely to succeed.

2. Key risk management principles for doubling safely

No matter how good your trading strategy is, you won’t be able to double your trading account safely without a strong foundation in risk management. In fact, it’s risk control not prediction that separates sustainable traders from impulsive gamblers. This section focuses on the core principles you need to protect your capital while pursuing steady growth.

Below are three essential techniques to manage risk effectively and support long-term account growth.

2.1. Position sizing based on risk per trade

One of the most important habits a trader can develop is calculating trade size based on a fixed percentage of their account balance. Rather than randomly choosing lot sizes, professional traders determine how much they’re willing to lose on any given trade often between 1% and 2% of their total capital.

For example: If your account is $1,000 and you risk 1% per trade, you only risk $10. That small risk protects your account from major drawdowns during a losing streak.

This approach keeps your losses manageable and ensures that no single trade can wipe out weeks of progress. It also supports psychological discipline, since smaller risks reduce the emotional pressure tied to each outcome.

2.2. Stop-loss and risk-to-reward ratio

Every trade should include a clearly defined stop-loss level, based on technical or logical price zones. Skipping stop-losses or widening them mid-trade to avoid closing a losing position is a fast way to damage your account.

Equally important is maintaining a favorable risk-to-reward ratio (RRR) at minimum 1:2. This means you aim to make $20 for every $10 you risk.

Benefits of using a consistent RRR:

- You can be profitable even with a lower win rate.

- It encourages patience and selectivity in trade entries.

- It discourages premature exits out of fear.

Traders who risk 2% per trade with a 1:2 RRR only need to win 34% of the time to break even, assuming consistent execution.

2.3. Compounding gains the smart way

The concept of compounding is simple yet powerful: by reinvesting profits rather than withdrawing them, your capital grows faster accelerating your progress toward doubling your account.

Instead of jumping from a $1,000 account to $2,000 with a single big win, think about growing by 5–10% per month, and allowing those returns to build upon each other.

Here’s an example of monthly compounding at 8% growth:

| Month | Balance ($) |

|---|---|

| 1 | 1,000 |

| 2 | 1,080 |

| 3 | 1,166 |

| 4 | 1,260 |

| 5 | 1,361 |

| 6 | 1,471 |

| 7 | 1,589 |

| 8 | 1,716 |

| 9 | 1,853 |

| 10 | 2,001 |

This example shows how safe, consistent returns can double an account in less than a year without extreme risk.

I can tell you this from countless observations: the most successful traders I know aren't the ones hunting for 'home run' trades. They are the ones who quietly reinvest their modest gains, and that makes all the difference in the long run.

Once you apply these risk management principles as standard practice not as a backup plan you create a framework for long-term success and safe account growth.

3. Strategic approaches to safely double your forex account

How to double my trading account safely with risk management in place, the next step is choosing the right trading strategies to support consistent growth. The goal here is not to find a “holy grail” but to use tested, low-risk strategies that align with your personality, market conditions, and time availability. Whether you're a swing trader or prefer shorter intraday moves, choosing the right approach is critical when aiming to double your account safely.

Below are three practical trading strategies to consider each with its own strengths and ideal use cases.

3.1. Trend-following strategies

Trend-following is one of the most recommended approaches for safely growing a Forex account. Instead of trying to predict reversals or catch tops and bottoms, you trade in the direction of the dominant trend. This improves win probability and reduces emotional decision-making.

“The trend is your friend” this timeless rule exists for a reason.

Popular indicators to support trend-following strategies include:

- EMA (Exponential Moving Average) – to identify trend direction

- RSI (Relative Strength Index) – to confirm strength or spot pullbacks

- ADX (Average Directional Index) – to measure trend strength

Suggested time frames for trend-following:

- H1 and H4 for clarity and reduced noise

- D1 (Daily) for more experienced swing traders

Tip: Wait for pullbacks to key levels (e.g., EMA20 or previous structure) before entering, rather than chasing the move.

3.2. Breakout & pullback strategies

Breakout and pullback trading focuses on identifying key price levels where the market is likely to move rapidly after consolidation. These strategies are ideal for catching strong moves while keeping risk tight.

There are two main ways to approach this:

- Breakout entries: Enter as price breaks above resistance or below support, often with momentum confirmation (volume, candle patterns).

- Pullback entries: Wait for price to retest the breakout zone before entering offers better risk-to-reward ratio and confirmation.

Advantages of breakout/pullback strategies:

- You enter with the momentum, reducing the need to “predict”.

- Well-defined invalidation zones for stop-loss placement.

- Pairs well with tools like TradingView’s price alerts or Myfxbook for volatility monitoring.

Personal experience has taught me a valuable lesson: waiting for a pullback requires patience, but it often provides much safer entry points than chasing aggressive breakouts, especially in highly volatile pairs.

3.3. Swing trading vs day trading – Which is better for growth?

Choosing between swing trading and day trading depends on your goals, schedule, and psychological profile. Both can be effective if executed with discipline, but each carries unique pros and cons.

Here’s a quick comparison:

| Factor | Swing Trading | Day Trading |

|---|---|---|

| Time Commitment | Low – trade a few times per week | High – requires constant screen time |

| Holding Time | 1–5 days or more | Intraday only (no overnight) |

| Risk per Trade | Slightly higher (wider SL) | Lower per trade, more trades |

| Suitable For | Part-time traders, less stress | Full-time traders, faster feedback loop |

| Strategy Types | Trend-following, breakouts | Scalping, intraday momentum |

If your goal is to double your account without burnout, swing trading often provides a more balanced path especially for those with jobs or limited time.

In summary, doubling your trading account doesn’t mean reinventing the wheel. It means using strategies that are simple, repeatable, and built on probability while integrating them with the risk controls you’ve already mastered.

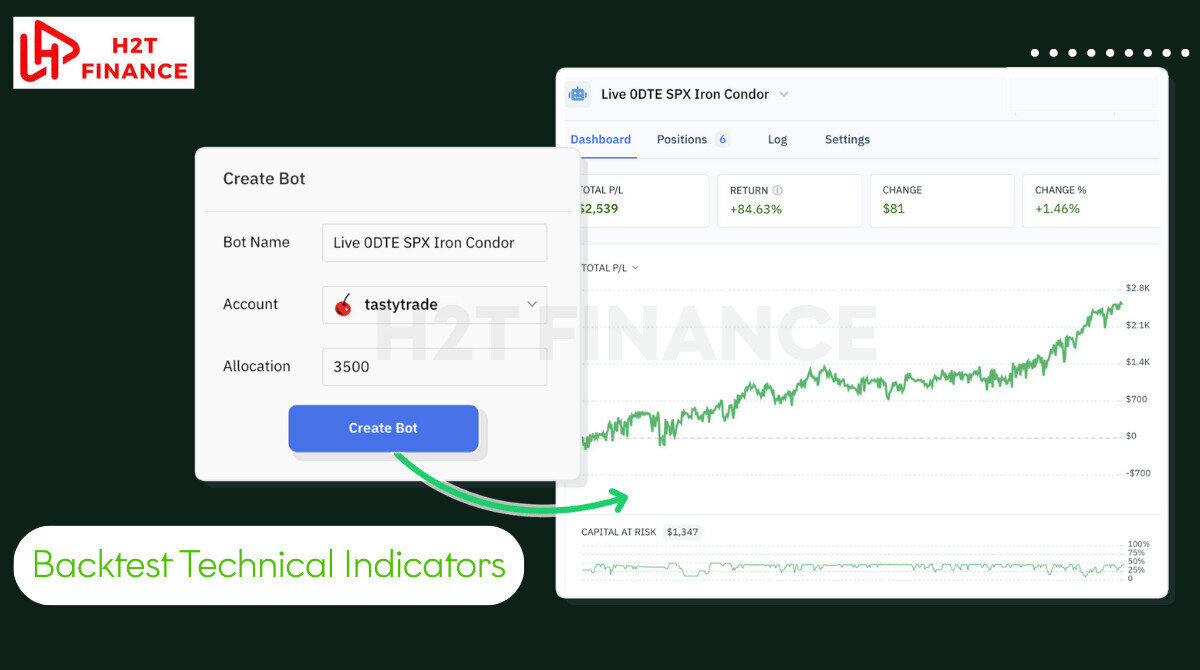

4. Tools and platforms to help you trade smarter

Even the best strategy will fall short if it’s not supported by the right tools. Whether you're testing setups, analyzing trends, or managing trades, your trading platform and technical tools play a critical role in your performance. To double your trading account safely, it’s essential to choose platforms that offer reliability, flexibility, and features that support data-driven decisions.

Let’s explore which platforms and tools can help you sharpen your edge.

4.1. Trading platforms comparison – MT4 vs MT5 vs TradingView

Choosing the right trading platform is more than just convenience it can directly influence your ability to execute and evaluate trades. Each platform has its strengths depending on your trading style and goals.

Below is a breakdown of three of the most widely used platforms by Forex traders:

| Feature | MT4 | MT5 | TradingView |

|---|---|---|---|

| Backtesting Capabilities | Yes | Yes | No (limited) |

| Custom Indicators | Yes | Yes | Yes |

| Community Tools & Sharing | No | No | Yes |

| Multi-Asset Trading | No (Forex only) | Yes (CFDs, stocks, etc.) | Yes |

| User Interface | Moderate | Moderate | Intuitive, modern |

| Web-based Access | Limited | Limited | Yes |

Summary:

- MT4 is lightweight and reliable for traditional Forex traders.

- MT5 offers more tools, better speed, and broader asset support.

- TradingView shines with its social features, modern charts, and scripting tools ideal for technical analysis and multi-device access.

Personally, I’ve found TradingView highly effective for backtesting and idea-sharing, especially for visual traders who rely on clean charting and market context.

4.2. Free technical analysis tools to support growth

There’s no need to invest in expensive software to access professional-grade analysis. Many free Forex tools provide excellent features that can help you plan trades, track performance, and manage risk effectively.

Here are some of the most useful free tools for traders aiming to double their accounts safely:

- Investing.com: Provides real-time news, economic calendar, and technical breakdowns by asset class. A great daily reference.

- Myfxbook: Offers advanced analytics, trade history tracking, and auto-trade features. Especially useful for reviewing performance and maintaining discipline.

- TradingView (Free Plan): Access to numerous public indicators, community scripts, and powerful charting tools. Ideal for backtesting and journaling.

- Autochartist (some brokers offer it for free): Scans the market for chart patterns, Fibonacci setups, and key levels helpful for confirming setups across multiple pairs.

When used alongside your chosen strategy, these tools enhance decision-making and help you avoid impulsive or emotion-driven trades.

5. Practical tips to stay disciplined during the doubling journey

No strategy or tool can replace discipline. In fact, most trading failures happen not because of bad market analysis, but due to poor execution, lack of consistency, and emotional decisions. If you're serious about doubling your trading account safely, mastering your mindset and daily habits is just as important as technical setups.

This section covers practical ways to stay focused, improve self-awareness, and maintain long-term consistency.

5.1. Journaling every trade

One of the most underrated habits of successful traders is keeping a trading journal. By recording every trade including entry, exit, reason for taking the trade, outcome, and emotional state you gain insights into your patterns, strengths, and recurring mistakes.

A simple Excel sheet or a tool like Notion, Evernote, or even a handwritten log works well. Your journal should include:

- Pair traded

- Entry & exit price

- Stop-loss & take-profit levels

- Trade setup (e.g., trend pullback, breakout)

- Why you entered

- What happened

- What you learned

This single habit has saved me more times than I can count. After a winning streak, my journal keeps my ego in check and my feet on the ground. After a tough loss, it stops me from 'revenge trading' out of desperation. Reviewing my notes forces me to confront the objective truth, instead of letting my emotions drive my decisions.

Over time, your journal becomes your most personal trading tool, revealing what works and what doesn’t.

5.2. Backtesting and forward testing your strategy

Before risking real capital, it's critical to validate your trading system in both historical and live (demo) environments.

- Backtesting: Go through past market data to test how your strategy would have performed. Tools like Soft4FX, TradingView’s Bar Replay, or Forex Tester allow for manual and automated testing.

- Forward testing: Use a demo account to test your system in real time without risking money. This helps you evaluate how the system behaves with live market dynamics.

Benefits:

- Builds confidence in your system.

- Identifies flaws before they cost real money.

- Helps fine-tune entries, exits, and SL/TP levels.

Backtesting with discipline also removes the emotional filter it’s just data. That clarity can prevent you from making impulsive adjustments when you move to live trading.

5.3. Managing trading psychology under pressure

Emotions are inevitable in trading but managing them is a skill you can learn. The path to doubling your account will likely include setbacks, periods of drawdown, and self-doubt. How you respond determines your long-term outcome.

Here are proven techniques to help manage your mindset:

- Set a daily loss limit (e.g., 2%): Once hit, stop trading for the day.

- Take scheduled breaks during the session especially after losses.

- Avoid trading when emotionally charged (e.g., after personal stress or major news).

- Review your trading journal weekly to stay accountable.

Professional traders often use routines, like pre-market checklists and post-trade analysis, to stay emotionally neutral. Building structure around your process reduces decision fatigue and panic-driven mistakes.

As someone who's mentored beginner traders, I’ve seen consistent mindset management make a bigger impact than any technical indicator.

Related reads to deepen your knowledge:

- How to draw regrassion channel indicator for MT4: Complete guide

- Japanese candlestick colors meaning: Easy Forex guide

- MT4 MT5 trading software forex ratings & strategy guide

6. Frequently asked questions (FAQs) how to double my trading account safely

When it comes to the goal of doubling a trading account, many traders especially those early in their journey have similar concerns. Below are the most common questions we hear, along with practical answers rooted in real trading experience.

6.1. How long does it take to double a trading account safely?

The answer depends on your monthly return and your level of risk. For example:

- At 5% monthly growth, it takes about 15 months to double your account.

- At 10% monthly growth, the timeline shortens to around 8 months.

These are reasonable targets with solid strategies and discipline. Trying to rush the process often leads to reckless decisions and blown accounts.

6.2. Is it possible to double your account in one month?

Technically, yes but not safely. Doubling an account in a single month usually requires extreme leverage, large positions, and aggressive trading. While some traders may get lucky, the risk of blowing up your account is far higher than the reward.

If your goal is sustainable, repeatable growth, avoid high-risk, short-term thinking.

6.3. What’s the safest risk-per-trade ratio to follow?

Most risk managers and experienced traders recommend risking between 0.5% to 2% of your account on any single trade. This range allows room to absorb losing streaks without destroying your capital.

- At 1% risk per trade, you’d need 69 consecutive losses to lose 50% of your account.

- At 5% per trade, you’d only need 14.

The takeaway? Small, consistent risk keeps you in the game long enough to benefit from a winning strategy.

6.4. Can I double my demo account first as practice?

Yes and it's a smart idea. Practicing on a demo account helps build familiarity with your platform, test strategies, and simulate emotional control. However, keep in mind:

- Demo trading doesn’t reflect real emotions.

- It’s easy to take risks you wouldn’t in a live account.

Once you have a strategy with consistent demo success, move to a small live account to start developing your real-world discipline.

6.5. How to double a trading account?

The safest way is through consistent, compounding returns, usually aiming for 5–10% monthly growth with strict risk management. Avoid overleveraging or chasing quick wins.

6.6. What is the 3 5 7 rule in trading?

It’s a guideline suggesting traders should aim for risk-to-reward setups of 1:3, 1:5, or 1:7 depending on the trade. The idea is to risk small but aim for larger multiples in return, ensuring long-term profitability.

6.7. What is the 100% profitable martingale strategy?

The martingale system involves doubling your position after each loss, hoping to recover all previous losses with one win. While it sounds “100% profitable” in theory, in reality it’s extremely risky and can quickly wipe out an account. It’s not considered a safe method to double your trading account.

6.8. What is the 5-3-1 rule in trading?

This rule encourages focus: trade 5 currency pairs, use 3 trading strategies, and master 1 time frame. It’s designed to reduce overwhelm and improve consistency by narrowing focus.

7. Final thoughts – Doubling your account is a journey, not a shortcut

At the end of the day, if you’re still wrestling with the question of "how to double my trading account safely", remember that the answer isn't found in a secret indicator or a perfect strategy. It's found in you in your discipline.

The traders who truly reach this milestone and go beyond it aren't chasing wild wins. They are simply doing the work, day in and day out. This path isn't sexy, and it isn't fast. But it's effective, and that's what matters.

At H2T Finance, we believe in helping traders grow through education, smart tools, and proven techniques not hype or shortcuts. Whether you’re just starting out or looking to scale your trading, the path to doubling your account is always rooted in discipline, strategy, and patience.

New to trading? Start building your foundation with our Forex Basics series essential guides for mastering the core concepts before scaling up.