How big is the foreign exchange market? This question highlights the scale and complexity of the world’s largest and most liquid financial market. With a staggering daily trading volume exceeding USD 7.5 trillion, the forex market dwarfs all other global markets, offering immense opportunities for investors, institutions, and speculators alike.

In this article, H2T Finance takes you inside the massive ecosystem of foreign exchange to uncover what drives its size, who the key players are, and why understanding its scale matters for every trader and investor.

Key takeaways:

- Massive scale: The foreign exchange (forex) market is the world’s largest financial market, with a daily trading volume of USD 7.5 trillion as of April 2022, far surpassing other markets.

- Global reach: Operating 24/5 across major hubs like London, New York, Tokyo, and Singapore, the forex market facilitates seamless international trade and investment.

- Diverse participants: Key players include reporting dealers (e.g., global banks like JPMorgan), other financial institutions (e.g., hedge funds), and non-financial customers (e.g., multinational corporations).

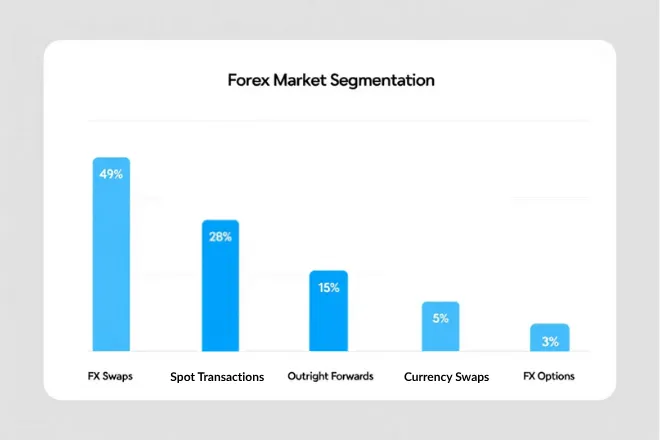

- Instrument variety: FX swaps dominate with ~49% of daily volume, followed by spot transactions (~28%), outright forwards (~15%), currency swaps (~5%), and FX options (~3%).

- Growth drivers: Globalization, cross-border trade, algorithmic trading, retail trader participation, and currency volatility fuel the market’s expansion, projected to grow from $0.89 trillion in 2025 to $1.18 trillion by 2030 (CAGR 5.83%).

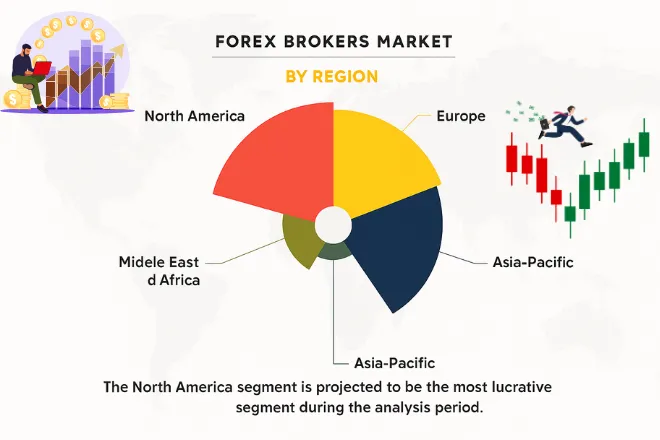

- Regional dynamics: North America holds the largest share (25.8%), while Asia-Pacific is the fastest-growing region due to economic development and digital adoption.

- Recent trends: Innovations like real-time hedging tools, strategic alliances (e.g., JPMorgan and Goldman Sachs), and enhanced regulations by the ECB are shaping the market in 2024–2025.

1. What is the foreign exchange market?

The foreign exchange market, commonly known as forex, is the world’s largest and most liquid financial marketplace where currencies are bought, sold, and exchanged. Unlike centralized markets like stock exchanges, forex operates over-the-counter (OTC), meaning trades occur directly between participants through electronic networks.

The forex market operates 24/5 across hubs like London, New York, Tokyo, and Singapore, enabling seamless global trading. It supports international commerce by facilitating currency conversions for businesses and investors.

Central banks use forex to stabilize economies through exchange rate interventions. With a $7.5 trillion daily volume, it’s the backbone of global finance.

For example, a U.S. company importing goods from Europe uses the forex market to exchange dollars for euros, while traders speculate on currency movements to profit from price fluctuations.

2. How big is the foreign exchange market?

The foreign exchange (forex) market is the largest and most liquid financial market in the world, dwarfing all others by sheer volume. According to the Bank for International Settlements’ Triennial Central Bank Survey (2022), the global forex market recorded a daily trading volume of USD 7.5 trillion in April 2022 — a significant increase from USD 6.6 trillion in 2019.

The forex market size in 2025 is projected to reach $0.89 trillion, growing to $1.18 trillion by 2030 (CAGR 5.83%). The international foreign exchange market thrives on increased cross-border trade. Algorithmic trading further boosts its massive scale. This exponential growth highlights the critical role of foreign exchange in today’s interconnected global economy.

2.1. Forex market segmentation by trading volume

The USD 7.5 trillion daily turnover encompasses various transaction types including spot transactions, forwards, FX swaps, currency swaps, and FX options. Of this amount, FX swaps accounted for the largest share, representing about 49% of total turnover.

| Transaction Type | Share of Daily Volume |

|---|---|

| FX Swaps | ~49% |

| Spot Transactions | ~28% |

| Outright Forwards | ~15% |

| Currency Swaps | ~5% |

| FX Options | ~3% |

These figures demonstrate the massive scale of the forex ecosystem and its indispensable role in global finance, trade, and investment.

2.2. Forex market segmentation by participants

The forex market comprises a variety of participants, each playing a distinct role:

- Reporting Dealers (e.g., global banks like JPMorgan, Citi, BNP Paribas): These institutions dominate the market due to their access to deep liquidity, advanced trading platforms, and robust infrastructure. In 2024, reporting dealers led the market thanks to their pivotal role in price discovery and risk management.

- Other Financial Institutions (e.g., hedge funds, pension funds, mutual funds): These participants engage in speculative trading and hedging, contributing significantly to market liquidity.

- Non-Financial Customers (e.g., multinational corporations, importers/exporters): They use forex primarily for managing operational exposure and currency risk in international transactions.

This layered structure illustrates the diversity and depth of the forex market, from high-frequency traders to corporate treasurers.

2.3. Forex market segmentation by instrument type

In terms of trading instruments, currency swaps led the market in 2024, accounting for approximately 40.2% of the market share. These instruments are widely used by global corporations and financial institutions for hedging and optimizing cash flows across currencies.

- Currency Swaps: Strategic tools for managing long-term currency risk and debt.

- Outright Forwards & FX Swaps: Common among traders managing short- to medium-term exposure.

- FX Options: Useful for structured trades with conditional outcomes, favored in risk-sensitive environments.

The diversity of instruments allows participants to tailor strategies based on risk appetite, time horizon, and business needs.

2.4. Forex market segmentation by regions

The forex market spans key regions, contributing to its size:

- North America: U.S. (19%), Canada, Mexico

- Europe: UK (38%, London), Germany, France, Italy, Spain

- Asia-Pacific: Japan, China, India, Vietnam, South Korea

- Middle East & Africa: UAE, Saudi Arabia, South Africa, Turkey, Egypt

- Latin America: Brazil, Argentina, Colombia

These regions and players highlight the global currency exchange market’s reach. The market’s structure, with diverse counterparties like reporting dealers and institutions, drives its $861 billion value in 2024 (IMARC Group).

See more related articles:

- Guide To Forex Technical Analysis for Beginners | Smart Trading

- Top 5 Forex Indicators: RSI, MACD, MA, Bollinger Bands, Stochastic

3. Factors driving the forex market’s growth

The forex market's size and continued expansion are the result of several fundamental forces shaping today’s global economy. From increased international trade to the proliferation of trading technology, each factor plays a vital role in accelerating the forex market growth rate and reinforcing its position as the world’s most liquid financial market.

3.1. Globalization and cross-border trade

The global economy is more interconnected than ever. As countries exchange goods and services across borders, the need to convert currencies becomes a daily necessity. In 2023, U.S. international trade alone exceeded $7 trillion, reflecting the massive volume of cross-border transactions requiring foreign exchange.

This demand for currency conversion fuels consistent activity in the forex market, particularly among businesses, governments, and multinational corporations, significantly contributing to the overall currency trading market size.

3.2. Technology and algorithmic trading

Technology has revolutionized how forex is traded. The rise of electronic platforms, mobile apps, and automated systems has made trading faster and more efficient. As of recent estimates, algorithmic trading accounts for nearly 70% of forex transactions globally.

These innovations have:

- Lowered barriers to entry for retail traders

- Increased trade volumes through high-frequency trading

- Improved market access for both institutional and individual participants

The seamless accessibility and real-time execution provided by platforms such as MetaTrader, cTrader, and TradingView continue to expand the size and liquidity of the market.

3.3. Retail trader participation

The number of retail forex traders has surged over the past decade, driven by increased awareness, user-friendly platforms, and the appeal of 24/5 trading. In the United States alone, approximately 175,000 active retail forex accounts were recorded in Q2 2022, with the global number reaching into the millions.

This trend continues to grow as more individuals seek alternative investment opportunities and flexible trading models. Retail traders, though smaller in size individually, collectively contribute a significant portion to daily trading volume, especially in major currency pairs.

3.4. Currency volatility and economic policy

The forex market thrives on volatility, and that volatility is largely influenced by macroeconomic events, interest rate decisions, and central bank policy. Monetary policy shifts from institutions like the U.S. Federal Reserve, European Central Bank (ECB), and Bank of Japan directly impact currency value fluctuations, creating opportunities for both short-term traders and long-term investors.

Other contributors to volatility include:

- Inflation and employment reports

- Political instability or geopolitical conflict

- Trade policy updates

These events drive price movement, increasing the volume of speculative and hedging activity, thereby supporting forex liquidity and growth.

4. Current trends shaping the rapid expansion of the forex market

Understanding how big the foreign exchange market is requires more than just looking at turnover statistics—it also involves identifying the underlying forces that continue to fuel its growth. With a daily trading volume of $7.5 trillion as of April 2022, the forex market is the largest and most liquid financial market in the world. Several emerging trends are responsible for the continued expansion of this already massive market.

4.1. Forecast of foreign exchange market growth (2025–2029)

According to the latest report from Technavio (2024), the global foreign exchange market is projected to grow by an additional USD 582 billion during the period 2025–2029, with a compound annual growth rate (CAGR) of 10.6%. This expansion is driven by digitalization, the rise of mobile trading, and the increasing demand for currency risk hedging amid global economic volatility.

Market size analysis by region:

- Europe is expected to contribute 47% of the global growth, particularly from financial hubs such as the UK, Germany, and Switzerland.

- Asia-Pacific (APAC), with rapidly developing markets like India, China, and Japan, is also experiencing outstanding growth thanks to rising foreign investments and high adoption of trading technologies.

- North America continues to lead in current market size, supported by high liquidity and robust legal systems in the U.S. and Canada.

Market segmentation by type and instrument:

- By participant type: The report notes that “reporting dealers” (large financial institutions) remain the dominant group, with an estimated value of USD 278.6 billion in 2019 and steady growth projected through 2029.

- By trading instrument: Popular instruments include currency swaps, FX options, and forward contracts, widely used for both hedging and investment purposes.

By platform: Electronic and mobile trading are gradually replacing traditional over-the-counter (OTC) methods.

4.2. Rising number of trading opportunities due to high liquidity and volatility

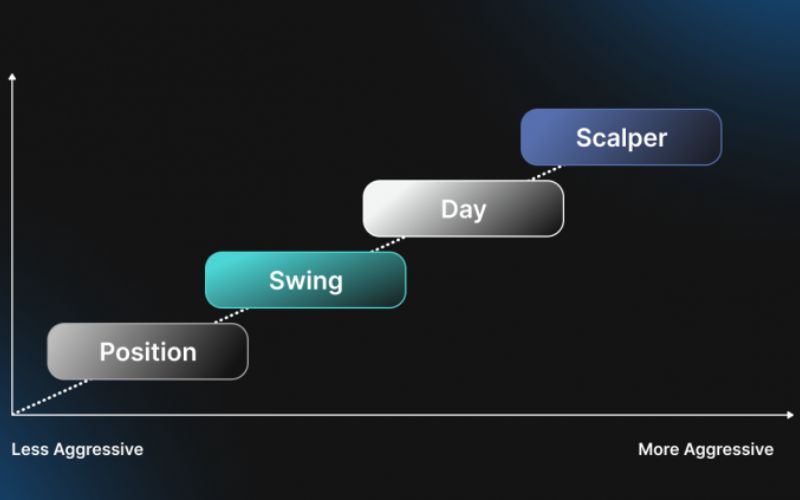

The foreign exchange market thrives on liquidity, a key factor that enables fast transactions with minimal price disruption. The high liquidity reduces transaction costs and provides flexibility in trading strategies such as:

- Scalping – benefiting from small price movements.

- Day trading – entering and exiting trades within the same day.

- Swing trading – capitalizing on short-term price trends.

- Position Trading – holding trades for the long term based on fundamental trends.

As more participants, from retail traders to institutions, enter the market to capitalize on these opportunities, the size and depth of the forex market continue to grow.

4.3. Increased mergers, acquisitions, and strategic partnerships

A significant driver of forex market expansion is the consolidation of services through mergers and acquisitions:

- In January 2023, the Rostro Group, a U.S.-based capital firm, acquired Scope Markets Group, a Belize-based FX provider—expanding its footprint across Asia, Latin America, and Africa.

- BNP Paribas, the largest bank in the EU, entered a major research partnership with Kayrros to support ESG-focused investment and trading—showing how environmental intelligence is becoming integrated with forex operations.

- BNP Paribas’s insurance subsidiary also signed a deal to acquire Fosun Group’s 9% stake in Ageas, indicating a broader trend of financial giants extending influence across sectors through strategic acquisitions.

These alliances reflect an ecosystem that is becoming more interconnected and comprehensive, helping forex firms diversify offerings and capture a larger share of the growing currency trading market.

4.4. Accelerated globalization and cross-border financial integration

The deregulation of capital markets and the rise of online payments have transformed how money moves around the world:

- Today, a student in Africa can pay tuition fees in the UK using local currency, which gets seamlessly converted into GBP or USD using payment platforms like PayPal or Wise.

- Cross-border e-commerce has exploded, with businesses accepting international payments through multi-currency gateways.

- Real-time currency conversion services support not only consumer transactions but also large-scale B2B forex settlements.

According to the Global Interconnection Index 2024 by Equinix:

- Businesses are now connecting with 30% more partners in twice as many locations.

- Industry leaders are innovating 25% faster by embedding global connectivity into operations.

- By 2025, over 80% of B2B transactions are projected to take place digitally—many involving currency conversion.

These developments significantly increase the demand for foreign exchange services, further expanding the global forex market value.

5. Latest updates on the foreign exchange market in 2025

The global foreign exchange market has experienced significant developments throughout 2024–2025, driven by the active participation of major financial institutions, technological innovation, and new regulatory measures. These changes not only reflect robust growth but are also reshaping how the market operates and connects on a global scale.

5.1. Next-generation forex products supporting real-time hedging

In January 2024, FX Solutions - a leading foreign exchange service provider announced a new product called Real-Time Hedging. This tool enables businesses to automate real-time currency hedging strategies, helping to mitigate the impact of exchange rate fluctuations. It represents a significant technological advancement in optimizing financial risk management.

5.2. Strategic alliances between global financial giants

March 2024 marked a strategic collaboration between JPMorgan Chase and Goldman Sachs, two global financial powerhouses, aimed at expanding their foreign exchange trading capabilities. The partnership leverages JPMorgan's extensive market access and Goldman Sachs' advanced technology platform, paving the way for a new generation of currency trading services.

5.3. Stripe expands global payments and forex services

In May 2024, payment technology company Stripe secured a strategic investment of USD 600 million from Sequoia Capital and other investors. The funding is intended to scale its global payment network and enhance its integrated foreign exchange services meeting the growing demand for currency conversion in cross-border e-commerce.

5.4. European Central Bank Tightens FX Trading transparency

In February 2025, the European Central Bank (ECB) introduced new regulations requiring banks to increase transparency in their foreign exchange trading activities. The goal is to improve market fairness and efficiency while reducing the risk of rate manipulation, a long-standing concern in the industry.

These recent developments highlight a period of significant transformation in the foreign exchange market, driven by technological innovation, large-scale strategic investments, and tighter regulatory oversight.

Keeping pace with these trends not only enables investors and businesses to adjust their strategies accordingly, but also reinforces the foreign exchange market’s role as a critical pillar of the modern global financial system.

6. Frequently asked questions (FAQs)

6.1. What is the current foreign exchange market size?

As of 2024, the foreign exchange market has a daily trading volume of approximately $7.5 trillion, making it the largest and most liquid financial market in the world.

6.2. Who are the key players in foreign exchange market?

Major players include Deutsche Bank AG, UBS Group AG, JPMorgan Chase & Co., State Street Corporation, XTX Markets Limited, Jump Trading LLC, Citigroup Inc., Bank of America, The Goldman Sachs Group, and The Bank of New York Mellon.

6.3. Which is the fastest growing region in foreign exchange market?

The Asia-Pacific region is the fastest growing due to rapid economic development and increasing digital adoption.

6.4. Which region has the biggest share in foreign exchange market?

North America holds the largest share, accounting for about 25.8% of the global forex market in 2024.

7. Conclusion

With a daily trading volume exceeding $7.5 trillion, the foreign exchange (forex) market stands as the largest and most liquid financial market in the world. It plays a vital role at the heart of global commerce and capital flow. The rapid rise of electronic trading, cross-border commerce, and algorithmic execution continues to expand the market’s depth and reach.

Whether you're a retail investor, financial institution, or multinational corporation, understanding the scale, structure, and growth drivers of the forex market is essential to unlocking opportunities, managing risk, and optimizing global financial strategies.

So, how big is the foreign exchange market? The answer lies not only in the staggering volume of trades but also in its profound impact on the global economy. If you're looking to navigate this vast financial ocean with confidence, H2T Finance is here to guide your journey with expert insights and trusted analysis.