Forex never sleeps, and neither does the pulse of opportunity it brings. But knowing exactly what time does the forex market open can be the difference between catching the wave or missing out entirely. Imagine the excitement of being in the right place at the right moment, ready to seize the market’s moves.

In this guide, I’ll personally walk you through the forex market hours, uncover the magic of session overlaps, and reveal how mastering these moments can transform your trading game. If you’re serious about leveling up, understanding the forex market open time is the foundation you simply can’t afford to overlook.

Key takeaways:

- Global 24/5 market: Forex operates 24 hours a day, five days a week, starting Sunday 5 PM EST (Sydney) and closing Friday 5 PM EST (New York).

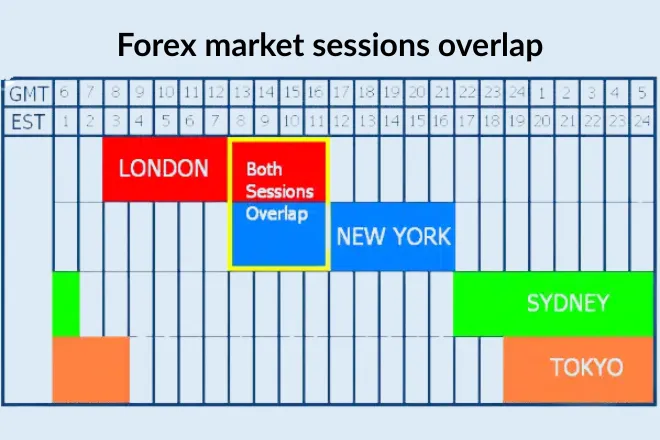

- Major trading sessions: Sydney, Tokyo, London, and New York sessions each have unique characteristics, with overlaps like London–New York (1 PM–5 PM GMT) offering high liquidity and volatility.

- Session overlaps: These periods, especially London–New York, provide the best trading opportunities due to increased volume and tighter spreads.

- Daylight saving time (DST): DST shifts session hours in regions like the US, UK, and Australia, requiring traders to adjust their schedules.

- Holidays impact: Christmas, New Year’s, and regional holidays like Japanese Golden Week can reduce liquidity or close the market entirely.

- Strategic timing: Align trading with active sessions (e.g., London for GBP/USD, Tokyo for JPY pairs) to optimize momentum and avoid slippage.

- Trusted resources: Use platforms for accurate market hours and economic calendars.

- Trading strategies: Leverage weekend gaps, London open breakouts, or London–New York overlap for intraday trading to maximize profits.

1. What are the forex market hours? What time does the forex market open?

Through years of trading, I’ve learned that timing can turn an average trade into a great one. Unlike traditional stock exchanges, the forex market operates 24 hours a day, five days a week, thanks to its global nature and decentralized structure.

The market opens on Sunday at 5 p.m. EST in New York and closes on Friday at 5 p.m. EST, giving traders worldwide the opportunity to trade at virtually any time during the workweek.

However, this doesn’t mean the market is always buzzing with activity. The heartbeat of the market changes volatility, trading volume, and the overall vibe can shift dramatically depending on whether you’re trading during the Sydney, Tokyo, London, or New York session. It’s like each session has its own personality, its own rhythm that can either fuel your excitement or test your patience.

Here’s how it all unfolds:

Forex trading kicks off in Sydney, then flows to Tokyo, sweeps through London, and finally lands in New York. Each session runs about 9 hours, but the magic happens during those overlap moments when one session is winding down and another is just getting started—bringing a surge of energy and opportunity to the market.

It’s like a global relay race that never stops, offering traders a constant stream of chances to jump in. Yet, there’s a peaceful lull between 7 PM and 10 PM EST, when New York is slowing down and Sydney hasn’t quite picked up the pace.

And if you’ve ever wondered when the forex market awakens on Sunday, it’s at 5 p.m. EST (that’s 10 p.m. UTC), marking the start of Sydney’s session and the fresh beginning of another exciting trading week.

The following outlines the opening and closing times of the four main forex trading sessions:

| Forex Session | Local Time (Open – Close) | EST (Open – Close) | UTC (Open – Close) |

|---|---|---|---|

| Sydney | 7:00 AM – 4:00 PM | 5:00 PM – 2:00 AM | 10:00 PM – 7:00 AM |

| Tokyo | 9:00 AM – 6:00 PM | 7:00 PM – 4:00 AM | 12:00 AM – 9:00 AM |

| London | 8:00 AM – 4:00 PM | 3:00 AM – 12:00 PM | 8:00 AM – 4:00 PM |

| New York | 8:00 AM – 5:00 PM | 8:00 AM – 5:00 PM | 1:00 PM – 10:00 PM |

Note: These hours may shift slightly during Daylight Saving Time (DST) in the U.S., U.K., and Australia.

2. Why can the forex market stay open 24 hours a day?

This around-the-clock nature of forex trading still surprises many newcomers. In my early days, I too was curious: How can a financial market never sleep?

The secret behind forex’s nonstop nature lies in a mix of cutting-edge technology and our planet’s vast geography. Unlike stock markets tied to a single exchange, forex trading happens over-the-counter (OTC), through a complex web of banks, brokers, and financial institutions scattered across different time zones.

As one major financial hub closes its doors for the day, another springs to life somewhere else in the world. This global relay race keeps the forex market buzzing 24 hours a day, Monday through Friday. It’s no wonder that, according to the Bank for International Settlements (BIS), the market sees an astounding average daily trading volume of $7.5 trillion making it the largest and most liquid market on Earth.

With over 170 currencies changing hands, the US dollar, euro, yen, and pound lead the pack. If you want to truly grasp the ebb and flow of the market, understanding when the forex market opens in each region is your key to spotting the best moments for liquidity and volatility those windows where opportunity really comes alive.

3. Why are the opening and closing hours of the forex market important for a trader’s success?

If there’s one thing I emphasize to traders I mentor, it’s this: timing your trades to match market activity can drastically improve your results.

Opening and closing hours are when volatility spikes, driven by news releases, institutional flows, and economic data. For example:

- The Tokyo trading session: Is particularly suitable for traders who concentrate on JPY pairs like USD/JPY and EUR/JPY.

- London session: offers strong momentum and is perfect for GBP/USD or EUR/USD.

- New York session: ideal for trading USD-crosses and catching late-day volatility.

Matching your strategy to these active hours can help you capture bigger moves, avoid slippage, and make more informed decisions. It’s also crucial if you’re a day trader or scalper, because these styles depend heavily on momentum and liquidity.

So next time you ask yourself at what time does the forex market open, don’t just look at the clock, look at your trading plan.

Check out more similar blog posts here:

Session overlaps create prime trading opportunities. These time windows are when two major sessions are open at once, resulting in increased trading volume and market volatility.

Understanding what time does the forex market open in each region helps traders identify these overlaps and capitalize on the most active hours. Here are the key overlap periods:

- London & New York: 1:00 PM – 4:00 PM GMT: Most active. High liquidity. Best for EUR/USD, GBP/USD.

- Sydney & Tokyo: 00:00 AM – 7:00 AM GMT: Quieter. Ideal for trading AUD/JPY or NZD/JPY.

- London & Tokyo: 8:00 AM – 9:00 AM GMT: Short overlap. Low volatility.

In my experience, the London–New York overlap is the golden hour for trading. During this period, I’ve consistently seen tighter spreads, faster executions, and explosive market moves.

5. Be aware of key factors when exploring what time does the forex market open

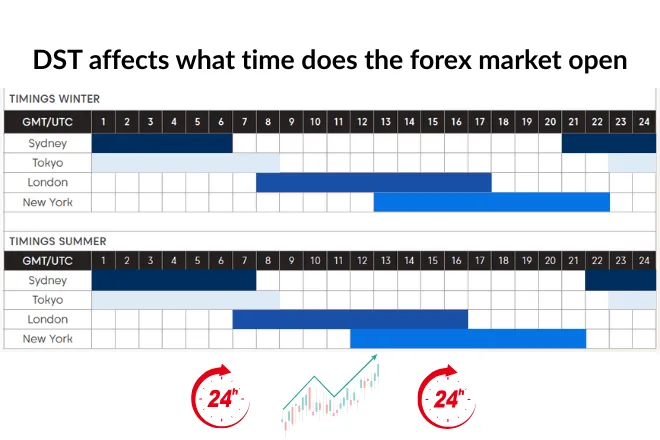

Understanding what time the forex market opens goes beyond looking at the clock. There are dynamic variables, such as daylight saving time and global holidays, that subtly shift the landscape of forex market hours, and these changes can either enhance or undermine your trading results if you're not paying attention.

5.1. Daylight Saving Time (DST)

One often-overlooked factor is daylight saving time (DST), which temporarily shifts the schedule of global forex trading sessions, particularly in countries like the United States, the United Kingdom, and Australia. If you're not tracking these seasonal changes, you may find yourself entering trades during thin liquidity hours or missing key overlaps between sessions.

During November to March (Winter), for example:

- The Sydney session operates between 10:00 PM and 8:00 AM GMT, which corresponds to 9:00 AM to 7:00 PM in local time.

- The Tokyo market is open from 11:00 PM to 9:00 AM GMT, aligning with 8:00 AM to 6:00 PM in local Tokyo time. (Note: Tokyo is not affected by DST.)

- London session shifts to 7:00 AM to 5:00 PM GMT.

- New York session adjusts to 12:00 PM to 10:00 PM GMT.

I’ve personally witnessed traders lose valuable pips simply because they overlooked these subtle time shifts. It’s a costly mistake that could have been avoided. That’s why, in my own trading routine, I make it a point to always double-check session openings with a reliable time converter or set up alerts on a trusted forex calendar app.

Keeping a close eye on when the forex market opens especially around Daylight Saving Time has saved me from more than a few painful timing errors.

And it’s not just the big sessions that matter. I’ve learned to watch the smaller markets too places like New Zealand, Frankfurt, Hong Kong, and Singapore because if you’re trading cross pairs or exotic currencies, these can be the hidden pockets of opportunity or risk that make all the difference.

5.2. Holidays that affect the forex market hours

Public holidays are another factor that can quietly disrupt your trades. Although the forex market operates 24 hours a day, five days a week, it shuts down completely on Christmas Day and New Year’s Day.

Other holidays like Japanese Golden Week or U.S. Thanksgiving may not shut down the market but can dramatically reduce liquidity and volatility, particularly in specific currency pairs. For example, trading the JPY during Japanese bank holidays can lead to sudden drops in volume and irregular price behavior.

To stay updated, I personally follow economic calendars from platforms like Forex Factory or Investing.com. These tools highlight global events and help identify low-volume days that can affect your spreads, slippage, and risk exposure.

6. When does the forex market open to offer the most favorable trading opportunities?

After years of tracking forex market hours, I’ve learned one truth: overlaps = opportunity.

The best time to trade forex is when two major sessions are active simultaneously, increasing volume and volatility. Knowing what time does the forex market open in each region helps traders align their strategies with these overlapping sessions for maximum impact.

The overlap between the London and New York sessions running from 1:00 PM to 5:00 PM GMT is known for its high liquidity. Major currency pairs such as EUR/USD and GBP/USD typically experience narrower spreads and more consistent price action during this time.

Here’s why:

- Increased volume means more participants and better pricing efficiency.

- Higher trading volumes during peak hours typically allow brokers to provide more competitive spreads.

- Institutional traders also prefer this window to act on news or economic data.

In contrast, when only one session is active, say, Tokyo before London, price movement tends to be narrower, which may not suit momentum strategies. That’s why knowing when and where the forex market opens helps align your trading style to the right session.

However, the Tokyo session should not be overlooked. While it may not offer the highest trading volume, it still presents viable opportunities especially for JPY-based currency pairs such as USD/JPY, EUR/JPY, or AUD/JPY.

The Tokyo trading session typically experiences reduced liquidity, as major Western financial institutions are less active, and there is little overlap with the more liquid London session. That said, if you prefer a steadier market environment with fewer price spikes or if your strategy aligns with Asia-Pacific momentum the Tokyo session could suit your trading style well.

The AUD/JPY pair known for its high volatility and active trading often shows notable price action during the hours when the Sydney and Tokyo sessions coincide.

7. Trusted sources where you can accurately find out what time does the forex market open

Whether you’re new to forex or a seasoned trader, it's essential to rely on trusted platforms that provide accurate and up-to-date information on forex market hours. I’ve personally used the following sites to track changes, confirm session overlaps, and understand how economic events might influence when the forex market opens or closes.

| Source | Why It’s Reliable | What You’ll Find |

|---|---|---|

| H2TFinance.com |

A knowledge-sharing platform for strategies and trading tools developed by a community of experienced traders. | In-depth analytical articles, experience sharing, real-time guidance, and thoroughly verified content presented in a neutral manner free from brokerage influence or account-opening promotions aimed at helping readers trade more effectively. |

| Babypips | Highly regarded in the trading community, especially among beginners. | Clear educational content on forex sessions, including charts and overlap windows. |

| Forex | Regulated broker with robust market insights and global reach. | Live updates on forex market hours, economic calendars, and trading tools. |

| Investing | One of the largest financial data aggregators. | Real-time economic calendars and market timing alerts tailored to your timezone. |

Make a habit of bookmarking these resources. I’ve often set up notifications from economic calendars to avoid placing trades right before low-liquidity periods or high-impact announcements.

8. Three trading strategies tailored to different forex market opening times

You don’t always need to change your trading strategy sometimes, simply adjusting when you trade can make a significant difference. Understanding the forex market open time helps you avoid entering trades during inactive sessions and improves both your win rate and risk management. Below are three practical strategies you can apply today, depending on your preferred trading hours.

8.1. Trading weekend price gaps on monday morning

Even though the forex market takes a break over the weekend, the world doesn’t stop turning and neither do economic and geopolitical events. These unseen forces can stir up waves beneath the surface, leading to sudden price gaps when the market bursts back to life on Monday.

Imagine waking up Monday morning to find that unexpected global tensions over the weekend have pushed prices sharply away from where they closed on Friday. It's a reminder that in forex, the calm can quickly give way to storms.

Experienced traders take advantage of these gaps by trading potential reversals or continuations. In many cases, the gap is filled before the price resumes its new trend.

Best used: Right when the Sydney session opens (7:00 AM AEST or 10:00 PM GMT Sunday).

Ideal for: Event-driven traders or those looking for quick setups at the start of the week.

8.2. Breakout trading during the London open

The London session stands out as the busiest, making up close to 30% of the daily forex trading volume. If you rely on breakout strategies, the hour between 8:00 AM and 9:00 AM London time offers prime opportunities.

Trading volume surges during this window, increasing the likelihood of successful breakouts. Use 5-minute or 15-minute charts to identify consolidation zones and breakout triggers.

Best used: Starting from 8:00 AM BST (or 7:00 AM GMT during winter time).

Ideal for: Short-term traders looking for significant momentum and ample liquidity.

8.3. Intraday trading during the second half of the London session

When New York opens, the London session is still active — creating the most liquid period of the entire trading day. Spreads are tighter, execution is faster, and high-impact news releases from the US or EU often drive sharp moves.

If you're a day trader, the overlap from 13:00 to 17:00 GMT is the sweet spot. With both major financial hubs open, you get maximum market activity and volatility.

Best used: Most effective during the hours of 1:00 PM to 5:00 PM GMT (8:00 AM to 12:00 PM New York time).

Ideal for: Day traders or scalpers who thrive on volume and price movement.

9. FAQs: Common questions when searching for what time does the forex market open

9.1. When does the forex market open on Sunday?

In New York, the forex market begins trading at 5:00 PM EST on Sunday, marking the start of the Sydney session. This marks the start of the global 24-hour trading cycle.

9.2. During which forex session is trading EUR/USD most favorable?

The London–New York overlap (1:00 PM–5:00 PM GMT) is ideal for EUR/USD. You’ll find high liquidity, tighter spreads, and stronger price action.

9.3. At what time does the forex market open according to GMT?

The market opens at 10:00 PM GMT on Sunday with the Sydney session and closes at 10:00 PM GMT on Friday, following the end of the New York session.

9.4. When is the forex market typically at its quietest?

Between 7:00 PM and 10:00 PM EST, there’s typically lower activity. This period marks the shift from the close of the New York session to the beginning of the Sydney session, commonly resulting in lower liquidity.

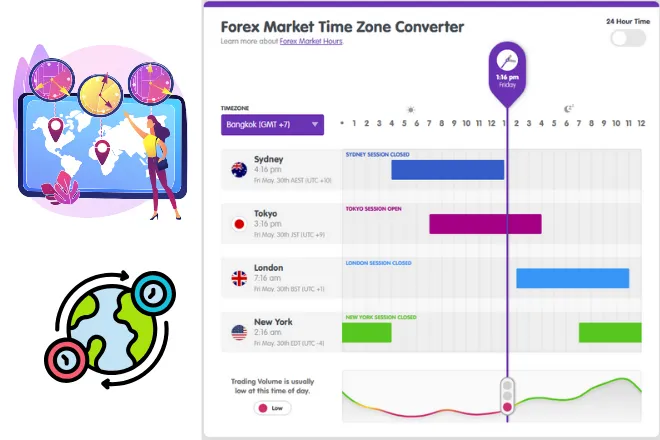

9.5. How can I convert forex market times to my timezone?

Utilize a Forex Market Time Zone Converter to check the opening and closing times of sessions according to your local time. This helps avoid errors and improves your trading precision.

9.6. At what time does the forex market start operating in Canada?

In Canada, the forex market begins trading at 5:00 PM EST on Sunday, coinciding with the opening of the Sydney session. This timing may vary slightly depending on your province and whether daylight saving time (DST) is in effect, so it’s best to use a forex market time converter for precision.

9.7. What time does the forex market open in South Africa?

In South Africa, the forex market opens at 12:00 AM (midnight) on Monday (SAST), corresponding with the Sydney session opening at 10:00 PM GMT on Sunday. This signals the beginning of the worldwide forex trading week.

9.8. What time does the Australian forex market open?

The Australian forex market, led by the Sydney session, opens at 7:00 AM local time (AEST) on Monday. For global traders, this is 5:00 PM EST on Sunday, making Sydney the first major forex center to open each week.

9.9. Is the forex market open on weekends?

No, the forex market is closed on weekends. It usually closes at 5 PM EST on Friday and reopens at 5 PM EST on Sunday.

9.10. Is it possible to trade forex continuously for 24 hours each day?

Indeed, forex trading is available around the clock from Sunday evening through Friday evening. Trading continues across different global sessions including Sydney, Tokyo, London, and New York, so there is always an active market somewhere.

10. Conclusion: Knowing what time does the forex market open is crucial for successful trading

By now, you’ve gained a comprehensive understanding of what time the forex market opens, including the nuances brought on by daylight saving shifts, holiday closures, and session overlaps.

You’ve learned:

- How the 24-hour forex cycle operates globally across four major sessions.

- Why session timing and overlap windows directly impact liquidity, volatility, and pricing efficiency.

- How to avoid common pitfalls by tracking economic calendars and monitoring session changes due to DST or holidays.

- Where to find accurate and trusted sources to guide your timing.

Whether you’re planning your first forex trade or fine-tuning your scalping strategy, timing matters. And understanding market hours gives you an edge, helping you trade with confidence, precision, and purpose.

Next step? Head over to the Forex Market Analysis section of H2T Finance. There, you’ll find real-time updates, weekly session recaps, and strategy tips tailored to current market conditions. Remember, mastering forex market open time is just as important as what to trade.