Choosing the right foreign exchange trading software can make or break your trading success. In a fast-moving market like Forex, your software isn’t just a tool, it’s your trading partner.

This guide helps you understand what makes forex software powerful and how we selected the top 10 picks that are shaping investor outcomes in 2025.

1. What is foreign exchange trading software? Why it matters for forex investors?

Foreign exchange trading software, also referred to as forex trading platforms or online foreign exchange trading tools, allows investors to analyze currency markets, execute trades, and manage risks in real-time. These platforms are the digital command centers of modern traders, packed with tools like charting indicators, one-click trading, currency converters, and automated strategy scripts.

When I started in forex, I underestimated the role software plays. It wasn’t until I switched to a robust platform that I saw my performance stabilize. Why? Because good software doesn’t just show you the data, it helps you act on it fast, with precision.

If you’re serious about trading, your success hinges on the platform’s ability to respond quickly, integrate with your broker, and support your growth with tools and insights.

2. How H2T Finance selected the top 10 best foreign exchange trading software of 2025

We didn’t just list platforms at random. At H2T Finance, our mission was to evaluate which foreign exchange software truly delivers value to real traders in 2025. Here’s our method:

- Hands-on Platform Testing

We opened real accounts to test features, UI flow, trade execution, and reliability. For instance, MetaTrader 5 earned points for seamless multi-asset support and advanced backtesting. - Broker Integration & Regulation

Foreign exchange trading software linked to brokers regulated by FINRA, FCA, or ASIC scored higher. Trust matters, especially when your funds are on the line. - Pricing Transparency

We broke down trading costs: spreads, commissions, overnight fees, and hidden charges. Only platforms with transparent pricing made our list. - Educational & Support Tools

We favored platforms with strong trading education modules, think tutorials, webinars, and market research. A good platform should grow with the trader. - Flexibility & Account Types

From beginners with demo accounts to pros managing large positions, we wanted platforms that scale with you. Bonus points went to those offering API access and algorithmic trading.

Every platform in our top 10 was chosen because it helps traders succeed, not just trade.

3. Overview: A quick look at the 10 best foreign exchange trading software tools

When searching for the best foreign exchange trading software, it helps to see how the top platforms compare at a glance. Here’s a quick overview table summarizing the key features and user experience of each tool in 2025:

| Software | Rating | Strengths | Weaknesses |

|---|---|---|---|

| MetaTrader 5 | 4.1/5 | Multi-asset support, Expert Advisors, economic calendar | Steep learning curve, limited interface customization |

| FXCM | 4/5 | Real Volume tool, Trader Sentiment, reliable execution | Needs strong internet, may lag on slower networks |

| XE | 3.7/5 | Real-time currency rates, crypto support, reliable data | Not a full trading platform, limited money transfer regions |

| AvaTrade | 3.6/5 | Mobile-first design, educational resources, multi-asset access | Complex for beginners, desktop version less intuitive |

| Plus500 US | 4.5/5 | Low deposit, futures trading, beginner-friendly interface | No phone support, advanced features take time to master |

| ActivTrades | 4.3/5 | Full MT4 support, advanced customization, cross-platform | High fees, inactivity penalty |

| Vantage | 4.6/5 | Copy trading, social features, MT4/MT5 access | Less beginner-oriented educational content |

| Tickmill | 4.4/5 | Beginner education, clear fee structure, MT4/MT5 access | Slightly wider spreads on Classic account |

| IG | 4.6/5 | 19,000+ instruments, advanced tools, regulated broker | Overwhelming for new users |

| IC Markets | 4.5/5 | Ultra-low spreads, MT4/MT5/cTrader support, fast execution | Not ideal for absolute beginners |

Each of these foreign exchange trading software tools excels in different areas. Some are tailored for professionals seeking powerful analytics and automation, while others simplify the experience for newcomers.

This breakdown provides a useful launchpad to help you choose the best fit for your trading strategy, whether you're aiming for manual trading precision or automated efficiency. In the next section, we’ll help you decide how to choose the right one.

See more useful articles:

- How do financial advisors get paid: Key models and pay structures

- What is a funded trading account? Full guide for 2025

- How does forex trading work? Learn the basics today

4. In-depth review: The 10 best foreign exchange trading software options for 2025, handpicked by experts

When it comes to choosing the best foreign exchange trading software, the options can feel overwhelming. After years of working with multiple platforms, I understand how critical it is to select software that not only supports your trading strategy but also enhances your efficiency and decision-making.

In this section, I’ll walk you through the top ten foreign exchange software picks for 2025, highlighting their standout features, advantages, and possible limitations. This detailed guide will help you decide which online foreign exchange forex trading software fits your needs perfectly.

4.1. MetaTrader 5 – Full-featured platform for professional traders

Rating: 4.1/5

Key Takeaways:

- Multi-asset support including forex, stocks, and futures.

- Advanced charting tools and technical analysis.

- Supports automated trading with Expert Advisors (EAs).

- Fast order execution and built-in economic calendar.

MetaTrader 5 (MT5) remains one of the most popular foreign exchange software for both novices and professionals. From my own trading journey, I found MT5 incredibly powerful for implementing diverse strategies, thanks to its rich technical analysis toolkit and multi-asset capabilities. It’s not just a forex trading platform, it supports commodities, indices, and cryptocurrencies, making it a versatile choice.

One of the aspects I value most is the seamless integration of automated trading through algorithmic programs called Expert Advisors. This feature allows traders to backtest strategies and automate order execution, which can boost efficiency and reduce emotional decision-making.

Advantages:

- Highly reliable with continuous product updates improving performance.

- Extensive community and third-party resources available for customization.

- Supports complex order types and multiple timeframes.

Disadvantages:

- Steeper learning curve for beginners due to advanced features.

- Limited interface customization compared to some competitors.

If you’re aiming for a full-featured foreign exchange trading software that grows with your skills, MT5 is a solid pick. Its balance of analytical depth and execution speed puts it ahead for traders focused on both manual and automated strategies.

4.2. FXCM – Long-standing broker with advanced trading tools

Rating: 4/5

Key Takeaways:

- Zero-commission trading on CFDs, forex, and shares.

- Powerful tools like Real Volume and Trader Sentiment.

- Customizable platforms tailored for all skill levels.

- Reliable real-time execution with near-perfect accuracy.

FXCM has a rich legacy, established in 1999 as a pioneer in online forex trading. I personally appreciate FXCM for combining broker services with sophisticated foreign trade software tools that provide critical market insights. Features like Real Volume and Trader Sentiment are invaluable for gauging market conditions beyond price charts alone.

The platform allows traders to customize layouts, download specialized indicators, and create watchlists tailored to their strategies. Such flexibility is a hallmark of effective foreign exchange trading software, enhancing user experience and helping traders stay organized and informed.

Advantages:

- Reliable and efficient service with minimal transaction failures.

- Innovative tools for deeper market analysis and strategy refinement.

- Suitable for both retail and institutional traders.

Disadvantages:

- Requires a robust internet connection for smooth performance.

- Interface may feel heavy or slow on weaker networks.

For traders looking to combine a trusted broker with powerful, customizable forex trading software, FXCM stands out as a comprehensive choice, especially for those who value advanced market data and tools.

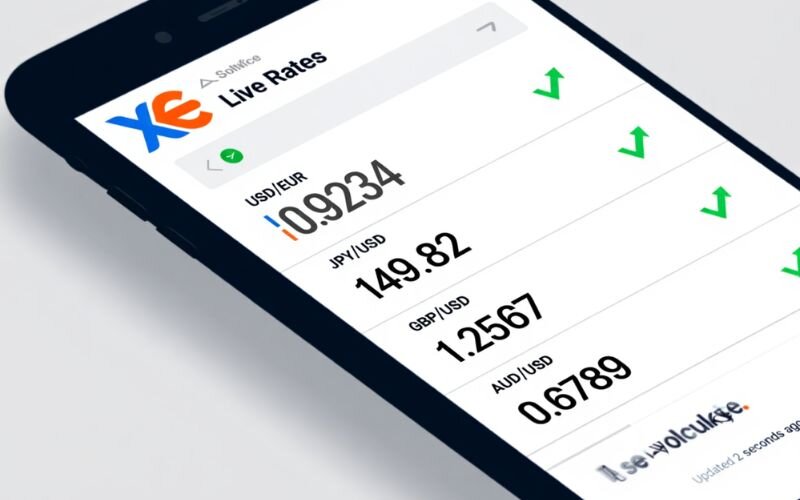

4.3. XE – Reliable source for global currency rates and conversions

Rating: 3.7/5

Key Takeaways:

- Real-time currency converter with accurate exchange rates.

- Supports fiat and cryptocurrency conversions.

- Trusted by millions worldwide for currency data and money transfers.

- Simple, user-friendly mobile apps and web tools.

XE is not a traditional forex trading platform but a highly respected currency authority that provides real-time exchange rate data essential for any forex trader. In my experience, XE’s foreign exchange trading software is perfect for quick currency conversions and tracking live rates across multiple currencies, including Bitcoin and Ethereum.

Though XE’s money transfer services have geographic restrictions, its reliable rate data supports informed trading decisions, especially for those trading across different currencies or dealing with cryptocurrencies.

Advantages:

- Continually updated with new features and data enhancements.

- Intuitive and accessible design ideal for beginners.

- Comprehensive currency coverage including digital currencies.

Disadvantages:

- Money transfer service limited to select countries.

- Not a full trading platform, more of a supplementary tool.

If your forex trading requires reliable, up-to-the-minute currency rates or cryptocurrency exchange data, integrating XE into your toolkit can support smarter trading decisions.

4.4. AvaTrade – Optimized for mobile trading experiences

Rating: 3.6/5

Key Takeaways:

- Supports forex, indices, commodities, and cryptocurrencies.

- Strong mobile app with educational resources.

- Various trading instruments and markets in one platform.

- Suitable for traders wanting to trade on the go.

From my time testing multiple platforms, AvaTrade impressed me with its mobile-first approach. The AvaTrader app offers a wide array of assets beyond forex, including commodities and cryptocurrencies, which is ideal for traders who prefer managing trades anywhere, anytime.

One highlight is the platform’s commitment to education, tutorials and webinars provide traders with the knowledge needed to navigate complex markets confidently. As a well-rounded foreign exchange trading software, AvaTrade equips users with both tools and resources to enhance decision-making. However, new users might find AvaTrade’s range of features a bit overwhelming initially.

Advantages:

- Reliable and performance-enhancing platform on mobile devices.

- Trade a wide variety of asset types all from a single platform.

- Dedicated resources and guidance to help traders learn and grow.

Disadvantages:

- The platform's complexity could be overwhelming for complete beginners.

- Desktop version slightly less intuitive than some rivals.

For those who prioritize mobile trading with educational support, AvaTrade offers a balanced combination of tools and accessibility.

4.5. Plus500 US – Top choice for U.S.-based retail traders

Rating: 4.5/5

Key Takeaways:

- Proprietary WebTrader platform and mobile app.

- Low minimum deposit ($100) and low fees.

- Wide range of tradable futures including forex, commodities, and cryptocurrencies.

- User-friendly interface with advanced order types.

Plus500 is my top recommendation for U.S.-based traders seeking a low-barrier entry into futures trading. The platform’s foreign exchange trading software capabilities extend beyond traditional forex to futures contracts on multiple asset classes. Its intuitive WebTrader interface makes placing complex orders straightforward, a huge plus for active traders.

Switching seamlessly between demo and live accounts allows users to practice strategies risk-free before going live. Plus500’s low commissions and flexible contract sizes (standard, mini, micro) give traders freedom to scale their investments comfortably.

Advantages:

- Cutting-edge, easy-to-navigate platform for desktop and mobile.

- Competitive fees and accessible minimum deposits.

- Excellent features like simultaneous entry of initial, profit target, and stop-loss orders.

Disadvantages:

- No phone support available.

- Some advanced features might require time to master.

If you want a straightforward, powerful trading platform with diverse futures and forex instruments, Plus500’s U.S. offering is a standout in 2025.

4.6. ActivTrades - Leading software for MetaTrader 4 enthusiasts

Rating: 4.3/5

Minimum Deposit: $0

Tradable Instruments: 1,108

Fees: High

Key Takeaways:

- Wide access to MetaTrader 4 and other popular platforms.

- Strong customization and technical analysis tools.

- Best suited for intermediate to advanced traders.

I’ve used ActivTrades extensively, and what consistently stands out is its dedication to delivering a seamless MetaTrader 4 (MT4) experience. Whether you're trading from a PC, Mac, browser, or mobile device, ActivTrades ensures full access to MT4’s features, custom indicators, strategy testers, multiple timeframes, and trailing stops.

It’s a reliable choice for traders seeking robust foreign exchange trading software that supports flexible, multi-device access without compromising functionality.

Their newly upgraded MT4 web platform rivals modern fintech interfaces. Dark and light themes, an intuitive drawing tools panel, and an inbuilt economic calendar make the trading process smarter and more insightful. In my daily workflow, I found these additions incredibly helpful when reacting to high-impact news events.

Advantages:

- Highly advanced desktop platform for strategy deployment.

- Multiple platforms including MT4, MT5, TradingView, and ActivTrader.

- Enhanced fund security with segregated accounts.

Disadvantages:

- High trading fees.

- Monthly inactivity fee applies.

4.7. Vantage - Ideal software for strategy sharing and copy trading

Rating: 4.6/5

Minimum Deposit: $50

Tradable Instruments: 1,039

Fees: Low

Key Takeaways:

- Integrated copy trading via mobile app.

- Ideal for both new and experienced traders.

- Access to third-party tools like ZuluTrade and Myfxbook.

What drew me to Vantage was its seamless integration of copy trading within a single app. You don’t need to switch between platforms to track strategies or monitor your performance , everything is bundled together, simplifying your trading life.

The ability to follow successful traders, gain followers, and even earn commissions through their tiered program (Explorer, Rising Star, Mentor) brings a community feel to your trading. This social layer enhances the appeal of the foreign exchange trading software for both beginners and experienced users. Advanced users can still enjoy the robust capabilities of MT4/MT5 or connect with external social trading platforms.

Advantages:

- User-friendly mobile interface with integrated social features.

- Extensive network of copy trading providers.

- Low fees and multiple account types.

Disadvantages: Educational content is skewed toward experienced traders.

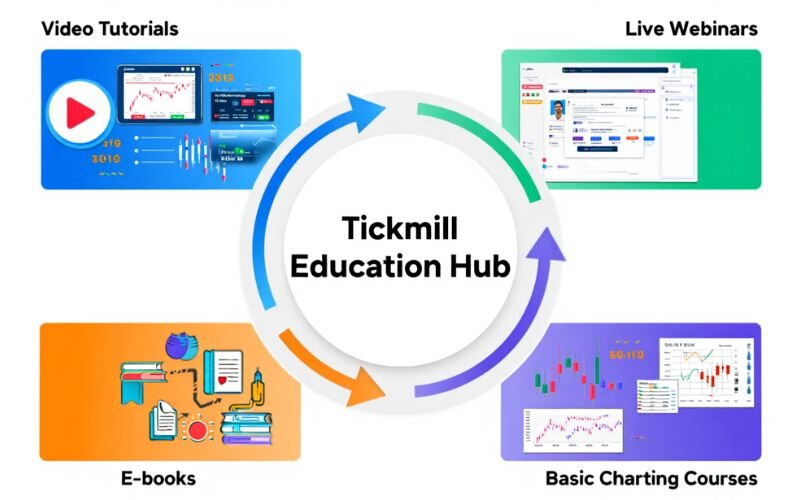

4.8. Tickmill - Great starting point for beginner forex traders

Rating: 4.4/5

Minimum Deposit: $100

Tradable Instruments: 649

Fees: Medium

Key Takeaways:

- Comprehensive educational resources.

- MT4, MT5, and proprietary app support.

- Ideal for beginners looking to learn and grow.

For newer traders looking for a supportive learning environment, Tickmill delivers. I was impressed by the Tickmill Education Hub, which features everything from video tutorials to interactive webinars. These materials can be game-changers for someone just beginning their forex journey.

While spreads on the Classic account can be slightly higher (averaging 1.6 pips for EUR/USD), they’re inclusive of all trading fees. This transparent pricing model is a key feature of reliable foreign exchange trading software, making it easier for beginners to plan their trades without worrying about hidden costs, something they will definitely appreciate.

Advantages:

- Excellent learning resources.

- Simple fee structure.

- No deposit or withdrawal charges.

Disadvantages: Less attractive spreads on the Classic account.

4.9. IG - Exceptional variety of tradeable assets and markets

Rating: 4.6/5

Minimum Deposit: $50

Tradable Instruments: 19,234

Fees: Medium

Key Takeaways:

- Huge selection of global instruments.

- Suitable for both casual and institutional traders.

- High-trust broker with top-tier regulation.

IG has been a cornerstone of my trading toolkit for years. With access to over 19,000 instruments, from forex to IPOs, it’s the ultimate foreign trade software for portfolio diversification. Their proprietary Web Trader platform balances usability with robust technical tools, which helped me manage trades efficiently even in fast markets.

If you're exploring online foreign exchange trading software that also offers global reach, IG should be high on your list. However, beginners might feel overwhelmed by the sheer volume of markets and tools available.

Advantages:

- Offers exposure to almost all major asset categories.

- Tight spreads available, particularly attractive on the EUR/USD pair.

- Free trading signals and customizable charts.

Disadvantages: Steep learning curve for some features.

4.10. IC Markets - Competitive spreads for cost-efficient trading

Rating: 4.5/5

Minimum Deposit: $200

Tradable Instruments: 2,245

Fees: Low

Key Takeaways:

- Enjoy minimal spreads, with some starting as low as 0.0 pips.

- Ideal for implementing sophisticated or high-level trading strategies.

- Supports MT4, MT5, and cTrader.

From my own trading tests, IC Markets stood out for its consistently low fees. The cTrader platform especially impressed me with over 70 built-in indicators and seamless usability. Whether you’re a scalper or a swing trader, the spreads and execution speed here give you a solid edge.

Tools like AutoChartist integrated into MetaTrader add a layer of automation to your analysis, saving time and reducing missed opportunities. That’s why I often recommend IC Markets to fellow traders who want to scale without escalating costs.

Advantages:

- Among the most cost-effective fee structures available in the market.

- A broad selection of trading software and analytical tools is provided.

- Access to third-party market analysis tools.

Disadvantages: Not ideal for beginners due to tool complexity.

5. FAQs: Common questions when searching for foreign exchange trading software

5.1. How do I choose the best forex trading broker for beginners?

Look for user-friendly interfaces, strong educational resources, and transparent pricing. Platforms like Tickmill and AvaTrade are great for new traders.

5.2. Can I use foreign exchange trading software on mobile devices?

Yes! Many platforms, such as AvaTrade and Vantage, offer mobile apps that let you trade on the go with full access to essential tools and features.

5.3. Are all foreign exchange trading software regulated?

Not all, but reputable platforms integrate with brokers regulated by authorities like FCA or ASIC, ensuring safer and more reliable trading environments.

5.4. How important is automated trading in forex software?

Very important for many traders. Automated trading, offered by platforms like MetaTrader 5, helps execute strategies precisely and reduces emotional trading mistakes.

5.5. What fees should I watch out for in foreign exchange trading software?

Look for spreads, commissions, overnight fees, and any hidden charges. Transparent platforms like Tickmill help you avoid surprises and plan trades better.

Read more:

- Forex Market Time Zone Converter: Master Global Trading Hours with Confidence

- How to Use Fibonacci Retracement: A Practical Guide for Traders

6. Conclusion: Choosing the Right Foreign Exchange Trading Software for a Successful Forex Journey

By now, you've explored the strengths, ratings, and real-world experiences tied to the best foreign exchange trading software of 2025. If you're serious about growing your portfolio or entering the world of forex trading with confidence, understanding these platforms is your first step to informed decision-making.

Let’s quickly recap what you’ve gained:

- A clear understanding of what foreign exchange software really is.

- A breakdown of industry-leading platforms rated for 2025, including their key features, drawbacks, and who they’re best suited for.

Choosing the right software means aligning your trading goals with a platform’s capabilities. Are you just beginning your journey and need guidance from educational tools? Start with Tickmill or AvaTrade. Looking for advanced algorithmic support and low-cost execution? Platforms like MetaTrader 5 and IC Markets may be your best match.

The world of online foreign exchange trading software is vast, but with the right resources and mindset, it’s a world you can master. If you’re ready to take the next step toward confidence, we invite you to explore our "Forex Basics" category here on H2T Finance. You’ll find easy-to-follow guides, platform walkthroughs, and essential strategies designed to help you build a rock-solid trading foundation.