Understanding Firstrade what marks you as a day trader is essential for anyone actively buying and selling forex positions within the same trading day. Day trading comes with specific rules and regulations to protect investors and maintain market integrity, especially the Pattern Day Trader (PDT) rule enforced by FINRA and applied by brokers like Firstrade.

Getting marked as a day trader can lead to account restrictions that impact your trading freedom, so knowing the criteria and how to avoid or manage these designations is key.

In this article, we will explore the key factors that lead to being marked as a day trader on Firstrade, explain how you get marked as a pattern day trader, what happens once your account is flagged, how long this status lasts, and practical strategies to stay compliant.

Whether you are a beginner or an experienced trader, this guide will help you understand the PDT rules clearly and trade confidently without unexpected limitations.

1. What is day trading?

Day trading is a trading strategy that involves opening and closing positions within the same trading day. In the context of forex, this means buying and selling currency pairs during short timeframes often minutes to hours with the goal of capturing quick price movements.

Unlike long-term investors, day traders rely on market volatility, technical analysis, and precise timing to execute multiple trades per day.

For forex traders using Firstrade or any other broker, day trading requires a deep understanding of market trends, strict discipline, and adherence to regulatory rules such as the Pattern Day Trader (PDT) rule.

Although the PDT rule originally applies to stocks and options, many brokers still monitor forex trading behavior to ensure compliance with similar standards especially when margin accounts are used.

Whether you're trading EUR/USD, GBP/JPY, or other currency pairs, it’s important to manage your risk, track your trading frequency, and be aware of any thresholds that could lead to being marked as a pattern day trader.

2. Firstrade what marks you as a day trader – key factors explained

If you are actively trading on Firstrade, understanding firstade what marks you as a day trader is crucial to avoid unexpected restrictions. Being labeled a Pattern Day Trader (PDT) can affect your account and trading strategies significantly. But what exactly triggers this status?

Firstrade, like many other brokers, follows FINRA’s rules that define a day trader based on specific trading activity. In general, you are marked as a day trader if you execute multiple round-trip trades (buy and sell of the same security) within a short time frame. This designation depends on several factors including the number of trades, timing, and your account equity.

Example: If you open a EUR/USD position at 9:00 AM and close it by 11:00 AM the same day, that counts as one day trade. If you repeat this four times within a single week, Firstrade will likely flag you as a pattern day trader even if you’re just experimenting with short-term setups.

Personal tip: If you're trading with a small account, limit your number of daily trades and keep a written reason for each one. It not only helps avoid being flagged but also builds a disciplined trading mindset.

Knowing how you get marked as a pattern day trader can help you plan your trades more carefully and avoid pitfalls. It’s important to understand what counts as a day trade, how often you can trade before being flagged, and the implications of getting marked as a pattern day trader on Firstrade.

3. What marks you as a day trader?

You are marked as a day trader when your trading activity meets specific criteria set by regulatory authorities like FINRA, and enforced by brokers such as Firstrade. These rules are designed to identify traders who frequently open and close positions within the same day, especially when using margin accounts.

In forex trading, this typically means executing multiple intraday trades in currency pairs over a short time period. Firstrade and similar platforms may flag your account as a Pattern Day Trader if:

- You execute four or more day trades within five consecutive business days, and

- These trades represent more than 6% of your total trading activity during that time.

This status is not applied after just one or two quick trades; it's a result of consistent short-term trading behavior. Being aware of these thresholds allows traders to avoid triggering unwanted restrictions, especially if they don’t maintain the required minimum equity balance of $25,000 in a margin account.

Understanding what marks you as a day trader is key to protecting your trading flexibility and staying compliant with your broker’s policies.

4. How do you get marked as a pattern day trader?

Understanding how do you get marked as a pattern day trader is key for Firstrade users who want to avoid sudden account restrictions. Pattern Day Trader (PDT) rules apply when certain trading thresholds are met within a short period. Let’s break down the main criteria Firstrade and other brokers use to identify day traders.

4.1. The 4-trades-in-5-days rule explained

One of the most important rules is the “4-trades-in-5-business-days” rule. If you execute four or more day trades within five consecutive business days, Firstrade will likely flag your account as marked as a pattern day trader. A day trade means buying and selling the same security on the same trading day.

This rule helps brokers and regulators identify traders who engage in frequent, short-term trading rather than long-term investing.

4.2. Why the 6% trading activity threshold matters

Another criterion that brokers consider is if your day trades represent more than 6% of your total trading activity within that 5-day window. Crossing this threshold can trigger the getting marked as a pattern day trader status on Firstrade. This ensures that only active day traders fall under these regulations, while casual traders are exempt.

4.3. Examples of trades that count as day trades

It’s important to know exactly what trades count toward the PDT designation. For example, buying and selling the same stock, ETF, or options contract on the same day will count. However, if you hold the position overnight, it does not count as a day trade.

If you are wondering will I get marked as a pattern day trader from occasional trades, these examples clarify the kinds of activities that cause the PDT flag to appear.

5. Getting marked as a pattern day trader: What happens next?

Once you are marked as a pattern day trader on Firstrade, it’s crucial to understand the consequences and how it affects your trading activities. This section explains the immediate changes you can expect and how Firstrade enforces these rules compared to other brokers.

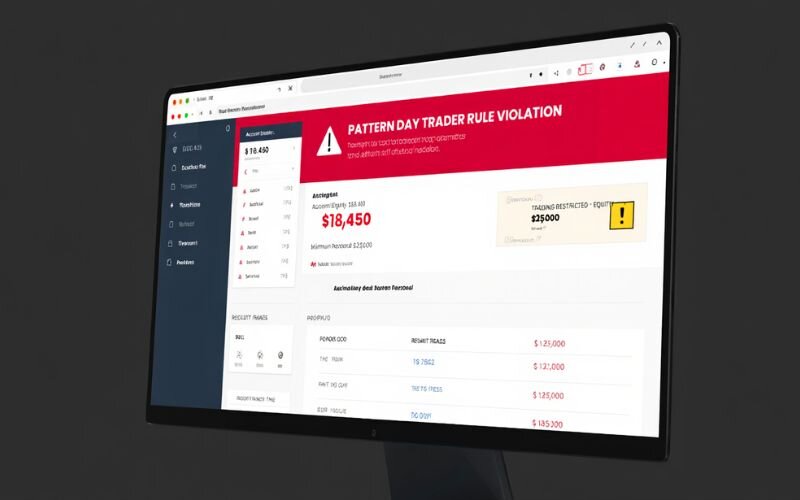

5.1. Immediate account restrictions and limitations

When Firstrade flags your account as a PDT, you will face certain restrictions. Most notably, you must maintain a minimum equity of $25,000 in your margin account to continue day trading. Without this, your account will be limited, preventing further day trades until the equity requirement is met.

This step is designed to protect both the trader and the brokerage from excessive risk.

5.2. Margin calls: What they are and how to respond

If your account falls below the $25,000 minimum equity, Firstrade will issue a margin call. This means you need to deposit more funds or liquidate positions to meet the required minimum.

Ignoring margin calls can result in forced liquidation of your holdings or suspension of your trading privileges.

Real experience: I once received a margin call after a sharp EUR/USD reversal during a Non-Farm Payroll release. Even though my account was only $200 below the threshold, Firstrade liquidated my position automatically. From that day, I made it a rule to always keep at least 10% of my capital as reserve and set up mobile alerts to monitor margin levels.

Practical advice: Set up alerts on your trading app to notify you if available margin drops below 40%. Don’t wait for the call manage your risk early.

5.3. Firstrade’s enforcement compared to other brokers

Firstrade generally follows the standard FINRA and SEC regulations regarding PDT rules, but enforcement can vary slightly by broker. Some brokers may be more lenient with warnings or allow for temporary exceptions, while Firstrade enforces the rules strictly to maintain compliance.

Knowing how Firstrade’s PDT enforcement works can help you better plan your trading strategy and avoid surprises.

View more:

- Maximize Your Trades: 5 Must-Have Tools for Forex Market Hour Conversion

- Canadian Dollar Forecast 2025: CAD Strengthens as USD/CAD Faces Continued Bearish Pressure

- What Is Leverage In Forex? How To Use Leverage In Forex Safely

6. How long are you marked as a pattern day trader?

Understanding how long are you marked as a pattern day trader on Firstrade is vital to managing your trading plan and account status. This section breaks down the duration of the PDT designation and the conditions for removing it.

6.1. Duration of the PDT designation

Once your account is flagged as a pattern day trader, Firstrade typically keeps this designation active for 90 days. During this period, you must comply with the PDT rules, including maintaining the $25,000 minimum equity to continue day trading without restrictions.

6.2. When and how can you remove the PDT status?

After the 90-day period, if you have not met the PDT criteria (i.e., limited day trades or maintaining account equity), Firstrade may remove the PDT status from your account. You can also contact Firstrade’s customer service to request a review, especially if your trading pattern has changed.

6.3. Firstrade’s policies on PDT flag removal

Firstrade follows FINRA guidelines for PDT status removal but may have its own specific procedures. It's important to stay informed via Firstrade’s official resources or customer support for updates on how to remove the PDT flag.

7. If you are marked as a pattern day trader: best practices and strategies

Being marked as a pattern day trader on Firstrade can feel restrictive, but understanding what this status means and how to navigate it can help you maintain your trading activity while staying compliant with regulations.

7.1. Understand your trading activity and PDT rules

First and foremost, it’s crucial to know how do you get marked as a pattern day trader. On Firstrade, if you make four or more day trades within five business days, your account will be flagged. This designation means you are considered an active day trader and subject to specific regulatory requirements.

Once marked as a pattern day trader, your account will have certain restrictions, so keeping track of your trades and frequency is essential. Use Firstrade’s built-in tools or third-party portfolio management software to monitor your trade count regularly. This helps you avoid unintentional breaches of the PDT rule.

7.2. Maintain the minimum equity to keep trading

One of the key requirements after getting marked as a pattern day trader is maintaining a minimum equity balance of $25,000 in your margin account. This is mandated by FINRA and is consistent across many brokers including Firstrade.

If your account equity falls below this threshold, your ability to execute day trades will be limited until you restore the minimum balance. Therefore, it is wise to plan your funding and withdrawals carefully. Keeping your equity above $25,000 means you can enjoy unlimited day trading privileges without further restrictions.

7.3. Adjust your trading style to avoid further restrictions

If maintaining $25,000 in your account is not feasible, consider modifying your trading approach. For example, shifting to swing trading or longer-term strategies will reduce the frequency of day trades and help prevent being flagged again.

Swing trading focuses on holding positions for several days or weeks, which means you make fewer trades per week compared to day trading. This strategy allows you to be active in the markets without triggering the PDT rule.

7.4. Leverage advanced technical analysis tools

When marked as a pattern day trader, it becomes even more important to make every trade count. Use free, reliable technical analysis tools such as TradingView, MetaTrader 4 (MT4), or MetaTrader 5 (MT5) to analyze market trends, identify high-probability setups, and optimize entry and exit points.

These tools help you refine your strategy, reduce the number of impulsive trades, and increase your success rate, which is especially useful when you want to avoid the consequences of excessive day trading.

7.5. Communicate proactively with Firstrade support

If you’re unsure about your PDT status or believe you were mistakenly flagged, reach out to Firstrade’s customer support team. They can clarify your account status, explain restrictions, and advise you on how to manage or possibly remove the PDT flag.

Being proactive and informed reduces the risk of unexpected trading limitations and helps you stay compliant with the rules set by Firstrade and regulatory authorities.

7.6. Plan for the future: Education and discipline

Lastly, being marked as a pattern day trader is also an opportunity to enhance your trading discipline. Educate yourself on the PDT rules, keep trading records, and develop a well-structured trading plan that respects regulatory limits.

Following best practices such as proper risk management, controlled trade frequency, and adherence to margin requirements will not only help you avoid getting marked as a pattern day trader again but also improve your overall trading performance.

8. Frequently asked questions (FAQ) about firstrade what marks you as a day trader

This section addresses common questions about pattern day trading rules and Firstrade’s specific policies to help traders stay informed.

8.1. Will I get marked as a pattern day trader if I make occasional day trades?

No, Firstrade only marks you as a pattern day trader if you execute four or more day trades within five business days. Occasional day trades below this threshold typically won’t trigger the PDT designation.

8.2. At what point are you considered a day trader?

You are considered a day trader if you buy and sell (or sell and buy) the same security on the same trading day. The day begins at 8 p.m. ET and ends at 7:59 p.m. ET the next day.

8.3. What is the $25,000 pattern day trader (PDT) rule?

Under FINRA rules, a PDT must maintain a minimum equity of $25,000 in their margin account to continue day trading without restrictions.

8.4. What are the PDT rules specifically for Firstrade?

Firstrade follows the standard PDT rule: if you exceed three day trades in five business days, your account is flagged as a pattern day trader. You then need at least $25,000 equity to continue day trading.

8.5. What happens if you are flagged as a PDT but have over $25,000?

If your account equity exceeds $25,000, you can continue day trading with no limits, using your available day-trading buying power, which Firstrade calculates based on your maintenance margin.

8.6. How does the IRS determine if you are a day trader?

The IRS considers a day trader someone who trades frequently (typically daily), with the intention of making a profit from short-term market movements, dedicating significant time to trading activities.

8.7. What qualifies someone as a day trader?

A day trader generally executes multiple trades in the same security within a single day, often using margin, and actively manages short-term trading positions for profit.

Read more:

- How do financial advisors get paid: Key models and pay structures

- How to Use Fibonacci Retracement: A Practical Guide for Traders

9. Summary and final thoughts

Understanding firstrade what marks you as a day trader is crucial for active traders to avoid unexpected account restrictions and continue trading smoothly. Being marked as a pattern day trader occurs when you exceed three day trades within five business days, triggering FINRA rules that require maintaining a minimum equity of $25,000 in your account.

Firstrade follows these regulatory requirements closely, but if you keep your equity above the threshold, you can enjoy greater buying power and more flexible trading opportunities. Knowing how you get marked as a pattern day trader, what it means for your account, and how long you are marked as a pattern day trader empowers you to manage your trading behavior effectively.

If you are marked as a pattern day trader, it's important to follow best practices like monitoring your trading frequency, managing margin responsibly, and adjusting your strategies to stay compliant.

For those looking to deepen their trading knowledge, especially in forex, we invite you to explore our comprehensive Forex Strategies category. Here, you’ll find essential guides on trading strategies, technical analysis tools, and risk management techniques to help you trade confidently and wisely.

Visit H2T Finance regularly for trusted insights and resources to support your trading journey.