If you've ever felt frustrated by the lagging signals of the MACD or the 'noise' from a volatile RSI, you're not alone. Most traders are on a constant hunt for a tool that can capture market momentum more smoothly and accurately.

To truly harness the power of this indicator, it's crucial to understand what makes it tick and that is the elegant oscillator indicator formula. In this guide, we are dedicated to breaking down the elegant oscillator indicator formula, exploring how it works, and most importantly, showing you how to apply it to improve your trading strategies.

1. What is the elegant oscillator?

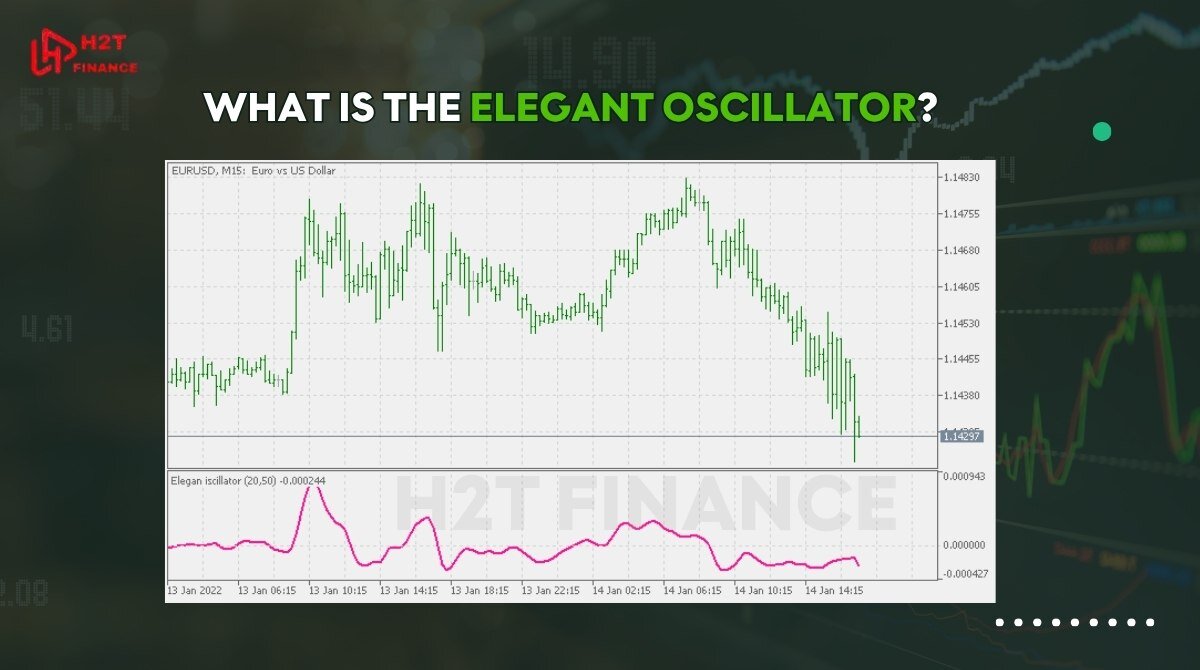

The elegant oscillator is a trend-following momentum tool designed to smooth price action while reducing lag. Developed by John Ehlers, the indicator leverages signal processing techniques originally used in engineering and digital communications to create a more refined view of price movements.

It is particularly known for its use of the super smoother filter, which minimizes noise and preserves relevant price cycles, allowing traders to identify trend direction and turning points with greater clarity.

At its core, the elegant oscillator works by calculating the difference between two smoothed price series: the current smoothed price and a delayed version of the same smoothed price. This differential creates a waveform-like oscillator that centers around the zero line. Positive values typically suggest bullish momentum, while negative values indicate bearish movement.

Unlike common oscillators such as the MACD or RSI, which rely on exponential moving averages or overbought/oversold zones, the elegant oscillator uses advanced filtering to ensure clean, lag-minimized signals making it particularly suitable for strategies that rely on precise trend entry points.

The elegant oscillator is part of a broader family of low-lag indicators designed by Ehlers, often preferred by algorithmic traders and those looking to avoid the whipsaws common in fast-moving markets.

By understanding how this indicator fits within your technical arsenal, you’ll be better equipped to use it in conjunction with other tools or even as the foundation of a rules-based trading system.

2. The elegant oscillator indicator formula explained

Now that we understand the concept and purpose of the elegant oscillator, let’s break down its underlying formula. This section will guide you through the elegant oscillator indicator formula, explain the components involved, and show how it transforms raw price data into a meaningful, low-lag momentum signal.

2.1. Understanding the core calculation

The name 'Super Smoother Filter' might sound intimidating, but don't let it put you off. At its core, John Ehlers wanted to filter out all the random, 'noisy' price jumps to get a clearer view of the main trend.

The Elegant Oscillator's formula does something quite clever: it compares a 'super-smoothed' version of the current price against its own value from a few periods ago (typically 10). This difference is what reveals the market's true momentum, plotted as a wave that oscillates around the zero line.

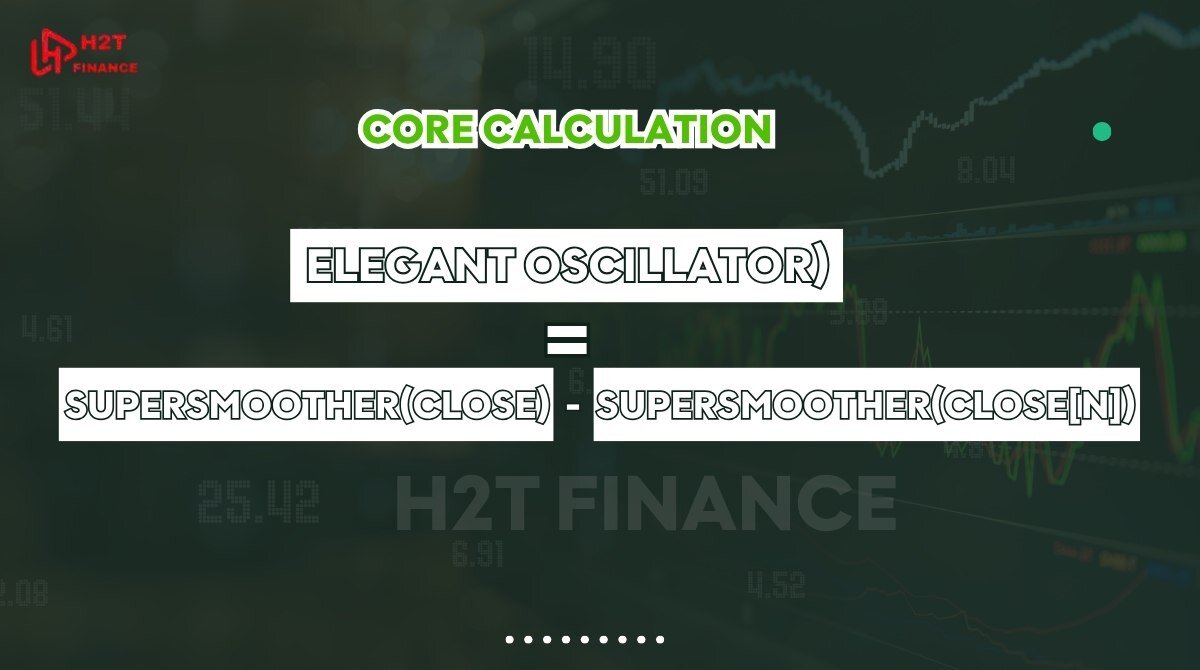

In simplified terms, the formula can be expressed as:

Elegant Oscillator = SuperSmoother(close) - SuperSmoother(close[n])

- close: The current closing price.

- SuperSmoother(close): The smoothed value of the closing price.

- SuperSmoother(close[n]): The smoothed value of the closing price delayed by n bars (typically 10).

This differential output oscillates above and below zero, reflecting the change in momentum between the current smoothed trend and its past state.

2.2. Formula structure in code (TradingView version)

To better illustrate the formula, here is an excerpt from the official TradingView script based on Ehlers' work:

smoother = 0.5 * (close + 2 * nz(close[1]) + 2 * nz(close[2]) + nz(close[3])) / 6

elegantOsc = smoother - smoother[10]

This approximation calculates a weighted smoothed price and subtracts its value 10 periods ago. The result is plotted as a line oscillator that gives clear signals based on momentum shifts.

2.3. Example calculation (illustrative)

Let’s consider a simplified dataset for visual reference:

|

Period |

Close Price |

Smoothed Value |

Delayed Smoothed (10 bars ago) |

Oscillator Value |

|---|---|---|---|---|

|

20 |

1.1550 |

1.1543 |

1.1531 |

0.0012 |

|

21 |

1.1560 |

1.1550 |

1.1538 |

0.0012 |

|

22 |

1.1575 |

1.1559 |

1.1544 |

0.0015 |

As the difference between the current smoothed value and its delayed counterpart increases, the oscillator shows growing momentum.

This basic table illustrates how traders can use the elegant oscillator to track market shifts in a smooth and interpretable way without being misled by short-term volatility or false signals.

3. How to use the elegant oscillator in forex trading

After understanding the elegant oscillator indicator formula, the next step is learning how to apply it effectively in real trading scenarios. While the formula provides the theoretical foundation, knowing how and when to use the indicator is key to making informed decisions in the forex market.

The elegant oscillator is primarily used to identify momentum shifts, trend continuation, and potential reversals. Because of its low-lag, smoothed nature, it helps filter out market noise, making it especially valuable in volatile currency pairs or longer time frames.

There are several ways traders integrate this oscillator into their technical analysis, depending on their preferred style trend following, reversal spotting, or momentum-based entry. Below are the most practical methods.

3.1. Zero-line crossovers

One of the most straightforward uses is to monitor when the oscillator crosses the zero line:

- Bullish signal: When the oscillator moves from negative to positive territory.

- Bearish signal: When it drops from positive to negative.

This suggests a shift in momentum and can be used as an early trend confirmation.

Example: In a EUR/USD 4H chart, a crossover from negative to positive accompanied by a breakout above a resistance level can support a long entry.

You can also pair the elegant oscillator with entry tools like the stop limit order to fine-tune execution.

Learn more: What is stop limit order ?

3.2. Divergence with price

Just like the MACD or RSI, the elegant oscillator can be used to spot divergence:

- Bullish Divergence: Be on alert when the price makes a new lower low, but the Elegant Oscillator refuses to follow, creating a higher low instead. This is the indicator 'whispering' to you that the selling pressure is fading and the bulls might be getting ready to take over.

- Bearish Divergence: This is one of the most powerful early warning signs. Picture this: the price on your chart is aggressively making a new high, but the Elegant Oscillator below is sluggish, creating a lower high. This is the market 'saying one thing, but doing another,' suggesting the upward momentum is running out of steam and a reversal could be just around the corner.

3.3. Confirmation tool in trend strategies

The elegant oscillator works well as a secondary confirmation in trend-following systems. For example:

- Combine it with a 50-period EMA: Only take trades in the direction of the moving average.

- Wait for the oscillator to confirm the trend continuation (stay on the same side of zero).

- Use it to avoid false breakouts in choppy markets.

3.4. Best practices for usage

To get the most out of the indicator, consider these guidelines:

- Stick to higher timeframes (1H and above) to reduce false signals.

- Always combine with other tools like ATR (for volatility), moving averages (for trend), or volume indicators.

- Avoid relying solely on the oscillator in sideways markets.

By integrating the elegant oscillator into your forex trading plan, you can enhance the precision of your entries and exits. Its smooth, filtered output makes it especially useful for traders who prefer clarity over complexity.

4. Elegant oscillator vs. other oscillators

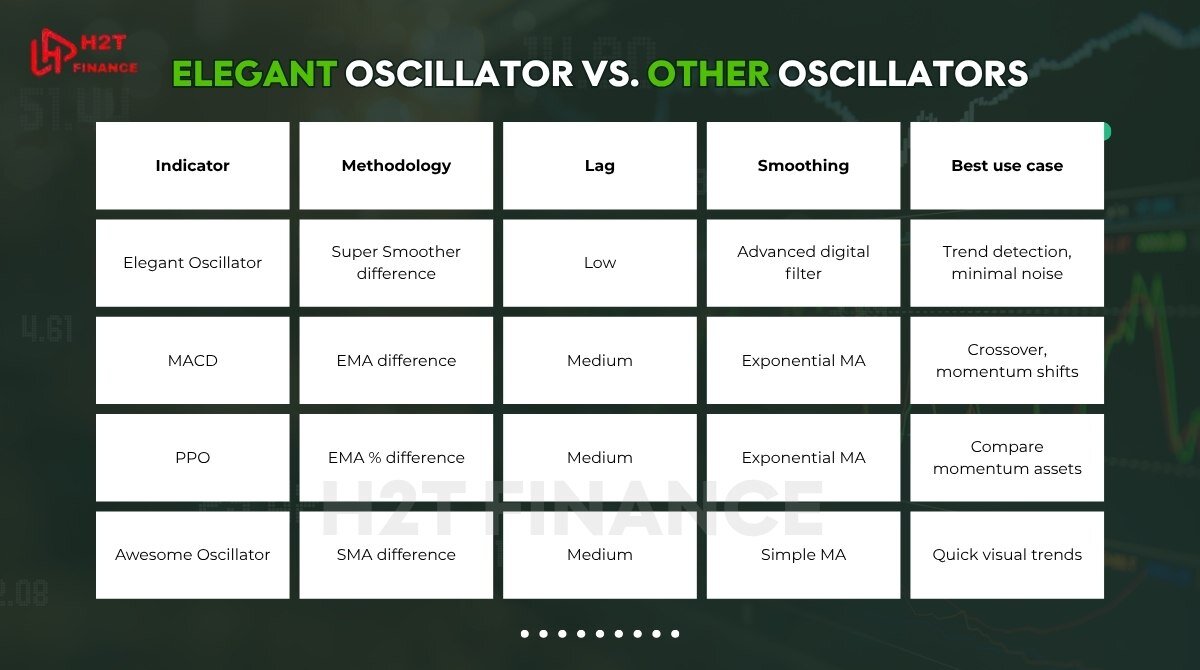

While the elegant oscillator offers distinct advantages in signal clarity and noise reduction, it's important to understand how it compares to more commonly used tools like the MACD, PPO, and Awesome Oscillator. Each of these indicators serves a similar purpose measuring momentum and identifying trend reversals but they differ in structure, responsiveness, and application.

This section will help you see where the elegant oscillator indicator formula stands in relation to its peers, so you can make better choices when selecting the right tool for your strategy.

4.1. Compare with MACD, PPO, Awesome Oscillator

Each oscillator processes price data differently. Some rely on moving averages, others on price differences or smoothing techniques. Let’s look at how the elegant oscillator contrasts with three widely used indicators:

- MACD (Moving Average Convergence Divergence): Uses exponential moving averages (EMAs) to calculate the difference between short-term and long-term momentum. MACD is useful for crossover strategies but may lag in volatile markets.

- PPO (Percentage Price Oscillator): Similar to MACD but expresses the difference as a percentage, making it better for comparing momentum across different instruments (according to Investopedia).

- Awesome Oscillator (AO): A histogram-style indicator using simple moving averages. It’s simple and visual, but less precise due to lack of advanced smoothing.

The elegant oscillator, in contrast, uses the Super Smoother filter developed by Ehlers, offering a cleaner and faster response to real trend changes.

4.2. Comparison table

Below is a comparison of the elegant oscillator and its counterparts, showing how they differ in structure, lag, smoothing method, and use cases:

As shown, the elegant oscillator offers a smoother, faster-reacting alternative to traditional tools, especially when applied in combination with trend-following strategies.

5. Pros and cons of the elegant oscillator

Before integrating any new indicator into your trading strategy, it’s crucial to weigh its advantages against potential drawbacks. The elegant oscillator indicator formula offers powerful smoothing and low-lag signals, but it also carries limitations common to specialized tools. Below is a balanced overview to help you decide if it fits your trading style.

5.1. Pros

- Low lag, smooth signals: Thanks to the Super Smoother filter, the elegant oscillator minimizes noise and delivers clearer momentum shifts sooner than many traditional oscillators.

- Enhanced trend detection: By focusing on the difference between smoothed values, it excels at highlighting underlying trend changes without frequent whipsaws.

- Customizable in advanced platforms: While not natively available on MT4/MT5, you can implement the formula in TradingView or other script-friendly charting tools, allowing for parameter tweaks.

- Ideal for algorithmic strategies: Its mathematically precise construction makes it well-suited for rule-based or automated systems where consistency and reduced false signals are paramount.

5.2. Cons

- Requires coding in MT4/MT5: Traders using MetaTrader must write or import custom scripts, which can be a barrier for those without Pine Script or MQL experience.

- Limited in very choppy markets: In sideways price action, even a low-lag filter can generate false crossovers, so additional filters or filters may be needed.

- Potential over-optimization: Because its smoothing parameters can be adjusted, there’s a risk of curve-fitting past data rather than capturing forward-looking momentum.

6. When should you use the elegant oscillator?

Knowing when to apply a technical indicator is just as important as understanding how it works. The elegant oscillator, with its low-lag and smooth filtering properties, is particularly effective in certain market conditions and trading styles. This section explores ideal use cases and practical tips to maximize the value of the elegant oscillator indicator formula.

6.1. Best market conditions for using the elegant oscillator

The elegant oscillator performs best when the market shows clear directional movement. In trending conditions, its smoothed calculation allows traders to confirm trend strength without being distracted by short-term price noise.

- Trending markets: Use it to confirm momentum in the direction of the trend.

- Pullbacks within trends: Look for zero-line pullbacks as potential re-entry zones.

- Breakouts: Watch for a sharp increase in oscillator slope after a breakout to confirm strength.

Avoid using the elegant oscillator in low-volatility or ranging environments, where the signal may become indecisive or lagging.

6.2. Ideal trading styles

The elegant oscillator works particularly well for:

- Swing trading: Spotting momentum shifts on the 1-hour to daily charts.

- Trend-following strategies: Using the oscillator as a confirmation tool for entries or exits.

- Systematic or rules-based trading: Where consistency and reduced noise are prioritized.

While some scalpers may try to apply it on lower timeframes (e.g., 5M or 15M), its true strength lies in higher timeframes where smoothed momentum signals are more reliable.

6.3. Best indicator combinations

To enhance its effectiveness, combine the elegant oscillator with complementary tools such as:

- EMA (50 or 200) – for confirming overall trend direction.

- ATR (Average True Range) – for setting dynamic stop-loss or identifying volatility conditions.

- RSI or Stochastic – to add confluence for overbought/oversold levels.

Tip: Always test combinations in a demo environment before applying them live. The elegant oscillator is most valuable when used as part of a broader system, not in isolation.

You might also find these guides useful:

- How to trade the Forex market: Strategies & tools explained

- How to Add Autochartist to MT5 – The Ultimate Guide for Smarter Trading

- How to save indicators on Sway Markets: Step-by-step guide

7. FAQs about the elegant oscillator

As traders explore new tools like the elegant oscillator, they often ask practical questions about platform compatibility, timeframes, and use cases. This section answers some of the most common queries related to the elegant oscillator indicator formula, helping you apply it more confidently across different trading scenarios.

7.1. Is the elegant oscillator available in MT4 or MT5?

No, the elegant oscillator is not included by default in MT4 or MT5. Since it relies on a specific smoothing technique (the Super Smoother filter), you would need to:

- Code it manually using MQL4 or MQL5

- Or download a third-party script developed by the trading community

If you’re unfamiliar with custom indicators, using TradingView is the most accessible and beginner-friendly option.

7.2. Can the elegant oscillator be used for scalping?

To be frank, I wouldn't use the Elegant Oscillator for scalping. Its very nature is to smooth out signals and filter noise, which is the opposite of what a scalper needs: instant reaction to every small price tick.

Using it on an M1 or M5 chart would be like trying to drive a semi-truck in a go-kart race. Its true power is unleashed on the H1 timeframe and above, where it helps you see the bigger picture of the trend.

7.3. What is the best time frame to use the elegant oscillator?

The most effective timeframes for the elegant oscillator are:

- 1-hour (H1)

- 4-hour (H4)

- Daily (D1)

These timeframes offer enough price action for the smoothing filter to provide clean, actionable signals. Using the indicator on ultra-low timeframes often leads to choppier readings and diminished reliability.

The elegant oscillator performs best when you want to spot mid-term momentum shifts and trend continuations, not micro-movements.

7.4. Is the elegant oscillator repainting?

No, the elegant oscillator does not repaint. It uses fixed past data with a consistent smoothing function, so once a bar is closed, the oscillator’s value remains unchanged. This makes it more reliable for backtesting and live execution, especially in rule-based or automated strategies.

Repainting indicators adjust historical values retroactively, which can create false impressions during backtesting. The elegant oscillator avoids this problem, offering traders a more trustworthy signal.

8. Final thoughts

Ultimately, the question is Elegant oscillator indicator formula worth using?, but how you'll use it. Its real power is unlocked when you truly understand the logic behind the elegant oscillator indicator formula.

Here at H2T Finance, we don't believe in 'magic' indicators; we believe in empowering traders with the knowledge to make confident decisions. Whether you're ready to master advanced tools like this, or you're just starting and want to build a solid foundation with our Forex Basics category to equip you to trade smarter.

Consider the elegant oscillator indicator formula one more powerful tool in your arsenal and use it wisely.