If you've ever browsed financial news or explored futures trading, you've likely encountered the acronym CME. But what exactly does it mean? In this beginner-friendly guide, we'll dive deep into your core question: CME what does it stand for in trading?

You’ll discover how CME evolved from a local agricultural exchange into one of the world’s most influential financial institutions, powering markets worth trillions of dollars.

Key takeaways:

- CME stands for Chicago Mercantile Exchange, one of the world’s largest financial exchanges.

- It started as an agricultural market and expanded into global finance.

- CME Group includes CME, CBOT, NYMEX, and COMEX under one umbrella.

- Products traded cover currencies, interest rates, stocks, commodities, crypto, and even weather.

- CME provides transparency, liquidity, and global reach for traders.

- It is a regulated exchange overseen by the CFTC in the United States.

- CME data plays a crucial role in global price discovery and risk management.

- CME differs from stock and crypto exchanges by specializing in derivatives.

1. What does CME stand for in trading?

To begin, CME stands for Chicago Mercantile Exchange, one of the largest and most influential financial exchanges in the world. It’s often referred to as “the Merc” and plays a key role in how prices are set, risks are managed, and speculation occurs across global markets.

1.1. Understanding the origin of CME

Originally founded in 1898 as the Chicago Butter and Egg Board, the exchange was created to bring transparency and order to the agricultural markets. By 1919, it changed its name to the Chicago Mercantile Exchange (CME) and continued to evolve along with the financial landscape.

1.2. From agriculture to global finance

The CME initially specialized in agricultural futures contracts that allowed producers and buyers to lock in prices for commodities like wheat and pork bellies. But starting in the 1970s, CME expanded its offerings to include financial instruments such as:

- Currency futures

- Interest rate derivatives

- Treasury futures

- Precious metals

This transition marked CME’s emergence as a central hub for institutional trading and risk management.

1.3. CME in today’s financial ecosystem

Today, CME is known for operating a vast and highly liquid marketplace. It enables participants to trade not just traditional commodities but also cryptocurrencies (like Bitcoin futures), weather derivatives, and complex financial instruments.

Importantly, CME is a regulated and centralized exchange, offering transparency, security, and reliability key attributes that make it essential to both commercial hedgers and speculative traders.

Did you know? CME handles around 3 billion contracts annually, with a staggering notional value estimated at approximately $1 quadrillion.

1.4. Clarifying the confusion: CME in trading vs. medicine

While our focus is on what CME stands for in trading, it's worth noting that CME also stands for Continuing Medical Education in the healthcare sector. This has no relation to financial markets, but it’s a common source of confusion when searching for “CME what does it stand for.”

To avoid this mix-up, context matters. If you're exploring financial education, you're most likely referring to the Chicago Mercantile Exchange, not medical certifications.

Read more: Mistakes New Traders Make When Misusing Terms

2. What is the CME Group?

To fully understand what CME stands for in trading, it’s important to look at the larger organization behind it CME Group. This entity has grown far beyond the original Chicago Mercantile Exchange and now encompasses several of the world’s most powerful financial exchanges.

2.1. From a single exchange to a global group

The CME Group was officially formed in 2007 after a landmark merger between the Chicago Mercantile Exchange (CME) and the Chicago Board of Trade (CBOT). This union combined two giants in the derivatives world and marked the beginning of CME Group's rapid global expansion (Source: Investopedia).

But the evolution didn’t stop there. CME Group continued acquiring key exchanges:

- 2008: Acquired NYMEX Holdings, Inc., the parent company of the New York Mercantile Exchange (NYMEX) and Commodity Exchange Inc. (COMEX)

- 2010: Acquired a 90% stake in the Dow Jones Indexes business, a move that led to the formation of S&P Dow Jones Indices, a joint venture with S&P's parent company

- 2012: Acquired the Kansas City Board of Trade (KCBT), which specialized in hard red winter wheat futures

Today, CME Group is one of the largest derivatives marketplace operators in the world, handling a diverse range of asset classes from commodities to cryptocurrency.

2.2. Structure and reach of CME Group

CME Group operates through multiple exchanges under one umbrella, including:

- CME – Financial futures and options

- CBOT – Agricultural products

- NYMEX – Energy and metals

- COMEX – Precious metals

This network allows CME Group to provide global coverage and serve a wide range of market participants, from multinational corporations to institutional investors and, indirectly, retail traders.

2.3. CME Group in numbers

According to official data, CME Group:

- Handles over 3 billion contracts annually

- Facilitates trades worth approximately $1 quadrillion per year

- Had nearly $206 billion in assets and over 3,400 employees as of 2022

- Has offices in 15+ countries, supporting global access and liquidity

Why does this matter? For traders trying to understand “CME what does it stand for in trading”, recognizing its global footprint explains why CME data often influences asset prices worldwide.

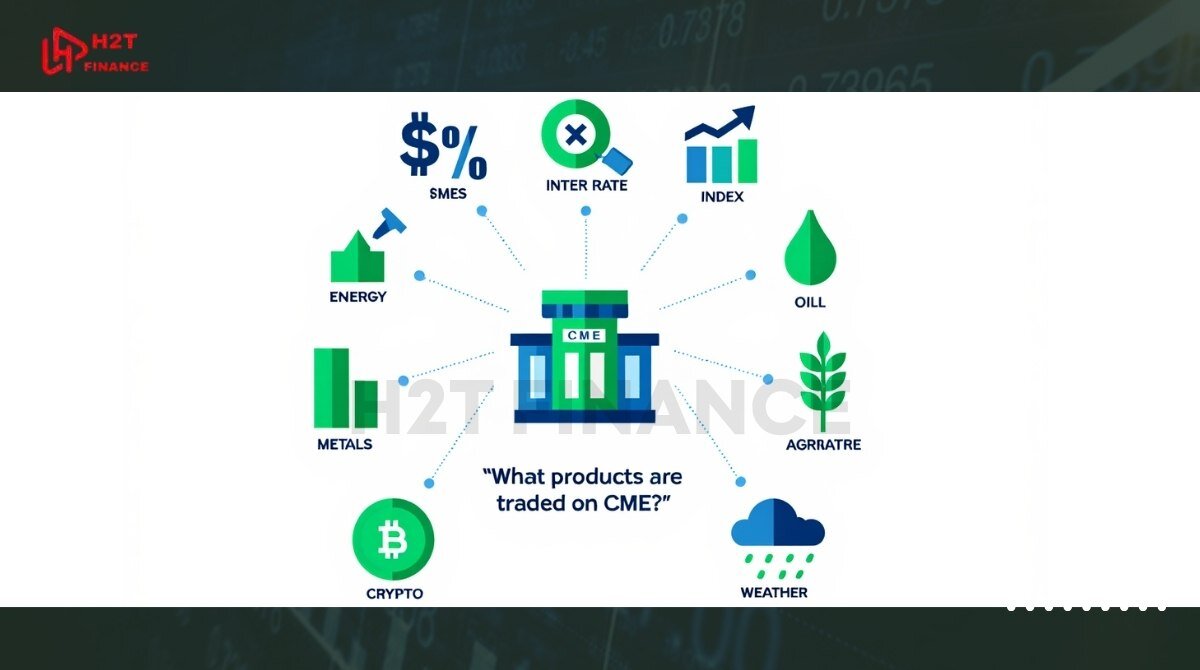

3. What products are traded on CME?

Now that we understand what CME stands for in trading and how the CME Group was formed, let’s explore the wide range of financial instruments available on the exchange. The diversity of products traded on CME is one of the key reasons it plays such a vital role in global markets.

3.1. A multi-asset marketplace for global participants

CME is not just for commodities. It offers a comprehensive platform where traders, institutions, and hedgers can access futures and options across various asset classes, including:

- Currencies (Foreign Exchange)

- Interest Rates

- Equity Indexes

- Commodities (agriculture, metals, energy)

- Cryptocurrencies

- Weather derivatives

These products are available through both futures and options contracts, enabling market participants to hedge risks, speculate on price movements, or gain exposure to global economic trends.

3.2. Overview of key asset classes traded on CME

The table below summarizes the major categories and example products available on the CME platform:

|

Asset class |

Examples |

Purpose |

|---|---|---|

|

Currencies (FX) |

EUR/USD, JPY/USD, GBP/USD |

Hedge or speculate on currency pairs |

|

Interest Rates |

Eurodollar futures, Treasury futures |

Manage exposure to interest rate shifts |

|

Stock Indexes |

S&P 500, Nasdaq-100, Dow Jones |

Index investing and portfolio hedging |

|

Energy |

Crude oil, natural gas, gasoline |

Hedge or trade global energy prices |

|

Metals |

Gold, silver, copper |

Gain exposure to precious/industrial metals |

|

Agriculture |

Corn, wheat, soybeans |

Essential for food producers and buyers |

|

Crypto |

Bitcoin futures |

Regulated crypto exposure |

|

Weather |

Temperature, rainfall, snowfall |

Hedge against weather-related risk |

The ability to trade across these sectors makes CME one of the most versatile exchanges in the world.

3.3. Spotlight: Bitcoin futures on CME

One of the more modern additions to CME’s product lineup is Bitcoin futures, launched in late 2017. These contracts allow traders and institutions to gain regulated exposure to cryptocurrency markets without owning the underlying asset directly.

Fun Fact: CME is among the few regulated venues offering Bitcoin futures in the U.S., providing a more secure and compliant path for institutional crypto trading.

3.4. Weather derivatives: a unique product category

A surprising yet powerful product on CME is weather derivatives. These allow companies in sectors like agriculture, energy, or even tourism to hedge against unpredictable weather conditions.

For example, businesses can take positions based on:

- Average temperature

- Rainfall

- Snowfall levels

In 2020 alone, CME traded up to 1,000 weather-related contracts per day, with a total notional value exceeding $1.2 billion across futures and options combined.

This kind of product shows how CME extends far beyond traditional markets and continues to innovate.

4. Why is CME important for traders?

Understanding what CME stands for in trading isn’t just about definitions, it's about recognizing the crucial role this exchange plays in the financial world. For both institutional investors and active traders, the Chicago Mercantile Exchange offers more than just access to futures and options. It provides structure, stability, and strategic opportunity.

4.1. CME as a tool for risk management

At its core, CME is a platform for risk transfer. Whether it’s an airline hedging against rising fuel costs or a multinational company managing currency exposure, CME provides the instruments needed to lock in prices and reduce uncertainty.

- Hedgers use CME futures to secure input or output prices (e.g., wheat farmers, gold producers, global exporters).

- Speculators take the other side of these trades, aiming to profit from market fluctuations while absorbing the price risk.

This interaction between hedgers and speculators creates a balanced and efficient marketplace, a foundation of modern financial stability.

4.2. Transparency and price discovery

Because CME operates as a centralized and regulated exchange, all trading occurs in a transparent environment with real-time data. This transparency supports fair pricing, minimizes manipulation, and helps all participants make more informed decisions.

- All trades are cleared through CME Clearing, which guarantees settlement and reduces counterparty risk.

- Open interest and volume data published daily offer insight into market sentiment, especially for institutional traders.

For those exploring the question 'CME what does it stand for trading,' it's essential to understand that CME is a primary engine for price discovery across major asset classes.

4.3. Liquidity and global reach

Thanks to its scale, CME delivers exceptional liquidity across markets. High daily volume ensures that participants can enter and exit positions with minimal slippage, even in volatile conditions.

- According to CME Group, the exchange handles an average of 3 billion contracts annually.

- Trading is supported 24 hours a day, enabling participation from Asia, Europe, and the Americas in real-time.

In my view, this global accessibility is one of CME’s most underappreciated advantages, especially for traders managing portfolios across time zones.

4.4. CME and innovation

Beyond its size, CME is also a driver of innovation in financial markets:

- It was the first exchange to demutualize and go public in 2000.

- It introduced Bitcoin futures ahead of most competitors.

- It offers niche products like weather derivatives and real estate indexes.

This constant evolution ensures CME remains relevant to modern traders, even as market dynamics shift.

5. CME vs other exchanges: how is it different?

Many beginner traders, especially those new to futures, often wonder how CME compares to other exchanges they’ve heard of, such as the NYSE, Binance, or even the CBOT. While all exchanges serve the purpose of facilitating trades, each has a unique Forex Market Structure, asset focus, and participant base.

Understanding these distinctions will help clarify why CME stands out in the trading world and where it fits into the broader financial ecosystem.

5.1. Different exchanges, different specializations

Here’s a simplified breakdown to compare CME with some well-known financial exchanges:

|

Exchange |

Main focus |

Ownership |

Key products |

Access type |

|---|---|---|---|---|

|

CME |

Derivatives & risk management |

CME Group |

Futures & options (FX, rates, metals, crypto...) |

Institutional & broker access |

|

CBOT |

Agricultural futures |

CME Group (merged) |

Corn, soybeans, U.S. Treasury futures |

Institutional & broker access |

|

NYSE |

Equities |

ICE (Intercontinental Exchange) |

Stocks, ETFs |

Direct (via brokers) |

|

Binance |

Cryptocurrency |

Privately held |

Crypto spot, futures, altcoins |

Retail-focused |

5.2. How CME stands apart from equity or crypto exchanges

CME’s uniqueness lies in its institutional-grade infrastructure and its specialization in futures contracts across diverse markets, not just stocks or crypto.

Here’s how CME compares:

- Unlike the NYSE, CME does not trade individual company stocks. Instead, it offers futures tied to stock indexes like the S&P 500 or Nasdaq-100.

- Unlike crypto-only exchanges such as Binance, CME offers regulated cryptocurrency futures (like Bitcoin futures), which appeal to institutional investors seeking compliance and transparency.

- Unlike spot markets, CME focuses on derivative contracts that settle at a future date, allowing for hedging and leverage.

5.3. CME and CBOT: different names, one group

Another common source of confusion is the difference between CME and the Chicago Board of Trade (CBOT). These two exchanges were once separate but merged in 2007 under the CME Group umbrella.

While both trade futures, they historically focused on different sectors:

- CBOT: Strong in agriculture (corn, wheat, soybeans), and U.S. Treasury products

- CME: Strong in foreign exchange, equity indexes, interest rates, and crypto

So if you're exploring 'CME what does it stand for trading' and come across CBOT products, remember that you're still within the CME Group universe.

Expand your knowledge with these topics:

- Elegant oscillator indicator formula: How it works & how to use

- How to trade the Forex market: Strategies & tools explained

- When is the best time to trade forex? Full beginner guide

6. FAQs – What beginners often ask about CME

Even after understanding what CME stands for in trading, it’s common for beginners to have lingering questions especially when comparing it with other exchanges or trying to assess its relevance to personal investing.

This section answers some of the most frequently asked questions in a straightforward, beginner-friendly way.

6.1. Is CME a regulated exchange?

Yes, the Chicago Mercantile Exchange is fully regulated. It operates under the supervision of the Commodity Futures Trading Commission (CFTC) in the United States.

The CFTC is responsible for:

- Ensuring fair trading practices

- Monitoring risk and market manipulation

- Overseeing brokers and futures commission merchants

This makes CME a secure and compliant venue for institutional and retail-accessible derivatives trading especially important when dealing with high-risk instruments like leverage or cryptocurrency futures.

6.2. Can retail traders access CME?

While CME primarily serves institutional participants, retail traders can access CME products indirectly through:

- Regulated brokers that offer futures contracts

- CFD (Contract for Difference) platforms mirroring CME price data

- Investment platforms with S&P 500 or gold futures exposure

If you're a beginner exploring the topic 'CME what does it stand for trading,' understanding these access methods is critical before you consider making live trades.

6.3. Is CME only for commodities?

No while CME’s origins are in agriculture, today it covers a wide range of asset classes, including:

- Currencies

- Stock indexes

- Interest rates

- Cryptocurrencies

- Weather events

This makes CME more than just a commodity exchange it’s a multi-asset marketplace where participants can hedge, speculate, or diversify their portfolios.

6.4. Why do traders watch CME volume data?

CME publishes daily trading volumes and open interest across all its contracts. These figures are closely monitored because they offer:

- Insight into institutional sentiment (e.g., rising open interest in S&P 500 futures)

- Signals of liquidity in different markets

- Clues about potential price trends or volatility spikes

For traders, especially those using futures as part of technical or macro strategies, CME volume is a key market signal.

6.5. What does the CME stand for?

CME stands for Chicago Mercantile Exchange, a global leader in futures and options trading.

6.6. What is CME short for?

CME is short for Chicago Mercantile Exchange, one of the main exchanges within CME Group.

6.7. What does CME exchange stand for?

The term CME Exchange refers to the Chicago Mercantile Exchange, which provides a centralized marketplace for derivatives.

6.8. What is CME known for?

CME is known for offering diverse futures and options contracts, transparent price discovery, high liquidity, and regulated markets for both traditional and modern assets like Bitcoin.

7. Final thoughts: why understanding CME matters

To wrap it up, the answer to the question 'CME what does it stand for' heavily depends on context. In trading and finance, it refers to the Chicago Mercantile Exchange, a leading global marketplace for futures and options. In contrast, in the medical field, CME stands for Continuing Medical Education. These are two very different worlds so knowing which “CME” you’re dealing with is essential.

If you’re exploring Forex basics or just starting out in financial markets, understanding the role of CME is a crucial stepping stone. Futures exchanges like CME shape how global prices are set, how risks are managed, and how capital flows across asset classes from currencies and commodities to cryptocurrencies and interest rates.

At H2T Finance, we’re committed to helping traders, especially beginners cut through the jargon and build a strong foundation in trading knowledge.