For anyone looking at charts for the first time, the sheer volume of candles, unfamiliar terms, and seemingly complex patterns can feel incredibly overwhelming. This is precisely why a candlestick cheat sheet PDF emerges as an indispensable companion for beginners. It meticulously distills that initial confusion into a concise, quick-reference trading tool you can always keep at your fingertips.

We understand that feeling – the struggle of trying to memorize dozens of candlestick patterns only to get them confused during live trades. A clear Forex cheat sheet PDF streamlines this process significantly, providing visual pattern recognition alongside concise notes on when a particular setup is most relevant.

Instead of sifting through textbooks or scattered online resources, you'll have a single, straightforward sheet readily available for forex, stocks, or crypto.

This guide is not about memorizing for the sake of it. It’s about learning faster, practicing smarter, and avoiding costly mistakes. And yes, you’ll find a candlestick cheat sheet PDF free download inside designed to be easy to print, simple to scan, and practical to use on any timeframe.

Key takeaways:

- A candlestick cheat sheet PDF condenses dozens of patterns into one quick reference guide that saves time and reduces confusion.

- Candlestick charts have a rich history, from Japanese rice markets in the 1700s to becoming the global standard on platforms like MT4, MT5, and TradingView.

- Patterns are classified into single, dual, and triple formations, each carrying different levels of strength and reliability.

- The real value of a cheat sheet comes from practice using it with live charts, multiple timeframes, and confirmation from indicators.

- A free candlestick cheat sheet PDF download provides clear visuals, simple notes, and is easy to print for everyday use.

- Beginners often make mistakes by over-relying on patterns, ignoring context, or skipping risk management, but these can be avoided with discipline.

1. What is a candlestick cheat sheet and why is it essential for beginners

A candlestick cheat sheet is a concise reference guide that compiles the most common chart patterns into one clear, easy-to-read format. Envision it as your trading roadmap: instead of getting lost in a sea of theory, you can quickly consult the sheet, recognize the candle formation before you, and understand its potential signal.

For new traders, both time and focus are precious commodities. A trading cheat sheet PDF empowers you to reclaim valuable hours by highlighting key reversal and continuation setups without any distracting clutter. With a single glance, you can ascertain if that hammer or engulfing pattern truly warrants your attention.

Having a stock trading candlestick guide PDF nearby also reduces the chances of misreading the market. Without a cheat sheet, it’s easy to confuse one formation for another, miss a potential entry, or worse jump into a trade on the wrong signal. We’ve seen many beginners fall into this trap, and we know how painful those mistakes can be.

In short, a candle patterns cheat sheet is not just about memorization. It’s about building confidence, avoiding avoidable errors, and making trading less overwhelming when you’re still finding your way.

Summary:

- A chart pattern cheat sheet PDF is a quick reference tool for recognizing patterns.

- It saves learning time and helps traders act faster.

- It lowers mistakes by clarifying signals.

- Without it, beginners risk confusion and missed opportunities.

2. The history of candlesticks

Candlestick charts didn’t appear overnight. They carry centuries of wisdom, starting from rice markets in Japan and traveling across the globe to shape modern trading as we know it today.

2.1. The 1700s: Origin in Japan

In the 1700s, a Japanese rice merchant named Munehisa Homma began using visual price charts to track supply and demand. These early candlestick forms gave him an edge in spotting shifts in market sentiment. What started as a simple tool for rice trade slowly became a groundbreaking method for reading human behavior in markets.

2.2. The 1800s: Growing popularity in Japan

By the 1800s, candlestick charting had spread among Japanese traders. They realized these charts were more than numbers; they were a language that revealed the emotions of buyers and sellers. For many, this clarity changed the way they approached trading decisions.

2.3. The 1980s: Introduction to the West

Fast forward to the 1980s, when American analyst Steve Nison stumbled upon candlestick charts. Fascinated by their potential, he introduced them to Western traders through his influential book Japanese Candlestick Charting Techniques. For many in the West, this was the first time they saw price action in such a vivid, story-like form.

2.4. The 1990s: Global adoption

In the 1990s, candlestick charts quickly gained worldwide adoption. Traders across forex, stocks, and commodities embraced them for their ability to simplify complex data into patterns anyone could recognize. Suddenly, the same tool that guided rice markets centuries earlier became a global trading standard.

2.5. The 2000s to now: A mainstream tool

From the 2000s onward, candlestick charts have solidified their position as a standard feature across virtually every trading platform, from MetaTrader 4 (MT4) and MetaTrader 5 (MT5) to TradingView. Regardless of whether you're trading forex, stocks, or crypto, candlestick charting is now an intrinsic component of modern technical analysis.

Read more: MT4 MT5 trading software forex ratings & strategy guide

Candlestick history is more than a timeline; it's proof of how a simple Japanese innovation grew into one of the most powerful ways to read markets. From rice warehouses to high-speed trading screens, candlesticks have stood the test of time, and today they remain a trader’s daily compass.

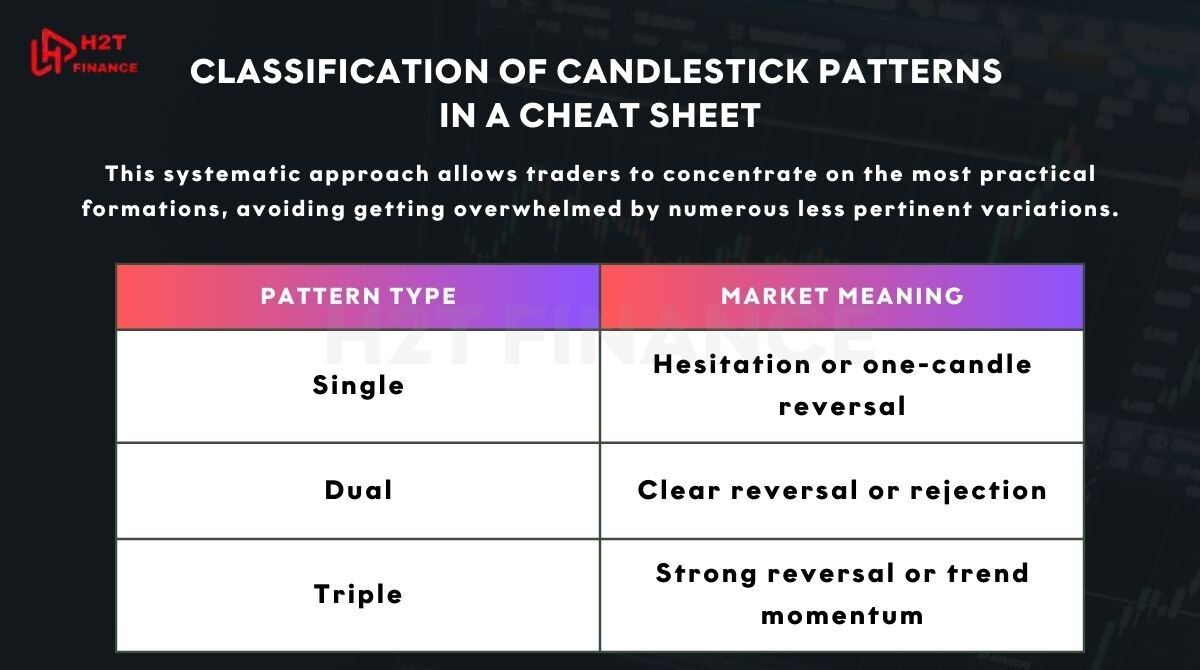

3. Classification of candlestick patterns in a cheat sheet

When traders discuss candlesticks, they often envision a dizzying array of names and shapes. However, a well-structured candlestick chart patterns cheat sheet simplifies this complexity by categorizing patterns into three primary types: single, dual, and triple candles.

This systematic approach allows traders to concentrate on the most practical formations, avoiding getting overwhelmed by numerous less pertinent variations.

3.1. Single candlestick patterns

These are the simplest yet surprisingly powerful signals.

- A Doji shows indecision, like the market holding its breath.

- A Hammer suggests buyers fighting back after a strong decline.

- A Shooting Star flips that picture, warning of weakness after a rally.

- A Spinning Top reflects hesitation, often appearing before bigger moves.

Each single candle might look small, but on the right chart, it can mark turning points with strong emotional weight.

Read more: What is a pip in forex trading? Understanding the basics for traders

3.2. Dual candlestick patterns

Two-candle formations give clearer confirmation.

- The Engulfing pattern (bullish or bearish) shows one side completely overpowering the other, often with high accuracy.

- Tweezer Tops and Bottoms act like mirrors, showing rejection at the same price level, a sign that the market respects that barrier.

In practice, dual patterns feel more reliable because they capture a short battle between buyers and sellers.

3.3. Triple candlestick patterns

These setups unfold across three candles and carry even stronger conviction.

- The Morning Star and Evening Star combine weakness, hesitation, and reversal into one sequence, making them favorites among traders.

- Three White Soldiers and Three Black Crows are dramatic displays of momentum, where the market marches forward in one direction with little doubt.

Triple patterns may take longer to form, but they often stand out clearly, even to beginners reading a Japanese candlestick PDF for the first time.

| Pattern type | Examples | Market meaning | Signal strength |

|---|---|---|---|

| Single | Doji, Hammer, Shooting Star, Spinning Top | Hesitation or one-candle reversal | Moderate |

| Dual | Bullish/Bearish Engulfing, Tweezer Top/Bottom | Clear reversal or rejection | High |

| Triple | Morning Star, Evening Star, Three White Soldiers, Three Black Crows | Strong reversal or trend momentum | Very high |

Candlestick classifications remind us that trading doesn’t have to be overwhelming. By focusing on these core patterns, traders can cut through noise and see the market’s story more clearly. With the right cheat sheet, the learning curve feels less intimidating and the path toward confident decision-making becomes smoother.

4. How to use candlestick cheat sheet PDF effectively

A cheat sheet is only useful if it moves from paper to practice. Simply memorizing shapes won’t make you a better trader. Real progress comes from seeing these patterns play out on live charts.

That’s why tools like TradingView, MetaTrader 4 (MT4), or MetaTrader 5 (MT5) are priceless. They allow you to test what you’ve learned, watch the candles form in real time, and compare your notes with the actual market flow. This is the real answer to how to use cheat sheet candlestick patterns in a way that makes a difference.

From our own experience, keeping the sheet printed next to the screen was a game-changer in the early days. Every time we spotted what looked like a Hammer or Engulfing, we paused, checked the cheat sheet, and then looked at the bigger chart context. This habit built discipline and helped us avoid rushing into false signals.

Practical tips for using your cheat sheet:

- Always combine patterns with multiple timeframes (M5 for scalping, H1 for intraday, D1 for swing).

- Confirm setups with other indicators such as RSI or MACD to boost reliability.

- Treat the sheet as a guide, not a crystal ball to avoid over-relying on it for every decision.

Using a cheat sheet the right way turns it into more than a study tool. It becomes your safety net, helping you filter out noise while you grow as a trader. With practice, the sheet will fade into the background as recognition becomes second nature but in the beginning, it’s the steady hand that keeps you from being lost in the crowd of candles.

5. Chart patterns cheat sheet PDF free download

Theory is valuable, but having the right tool within reach makes the difference when you’re facing a live chart. That’s why we created a candle stick cheat sheet PDF free download a compact guide you can keep on your screen or print out for quick access.

This PDF brings together the most reliable candlestick formations, complete with clear visuals and simple notes on how to use them. No fluff, no confusing jargon, just the essentials you actually need when making trading decisions.

We remember how much easier it became when we finally had a one-page sheet taped next to the monitor. Instead of second-guessing every candle, we could glance at the chart, match the pattern, and trade with more confidence.

Download now and get your candle pattern cheat sheet in an easy-to-print A4 format, designed to work for forex, stocks, and crypto traders alike.

A good cheat sheet won’t predict the future for you, but it will remove hesitation in those crucial moments when decisions matter most.

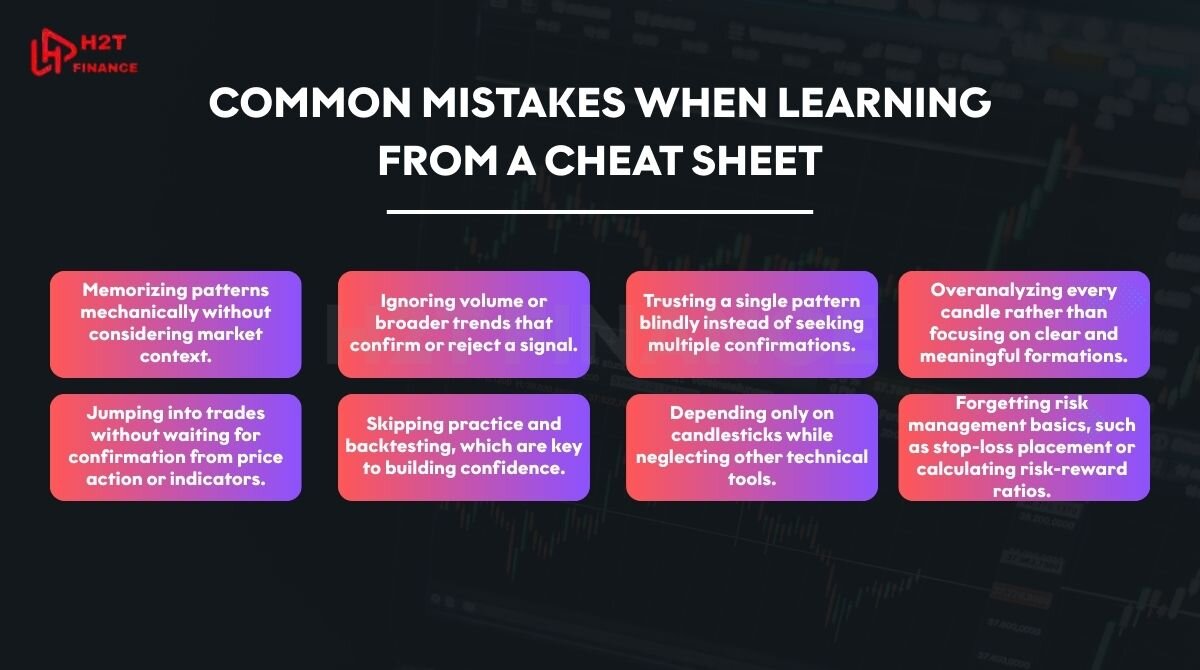

6. Common mistakes when learning from a cheat sheet

A cheat sheet is designed to guide you, not to lead you astray. Nevertheless, many traders fall into common traps when attempting to master candlesticks too rapidly.

Here are the most frequent errors we've observed:

- Memorizing patterns mechanically without considering market context.

- Ignoring volume or broader trends that confirm or reject a signal.

- Trusting a single pattern blindly instead of seeking multiple confirmations.

- Overanalyzing every candle rather than focusing on clear and meaningful formations.

- Jumping into trades without waiting for confirmation from price action or indicators.

- Skipping practice and backtesting, which are key to building confidence.

- Depending only on candlesticks while neglecting other technical tools.

- Forgetting risk management basics, such as stop-loss placement or calculating risk-reward ratios.

We’ve made some of these mistakes ourselves in the beginning like trading a Bullish Engulfing in the middle of a sideways market and watching it fail instantly. That frustration taught us the importance of context and discipline.

In the end, a cheat sheet is a powerful map, but without practice, confirmation, and risk control, it’s just paper. Used wisely, though, it becomes a steady guide that saves both money and stress.

See more articles in this category:

7. FAQs – Quick answers

7.1. Is a candlestick patterns cheat sheet PDF enough for trading?

No. A cheat sheet is only a reference. You need context, confirmation, and risk management to trade effectively.

7.2. How long does it take to remember the patterns?

With daily practice, most traders recognize the core setups within a few weeks. Mastery takes longer, especially when applying them in live markets.

7.3. Do I need to combine the cheat sheet with indicators?

Yes. Indicators like RSI or MACD improve accuracy and reduce false signals. Candles alone are rarely reliable.

7.4. Can a candlestick pattern cheat sheet be used for crypto, forex, and stocks?

Absolutely. Price action patterns apply across all markets because they reflect human behavior, not just asset type.

7.5. Is the PDF free to download?

Yes. Our candle chart cheat sheet PDF is free to access, easy to print, and made for everyday trading use.

8. Conclusion & advice for beginners

A candlestick cheat sheet PDF is far from the culmination of your trading journey; rather, it serves as a foundational step towards building genuine confidence. Consider it an indispensable tool that helps bridge the gap from confusion to sharper clarity, enabling you to recognize signals more swiftly as you continue to accumulate experience.

We always encourage beginners to print the sheet, tape it next to the screen, and glance at it during every trading session. Over time, the patterns will become second nature, and you won’t need to check as often. The key is practice, not memorization.

The next stage after mastering a cheat sheet is exploring advanced Price Action, sharpening your risk management, and learning how to combine candles with support, resistance, and indicators. That’s where deeper growth happens.

At H2T Finance, our mission is to share tools and knowledge that simplify learning. In our Forex Strategies category, you’ll find the next resources to expand beyond the basics and apply candlestick reading in real-world trading plans.

So, download your cheat sheet, practice daily, and let it be the stepping stone toward more confident and disciplined trading.