I still remember the first time I opened a trading platform; the screen was a chaotic mess of red and green bars, and I had absolutely no idea where to start. That feeling was truly overwhelming and a bit discouraging.

It was at that moment I realized the real value of a candle pattern PDF. A focused file like that is what finally gave structure to the chaos.

Instead of memorizing endless shapes, you get a clear map: which patterns matter, when they appear, and how to read them in real trading conditions. More importantly, you can print it, keep it on your desk, or save it on your phone as a quick reference.

This guide is not just about downloading a candlestick PDF. It’s about turning those static patterns into something practical. We’ll share the core models, explain how to apply them step by step, highlight mistakes we made as beginners, and offer tips that helped us finally make sense of price action.

Key takeaways:

- A candle pattern PDF gives traders a compact, printable guide to read candlesticks faster.

- It includes 30+ bullish, bearish, and continuation patterns with visuals for quick recognition.

- Patterns should not be used alone context, volume, and indicators are essential for accuracy.

- The free PDF download is lightweight, easy to store on mobile, and ready for offline study.

- Using the PDF with a trading journal turns theory into practical, repeatable habits.

1. What is a candle pattern? A simple foundation for beginners

A candle pattern is a recognizable formation created by one or more candlesticks. Each pattern tells a story of how buyers and sellers fought during that period.

In forex, crypto, or stocks, these signals help traders understand whether the market is about to reverse, continue, or pause, which is why learning how does forex trading work is an essential step for beginners.

Not all patterns are built the same. A single candlestick, like a hammer, can suggest reversal on its own. But some formations require two or three candles, such as engulfing patterns or morning stars, which often carry stronger meaning.

The moment I truly grasped this difference was a breakthrough. Suddenly, the charts started making sense, shifting from random noise to a readable language. For anyone who feels lost, a beginner candlestick guide is the first step to making the charts less intimidating.

Instead of drowning in dozens of names, focus on a handful of core setups. Once you understand these basics, you’ll be able to spot when markets are shifting. That clarity is exactly why a candle patterns explained resource is so valuable to new traders.

Summary:

- Candle patterns are formations that reflect market psychology.

- They are used across forex, crypto, and stock markets.

- Some involve one candle, others two or three, with different strengths.

- A simple beginner candlestick guide can make charts less overwhelming.

2. Why a candle pattern PDF is a useful learning tool

One of the first hurdles traders face when studying candlesticks is how scattered the information is. Videos can be too long, courses demand weeks of commitment, and thick ebooks often end up collecting dust.

This is why a candle pattern PDF is so effective: it's simple, can be downloaded in seconds, and kept next to a trading desk like a quick cheat sheet.

The real power of a PDF is its practicality. Think about this real-world scenario: a critical setup is forming on your chart, and the market is moving fast. You don't have time to scrub through a 30-minute video.

A printed page next to you, however, lets you confirm that hammer or engulfing pattern in two seconds. For me, that speed was the difference between a confident entry and a missed opportunity. Anyone searching for a candle pattern PDF free download understands this need for a tool that is light, focused, and ready when you are.

Another reason traders prefer PDFs is that they work offline. We’ve been in situations where the internet dropped mid-session, and the only thing that saved us from guessing was a single printed sheet taped to our wall. No buffering, no login, just pure reference. In that sense, candlestick patterns PDF is more than just a file it becomes a trading companion.

New traders especially benefit from this format. If you’re still memorizing the basics, the PDF serves as a safety net. For part-time traders balancing work and study, it becomes a time-saver. Even experienced traders sometimes revisit it as a reminder not to overlook the fundamentals.

In conclusion, a candle pattern PDF combines clarity, portability, and speed. It distills a complex subject into something you can use instantly, whether you’re trading at your desk or reviewing setups on the go. That’s why, despite the flood of digital courses and tutorials, the humble PDF continues to hold its place as one of the most useful tools for traders.

3. Groups of candle patterns in the PDF

When we first built our own candle pattern PDF, we realized that traders don’t need a collection of 100 models. What really matters are a few core groups that cover most scenarios. Breaking them down into categories makes it easier to understand and apply them on charts.

3.1. Bullish reversal patterns

One of the first setups we learned was the hammer. After getting burned by chasing a falling market, we noticed this candle forming at the bottom of a trend, signaling strength from buyers.

Other patterns like the morning star give similar clues: sellers push down, but buyers reclaim control over the next candles. For anyone flipping through a bullish candlestick PDF, these are usually highlighted as must-know because they appear often and can help you spot potential bottoms.

3.2. Bearish reversal patterns

On the flip side, bearish formations warn when the market may be running out of steam. We remember shortly after spotting a shooting star at a key resistance level it felt like watching a balloon deflate right after it peaked.

Evening star setups carry the same weight, often showing that buyers have lost momentum. In every bearish candle patterns PDF, these signals stand out as early alerts for possible downturns.

3.3. Continuation patterns

Not every pattern points to a reversal. Some simply show that the trend is pausing before moving again. Rising three methods, for example, appear in strong uptrends when price takes a short break before pushing higher, quite similar to flag and pennant patterns that signal continuation.

We once printed this exact example on our cheat sheet because it helped us avoid exiting too early. Falling three methods work the same way in downtrends, confirming that sellers are still in charge after a brief consolidation.

In summary, these three groups, bullish reversals, bearish reversals, and continuation signals form the backbone of any candlestick study. With clear illustrations in the PDF, traders can quickly recognize them in real time and avoid the trap of memorizing dozens of less relevant patterns.

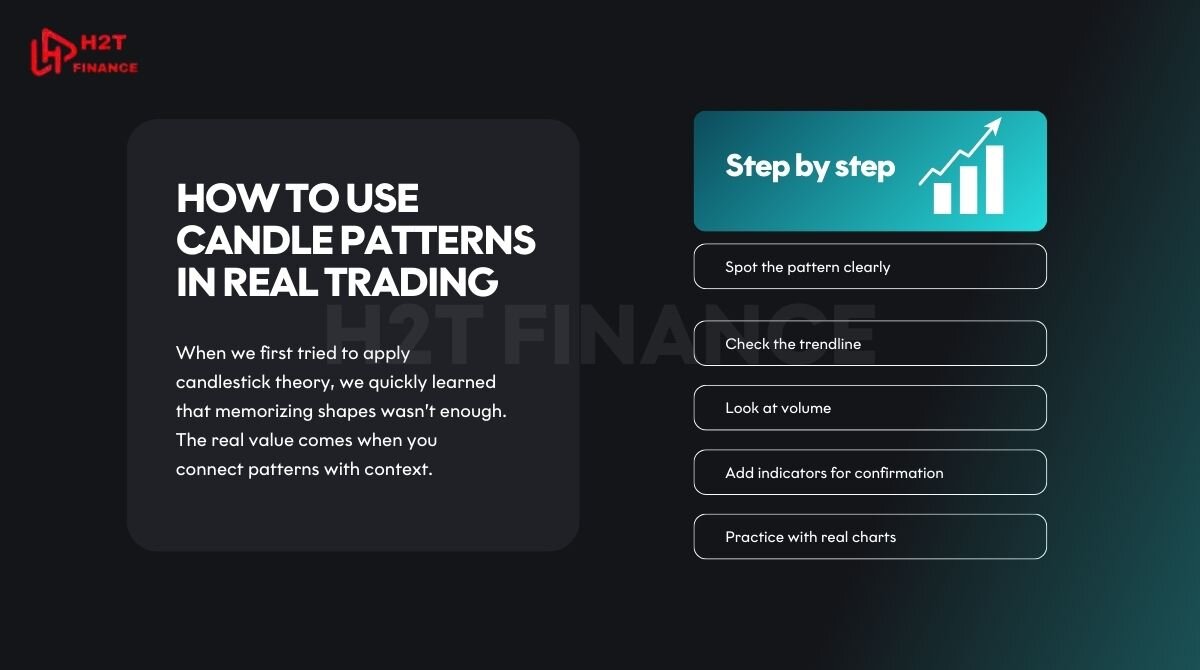

4. How to use candle patterns in real trading

When we first tried to apply candlestick theory, we quickly learned that memorizing shapes wasn’t enough. The real value comes when you connect patterns with context.

Here’s how we use them in practice:

- Spot the pattern clearly: Before reacting, we confirm that the candle formation fits the definition. For example, a hammer should have a small body and a long lower wick, not just any random candle with a tail. Learning how to use candle patterns starts with discipline in recognition.

- Check the trendline: A classic beginner's mistake is seeing a morning star in a strong downtrend and assuming it's a reversal, only to get stopped out quickly. That's why you must always confirm the broader market context: is it trending or ranging? before trusting a pattern.

- Look at volume: A hammer without strong buying volume often fails, and combining it with a support and resistance indicator can give stronger confirmation. When we saw a bullish engulfing on EUR/USD backed by a surge in volume, that trade became one of our cleanest entries. Volume adds weight to the setup.

- Add indicators for confirmation: While we keep charts simple, tools like RSI or MACD help. For instance, a bullish divergence on RSI paired with a hammer candle has saved us from second-guessing many times, just like when using fibonacci retracement to validate entries. This is where a candlestick strategy PDF can serve as a quick checklist.

- Practice with real charts: One of our breakthroughs came from tracking BTC/USD during a choppy week. We spotted a shooting star right at resistance, confirmed by declining volume, and entered short with confidence. Those real-world notes turned theory into results.

In conclusion, candlestick patterns only come alive when placed in context. By combining recognition with trendlines, volume, and simple indicators, we transform static textbook examples into reliable trading signals. That’s the difference between memorizing and truly understanding.

5. Download the candle pattern PDF for free

We know most of you came here searching for the file itself, so let’s make it simple. You can grab the candlestick patterns PDF free download right here:

[Download the Candle Pattern PDF now]

Inside the file, you’ll find a carefully curated list of more than 30 candle formations, each with a clean illustration and a short description. We designed it to be print-friendly, so you can pin it on your trading desk, and mobile-friendly, so you can swipe through it on your phone while checking charts.

To get the most out of the PDF:

- Save it on both your computer and phone for quick access.

- Print it in A4 format and highlight the patterns you want to master first.

- Use it as a live checklist while analyzing EUR/USD, BTC/USD, or any market you trade.

6. Common mistakes when relying only on candle patterns

In our early trading days, we made painful errors by trusting candlesticks blindly. A pattern might look perfect, but without context, it can become a trap. Here are some of the biggest candlestick mistakes we’ve seen and experienced ourselves:

- Confusing reversals with continuations: We once mistook a rising three methods for a bullish reversal and entered long, only to watch the trend collapse. Knowing the difference is critical because both formations can look similar at first glance.

- Ignoring market context: A morning star in the middle of a strong downtrend rarely means the market has truly turned. We learned this the hard way when several trades hit stop-losses in a row. Price action only works when combined with bigger-picture analysis.

- Skipping confirmation tools: Patterns without support from trendlines, RSI, or volume are weaker. For example, we shorted a shooting star without checking volume, and the market kept climbing. That loss taught us to always add confirmation.

- Treating the PDF as a “holy grail”: Here’s a crucial lesson on trading psychology for beginners I had to learn: no document, not even the best candlestick patterns cheat sheet, can replace screen time and practice.

Think of the PDF as your map, but you still have to drive the car. My own confidence only truly started to build after I began meticulously journaling every trade win or lose and reviewing those setups against my cheat sheet each weekend.

These mistakes often come from rushing to act after spotting a candle shape. We know how tempting it feels to jump in, but discipline is what separates real progress from repeated frustration.

7. Expert advice: How to turn the candle pattern PDF into your pocket guide

Over the years, we realized that the real value of a trading for beginners PDF is unlocked only when you make it part of your daily routine. It’s not about memorizing; it’s about building habits that transform knowledge into instinct. Here are some expert candlestick tips we’ve applied ourselves:

- Create flashcards: We printed key patterns on one side and their meaning on the other. Flipping through them during short breaks helped us memorize faster without feeling overwhelmed.

- Mark charts every day: Even on days when we didn’t trade, we opened charts and noted where hammer, engulfing, or morning star patterns appeared. This exercise trained our eyes to recognize setups instantly.

- Combine PDF with a journal: We kept a trading journal alongside the PDF. Every time we spotted a candle formation, we wrote down the market, the context, and the outcome. Reviewing these notes later was far more valuable than any theory.

- Focus on repetition, not shortcuts: At first, it felt frustrating when we misread a setup, but with time, persistence turned mistakes into lessons. Only through consistent practice did the patterns stop looking like random shapes and start feeling like signals.

For us, the turning point came when the PDF shifted from being just a file to becoming a pocket guide we trusted daily. It wasn’t magic, it was discipline. By blending study with practice, the charts stopped being intimidating and started speaking a language we finally understood.

Read more:

8. FAQs – common questions

8.1. Does the candle pattern PDF apply to forex, crypto, and stocks?

Yes, candlestick psychology works the same across all markets, though context like volatility or trading hours may differ.

8.2. How many patterns should beginners learn first?

Start with 7–10 core formations. Once you master those, you’ll cover most real-world situations without feeling overloaded.

8.3. Can you trade using only candle patterns?

Not reliably. Patterns should be combined with trendlines, volume, or indicators for confirmation.

8.4. How is this PDF different from a 200-page ebook?

It’s focused, visual, and easy to print designed for quick reference instead of long theory.

9. Conclusion

In the end, a candle pattern PDF is not a magic formula, but it is one of the fastest and most effective learning tools for traders. It condenses what really matters into a format you can carry anywhere, helping you cut through confusion and build confidence step by step.

If you haven’t yet, download the PDF and keep it as your daily companion. Follow our blog for advanced ebooks and guides, and most importantly practice in demo mode before risking real money. That balance of study and experience is where growth happens.

At H2T Finance, we created this resource to support traders who want clarity, not noise. In our Forex Strategies category, you’ll continue to find practical tools and honest insights to guide your journey.