Finding the best time to trade forex is one of the top priorities for any trader. While the market runs 24/5, thinking that every hour offers the same profit potential is a common mistake. Trading during quiet market lulls is like trying to sail a boat with no wind – incredibly exhausting with nothing to show for it.

Imagine entering a conversation when half the participants are asleep or stepping onto the trading floor when no one’s watching the charts. Timing, in forex, is not just about convenience it’s about capitalizing on liquidity, volatility, and volume.

In this comprehensive beginner guide, we’ll explore the most active trading sessions, how global overlaps impact your trades, and why aligning your strategy with the market’s rhythm can give you a real edge.

Whether you’re just starting out or refining your schedule, understanding the best time to trade forex might be the most valuable lesson you learn today.

Key takeaways:

- The forex market runs 24/5, but not all hours are equally profitable.

- The London–New York overlap (1:00 PM – 5:00 PM UTC / 8:00 PM – 12:00 AM Vietnam time) is the most active and liquid period.

- Each trading session (Sydney, Tokyo, London, New York) has unique characteristics that affect volatility and spreads.

- Currency pairs have their own peak hours e.g., EUR/USD thrives during the London–New York overlap, while AUD/JPY is more active in the Asian session.

- High-impact economic news (NFP, CPI, rate decisions) can create sharp trading opportunities, but also higher risks.

- The best time to trade depends on your strategy and style (day trading, swing trading, news trading, or part-time trading).

- Avoid common mistakes such as trading in low-liquidity hours, ignoring time zones, or forgetting daylight saving adjustments.

- The ultimate “best time” is to personally track your trades, align with your lifestyle, and find when you perform best.

1. What is the best time to trade Forex?

Before diving into charts and session times, let’s clarify what traders really mean when they ask, 'What’s the best time to trade forex?' or search for the best times to trade forex to optimize their strategies.

Let's be clear: there is no single 'golden hour' that works for everyone. The 'best time' really refers to those periods when the market is most alive, when a high volume of buyers and sellers creates an ideal trading environment.

- Greater liquidity, which allows for faster order execution

- Tighter spreads, reducing the cost of entry and exit

- Increased volatility, which can present more trading opportunities

These conditions tend to occur during overlaps of major trading sessions, when financial centers like London and New York are simultaneously open. However, the best time for you specifically will depend on your trading style, the currency pairs you focus on, and your local time zone.

In the following sections, we’ll break down how forex market hours work, when overlaps occur, and how to find the most suitable time to trade based on your strategy and experience level.

2. What is the most profitable time to trade forex?

The most profitable time to trade forex is typically during periods of high liquidity and volatility, particularly when major trading sessions overlap, such as the London - New York overlap (1:00 PM – 5:00 PM UTC, or 8:00 PM – 12:00 AM Vietnam time).

During these hours, trading volume peaks, spreads tighten, and price movements are more pronounced, offering greater opportunities for profit. For example, major currency pairs like EUR/USD and GBP/USD often see significant activity due to the involvement of two of the largest financial hubs.

However, profitability also depends on your trading strategy, risk management, and ability to capitalize on market conditions. Day traders may prefer this high-volatility window, while swing traders might focus on session openings for breakout opportunities. We’ll explore these dynamics further in the sections below.

3. Overview of forex market hours

The forex market operates continuously from Monday to Friday, thanks to the global rotation of trading sessions across different time zones.

Unlike stock exchanges, which have fixed operating hours, forex trading follows the business hours of four major financial centers: Sydney, Tokyo, London, and New York.

Understanding when each session opens and closes is essential for planning your trades. While there is always at least one market open, not all hours are equally active or profitable.

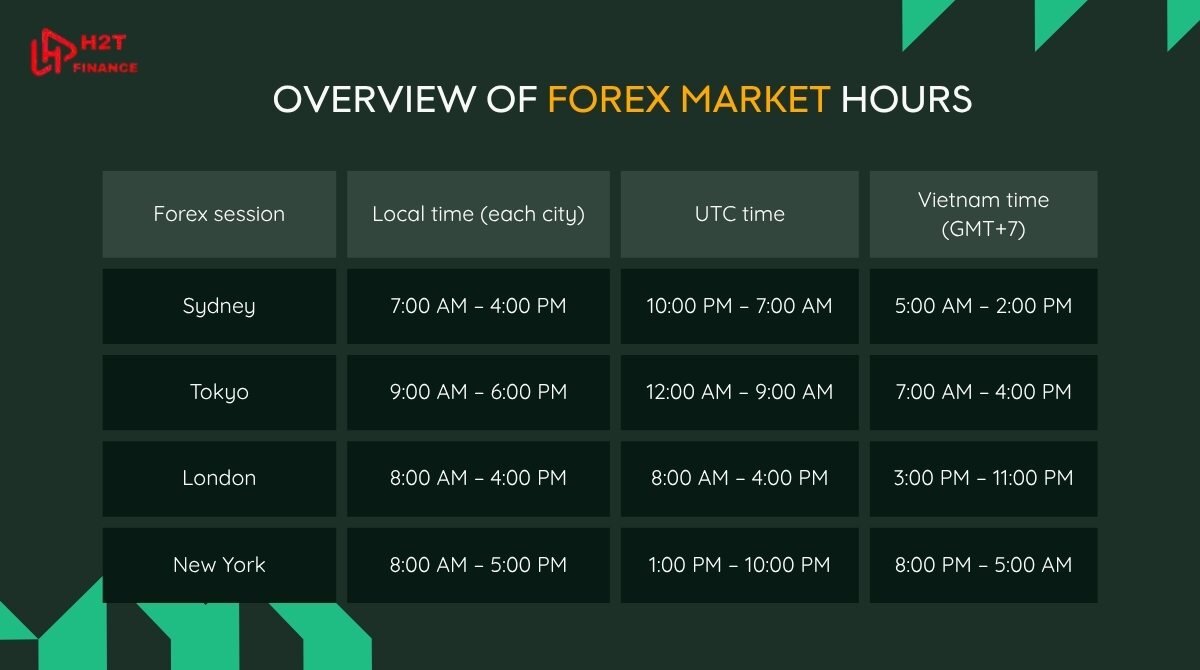

Here’s a quick overview of the four main trading sessions:

Important Note on Daylight Saving Time (DST): Daylight Saving Time (DST) will shift trading hours in financial centers like London and New York around March and November each year. Therefore, the table above is for reference only. Traders must always use online forex market clock tools or check the time against the UTC standard to get the most accurate information at all times.

Each trading session has its own characteristics. The Asian session (Sydney & Tokyo) tends to be more stable with narrower price movements.

The European session (London) introduces increased volatility, while the U.S. session (New York) often brings the highest volume and news-driven price swings.

So, how exactly do these overlaps create the most dynamic windows of opportunity? Let's find out.

4. Session overlaps – the real best time to trade forex

While the forex market is open 24 hours a day, not every moment offers the same level of opportunity. If you're wondering what's the best time to trade forex or searching for the best forex times to trade, most experts and seasoned traders will agree: it's during the session overlaps.

Session overlaps occur when two major trading centers are open at the same time. During these periods, trading volume spikes, volatility increases, and spreads tend to tighten ideal conditions for both day traders and swing traders.

Let’s break down the key overlaps and why they matter (Source: forex.com):

| Overlap | Time (UTC) | Vietnam Time (GMT+7) | Highlights |

|---|---|---|---|

| London – New York | 1:00 PM – 5:00 PM | 8:00 PM – 12:00 AM | The most active overlap. Liquidity and volatility are at their peak, ideal for major pairs like EUR/USD and GBP/USD. |

| London – New York | 1:00 PM – 5:00 PM | 8:00 PM – 12:00 AM | The most active overlap. Liquidity and volatility are at their peak, ideal for major pairs like EUR/USD and GBP/USD. |

| Tokyo – London | 8:00 AM – 9:00 AM | 3:00 PM – 4:00 PM | Short duration (1 hour). Liquidity starts to increase, good for watching EUR/JPY and GBP/JPY pairs. |

Note: The exact timing of these overlaps can shift by one hour depending on Daylight Saving Time (DST) rules.

Why London - New York is considered the best time to trade forex?

This overlap is often referred to as the prime time in forex trading. During these four hours, liquidity is at its peak, especially for USD, EUR, and GBP currency pairs. Major news releases from the U.S. and Europe tend to happen in this window, leading to sharper price movements and more trading opportunities.

Traders often observe:

- Tighter bid-ask spreads

- Increased momentum and volatility

- Strong trend continuations or reversals

If you’re searching for the best time to trade forex, this is the window where many of the market’s biggest moves unfold.

Coming up next, we’ll explore how different currency pairs behave during various sessions and how timing your trades around that behavior can give you an edge.

5. Currency pairs and their most active hours

Understanding when specific currency pairs are most active is essential if you want to optimize your forex trading performance. Different pairs experience higher liquidity and volatility at different times of the day, depending on which markets are open.

If you’re wondering what’s the best time to trade forex for your chosen pair, aligning your trading hours with its peak activity is a smart strategy especially for pairs tied to major financial hubs.

5.1. Overview: best trading hours by currency pair

The table below outlines when the major currency pairs tend to be most active based on session overlaps:

The table below outlines when the major currency pairs tend to be most active based on session overlaps:

| Currency Pair | Most Active During | Why |

|---|---|---|

| EUR/USD | London–New York Overlap | Involves the euro and US dollar – the two most traded currencies |

| GBP/USD | London–New York Overlap | High volatility, major news releases from UK and US |

| USD/JPY | Tokyo and early New York sessions | Strong volume when Tokyo and US markets are active |

| AUD/USD | Sydney–Tokyo and early London | Activity from Australian and Asian institutions |

| EUR/JPY | Tokyo–London Overlap | Cross between European and Japanese markets |

| USD/CAD | New York session | Canadian and US markets open, high responsiveness to oil data |

| NZD/USD | Sydney–Tokyo | Best traded in the early hours of the trading day |

5.2. Why timing matters by currency

Trading a pair like EUR/USD during the London–New York overlap typically means:

- Lower spreads

- More trade setups

- Faster execution and less slippage

Meanwhile, pairs like AUD/JPY or NZD/USD see more movement during the Asian session, making them suitable for early-morning traders in Vietnam or other Asian time zones.

5.3. Quick tip for beginners

If you're just starting out, consider focusing on one or two major pairs and learn their behavior during different trading sessions. This allows you to get familiar with how price moves and how news events affect each pair in real time.

Next, let’s explore how economic news impacts the best time to trade forex.

6. Impact of economic news on forex timing

Besides trading session overlaps, another key factor that defines the best time to trade forex is the release of high-impact economic news. These events can move currency prices within seconds creating both opportunities and risks.

For traders wondering what’s the best time to trade forex, paying attention to the news calendar is just as crucial as knowing when markets overlap.

6.1. Why news releases matter

Economic indicators give investors insights into a country's health. As soon as unexpected data hits the market, traders adjust their positions causing spikes in volatility. This is especially true for the U.S. dollar, which is involved in nearly 90% of all forex transactions.

6.2. Common high-impact news events

Here are examples of key economic reports that often trigger large movements in forex:

- Interest rate decisions (Federal Reserve, ECB, BoJ, etc.)

- Non-Farm Payrolls (NFP) – U.S. employment data

- Consumer Price Index (CPI) – measures inflation

- Gross Domestic Product (GDP) – economic growth indicator

- Retail sales and consumer confidence

- Central bank speeches or press conferences

These events are typically scheduled and announced in advance. Smart traders use economic calendars to plan their sessions accordingly.

6.3. Best times to watch for news-driven volatility

Most economic data is released during business hours of each country’s respective session. For example:

- U.S. news: between 8:30 AM – 10:00 AM EST (New York session)

- Eurozone/UK news: 7:00 AM – 9:00 AM GMT (London session)

- Japan and Australia: 7:00 PM – 9:00 PM EST (Tokyo/Sydney sessions)

6.4. Trade or avoid?

Some traders love volatility it means more price action and trading setups. Others, especially beginners, may want to avoid news hours due to unpredictable whipsaws.

The key is to always:

- Check the news calendar before trading

- Avoid opening new positions right before high-impact events (unless you're a news trader)

- Use stop-losses and manage risk tightly if trading through news

Up next, we’ll match the best time to trade forex with different trading styles.

7. Best time to trade forex based on trading style

Not every trader benefits from the same time window. The best time to trade forex, or the best time frame to trade forex, depends largely on your trading strategy and personal preferences.

Whether you're a day trader, swing trader, or someone who only has evenings to spare, choosing the right time can directly impact your success.

Let’s break it down by trading style.

7.1. Day traders: prefer London–New York

Day traders thrive on short-term price movements. For them, liquidity and volatility are critical.

- Optimal time: 8:00 AM to 12:00 PM EST (1:00 PM to 5:00 PM GMT) – the London–New York overlap

- Why? This period has the highest trading volume and tightest spreads.

- Ideal pairs: EUR/USD, GBP/USD, USD/JPY, and USD/CHF

If you’re asking what’s the best time to trade forex for fast entries and exits, this four-hour window is your best bet.

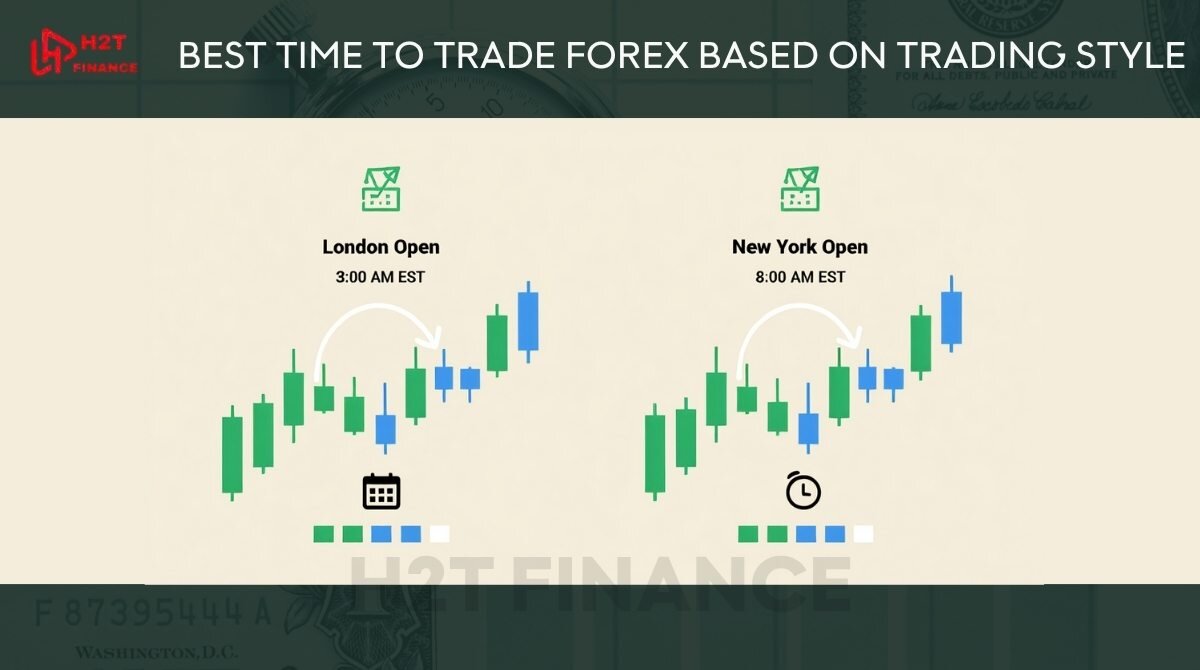

7.2. Swing traders: look for breakouts at session opens

Swing traders aim to capture larger price movements over several days or weeks. Timing isn’t about minute-by-minute action, but they still need strong momentum.

- Optimal time: the start of major sessions (London open at 3:00 AM EST / 8:00 AM GMT or New York open at 8:00 AM EST)

- Why? New institutional orders often flow in during session opens, creating breakout opportunities.

Session opens often lead to trend continuation or reversals a sweet spot for swing entries.

7.3. News traders: watch for high-impact data releases

Some traders specialize in capitalizing on volatility caused by economic news.

- Optimal time: 5–15 minutes before and after scheduled data releases (like NFP, CPI, central bank speeches)

- Risk level: High – prices can spike unpredictably

- Tip: Use economic calendars to prepare, and consider bracketing strategies or straddle orders

For news traders, the best time to trade forex isn’t about sessions it’s about economic timing.

7.4. Tips for part-time traders (e.g., evenings in Vietnam)

If you’re in Vietnam (GMT+7) and can only trade after work, you still have options.

- Best hours: 8:00 PM to 12:00 AM VN time (this overlaps with the London–New York session)

- Why? You get access to the busiest time in forex, even after a full day of work.

- Bonus: These hours often include U.S. news releases

Just remember to stay consistent with your time slot and trade only when volatility is meaningful, not erratic.

8. Common mistakes when choosing trading hours

Choosing the right time to trade is crucial, especially for beginners. However, many new traders fall into avoidable traps when planning their trading schedule. Understanding these common mistakes can help you avoid losses and improve consistency in your strategy.

8.1. Trading during low-liquidity periods (spread widening)

Many traders underestimate the impact of liquidity on trading costs.

- During quiet hours (like late Asian or post-U.S. sessions), liquidity drops.

- Wider bid–ask spreads occur, which can eat into profits or even turn winners into losers.

- Low liquidity also increases the chance of slippage.

If you're asking what’s the best time to trade forex, avoid early Sydney hours or Friday afternoons when markets begin to close.

8.2. Ignoring local time zone differences

Forex runs globally, but your trading screen operates in your local time zone.

- Failing to adjust for session overlaps in your timezone can lead to mistimed trades.

- Many new traders follow U.S. or UK news events without converting time zones properly, leading to missed opportunities.

Use a reliable Forex Market Hours tool to match session overlaps with your location.

8.3. Overtrading at “off” hours

Some beginners feel the need to be in the market at all times.

- This leads to overtrading in inactive sessions, increasing exposure without opportunity.

- Off-hour trading often results in random, low-volume price movements that lack real trend support.

Instead, choose 1–2 high-quality time slots and stick to them.

8.4. Not adjusting for daylight savings

Daylight Saving Time (DST) shifts trading hours twice a year in the U.S., UK, and parts of Europe.

- Failing to adjust your schedule can mean logging in too early or too late.

- It may also change when major news events occur.

Always verify session open/close times during DST transitions in March and November.

9. Tips to find your own best forex trading time

While general overlaps like London - New York offer optimal liquidity, the answer to 'What is the best time frame to trade forex?' is ultimately personal. It should align with your goals, availability, and risk tolerance, ensuring you trade when market conditions match your strategy.

9.1. Track your trades in a journal

Keeping a trading journal can reveal when you perform best.

- Record trade time, outcome, volatility level, and your mental state.

- Look for patterns: Are you more successful in the morning or evening? During volatile or calm markets?

- Over time, you’ll spot your own “prime time.”

This is especially useful when testing the advice behind “what’s the best time to trade forex?” for your specific strategy.

9.2. Use demo accounts to test different time slots

Before risking real money, experiment with various sessions.

- Try trading the London session for a week, then the New York session next.

- Measure performance and comfort level.

- This approach helps you simulate real-world conditions without financial pressure.

Tip: Demo testing also allows you to practice news trading and observe how fast the market reacts in each session.

9.3. Align trading time with your lifestyle and risk appetite

The right timing should fit your daily routine, not disrupt it.

- Are you a morning person? The London open may be perfect.

- Working full-time? Try Tokyo–London overlap before work, or late New York session after hours.

- Prefer calm markets? Focus on early Asian hours.

Matching your trading hours to your lifestyle prevents burnout and supports long-term consistency.

9.4. Combine session timing + news impact for optimal entries

The most powerful trades often come when market sessions and economic events align.

- For example, trading EUR/USD during the London–New York overlap right before U.S. CPI data can offer large but manageable moves.

- Use economic calendars alongside a session map to identify such windows.

By combining liquidity and volatility intelligently, you increase your odds of finding quality entries.

Related reads to deepen your knowledge:

- What is contract size in Forex? Beginner’s guide

- What is leverage in Forex trading? A simple explanation for beginners

- How to get money from forex? A 7-step guide you need in 2025

10. FAQs: Related questions about the best time to trade forex

New traders often have follow-up concerns when learning about optimal trading times. Below are some of the most commonly asked questions to help clarify timing strategies and expectations.

10.1. What time is the most volatile in forex?

The most volatile time in forex is during the London–New York overlap, from 1:00 PM to 5:00 PM GMT (8:00 AM to 12:00 PM EST). During this period, both major financial centers are active, and significant economic news is often released, creating sharp price movements and increased volume.

10.2. Should beginners trade during high volatility?

High volatility offers greater profit potential but also increases risk. Beginners should:

- Start with a demo account during volatile periods.

- Focus on risk management (tight stop-losses, smaller position sizes).

- Trade major currency pairs with tighter spreads like EUR/USD or GBP/USD.

You don’t have to avoid volatility entirely but respect it and trade smaller until you're comfortable.

10.3. Is it good to trade forex at night?

Trading at night (e.g., during the Asian session) can be suitable for certain strategies:

- Lower volatility favors range-trading or scalping techniques.

- Pairs like USD/JPY or AUD/JPY tend to be more active during this time.

- It’s not ideal for trend-based strategies that require strong momentum.

Night trading works well if you're consistent, patient, and understand the slower pace.

10.4. What is the best time to trade Forex EUR/USD?

The EUR/USD pair, being the most traded currency pair, is most active during the London–New York overlap from 1:00 PM to 5:00 PM UTC (8:00 PM to 12:00 AM Vietnam GMT+7).

This period offers high liquidity, tighter spreads, and increased volatility, driven by economic news from both the Eurozone and the U.S. Day traders and scalpers find this window ideal for quick entries and exits, while swing traders can capitalize on trend continuations or reversals.

10.5.What is the best time to trade Forex in California?

In California (Pacific Time, UTC-8, or UTC-7 during DST), the best time to trade forex is during the London–New York overlap, which occurs from 5:00 AM to 9:00 AM PST (during standard time) or from 6:00 AM to 10:00 AM PDT (during daylight saving time).

This early morning window aligns with peak market activity, offering high liquidity and volatility, especially for pairs like EUR/USD and GBP/USD. Traders in California can also catch U.S. economic news releases around 5:30 AM to 7:00 AM PST, which often trigger significant price movements.

10.6. What is the best time to trade Forex in New York?

In New York (Eastern Time, UTC-5, or UTC-4 during DST), the optimal trading time is during the London–New York overlap from 8:00 AM to 12:00 PM local time. As New York is a major financial hub, this four-hour window sees maximum trading volume, tight spreads, and strong price action, particularly for USD-based pairs like EUR/USD and USD/JPY.

Local traders also benefit from U.S. economic data releases typically scheduled around 8:30 AM to 10:30 AM EST.

10.7. What is the best time to trade Forex in South Africa?

In South Africa (UTC+2, no DST), the best time to trade forex is during the London–New York overlap from 3:00 PM to 7:00 PM SAST. This afternoon window provides high liquidity and tight spreads, ideal for trading pairs like EUR/USD, GBP/USD.

Additionally, the London session open at 9:00 AM SAST offers good volatility for pairs involving EUR or GBP, while early morning hours (1:00 AM to 4:00 AM SAST) align with the Tokyo session for JPY-related pairs. Traders should monitor European news releases around 8:00 AM to 10:00 AM SAST for added opportunities.

10.8 What time of day is best to trade forex?

The best time of day to trade forex is during the London–New York overlap (1:00 PM – 5:00 PM UTC). This period has the highest liquidity, tight spreads, and strong price movements, ideal for both day traders and swing traders.

10.9. What is the 5-3-1 rule in forex?

The 5-3-1 rule is a trading guideline suggesting you focus on:

- 5 major currency pairs

- 3 trading strategies

- 1 specific time of day

This helps traders avoid overcomplication and build consistency.

10.10. What are the golden hours for forex?

The “golden hours” for forex trading are the session overlaps, especially the London–New York overlap. During this time, markets are most active, creating more trade setups and higher profit potential.

10.11. What is the 90% rule in forex?

The 90% rule highlights that 90% of trading volume happens during 10% of the trading day — usually during major overlaps. This underlines the importance of timing your trades to when liquidity and volatility are at their peak.

11. Final thoughts: Timing is your forex edge

The best time to trade forex often aligns with high liquidity and volatility, especially during session overlaps like the London–New York window. However, the “best” time is not universal it depends on your trading style, preferred currency pairs, local time zone, and personal routine.

To recap, here are the key takeaways:

- London–New York overlap (8:00 PM – 12:00 AM Vietnam time) is the most active and widely preferred window.

- Currency pairs have specific peak times match your trading hours to your pairs.

- High-impact news events can create sharp opportunities (and risks).

- Your trading strategy (day trading, swing trading, news trading) should dictate your timing.

- Avoid common mistakes like trading during low-liquidity periods or ignoring daylight saving shifts.

If you're serious about improving your results, track your trading performance across different sessions and adjust accordingly. Over time, you’ll discover your own best time to trade forex one that matches both your strategy and your lifestyle.

What time has worked best for you so far? Have you noticed a difference in performance during specific sessions? Let us know your thoughts or questions below we’re here to help you trade smarter.

At H2T Finance, our mission is to empower beginners with knowledge, not to promote trading accounts.

As a platform dedicated to sharing forex insights, tools, and strategies, we invite you to dive deeper into our Forex Basics category to build a strong foundation. Ready to learn more?