The first time we opened a trading chart, it wasn't a chart; it was a wall of red and green barcodes, a chaotic mess we couldn't make sense of. That feeling of being lost is universal for beginners.

But the turning point for us was realizing we didn't need to understand all candlestick patterns at once. We just needed to master three. Like many beginners, we found ourselves wondering how forex trading works before even understanding the patterns.

The truth is, understanding 3 candlestick patterns completely changed how we look at a candlestick chart. Many beginners face the same moment of confusion, asking which candlestick patterns are worth learning first.

That is why starting with just 3 candlestick patterns can change everything. These formations are simple but powerful to help you cut through the noise. They give structure to the chaos, reveal the psychology of buyers and sellers, and create clear entry and exit rules you can practice right away.

This guide will walk you through each of the three patterns, explain the story behind them, and show you how to apply them with confidence. By the end, you’ll see that mastering a few reliable patterns is far better than memorizing dozens without understanding.

Key takeaways:

- The 3 candlestick patterns every new trader should know are Morning/Evening Star, Three White Soldiers/Three Black Crows, and Three Inside Up/Down.

- These setups reveal the psychology of the market and combine signals with confirmation, making them easier for beginners to trust.

- A candlestick cheat sheet or 3 candlestick patterns pdf helps recognition and speeds up decision-making in live trading.

- Simple trading rules entry after the third candle, stop beyond the formation, and clear targets reduce hesitation and risk.

- A side-by-side candlestick decision guide and trading checklist make it easier to choose the right setup in the right context.

- Avoid common candlestick mistakes such as mislabeling, ignoring trend and volume, or trading without practice.

- Apply expert candlestick tips: use flashcards, mark charts daily, combine a cheat sheet with a journal, and stay patient.

- These patterns are universal across forex, crypto, and stocks, but they work best when paired with context and practice.

1. Introduction: Why should new traders start with 3 candlestick patterns?

The honest answer: Because too many candlestick patterns can overwhelm you. We still remember staring at charts filled with dozens of shapes, unsure which ones mattered and which were just noise. In those early days, chasing every pattern only left us frustrated and more confused.

Focusing on 3 candlestick patterns gives you clarity. These specific formations are easy to recognize, simple to apply, and powerful enough to guide real trades. They turn the chart from a puzzle into a story, showing when buyers are gaining control, when sellers push back, and when momentum is about to shift.

For beginners, this is the safest way forward. Instead of memorizing endless candlestick patterns, you get a small toolkit that reduces hesitation and lowers the risk of random entries. We found that by practicing only these three, we built confidence faster and avoided many of the mistakes that drained our accounts in the past.

Summary:

- Learning 3 candlestick patterns is not about limiting your knowledge, it's about building a strong base.

- They are easier to remember, practical for beginners, and help reduce risks when placing trades.

2. Definition of the 3 core patterns

When people search for candlestick patterns explained, what they really want is clarity without being buried under endless theory. We get that, because in our first months of trading, we printed out long candlestick cheat sheets and still froze when facing a live chart.

That’s why narrowing down to three candle patterns feels like a lifeline: It cuts the noise and gives you something concrete to act on.

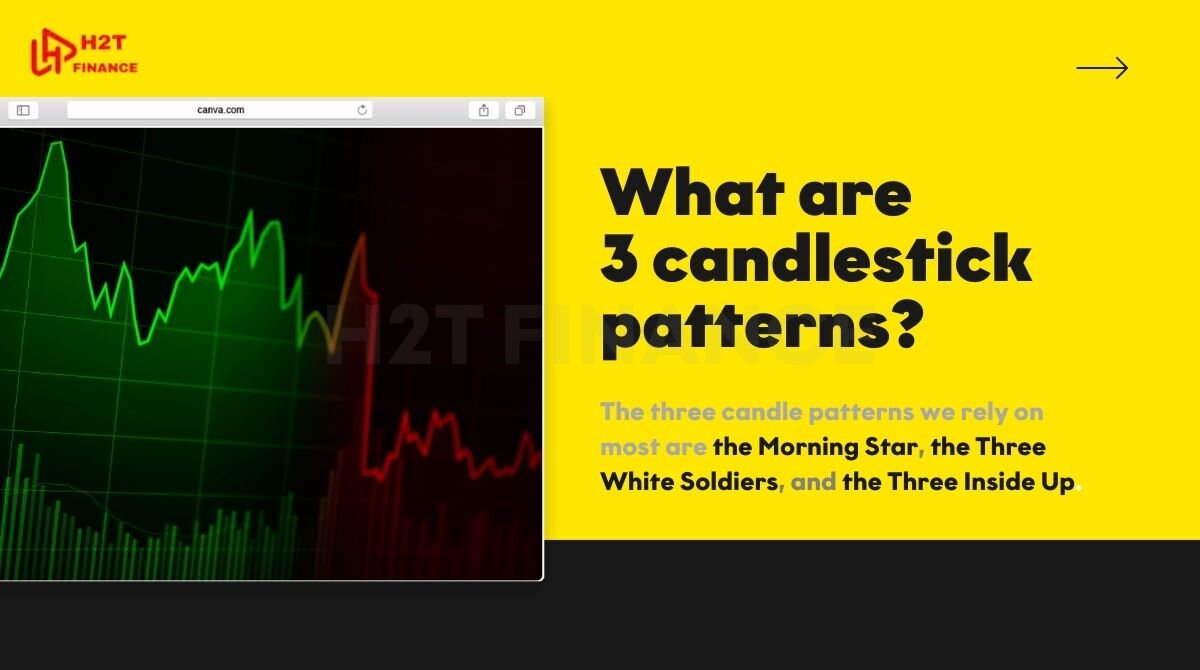

2.1. What are 3 candlestick patterns?

The three candle patterns we rely on most are the Morning Star, the Three White Soldiers, and the Three Inside Up. Each one forms with three consecutive candlesticks and tells a small but powerful story of how the market shifts.

For us, learning their shapes was like learning the alphabet of trading suddenly, the chart spoke a language we could actually read.

2.2. The psychology behind each formation

Charts are not just numbers; they are the collective emotion of traders. The Morning Star reflects buyers stepping back in after heavy selling. The Three White Soldiers show strong confidence, almost like a wave of optimism that refuses to stop.

The Three Inside Up reveals hesitation followed by conviction, a tug-of-war ending with one side clearly winning. We'll never forget hesitating on a textbook Three Inside Up candlestick pattern on the EUR/USD hourly chart.

We doubted it, thinking the market was too choppy. Then we just sat there and watched it climb 80 pips without us. That wasn't just a missed profit; it was a painful lesson about the accuracy of three candlestick signals and why you must trust a clear price action reversal when you see one.

2.3. Difference between single, two-candle, and three-candle models

A single candlestick, like a hammer, can hint at reversal but often lacks confirmation, similar to how traders misread signals when they don’t combine them with tools such as support and resistance indicator or volume analysis. Two-candle patterns, such as an engulfing, add more reliability, yet they can still trick you in choppy markets.

The key difference between 2 and 3 candlestick patterns is what we call the power of confirmation. A two-candle pattern, like an engulfing setup, can give you a hint. But a three candle reversal pattern tells a complete story.

The third candle is the crucial three candlestick confirmation that separates a real move from a fakeout. Trusting that third candle was the turning point that elevated our trading strategy with 3 candlestick setup.

Three candle patterns are easier for beginners to trust because they combine signal and confirmation. They tell the emotional story of the market, and they are far more practical than memorizing dozens of shapes you may never use.

3. Why should you learn through examples and cheat sheets?

The quickest way to remember 3 candle patterns is by seeing them, not just reading about them. We learned this lesson the hard way. In our first months, we tried to memorize descriptions from textbooks, but when the same candlestick formations showed up on live charts, they looked completely different. It wasn’t until we kept a candlestick cheat sheet printed on our desk that things finally clicked.

3.1. Visuals make recognition faster

A chart tells a story best through pictures. When you look at a cheat sheet or a 3 candle patterns pdf, you immediately see the size, the color, and the sequence of each candlestick.

This shortcut saves you from overthinking and helps you recognize a setup in seconds. For us, one glance at a Morning Star on a cheat sheet was worth ten paragraphs of theory.

3.2. Text or video vs cheat sheet

Text and videos are great for understanding context, but they can be slow when you need quick decisions. A mini PDF acts like a trading patterns for beginners handbook; it's short, visual, and always ready.

During one trading session, we kept flipping between a long tutorial video and our open chart, missing the entry completely. After that, we never traded without a simple cheat sheet nearby.

3.3. Who benefits most from cheat sheets

New traders who are still learning candlestick shapes find cheat sheets invaluable. But even intermediate traders use them as quick reference, especially when emotions run high. We often carry a one-page printout in our journal, and it has saved us from second-guessing trades more times than we can count.

A candlestick cheat sheet or a 3 candle patterns pdf is the fastest way to recognize and apply trading patterns for beginners. It offers clarity, speed, and confidence compared to relying only on text or video explanations.

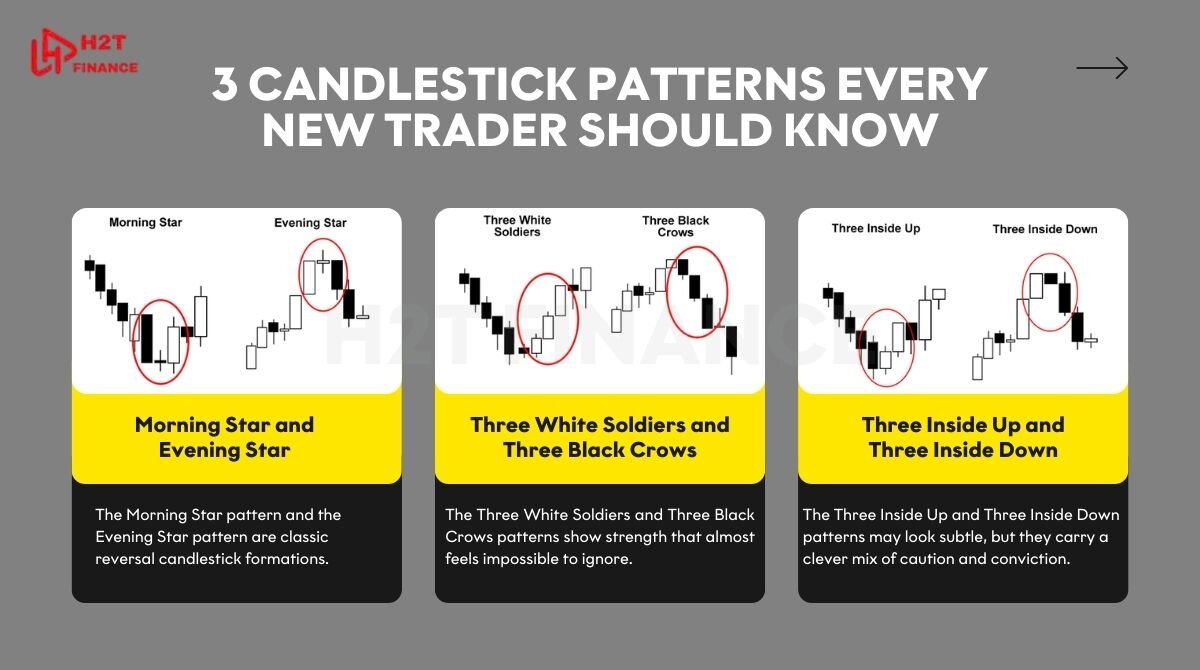

4. Pattern 1: Morning Star and Evening Star

The Morning Star pattern and the Evening Star pattern are classic reversal candlestick formations. They both use three candles to signal a potential change in direction, and once we learned them, it felt like someone had finally handed us a flashlight in a dark room.

4.1. How to recognize the pattern

The Morning Star shows up after a strong downtrend. It begins with a long bearish candle, followed by a small candle that reflects hesitation, and ends with a strong bullish candle that pushes price upward.

The Evening Star is its mirror image, appearing at the top of an uptrend with the final candle breaking lower. The clear sequence of colors and sizes makes these setups easier to identify than single candles that can be misleading.

4.2. The psychology behind Morning and Evening Stars

When we first spotted a Morning Star on GBP/USD, the market had been selling off for days. That small middle candle felt like the crowd taking a breath. Then the third candle erupted upward, showing buyers were finally stepping in with conviction.

The Evening Star is the same story in reverse: a burst of optimism fading into exhaustion and then clear selling pressure.

4.3. Simple rules for trading

- Entry: After the third candle closes in the direction of the reversal.

- Stop loss: Below the low of the Morning Star or above the high of the Evening Star.

- Target: Next resistance or support level, often aiming for a 2:1 risk-to-reward.

Read more: Formula for risk ratio: How to calculate and use it in real-world investing

In our experience, these rules saved us from jumping too early. Waiting for the third candle gave confirmation that the shift in momentum was real.

The Morning Star pattern and the Evening Star pattern are reliable reversal candlestick signals. Recognizing their three-step sequence and applying basic rules can help beginners avoid impulsive entries.

5. Pattern 2: Three White Soldiers and Three Black Crows

The Three White Soldiers and Three Black Crows patterns show strength that almost feels impossible to ignore. When we first traded them, we realized they could signal not just a shift, but a surge of momentum that often carried further than expected.

5.1. How to recognize the pattern

Three White Soldiers form with three long bullish candles closing near their highs, usually after a period of weakness. Three Black Crows appear with three consecutive bearish candles closing near their lows, often after an extended rally. Their back-to-back strength is what makes them so striking on the chart.

5.2. The psychology behind the move

Three White Soldiers reflect relentless buying pressure, almost as if bulls refuse to let the price breathe. We once spotted this on gold after a pullback; it felt like the market roared back to life in just three candles. The Three Black Crows tell the opposite story: Buyers exhausted, sellers stepping in aggressively, pushing price down without pause.

5.3. Simple rules for trading

- Entry: After the third candle closes, preferably with trend confirmation.

- Stop loss: Below the low of the first soldier or above the high of the first crow.

- Target: Use nearby levels or trail stops, as these patterns often lead to extended moves.

We learned the hard way that entering on the first candle of the sequence can be dangerous; waiting for the third keeps you safer and avoids false enthusiasm.

Three White Soldiers and Three Black Crows are powerful signals of bullish or bearish momentum. Their clear structure and emotional weight make them useful guides for trend continuation or reversal.

6. Pattern 3: Three Inside Up and Three Inside Down

The Three Inside Up and Three Inside Down patterns may look subtle, but they carry a clever mix of caution and conviction. We ignored them at first, thinking they were less important, until a missed trade on EUR/JPY proved otherwise.

6.1. How to recognize the pattern

Three Inside Up appears after a downtrend: the first candle is bearish, the second is smaller and closes inside the first, and the third confirms with a strong bullish push. The Three Inside Down is its bearish counterpart. These setups are smaller in size than the Soldiers or Stars but can be just as telling.

6.2. The psychology behind the move

The second candle reflects hesitation, a pause where neither side dominates. Then the third candle shows who truly wins. For us, this captured the market’s psychology perfectly: Hesitation followed by conviction.

Once we started spotting these, we realized they often show up at key support or resistance zones, acting as a quiet but reliable signal.

6.3. Simple rules for trading

- Entry: At the close of the third candle confirming direction.

- Stop loss: Below the second candle for Three Inside Up, above for Three Inside Down.

- Target: First major level ahead, with a modest risk-to-reward ratio.

On one occasion, entering on a Three Inside Down kept us safe from a false breakout; it was a reminder that even subtle signals can protect capital.

Three Inside Up and Three Inside Down are continuation patterns that combine caution with confirmation. They are practical for traders who want reliable signals without chasing dramatic moves.

7. Comparison and when to use each pattern

When we first learned these three setups, we often asked the same question: which one should I trust right now? A candlestick decision guide makes the choice easier. Each pattern works best under certain conditions, and using the wrong one in the wrong place can lead to painful losses.

7.1. Quick comparison table

Before jumping into trades, we always wanted a shortcut that told us which signal fit the market we were facing. That’s why a clear table works so well it strips away the guesswork.

Instead of holding all the rules in your head, you can glance once and know if the setup is a reversal candlestick, a continuation, or a flexible formation. This side-by-side view has saved us countless times from forcing trades that didn’t belong to the market context.

| Pattern | Main signal | Best context | Common mistake to avoid |

|---|---|---|---|

| Morning Star / Evening Star | Reversal candlestick | At the end of a strong trend, near support or resistance | Entering before the third candle confirms |

| Three White Soldiers / Three Black Crows | Continuation or strong reversal | When volume supports the move, ideally in trend direction | Mistaking them for pullbacks in choppy markets |

| Three Inside Up / Three Inside Down | Flexible: can show reversal or continuation | Works best at key levels on higher timeframes | Ignoring the small second candle and mislabeling the setup |

7.2. Checklist for traders

Here’s a simple trading checklist we use before acting on these patterns:

- Identify the trend direction clearly, and don’t forget that knowing forex currency trading hours also influences how reliable a signal becomes.

- Check if the price is near a strong support or resistance.

- Look for volume confirming the pattern.

- Wait for the third candle to close before entering.

- Place stops beyond the formation to reduce false breakouts.

Choosing the right setup depends on context. Morning Stars mark reversals, Three Soldiers show momentum continuation, and Three Inside patterns adapt to both. A structured candlestick decision guide and trading checklist protect you from misreading signals.

8. Mini cheat sheet and practical reference

When we were starting out, we wished someone had handed us a one-page guide we could stick on the wall next to our trading desk. A 3 candlestick patterns pdf does exactly that. It distills all the key details into a quick visual map, so you don’t waste time flipping through books while the market is moving.

Download or create your own one-page PDF!

How to use the cheat sheet effectively?

A cheat sheet candlestick is not just a poster, it's a decision tool. We recommend printing it and keeping it beside your monitor. During live sessions, glance at it to confirm what you see, then check your trading plan.

Over time, you’ll rely on it less, but in the beginning, it anchors your judgment. For us, it stopped many impulse trades when emotions were high.

9. Common mistakes when relying only on 3 candlestick patterns

Even the best setups can mislead if you treat them like a magic formula. We’ve fallen into that trap ourselves seeing a clear pattern, rushing in, and then wondering why the market flipped against us. These are the candlestick mistakes we wish someone had warned us about earlier.

- Misreading the pattern: It’s easy to confuse a continuation with a reversal candlestick, especially when emotions are high. We once mistook Three Black Crows for a pullback and jumped in too soon, only to get stopped out within minutes.

- Ignoring context: Patterns lose meaning without trend, volume, or support/resistance. A Morning Star in the middle of a sideways market is often just noise. We learned to always confirm the bigger picture before acting.

- Trading psychology slips: Overconfidence is dangerous. Believing that three candle setups alone can predict every move leads to disappointment. Our trading psychology for beginners tip: treat these patterns as signals, not guarantees.

- Skipping practice: Jumping into live trades without demo testing is one of the fastest ways to burn capital. We spent months on demo accounts, and that discipline built confidence we couldn’t have gained otherwise.

Mislabeling formations, ignoring context, and skipping practice are the most costly candlestick mistakes. Combine patterns with broader analysis, manage emotions, and practice on demo first to turn them into reliable tools.

10. Expert advice: Turning 3 candlestick patterns into your pocket guide

Over the years, we’ve found that keeping things simple works better than chasing every shiny new strategy. These are our expert candlestick tips habits that turned three simple patterns into tools we could trust.

- Use flashcards: Print or draw the three setups on cards and test yourself daily. We did this on the bus ride to work, and it burned the images into memory faster than rereading textbooks.

- Mark charts every day: Even when we didn’t trade, we opened charts and highlighted any Morning Star, Three Soldiers, or Three Inside we could find. This daily ritual sharpened our eyes and made live trading less stressful.

- Practice with a PDF and journal: A trading for beginners pdf or cheat sheet is perfect for quick checks, but pairing it with a journal is where the real growth happens. We logged not just wins but also our emotions, and patterns in our behavior became just as clear as the ones on the chart.

- Stay patient: Mastery doesn’t come in a week. It took us dozens of demo trades before these patterns felt natural. The repetition built confidence, and confidence brought consistency.

By using flashcards, daily chart notes, and a mix of cheat sheets with journaling, you can transform 3 candlestick patterns into a true pocket guide. These steps are simple but powerful, and they will carry you further than memorizing theory alone.

Read more:

11. FAQs – Frequently asked questions

11.1. Do these 3 patterns work in forex, crypto, and stocks?

Yes. Price action is universal, so the same formations apply across markets.

11.2. How many candlestick patterns should beginners learn first?

Start with three. It’s better to master a few than to skim through dozens and use none correctly.

11.3. Can you trade using only 3 candlestick patterns?

They can guide entries, but relying only on them is risky. Always confirm with trend and levels.

11.4. How is a cheat sheet PDF different from a 100–200 page ebook?

A cheat sheet is a quick visual tool for live trading, while an ebook is for in-depth study. Both are useful, but the cheat sheet is faster when every second counts.

12. Conclusion and extended call to action

The journey through these 3 candlestick patterns shows one clear truth: you don’t need to learn every formation under the sun to trade effectively.

By focusing on Morning/Evening Stars, Three Soldiers/Three Crows, and Three Inside patterns, you gain a foundation that makes price action easier to read and trading decisions less stressful. They are simple, practical, and powerful when used with context.

We encourage you to take the next step:

- Download or create your own cheat sheet PDF.

- Practice each setup at least ten times on a demo account.

- Keep a journal to track trades and emotions.

- Follow our guides to deepen your knowledge as you grow.

Above all, remember that no candlestick pattern is a magic bullet. Real progress comes from patience, discipline, and consistent practice. Start small, master the basics, and build confidence one trade at a time.

The 3 candlestick patterns are your fast track to learning price action. Use them with a cheat sheet PDF, demo practice, and steady journaling to grow into a confident trader. For more guidance, explore H2T Finance and our Forex Strategies category your next step toward stronger trading decisions.